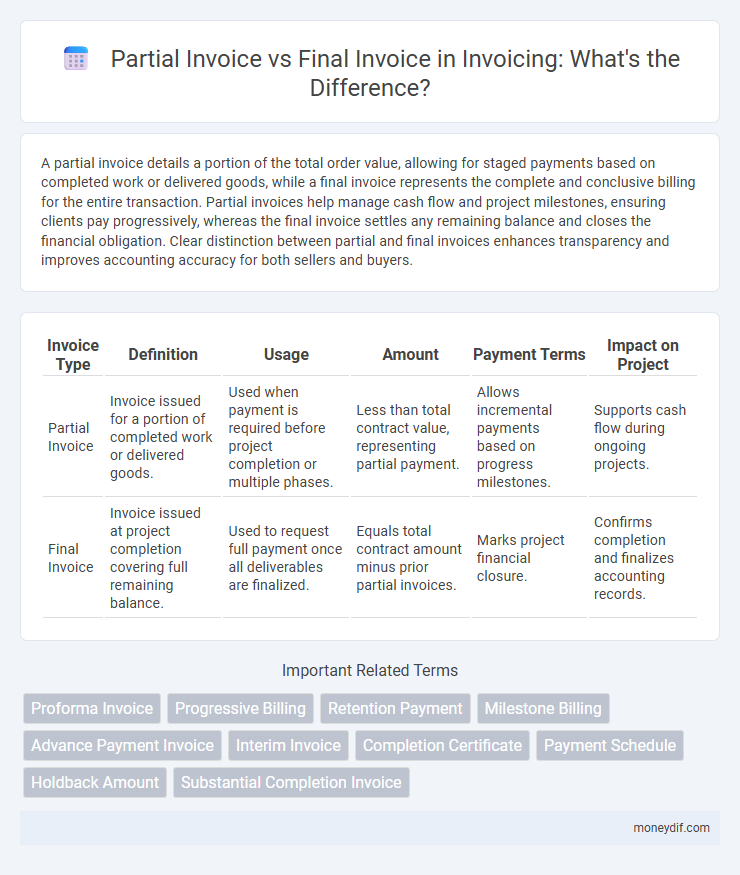

A partial invoice details a portion of the total order value, allowing for staged payments based on completed work or delivered goods, while a final invoice represents the complete and conclusive billing for the entire transaction. Partial invoices help manage cash flow and project milestones, ensuring clients pay progressively, whereas the final invoice settles any remaining balance and closes the financial obligation. Clear distinction between partial and final invoices enhances transparency and improves accounting accuracy for both sellers and buyers.

Table of Comparison

| Invoice Type | Definition | Usage | Amount | Payment Terms | Impact on Project |

|---|---|---|---|---|---|

| Partial Invoice | Invoice issued for a portion of completed work or delivered goods. | Used when payment is required before project completion or multiple phases. | Less than total contract value, representing partial payment. | Allows incremental payments based on progress milestones. | Supports cash flow during ongoing projects. |

| Final Invoice | Invoice issued at project completion covering full remaining balance. | Used to request full payment once all deliverables are finalized. | Equals total contract amount minus prior partial invoices. | Marks project financial closure. | Confirms completion and finalizes accounting records. |

Understanding Partial Invoices

Partial invoices allow businesses to bill clients incrementally for completed portions of a project, improving cash flow and aligning payments with work progress. These invoices detail specific milestones or percentages of work done, offering transparency and reducing financial risk for both parties. Understanding partial invoicing is essential for managing large contracts and ensuring consistent revenue streams before issuing a final invoice that consolidates all charges.

What Is a Final Invoice?

A final invoice is the definitive billing document issued after all goods or services have been delivered and completed, reflecting the total outstanding amount owed by the client. It accounts for any prior partial invoices or deposits, consolidating all charges into a single, comprehensive statement. This invoice serves as the formal request for full payment, closing the transaction between the service provider and the customer.

Key Differences Between Partial and Final Invoices

Partial invoices request payment for a portion of the total project cost, often used in stages or milestones, enabling cash flow throughout long-term projects. Final invoices summarize all previous partial payments and bill the remaining balance, marking the completion of the contract or service. Understanding these differences ensures accurate payment tracking and financial management in project workflows.

When to Use Partial Invoices

Partial invoices are used when payments are required before the full completion of a project or delivery, allowing businesses to manage cash flow effectively. They are ideal for large contracts where work progresses in stages, ensuring clients are billed incrementally for completed portions. This approach reduces financial risk and maintains steady revenue during lengthy projects.

Advantages of Issuing Final Invoices

Issuing final invoices ensures complete clarity by consolidating all charges, payments, and adjustments into a single document, reducing discrepancies and simplifying financial tracking. Final invoices improve cash flow management by triggering final payment commitments, facilitating precise revenue recognition and accurate accounting entries. They also serve as definitive proof of transaction completion, minimizing disputes and enhancing client trust.

Common Use Cases for Partial Invoicing

Partial invoicing is commonly used in project-based industries such as construction, consulting, and manufacturing where payments are made incrementally based on milestones or completed work phases. This method allows businesses to improve cash flow management by billing clients progressively, reducing financial risk associated with extended payment terms. Final invoices are issued after the completion of all services or delivery of goods, summarizing the total amount due and balancing all prior partial payments.

Essential Elements in a Final Invoice

A final invoice must include essential elements such as the invoice number, date of issue, detailed description of all goods or services provided, total amount due including taxes, payment terms, and contact information of both the seller and buyer. It should clearly indicate that it is the final invoice and reflect any previous partial invoices to avoid duplication or confusion. Accurate itemization ensures transparency and facilitates timely payment, making it crucial for accounting and legal records.

Legal Considerations for Partial and Final Invoices

Partial invoices must comply with contractual payment terms and clearly specify the amount billed relative to the total contract value to avoid disputes or legal challenges. Final invoices require comprehensive documentation of all completed work or delivered goods, including any adjustments or credits, to ensure legal enforceability and accurate tax reporting. Compliance with local tax laws and timely submission of both partial and final invoices is critical to maintain legal protection and prevent penalties.

How Partial and Final Invoices Affect Cash Flow

Partial invoices improve cash flow by enabling businesses to receive payments earlier during project phases, reducing financial strain and enhancing liquidity. Final invoices consolidate all remaining charges, ensuring full payment and closing the billing cycle, which can lead to a significant cash inflow. Managing the timing and accuracy of partial and final invoices is crucial for maintaining steady cash flow and optimizing working capital.

Best Practices for Managing Partial and Final Invoices

Managing partial and final invoices effectively requires clear documentation of payment milestones and deliverables to ensure accurate financial tracking and client transparency. Establish defined terms for partial invoices, specifying the percentage or amount due at each project phase, while final invoices should consolidate all charges, adjustments, and confirm project completion. Implement consistent follow-ups and automated reminders to maintain timely payments and reduce discrepancies in the invoicing process.

Important Terms

Proforma Invoice

A Proforma Invoice provides an estimated bill before shipment, while a Partial Invoice requests payment for a portion of goods or services, and a Final Invoice reflects the total amount due after all items or services are delivered.

Progressive Billing

Progressive Billing allows businesses to issue partial invoices based on project milestones, ensuring accurate cash flow management before issuing the final invoice upon project completion.

Retention Payment

Retention payment is withheld from partial invoices to ensure project completion and is released upon approval of the final invoice.

Milestone Billing

Milestone billing involves issuing partial invoices based on project stages or deliverables, while the final invoice consolidates all previous partial payments and reflects the total project cost.

Advance Payment Invoice

An Advance Payment Invoice records a partial upfront payment toward a total contract, whereas a Final Invoice reflects the complete settlement after all goods or services have been delivered.

Interim Invoice

An interim invoice is a partial invoice issued during a project to request payment for completed work segments, whereas a final invoice is the comprehensive, concluding invoice summarizing all charges after project completion.

Completion Certificate

A Completion Certificate verifies project fulfillment and is essential for issuing the final invoice, while partial invoices are based on completed milestones before project completion.

Payment Schedule

The payment schedule is structured to align partial invoice installments with project milestones, while the final invoice consolidates all outstanding payments for project completion validation.

Holdback Amount

The holdback amount represents a retained portion of the partial invoice payment, withheld until the final invoice is issued and all contractual obligations are verified.

Substantial Completion Invoice

A Substantial Completion Invoice marks the transition from partial invoices to the final invoice by billing the remaining balance after key project milestones are met.

partial invoice vs final invoice Infographic

moneydif.com

moneydif.com