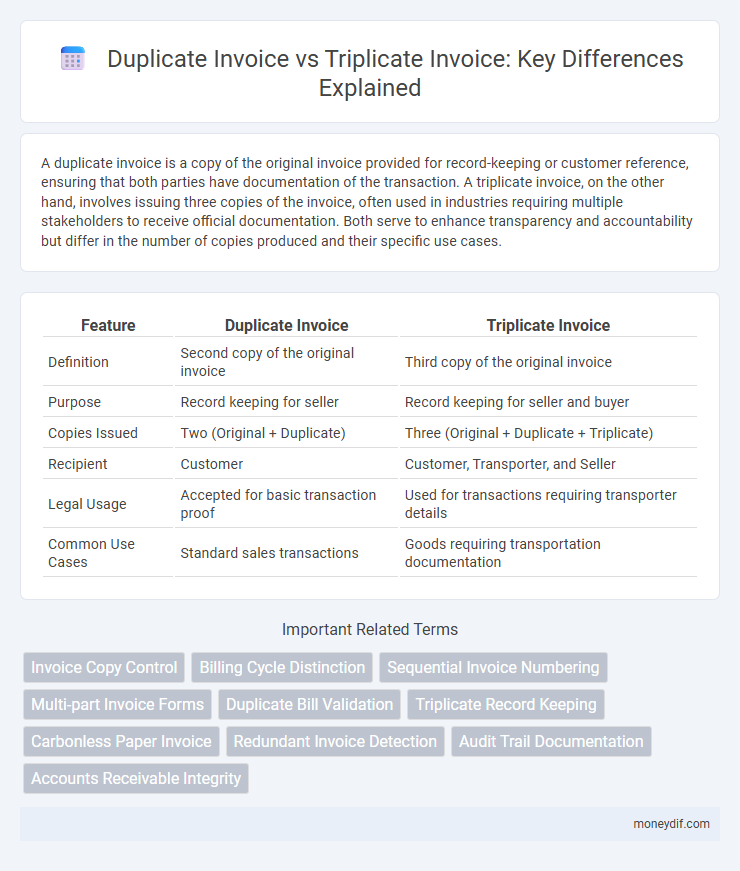

A duplicate invoice is a copy of the original invoice provided for record-keeping or customer reference, ensuring that both parties have documentation of the transaction. A triplicate invoice, on the other hand, involves issuing three copies of the invoice, often used in industries requiring multiple stakeholders to receive official documentation. Both serve to enhance transparency and accountability but differ in the number of copies produced and their specific use cases.

Table of Comparison

| Feature | Duplicate Invoice | Triplicate Invoice |

|---|---|---|

| Definition | Second copy of the original invoice | Third copy of the original invoice |

| Purpose | Record keeping for seller | Record keeping for seller and buyer |

| Copies Issued | Two (Original + Duplicate) | Three (Original + Duplicate + Triplicate) |

| Recipient | Customer | Customer, Transporter, and Seller |

| Legal Usage | Accepted for basic transaction proof | Used for transactions requiring transporter details |

| Common Use Cases | Standard sales transactions | Goods requiring transportation documentation |

Understanding Duplicate and Triplicate Invoices

Duplicate invoices serve as an exact replica of the original invoice, typically used for record-keeping and audit purposes, ensuring both the vendor and purchaser have consistent transaction documentation. Triplicate invoices extend this concept by providing three identical copies, facilitating multiple departments or entities involved in the transaction to maintain synchronized financial records. Understanding duplicate and triplicate invoices helps organizations streamline accounting processes, ensure compliance, and reduce errors in invoice management.

Key Differences Between Duplicate and Triplicate Invoices

Duplicate invoices contain two copies: the original for the buyer and the duplicate for the seller, primarily used for record-keeping and transaction verification. Triplicate invoices include three copies, adding an additional layer for tax authorities or internal reference, facilitating compliance with regulatory requirements. The key difference lies in the number of copies and their intended recipients, influencing documentation and audit processes.

Purpose of Duplicate Invoices in Business

Duplicate invoices serve as exact copies of the original invoice, primarily used for record-keeping and transparency between businesses and clients. They ensure that both parties have identical documentation of a transaction, facilitating accurate financial tracking and dispute resolution. Maintaining duplicate invoices enhances accountability and supports compliance with auditing and tax regulations.

Importance of Triplicate Invoices for Record Keeping

Triplicate invoices play a crucial role in comprehensive financial record keeping by providing three copies: one for the seller, one for the buyer, and one for accounting or tax authorities. Unlike duplicate invoices, which offer only two copies, triplicate invoices ensure thorough documentation and facilitate easier auditing and compliance with tax regulations. Maintaining triplicate invoices helps organizations track transactions accurately and supports better financial transparency and accountability.

Legal Requirements for Duplicate vs Triplicate Invoices

Duplicate invoices typically consist of two copies: the original and one carbon copy, meeting basic legal requirements for record-keeping and tax purposes in many jurisdictions. Triplicate invoices include three copies--original plus two carbon copies--to comply with stricter regulations often required in industries like transportation or manufacturing for enhanced audit trails and accountability. Legal mandates for issuing duplicate versus triplicate invoices vary by country and sector, with triplicate formats ensuring comprehensive documentation for invoicing, delivery, and client verification.

Advantages of Using Duplicate Invoices

Using duplicate invoices enhances record-keeping by providing an immediate, exact copy for both the seller and buyer, facilitating transparent transaction tracking. It reduces errors and disputes by ensuring that both parties have consistent documentation, which is crucial for accounting and auditing purposes. Duplicate invoices also streamline payment processing and improve financial accountability in business operations.

Benefits of Triplicate Invoices in Accounting

Triplicate invoices enhance accounting accuracy by providing three copies, enabling seamless record-keeping for the seller, buyer, and accounting department. They facilitate efficient tracking of transactions, reducing errors and disputes during audits. The additional copy supports compliance with tax regulations and improves financial transparency across all parties involved.

Common Scenarios Requiring Duplicate or Triplicate Invoices

Common scenarios requiring duplicate or triplicate invoices include transactions involving multiple parties such as buyers, sellers, and tax authorities where documentation needs to be shared for verification and record-keeping. Duplicate invoices are often used in sales where the buyer and seller each require a copy for accounting and tax compliance, while triplicate invoices are essential in industries like manufacturing and logistics to provide copies to the buyer, seller, and transporters. These multi-copy invoices help ensure transparency, prevent disputes, and maintain accurate financial records across all stakeholders involved in a transaction.

How to Prevent Duplicate Invoice Fraud

Implementing robust invoice verification systems and cross-referencing invoice numbers with purchase orders can prevent duplicate invoice fraud. Utilizing automated software that flags repeated invoice submissions and enforcing strict approval workflows reduces the risk of payment errors. Regular audits and employee training create additional safeguards against fraudulent duplicate invoices.

Choosing Between Duplicate and Triplicate Invoices for Your Business

Choosing between duplicate and triplicate invoices depends on your business's record-keeping and audit requirements. Duplicate invoices provide two copies, typically one for the buyer and one for the seller, ensuring clear transaction records, while triplicate invoices include an additional copy for third-party verification or internal documentation. Evaluate your need for compliance, tax filing accuracy, and stakeholder transparency to determine which invoice type optimally supports your operational and financial processes.

Important Terms

Invoice Copy Control

Invoice Copy Control distinguishes between Duplicate Invoice, a first carbon copy for the customer, and Triplicate Invoice, the third copy primarily used for internal accounting and record-keeping purposes.

Billing Cycle Distinction

A billing cycle distinction lies in the issuance of duplicate and triplicate invoices, where duplicate invoices serve as exact copies of the original for the customer's records, while triplicate invoices include an additional copy typically for internal accounting or tax purposes. Each invoice type maintains the same billing details and transaction date, ensuring consistent financial documentation across multiple recipients.

Sequential Invoice Numbering

Sequential invoice numbering ensures unique identification of each invoice, preventing confusion between duplicate invoices issued for record-keeping and triplicate invoices used for multiple party distribution.

Multi-part Invoice Forms

Multi-part invoice forms typically include duplicate invoices for customer records and triplicate invoices for internal accounting and supplier documentation, ensuring accurate transaction tracking and compliance.

Duplicate Bill Validation

Duplicate bill validation distinguishes between duplicate invoices, which are identical copies issued unintentionally, and triplicate invoices, which are authorized multiple copies for record-keeping purposes to prevent billing errors.

Triplicate Record Keeping

Triplicate record keeping enhances financial accuracy by maintaining three copies of invoices, ensuring better audit trails and reducing errors compared to duplicate invoices that only produce two copies.

Carbonless Paper Invoice

Carbonless paper invoices efficiently produce duplicate invoices with two copies and triplicate invoices with three copies, enabling accurate record keeping and streamlined transaction documentation.

Redundant Invoice Detection

Redundant invoice detection algorithms accurately distinguish duplicate invoices, which are exact copies of the same bill, from triplicate invoices, which represent multiple authorized copies issued for record-keeping.

Audit Trail Documentation

Audit Trail Documentation ensures transparency by recording every action taken on financial documents, distinguishing between Duplicate Invoice copies, which serve as exact replicas for record-keeping, and Triplicate Invoices, which involve a third copy utilized for additional verification or external submission. Accurate audit trails help prevent discrepancies, fraud, and errors by maintaining detailed logs that verify the issuance and handling of these invoice types within accounting and compliance frameworks.

Accounts Receivable Integrity

Ensuring accounts receivable integrity requires detecting and preventing duplicate invoices while maintaining accurate records without unnecessary triplicate invoices to avoid financial discrepancies.

Duplicate Invoice vs Triplicate Invoice Infographic

moneydif.com

moneydif.com