A reverse charge invoice shifts the tax liability from the supplier to the customer, commonly used in cross-border or specific domestic transactions to simplify VAT reporting and prevent tax fraud. In contrast, a standard charge invoice requires the supplier to charge and collect VAT on the sale, reflecting the typical taxation process for goods and services. Understanding the distinctions ensures proper compliance with tax regulations and accurate financial accounting.

Table of Comparison

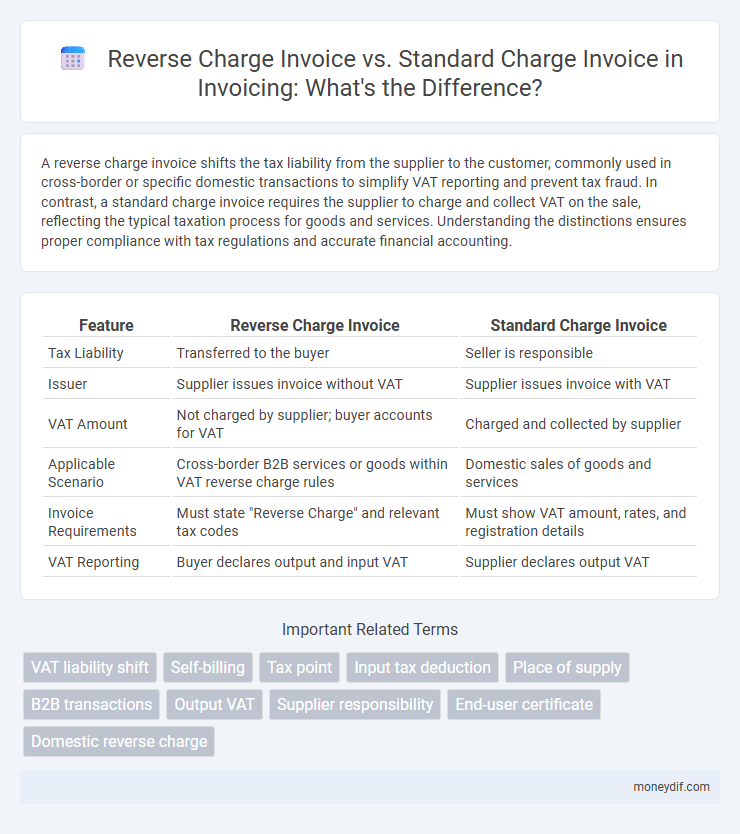

| Feature | Reverse Charge Invoice | Standard Charge Invoice |

|---|---|---|

| Tax Liability | Transferred to the buyer | Seller is responsible |

| Issuer | Supplier issues invoice without VAT | Supplier issues invoice with VAT |

| VAT Amount | Not charged by supplier; buyer accounts for VAT | Charged and collected by supplier |

| Applicable Scenario | Cross-border B2B services or goods within VAT reverse charge rules | Domestic sales of goods and services |

| Invoice Requirements | Must state "Reverse Charge" and relevant tax codes | Must show VAT amount, rates, and registration details |

| VAT Reporting | Buyer declares output and input VAT | Supplier declares output VAT |

Introduction to Invoicing: Reverse Charge vs Standard Charge

Reverse charge invoices shift the VAT liability from the supplier to the buyer, commonly applied in cross-border transactions within the EU and specific domestic situations, reducing the risk of tax evasion. Standard charge invoices require the supplier to charge VAT at the applicable rate, collecting and remitting it to the tax authorities, which is typical for most domestic sales. Understanding the distinction is crucial for compliance with tax regulations, accurate bookkeeping, and avoiding penalties.

What Is a Standard Charge Invoice?

A standard charge invoice is a commercial document issued by a seller to a buyer, reflecting the amount due for goods or services rendered, including applicable taxes such as VAT or sales tax. This invoice type clearly details the seller's taxable supply and the tax amount the buyer must pay, which is collected and remitted by the seller to tax authorities. Standard charge invoices are crucial for straightforward VAT accounting, enabling buyers to claim input tax credits when eligible.

What Is a Reverse Charge Invoice?

A reverse charge invoice shifts the responsibility for VAT payment from the supplier to the customer, commonly used in cross-border transactions within the EU or specific industries. This mechanism helps prevent VAT fraud by requiring the buyer to account for the VAT instead of the seller, ensuring compliance with tax regulations. Unlike a standard charge invoice, which includes VAT charged by the supplier, a reverse charge invoice does not display VAT separately, placing the tax accounting burden on the recipient.

Key Differences Between Reverse Charge and Standard Charge Invoices

Reverse charge invoices shift the tax liability from the supplier to the recipient, requiring the buyer to self-account for VAT, while standard charge invoices place the VAT responsibility on the supplier to collect and remit sales tax. In a reverse charge scenario, no VAT is charged on the invoice, but the buyer must report both output and input VAT on their tax return, contrasting with standard invoices where VAT is explicitly included and paid to the supplier. This difference fundamentally affects bookkeeping, cash flow, and compliance requirements for businesses engaged in cross-border or specified sector transactions.

Legal Requirements for Each Invoice Type

Reverse charge invoices require compliance with specific VAT regulations, mandating clear indication of the reverse charge mechanism and the buyer's responsibility for tax payment. Standard charge invoices must include detailed seller information, VAT rates, taxable amount, and total VAT charged to fulfill legal tax documentation criteria. Failure to adhere to these legal requirements can result in penalties and invalidation of VAT claims by tax authorities.

Industries Commonly Using Reverse Charge Mechanisms

Industries commonly using reverse charge mechanisms include telecommunications, construction, and import/export sectors where cross-border services are prevalent. Reverse charge invoices shift the tax liability from the supplier to the recipient, streamlining VAT compliance in complex supply chains. Standard charge invoices, by contrast, assign VAT collection responsibility to the supplier, relevant in typical domestic transactions without reverse charge applicability.

Impact on VAT/GST Reporting

Reverse charge invoices shift the VAT/GST liability from the supplier to the recipient, requiring recipients to self-account for tax on their VAT/GST returns, which can streamline cross-border transactions and reduce supplier compliance burdens. Standard charge invoices impose the VAT/GST collection responsibility on the supplier, who reports and remits the tax to authorities, affecting cash flow and necessitating accurate tax rate application. Both invoicing methods impact VAT/GST reporting obligations distinctly, influencing input tax credit claims and necessitating precise documentation to ensure regulatory compliance.

How to Issue a Reverse Charge Invoice

Issuing a reverse charge invoice requires clearly stating that the reverse charge mechanism applies, including the buyer's VAT identification number and a reference to the applicable reverse charge legislation. The invoice must omit VAT amount, as the buyer is responsible for reporting and paying VAT in their jurisdiction. Ensuring accurate description of goods or services, invoice date, and total amount exclusive of VAT is essential for compliance and audit purposes.

Common Mistakes in Handling Reverse and Standard Charges

Common mistakes in handling reverse charge and standard charge invoices include incorrect tax calculation, leading to potential compliance issues and penalties. Businesses often confuse the party responsible for VAT payment, resulting in inaccurate bookkeeping and reporting errors. Proper training on tax regulations and clear differentiation between invoice types are crucial to avoid financial risks and regulatory scrutiny.

Choosing the Right Invoice Type for Your Business

Choosing the right invoice type for your business depends on understanding the key differences between reverse charge and standard charge invoices. A reverse charge invoice shifts the VAT payment responsibility from the supplier to the customer, commonly used in B2B transactions across EU countries to simplify cross-border compliance. Standard charge invoices require the supplier to include VAT in the invoice amount and remit it to the tax authorities, suitable for domestic transactions where the supplier is liable for VAT collection.

Important Terms

VAT liability shift

VAT liability shifts to the customer under a reverse charge invoice, whereas the supplier accounts for VAT under a standard charge invoice.

Self-billing

Self-billing requires the buyer to issue reverse charge invoices when VAT liability shifts, contrasting standard charge invoices where the seller accounts for VAT.

Tax point

The tax point for a reverse charge invoice occurs when the customer accounts for VAT, differing from the standard charge invoice where the supplier's invoice date establishes the tax point.

Input tax deduction

Input tax deduction applies only when the reverse charge invoice is properly accounted for, whereas standard charge invoices allow direct input tax credit claims from suppliers.

Place of supply

Place of supply determines tax jurisdiction, affecting whether a reverse charge invoice or standard charge invoice applies under GST regulations.

B2B transactions

B2B transactions under reverse charge invoicing transfer VAT liability from the supplier to the buyer, unlike standard charge invoices where the supplier charges and remits VAT.

Output VAT

Output VAT on a reverse charge invoice is accounted by the buyer instead of the supplier, contrasting with a standard charge invoice where the supplier charges and remits the VAT directly.

Supplier responsibility

Supplier responsibility involves correctly determining whether to issue a reverse charge invoice, where the buyer accounts for VAT, or a standard charge invoice, where the supplier charges VAT, based on applicable tax regulations and transaction context.

End-user certificate

An end-user certificate verifies the final recipient's compliance for tax purposes and is crucial in distinguishing reverse charge invoices, which shift VAT liability to the buyer, from standard charge invoices where the seller includes VAT.

Domestic reverse charge

Domestic reverse charge shifts VAT payment responsibility from the supplier to the customer, requiring reverse charge invoices to exclude VAT amounts, unlike standard charge invoices which include VAT charged by the supplier.

reverse charge invoice vs standard charge invoice Infographic

moneydif.com

moneydif.com