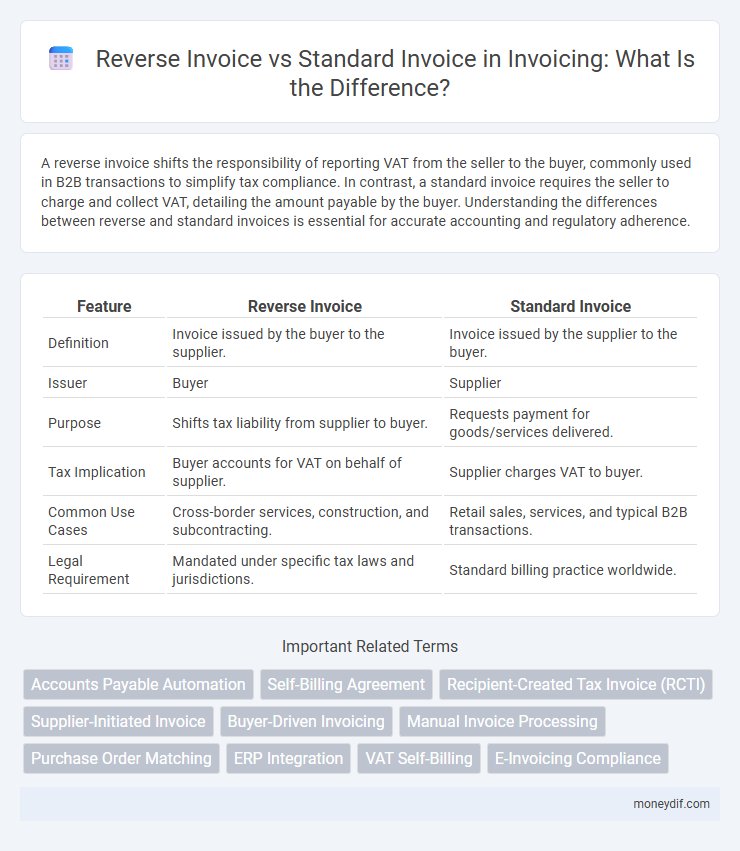

A reverse invoice shifts the responsibility of reporting VAT from the seller to the buyer, commonly used in B2B transactions to simplify tax compliance. In contrast, a standard invoice requires the seller to charge and collect VAT, detailing the amount payable by the buyer. Understanding the differences between reverse and standard invoices is essential for accurate accounting and regulatory adherence.

Table of Comparison

| Feature | Reverse Invoice | Standard Invoice |

|---|---|---|

| Definition | Invoice issued by the buyer to the supplier. | Invoice issued by the supplier to the buyer. |

| Issuer | Buyer | Supplier |

| Purpose | Shifts tax liability from supplier to buyer. | Requests payment for goods/services delivered. |

| Tax Implication | Buyer accounts for VAT on behalf of supplier. | Supplier charges VAT to buyer. |

| Common Use Cases | Cross-border services, construction, and subcontracting. | Retail sales, services, and typical B2B transactions. |

| Legal Requirement | Mandated under specific tax laws and jurisdictions. | Standard billing practice worldwide. |

Understanding Standard Invoices

Standard invoices are documents issued by a seller to a buyer, detailing products or services provided, payment terms, and the total amount due. They serve as a formal request for payment and include key details such as invoice number, date, item descriptions, quantities, prices, and applicable taxes. Standard invoices play a crucial role in accounting by ensuring accurate revenue tracking and compliance with tax regulations.

What Is a Reverse Invoice?

A reverse invoice is a billing document issued by the buyer rather than the seller, typically used in transactions involving tax regulations such as VAT. It shifts the responsibility for reporting the transaction from the supplier to the purchaser, often applied in cross-border services or goods. Unlike standard invoices that detail the sale from seller to buyer, reverse invoices ensure tax compliance by having the buyer account for the VAT on the transaction.

Key Differences Between Reverse and Standard Invoices

A standard invoice is issued by the seller to the buyer, detailing the products or services provided along with the payment terms, while a reverse invoice is generated by the buyer to request payment, often used in consignment or drop-shipping arrangements. Reverse invoices shift the responsibility of invoice creation from the supplier to the recipient, which simplifies tax reporting and compliance in some jurisdictions. Key differences include who issues the invoice, the flow of tax liability, and the roles each party plays in the accounting process.

Advantages of Using Standard Invoices

Standard invoices provide clear documentation of sales transactions, ensuring accurate record-keeping and simplifying financial audits. They facilitate timely payment collection by detailing the amount owed, payment terms, and buyer information. Using standard invoices enhances transparency and compliance with tax regulations, reducing the risk of errors and disputes.

Benefits of Reverse Invoicing for Businesses

Reverse invoicing shifts the responsibility of invoice creation from the supplier to the buyer, enhancing accuracy by reducing discrepancies and errors in billing. This method streamlines accounts payable processes, resulting in faster approvals and improved cash flow management for businesses. Companies benefit from increased transparency and better control over purchase data, facilitating more effective budgeting and auditing practices.

Use Cases for Standard Invoices

Standard invoices are primarily used in transactions where the seller issues a document detailing goods or services provided, specifying payment terms and amounts due. They are common in typical B2B sales, retail purchases, and service contracts, facilitating straightforward payment processing and accounting. This invoicing method supports clear tax reporting and compliance by itemizing VAT or sales tax applied.

Scenarios Where Reverse Invoicing Is Preferred

In industries such as construction, manufacturing, and large-scale procurement, reverse invoicing is preferred due to its ability to streamline payment processes by shifting the responsibility of invoice creation from supplier to buyer. This approach enhances control over purchase verification, reduces invoice discrepancies, and accelerates reconciliation by integrating directly with procurement systems. Reverse invoicing is particularly effective in scenarios involving bulk orders, long-term contracts, or complex supply chains where accuracy and transparency in billing are critical.

Compliance and Legal Considerations

Reverse invoices require strict adherence to tax regulations as the buyer assumes responsibility for reporting VAT, ensuring compliance with local jurisdiction laws to avoid legal penalties. Standard invoices mandate the supplier to include detailed transaction information, such as tax identification numbers and breakdowns of VAT, to maintain transparency and meet auditing standards. Both invoice types must be aligned with country-specific invoice retention policies and electronic invoicing mandates to ensure full legal compliance.

Common Challenges with Both Invoice Types

Handling reverse invoices and standard invoices often involves challenges such as accurate tax calculation and compliance with varying regional VAT rules. Both invoice types require meticulous matching of purchase orders and payment terms to prevent discrepancies and payment delays. Ensuring proper documentation and audit trails is crucial for financial transparency and regulatory adherence across accounting systems.

Choosing the Right Invoice Method for Your Business

Selecting the appropriate invoice method depends on your business model and tax compliance requirements. Reverse invoices shift the responsibility of tax reporting from the seller to the buyer, commonly used in B2B transactions and cross-border trade to simplify VAT handling. Standard invoices, issued by the seller, provide clear documentation for payment requests and are essential for straightforward sales processes and maintaining transparent financial records.

Important Terms

Accounts Payable Automation

Accounts Payable Automation streamlines processing by automatically handling reverse invoices, where the supplier confirms goods or services received, and standard invoices, which require full invoice data submission for payment.

Self-Billing Agreement

A Self-Billing Agreement allows the buyer to issue invoices on behalf of the supplier, typically utilizing reverse invoicing where the buyer calculates and records the amount payable, contrasting with standard invoicing where the supplier issues the invoice.

Recipient-Created Tax Invoice (RCTI)

Recipient-Created Tax Invoice (RCTI) allows the recipient to issue the invoice, reversing the standard invoicing process where the supplier generates the invoice for tax and payment purposes.

Supplier-Initiated Invoice

Supplier-initiated invoices typically involve standard invoices issued by the supplier, while reverse invoices refer to buyer-generated documents for verification and payment reconciliation.

Buyer-Driven Invoicing

Buyer-driven invoicing shifts payment control to the buyer by validating reverse invoices generated from purchase orders, unlike standard invoices issued by suppliers for direct billing.

Manual Invoice Processing

Manual invoice processing involves higher error rates and longer approval times, with reverse invoices requiring additional verification steps compared to standard invoices.

Purchase Order Matching

Purchase Order Matching compares reverse invoices, which credit returns or adjustments, with standard invoices to ensure accurate payment reconciliation and prevent discrepancies.

ERP Integration

ERP integration streamlines financial workflows by automating the processing of reverse invoices for returns and credit adjustments, contrasting with standard invoice processing that records regular sales transactions.

VAT Self-Billing

VAT self-billing involves the customer issuing the invoice on behalf of the supplier, differing from a standard invoice where the supplier issues it, and can affect tax compliance, VAT reporting, and accounting processes.

E-Invoicing Compliance

E-Invoicing compliance requires accurate classification between reverse invoices, issued by the buyer, and standard invoices, generated by the seller, to ensure regulatory adherence and proper tax reporting.

reverse invoice vs standard invoice Infographic

moneydif.com

moneydif.com