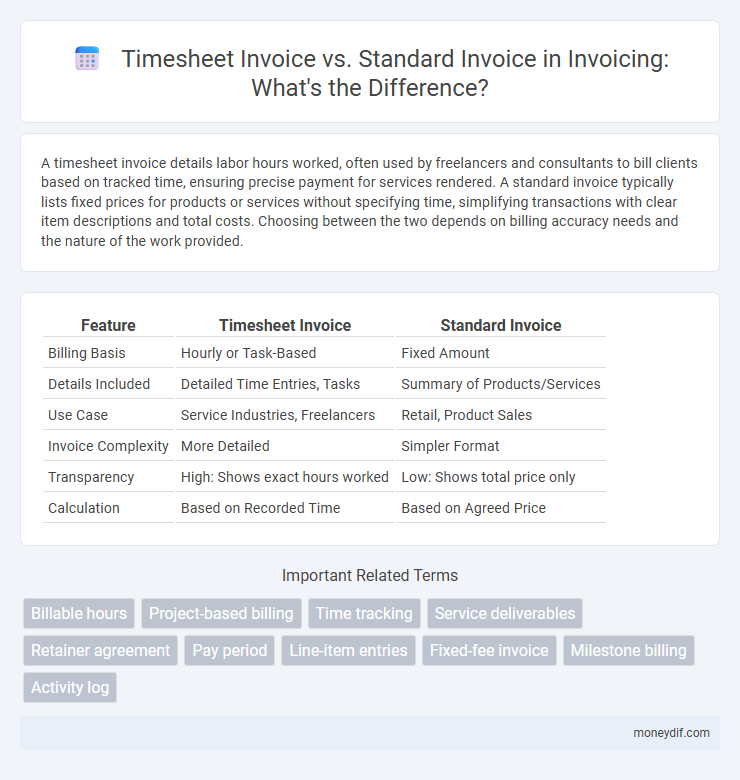

A timesheet invoice details labor hours worked, often used by freelancers and consultants to bill clients based on tracked time, ensuring precise payment for services rendered. A standard invoice typically lists fixed prices for products or services without specifying time, simplifying transactions with clear item descriptions and total costs. Choosing between the two depends on billing accuracy needs and the nature of the work provided.

Table of Comparison

| Feature | Timesheet Invoice | Standard Invoice |

|---|---|---|

| Billing Basis | Hourly or Task-Based | Fixed Amount |

| Details Included | Detailed Time Entries, Tasks | Summary of Products/Services |

| Use Case | Service Industries, Freelancers | Retail, Product Sales |

| Invoice Complexity | More Detailed | Simpler Format |

| Transparency | High: Shows exact hours worked | Low: Shows total price only |

| Calculation | Based on Recorded Time | Based on Agreed Price |

Introduction to Timesheet Invoice vs Standard Invoice

Timesheet invoices track billable hours based on recorded work time, making them ideal for projects with variable hours or hourly rates. Standard invoices typically list fixed amounts for products or services, offering straightforward billing without detailed time tracking. Businesses choose between these invoicing methods depending on project complexity, client requirements, and payment structure preferences.

Key Differences Between Timesheet and Standard Invoices

Timesheet invoices itemize billable hours with detailed employee work logs, providing transparency and accuracy in client billing. Standard invoices present fixed or product-based charges without hourly breakdowns, ideal for prepaid or flat-rate services. Choosing between these depends on billing structure preference, project scope, and client requirements for accountability.

When to Use a Timesheet Invoice

Timesheet invoices are ideal for billing clients based on hourly work or tasks completed over specific time intervals, providing detailed records of hours worked and activities performed. They ensure transparent and accurate billing when project scopes vary or evolve, especially in consulting, freelancing, or service industries. Use timesheet invoices when precise time tracking is essential for client trust and project accountability.

When to Choose a Standard Invoice

A standard invoice is ideal for fixed-price projects where the scope and costs are predefined, providing clarity and simplicity for both parties. This type of invoice suits businesses requiring straightforward billing without tracking hours, ensuring predictable cash flow and streamlined accounting. Choosing a standard invoice reduces administrative complexity when services or products are delivered as a lump sum or predetermined amount.

Essential Elements of a Timesheet Invoice

A timesheet invoice includes detailed records of hours worked, specifying dates, tasks, and hourly rates, ensuring accurate billing based on employee productivity. Essential elements of a timesheet invoice comprise client information, project description, total hours logged, and a breakdown of time entries. This format enhances transparency and supports precise payment calculations compared to a standard invoice.

Essential Elements of a Standard Invoice

A standard invoice must include essential elements such as the seller's and buyer's contact information, a unique invoice number, the date of issue, and a detailed description of the goods or services provided. It should clearly state the quantity, unit price, total amount due, payment terms, and accepted payment methods to ensure transparency and prompt payment. Including tax identification numbers and applicable taxes or discounts further enhances accuracy and compliance with legal requirements.

Advantages of Timesheet Invoicing

Timesheet invoicing provides precise billing based on actual hours worked, enhancing transparency and accuracy for both clients and service providers. This method allows detailed tracking of labor, reducing disputes and improving project management efficiency. Timesheet invoices also facilitate better resource allocation by highlighting time spent on specific tasks or projects.

Pros and Cons of Standard Invoicing

Standard invoices provide a clear, itemized summary of fixed charges, making them ideal for predictable billing cycles and straightforward financial tracking. They simplify accounting by consolidating payments into a single document, reducing administrative overhead compared to timesheet invoices that require detailed tracking of hours worked. However, standard invoices may lack the flexibility needed for projects with variable time inputs, potentially causing discrepancies in billing accuracy and client disputes.

Common Mistakes with Timesheet and Standard Invoices

Timesheet invoices often contain errors such as incorrect time entries, inconsistent date formats, and missing approval signatures, leading to delayed payments and disputes. Standard invoices frequently suffer from issues like inaccurate billing amounts, omitted purchase order numbers, and insufficient item descriptions. Ensuring accuracy in both invoice types requires meticulous verification of all data points to prevent processing delays and maintain financial compliance.

Choosing the Right Invoice Type for Your Business

Timesheet invoices are ideal for businesses billing clients based on hours worked, ensuring accurate tracking of labor and project time. Standard invoices suit fixed-price projects or product sales, offering straightforward billing without detailed time breakdowns. Choosing the right invoice type enhances payment clarity and aligns billing practices with your business model.

Important Terms

Billable hours

Billable hours recorded in a timesheet invoice are detailed and client-specific, enabling precise billing, whereas a standard invoice typically aggregates costs without itemizing time spent.

Project-based billing

Project-based billing leverages detailed timesheet invoices to accurately capture billable hours per task, offering enhanced transparency compared to standard invoices that typically summarize charges without granular time tracking.

Time tracking

Time tracking enables precise documentation of billable hours, facilitating the generation of timesheet invoices that reflect actual work performed, unlike standard invoices which often use fixed or estimated amounts. Accurate timesheet invoices improve client transparency, optimize payment accuracy, and support detailed project cost analysis.

Service deliverables

Service deliverables for timesheet invoices require detailed tracking of hours worked and tasks completed, ensuring accurate billing based on actual time recorded. Standard invoices focus on pre-defined deliverables or milestones, emphasizing fixed costs and agreed-upon project scopes rather than hourly data.

Retainer agreement

A retainer agreement stipulates ongoing services paid via regular timesheet invoices that detail hours worked, in contrast to standard invoices which typically bill fixed amounts or project milestones. Timesheet invoices enhance transparency and accuracy in billing by matching exact time spent, while standard invoices simplify payments with predetermined fees.

Pay period

The pay period defines the specific timeframe during which employee work hours are recorded and is critical for aligning timesheet invoices with actual labor costs. Timesheet invoices detail hours worked within the pay period, ensuring accurate billing based on tracked time, unlike standard invoices which may use fixed rates or project milestones without granular time data.

Line-item entries

Line-item entries in timesheet invoices detail hours worked per task, ensuring precise billing, whereas standard invoices use aggregated charges without task-specific breakdowns.

Fixed-fee invoice

Fixed-fee invoices provide a predetermined charge regardless of hours recorded, contrasting with timesheet invoices that bill based on actual hours worked and standard invoices which combine fixed rates and variable components. Timesheet invoices optimize transparency for hourly projects while fixed-fee invoices simplify budgeting in contracts with agreed deliverables.

Milestone billing

Milestone billing allocates payments based on completed project phases, contrasting with standard invoices that bill for fixed amounts or time worked. Timesheet invoices itemize hours logged and tasks performed, providing detailed labor costs, whereas milestone invoices trigger payments upon achieving specific project deliverables or deadlines.

Activity log

The activity log tracks detailed time entries and billable hours to accurately reconcile timesheet invoices versus standard invoices in project accounting systems.

Timesheet invoice vs Standard invoice Infographic

moneydif.com

moneydif.com