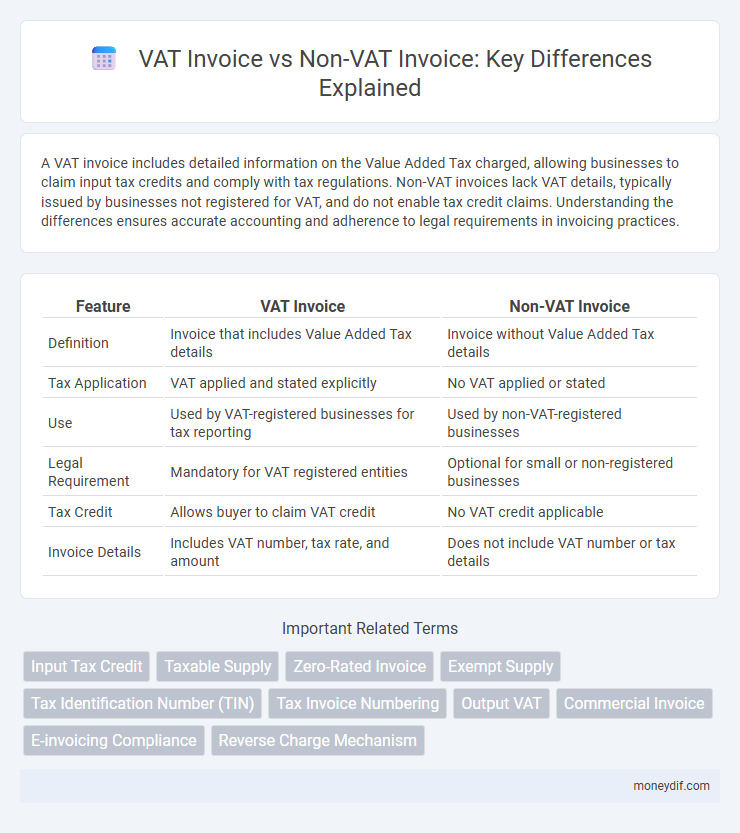

A VAT invoice includes detailed information on the Value Added Tax charged, allowing businesses to claim input tax credits and comply with tax regulations. Non-VAT invoices lack VAT details, typically issued by businesses not registered for VAT, and do not enable tax credit claims. Understanding the differences ensures accurate accounting and adherence to legal requirements in invoicing practices.

Table of Comparison

| Feature | VAT Invoice | Non-VAT Invoice |

|---|---|---|

| Definition | Invoice that includes Value Added Tax details | Invoice without Value Added Tax details |

| Tax Application | VAT applied and stated explicitly | No VAT applied or stated |

| Use | Used by VAT-registered businesses for tax reporting | Used by non-VAT-registered businesses |

| Legal Requirement | Mandatory for VAT registered entities | Optional for small or non-registered businesses |

| Tax Credit | Allows buyer to claim VAT credit | No VAT credit applicable |

| Invoice Details | Includes VAT number, tax rate, and amount | Does not include VAT number or tax details |

Understanding VAT Invoices: Definition and Key Features

A VAT invoice is a legal document issued by registered businesses, detailing the sale of goods or services with a specified Value Added Tax amount clearly indicated, enabling buyers to reclaim VAT. Key features include the supplier's VAT registration number, invoice date, description of goods or services, unit prices, total amount excluding and including VAT, and the applicable VAT rate. Non-VAT invoices are issued by non-registered entities or for transactions not subject to VAT, lacking VAT details and offering no tax reclaim benefits.

What is a Non-VAT Invoice? Essential Differences

A Non-VAT invoice is a type of sales document issued by businesses that are not registered for Value Added Tax (VAT) and therefore do not charge VAT on their goods or services. Unlike VAT invoices, Non-VAT invoices do not include VAT amounts or tax identification numbers, which means buyers cannot claim VAT credits from these transactions. Key distinctions include the absence of VAT rates and tax breakdown, making Non-VAT invoices simpler but less advantageous for tax deduction purposes.

Legal Requirements for Issuing VAT and Non-VAT Invoices

Legal requirements for issuing VAT invoices mandate the inclusion of the vendor's Tax Identification Number (TIN), the VAT amount, and a sequential invoice number to ensure compliance with tax authorities. Non-VAT invoices, issued by entities exempt from VAT registration or for transactions outside VAT scope, require basic details such as seller and buyer information but exclude VAT-specific data. Proper classification and issuance of VAT and non-VAT invoices are crucial for accurate tax reporting and audit readiness under prevailing tax regulations.

Components of a Standard VAT Invoice

A standard VAT invoice must include the seller's name, address, and VAT registration number, along with the invoice date and a unique invoice number. It should itemize goods or services with descriptions, quantities, unit prices, and the applicable VAT rate and amount for each line. Total amounts, both excluding and including VAT, are essential components to ensure compliance with tax regulations and facilitate accurate record-keeping.

When to Issue a VAT Invoice vs Non-VAT Invoice

A VAT invoice must be issued when a business is VAT-registered and supplies goods or services subject to VAT, ensuring compliance with tax regulations and enabling the recipient to claim input tax credits. Non-VAT invoices apply to non-registered suppliers or transactions exempt from VAT, where issuing a VAT invoice is not mandatory. Accurate determination between VAT and non-VAT invoices depends on the supplier's registration status and the nature of the transaction.

Tax Implications: Claiming Input VAT and Deductions

VAT invoices allow businesses to claim input VAT deductions, reducing their overall tax liability by offsetting the VAT paid on purchases against their VAT collected on sales. Non-VAT invoices do not enable input VAT claims, resulting in no VAT deductions and potentially higher tax burdens for businesses. Understanding these distinctions is crucial for accurate tax reporting and optimizing VAT-related financial outcomes.

Recordkeeping and Compliance for VAT and Non-VAT Invoices

VAT invoices are essential for accurate VAT recordkeeping and compliance, as they include detailed VAT amounts and enable businesses to claim input tax credits. Non-VAT invoices exclude VAT details, simplifying transactions but limiting the ability to recover VAT, necessitating careful documentation to ensure regulatory adherence. Proper maintenance of both VAT and non-VAT invoices ensures transparent financial records and compliance with tax authorities.

Common Mistakes in Issuing VAT and Non-VAT Invoices

Common mistakes in issuing VAT and non-VAT invoices include incorrect application of VAT rates, failure to specify VAT registration numbers, and omission of essential invoice details such as invoice date and serial number. Businesses often confuse taxable and non-taxable transactions, leading to improper classification of invoices and potential tax compliance issues. Proper training on VAT regulations and accurate invoice templates help minimize errors and ensure adherence to tax authority requirements.

Impact on Businesses: VAT Registered vs Non-VAT Registered Entities

VAT invoices are mandatory for VAT-registered businesses and enable them to claim input tax credits, improving cash flow and reducing tax liabilities. Non-VAT registered entities issue non-VAT invoices, which do not include VAT charges, limiting their ability to reclaim input tax and potentially increasing their overall tax burden. The choice between VAT and non-VAT invoicing directly affects business compliance, pricing strategies, and competitive positioning within the market.

Sample Templates: VAT Invoice vs Non-VAT Invoice

Sample templates for VAT invoices include detailed sections for tax identification numbers, VAT rates, and the calculated VAT amount, ensuring compliance with tax authorities. Non-VAT invoice templates typically omit VAT-specific fields and focus on subtotals and total amounts without tax breakdowns, suitable for businesses not registered for VAT. Both templates require clear item descriptions and payment terms but differ primarily in their handling of tax details.

Important Terms

Input Tax Credit

Input Tax Credit can only be claimed on purchases supported by a valid VAT invoice, whereas non-VAT invoices do not qualify for reclaiming VAT paid.

Taxable Supply

A taxable supply under VAT law requires issuing a VAT invoice with specified tax details, whereas non-VAT invoices are issued for exempt or non-taxable supplies without VAT charges.

Zero-Rated Invoice

A Zero-Rated Invoice is a VAT Invoice indicating taxable goods or services charged at 0% VAT, allowing input tax credit claims, unlike a Non-VAT Invoice which applies to entities not registered for VAT and incurs no VAT-related reporting or credits.

Exempt Supply

Exempt supply transactions do not require a VAT invoice, as they are excluded from VAT charges, whereas non-exempt transactions must issue a VAT invoice to document VAT collection.

Tax Identification Number (TIN)

A Tax Identification Number (TIN) is mandatory on VAT invoices to validate tax payments and enable VAT claims, while it is typically optional or less emphasized on non-VAT invoices.

Tax Invoice Numbering

Tax invoice numbering must distinguish VAT invoices by following government regulations for sequential numbering, while non-VAT invoices require separate unique numbering to ensure accurate tax reporting and compliance.

Output VAT

Output VAT is charged only on VAT invoices issued to customers, whereas non-VAT invoices do not generate Output VAT liability.

Commercial Invoice

A commercial invoice serves as a legal document for customs and payment purposes, while a VAT invoice includes detailed tax information required for VAT reclaim, and a non-VAT invoice lacks VAT details, affecting tax deduction eligibility.

E-invoicing Compliance

E-invoicing compliance mandates precise differentiation between VAT invoices, which document value-added tax for tax credit purposes, and non-VAT invoices that do not include VAT, ensuring accurate tax reporting and legal adherence.

Reverse Charge Mechanism

The Reverse Charge Mechanism shifts VAT payment responsibility from the supplier to the recipient, applicable only to VAT invoices while non-VAT invoices remain exempt from this VAT liability.

VAT Invoice vs Non-VAT Invoice Infographic

moneydif.com

moneydif.com