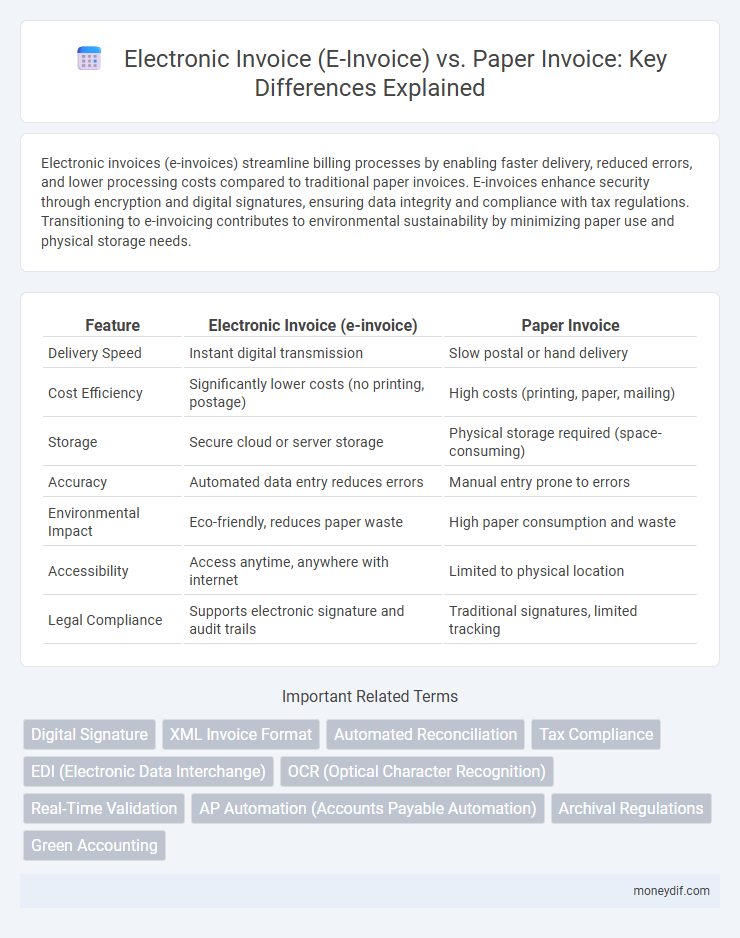

Electronic invoices (e-invoices) streamline billing processes by enabling faster delivery, reduced errors, and lower processing costs compared to traditional paper invoices. E-invoices enhance security through encryption and digital signatures, ensuring data integrity and compliance with tax regulations. Transitioning to e-invoicing contributes to environmental sustainability by minimizing paper use and physical storage needs.

Table of Comparison

| Feature | Electronic Invoice (e-invoice) | Paper Invoice |

|---|---|---|

| Delivery Speed | Instant digital transmission | Slow postal or hand delivery |

| Cost Efficiency | Significantly lower costs (no printing, postage) | High costs (printing, paper, mailing) |

| Storage | Secure cloud or server storage | Physical storage required (space-consuming) |

| Accuracy | Automated data entry reduces errors | Manual entry prone to errors |

| Environmental Impact | Eco-friendly, reduces paper waste | High paper consumption and waste |

| Accessibility | Access anytime, anywhere with internet | Limited to physical location |

| Legal Compliance | Supports electronic signature and audit trails | Traditional signatures, limited tracking |

Introduction to Electronic and Paper Invoices

Electronic invoices (e-invoices) streamline billing by enabling faster processing, reducing errors, and promoting sustainability through paperless transactions. Paper invoices, traditionally printed and mailed, often involve higher costs, longer delivery times, and increased risk of loss or damage. E-invoices integrate seamlessly with accounting software, enhancing accuracy and compliance with tax regulations compared to manual handling in paper invoicing.

Key Differences Between E-Invoices and Paper Invoices

Electronic invoices (e-invoices) streamline transaction processing by enabling instant digital delivery, automated data entry, and real-time tracking, reducing human error and operational costs compared to traditional paper invoices. Paper invoices rely on manual handling, physical storage, and postal services, often resulting in slower processing times and higher chances of loss or damage. E-invoices support enhanced compliance through easy integration with accounting systems and regulatory frameworks, whereas paper invoices demand extensive manual audits and filing.

Advantages of Electronic Invoicing

Electronic invoicing significantly reduces processing time and minimizes errors by automating data entry and validation, resulting in faster approval and payment cycles. It enhances security and compliance through encrypted data transmission and digital signatures, ensuring authenticity and reducing fraud risk. Cost savings are achieved by eliminating paper, printing, and postage expenses, while enabling seamless integration with accounting software for improved financial management and reporting.

Drawbacks of Electronic Invoicing

Electronic invoicing (e-invoicing) faces significant drawbacks such as high initial setup costs and dependency on stable internet connectivity, which can disrupt processing for businesses in low-bandwidth areas. Security concerns related to data breaches and cyberattacks pose risks to sensitive financial information during electronic transmission. Additionally, compliance complexities with varying regulations across different regions create challenges for companies operating internationally.

Benefits of Paper Invoicing

Paper invoicing offers tangible document handling that many businesses trust for legal and archival purposes, ensuring physical proof of transactions. It facilitates easier signature verification and notarization compared to digital formats, enhancing authenticity in certain regulatory environments. Paper invoices also maintain accessibility without reliance on technology, making them valuable in regions with limited digital infrastructure.

Limitations of Paper Invoices

Paper invoices face significant limitations including higher processing costs, increased risk of human error, and longer payment cycles. Manual handling often leads to lost or damaged documents, reducing overall efficiency and accuracy. Paper invoices also lack real-time tracking capabilities, hindering prompt financial decision-making and audit transparency.

Security and Compliance in Invoicing Systems

Electronic invoices (e-invoices) offer enhanced security through encryption, digital signatures, and secure transmission protocols, reducing the risk of fraud compared to paper invoices. E-invoicing systems facilitate compliance with tax regulations by automating data validation and maintaining audit trails, ensuring adherence to legal standards. Paper invoices, while traditional, are more susceptible to loss, tampering, and errors, making them less reliable for secure and compliant invoicing.

Cost Comparison: E-Invoice vs Paper Invoice

Electronic invoices reduce processing costs by up to 80% compared to paper invoices, mainly due to lower printing, mailing, and manual handling expenses. According to industry data, the average cost per paper invoice ranges from $8 to $12, while e-invoices typically cost between $1 and $3 each. Businesses adopting e-invoicing also benefit from faster payment cycles and reduced errors, further decreasing overall operational costs.

Impact on Business Efficiency and Productivity

Electronic invoices (e-invoices) streamline accounts payable workflows by automating data entry and minimizing errors, leading to faster processing times and reduced operational costs. Paper invoices require manual handling, increasing the risk of delays, lost documents, and higher labor expenses, which can hinder cash flow and overall business productivity. Implementing e-invoicing enhances real-time tracking, improves compliance accuracy, and accelerates payment cycles, directly boosting organizational efficiency.

Future Trends in Invoicing Technologies

E-invoices are rapidly replacing paper invoices due to their enhanced efficiency, reduced processing times, and lower operational costs, driven by advancements in blockchain and AI-powered validation systems. Future trends in invoicing technologies emphasize automation, real-time data exchange, and integration with cloud-based Enterprise Resource Planning (ERP) systems to ensure accuracy and compliance. Governments worldwide are adopting mandatory e-invoicing standards to improve tax transparency and reduce fraud, accelerating the shift away from traditional paper invoicing.

Important Terms

Digital Signature

Digital signatures enhance the security and authenticity of electronic invoices (e-invoices) by providing tamper-proof verification, unlike traditional paper invoices that lack automated validation features.

XML Invoice Format

The XML Invoice Format streamlines electronic invoicing by enabling standardized, machine-readable e-invoices that improve accuracy and processing speed compared to traditional paper invoices.

Automated Reconciliation

Automated reconciliation streamlines the comparison of electronic invoices (e-invoices) and paper invoices by electronically matching transaction data to reduce errors and processing time.

Tax Compliance

Tax compliance improves significantly with electronic invoices (e-invoices) due to enhanced accuracy, real-time data validation, and reduced fraud compared to traditional paper invoices.

EDI (Electronic Data Interchange)

EDI enables seamless and secure electronic invoice exchanges between businesses, significantly reducing processing time, errors, and costs compared to traditional paper invoices.

OCR (Optical Character Recognition)

OCR technology accelerates the accurate extraction and digital conversion of data from paper invoices, enabling seamless integration with electronic invoice (e-invoice) systems for enhanced efficiency and reduced processing errors.

Real-Time Validation

Real-Time Validation enhances electronic invoice accuracy and compliance by instantly verifying data, unlike paper invoices which require manual post-processing and are prone to errors.

AP Automation (Accounts Payable Automation)

AP Automation streamlines invoice processing by replacing time-consuming paper invoices with faster, more accurate electronic invoices (e-invoices), reducing errors and improving payment cycle efficiency.

Archival Regulations

Archival regulations require electronic invoices (e-invoices) to be securely stored in digital formats with traceable audit trails, ensuring data integrity and accessibility over mandatory retention periods, unlike paper invoices which depend on physical storage conditions and are more susceptible to damage or loss.

Green Accounting

Green accounting significantly reduces environmental impact by promoting electronic invoices (e-invoices) over paper invoices, which lowers paper consumption and carbon emissions.

Electronic Invoice (e-invoice) vs Paper Invoice Infographic

moneydif.com

moneydif.com