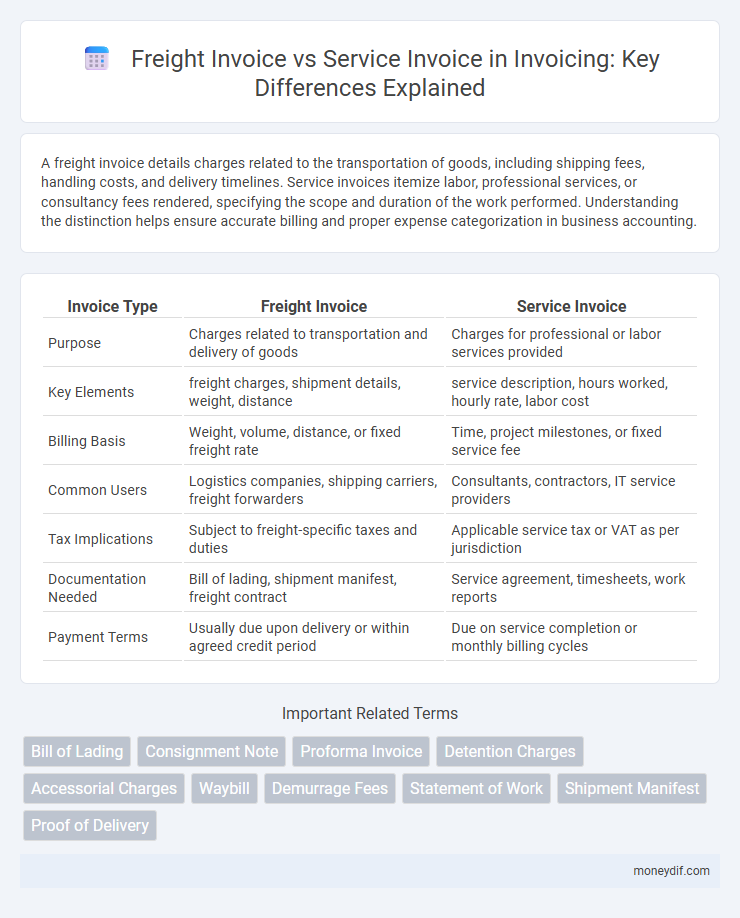

A freight invoice details charges related to the transportation of goods, including shipping fees, handling costs, and delivery timelines. Service invoices itemize labor, professional services, or consultancy fees rendered, specifying the scope and duration of the work performed. Understanding the distinction helps ensure accurate billing and proper expense categorization in business accounting.

Table of Comparison

| Invoice Type | Freight Invoice | Service Invoice |

|---|---|---|

| Purpose | Charges related to transportation and delivery of goods | Charges for professional or labor services provided |

| Key Elements | freight charges, shipment details, weight, distance | service description, hours worked, hourly rate, labor cost |

| Billing Basis | Weight, volume, distance, or fixed freight rate | Time, project milestones, or fixed service fee |

| Common Users | Logistics companies, shipping carriers, freight forwarders | Consultants, contractors, IT service providers |

| Tax Implications | Subject to freight-specific taxes and duties | Applicable service tax or VAT as per jurisdiction |

| Documentation Needed | Bill of lading, shipment manifest, freight contract | Service agreement, timesheets, work reports |

| Payment Terms | Usually due upon delivery or within agreed credit period | Due on service completion or monthly billing cycles |

Understanding Freight Invoices and Service Invoices

Freight invoices detail costs related to the transportation and delivery of goods, specifying charges such as shipping fees, fuel surcharges, and handling costs. Service invoices encompass charges for labor or professional services provided, including consulting, maintenance, or installation fees, with less emphasis on physical goods movement. Understanding the distinction aids businesses in accurate financial tracking and ensures compliance with billing standards for logistics versus service-based transactions.

Key Differences Between Freight and Service Invoices

Freight invoices primarily detail charges related to transportation of goods, including shipping fees, fuel surcharges, and handling costs, while service invoices focus on billing for labor, consulting, or other professional services provided. Key differences include the billing components, with freight invoices emphasizing shipment tracking numbers, weight, and delivery timelines, whereas service invoices highlight service descriptions, hours worked, and rates per hour or project milestones. Accurate classification between freight and service invoices ensures proper accounting, tax compliance, and cost allocation in logistics and operational management.

Essential Components of Freight Invoices

Freight invoices primarily include essential components such as the shipment date, origin and destination addresses, detailed description of goods, weight or volume, and freight charges based on agreed tariffs or rates. Additional crucial elements include the carrier information, freight terms (e.g., FOB or CIF), bill of lading number, and any accessorial charges like fuel surcharges or detention fees. These specifics distinguish freight invoices from service invoices, which typically focus on labor or professional fees and time-based billing.

What Makes Up a Service Invoice?

A service invoice itemizes labor, hours worked, service descriptions, and associated costs, often including hourly rates and task-specific charges. It may also detail taxes, discounts, and payment terms relevant to the provided service. Freight invoices differ by emphasizing shipment details, carrier fees, and logistic expenses rather than labor components.

When to Use Freight Invoices vs. Service Invoices

Freight invoices are used specifically for billing transportation and shipping charges related to the movement of goods, detailing carrier services, shipment weights, and delivery dates. Service invoices apply to billing for professional or labor services rendered, outlining tasks performed, hours worked, and service rates. Use freight invoices when charging for logistics and shipping costs, and service invoices when billing for services like consulting, maintenance, or repairs.

Legal and Compliance Aspects of Freight and Service Billing

Freight invoices must comply with transportation regulations, including accurate documentation of shipment details, carrier identification, and tariffs to avoid legal disputes and ensure customs clearance. Service invoices require detailed descriptions of rendered services, adherence to contract terms, and proper tax codes to meet regulatory standards and prevent compliance issues. Both invoice types must maintain transparency, accuracy, and traceability to support audits and fulfill accounting regulations.

Common Challenges in Freight and Service Invoicing

Freight invoices often face challenges such as inaccurate weight measurements, hidden surcharges, and discrepancies in delivery documentation, leading to payment delays and disputes. Service invoices commonly encounter issues like unclear service descriptions, inconsistent billing rates, and difficulty verifying service hours, impacting client trust and cash flow. Both invoice types require stringent validation processes and transparent communication to minimize errors and enhance financial accuracy.

Best Practices for Managing Freight and Service Invoices

Freight invoices require detailed documentation of shipping charges, weight, and carrier information to ensure accurate billing and compliance with transport agreements. Service invoices should clearly itemize labor hours, service descriptions, and applicable rates to streamline verification and payment processes. Implementing standardized templates and automated matching systems reduces errors and improves efficiency in managing both freight and service invoices.

Impact on Accounting and Financial Reporting

Freight invoices primarily affect cost of goods sold and inventory valuation, influencing gross profit and balance sheet accuracy. Service invoices impact operating expenses, affecting net income and cash flow statements due to ongoing business operations costs. Accurate differentiation ensures compliance with accounting standards and improves financial reporting reliability.

Choosing the Right Invoicing Method for Your Business

Choosing the right invoicing method depends on the nature of your business activities, with freight invoices specifically detailing shipping costs, itemized by weight, distance, and handling fees, ensuring precise billing for logistics services. Service invoices focus on labor, hourly rates, and task descriptions, tailored for businesses providing intangible solutions such as consulting or repair work. Selecting between freight and service invoices optimizes financial accuracy and client transparency, improving cash flow management and contractual clarity.

Important Terms

Bill of Lading

A Bill of Lading serves as a legally binding freight invoice document detailing shipped goods, whereas a service invoice itemizes the charges for transportation services rendered.

Consignment Note

Consignment notes detail shipment specifics and support freight invoices by documenting cargo transfer, while service invoices bill for logistics services rendered beyond transportation.

Proforma Invoice

A Proforma Invoice outlines estimated costs for freight and service invoices, distinguishing freight charges for transportation from service fees for handling and related logistics.

Detention Charges

Detention charges incurred due to delayed return of freight equipment must be clearly itemized and differentiated on freight invoices from service invoices to ensure accurate billing and dispute resolution.

Accessorial Charges

Accessorial charges on freight invoices itemize extra transportation costs like fuel surcharges, detention, and unloading fees, while service invoices detail additional service-related fees such as packing, handling, and administrative expenses.

Waybill

A waybill serves as a critical document detailing freight shipment information, distinguishing freight invoices that bill for transportation costs from service invoices that cover additional logistics or handling services.

Demurrage Fees

Demurrage fees on freight invoices often differ from those on service invoices due to variations in billing criteria, calculation methods, and contractual terms.

Statement of Work

A Statement of Work clearly differentiates freight invoices, which itemize transportation charges, from service invoices that detail labor or operational services provided.

Shipment Manifest

A shipment manifest details all cargo items for freight transportation, serving as a critical reference to reconcile freight invoices against service invoices for accurate billing and payment validation.

Proof of Delivery

Proof of Delivery verifies receipt of goods, serving as a critical document for reconciling freight invoices with service invoices to ensure accurate billing and payment.

freight invoice vs service invoice Infographic

moneydif.com

moneydif.com