A factored invoice involves selling outstanding invoices to a third-party factoring company to improve cash flow, whereas an unfactored invoice means the business retains full ownership and responsibility for collection. Factoring provides immediate payment but often at a discount, while unfactored invoices may tie up capital until the customer pays. Choosing between factored and unfactored invoices depends on the company's cash flow needs and risk tolerance.

Table of Comparison

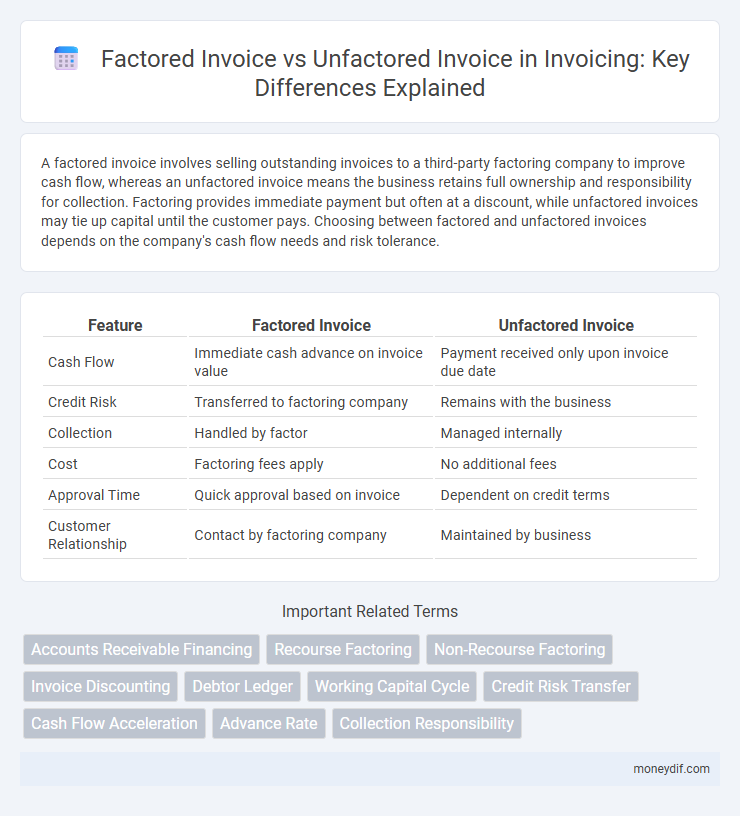

| Feature | Factored Invoice | Unfactored Invoice |

|---|---|---|

| Cash Flow | Immediate cash advance on invoice value | Payment received only upon invoice due date |

| Credit Risk | Transferred to factoring company | Remains with the business |

| Collection | Handled by factor | Managed internally |

| Cost | Factoring fees apply | No additional fees |

| Approval Time | Quick approval based on invoice | Dependent on credit terms |

| Customer Relationship | Contact by factoring company | Maintained by business |

Understanding Factored and Unfactored Invoices

Factored invoices involve selling accounts receivable to a third-party factor, providing immediate cash flow and transferring the collection risk, while unfactored invoices retain the receivables on the company's balance sheet and require internal collection efforts. Businesses choose factored invoices to improve liquidity and reduce credit management costs, whereas unfactored invoices maintain full control over customer relationships and payment terms. Understanding the differences helps optimize cash flow management and financial strategy based on a company's operational needs and credit risk tolerance.

Key Differences Between Factored and Unfactored Invoices

Factored invoices involve selling accounts receivable to a third party (factor) at a discount for immediate cash flow, while unfactored invoices are retained by the business until payment from customers. Factored invoices improve liquidity and reduce credit risk, whereas unfactored invoices require businesses to manage collections and bear the risk of late or non-payment. The key difference lies in ownership transfer and the timing of cash inflows, impacting cash flow management and financial planning.

How Factored Invoices Work

Factored invoices involve selling accounts receivable to a factoring company at a discount, providing immediate cash flow for businesses. The factoring company assumes the responsibility of collecting payments from customers, reducing the seller's credit risk and administrative burden. This process accelerates working capital turnover compared to unfactored invoices, which require waiting for payment terms to be fulfilled.

How Unfactored Invoices Work

Unfactored invoices remain on a business's accounts receivable ledger until payment is collected directly from customers, maintaining full control over collections and cash flow management. Businesses must manage credit risk and wait for the standard payment terms, often 30 to 90 days, which can delay working capital availability. This approach requires robust accounting practices to monitor outstanding invoices and ensure timely follow-up with clients.

Benefits of Factoring Invoices

Factoring invoices improves cash flow by converting outstanding receivables into immediate working capital, which helps businesses meet operational expenses without waiting for customer payments. It reduces credit risk, as the factoring company assumes the responsibility of collecting payments, allowing companies to focus on growth and customer relationships. Enhanced financial stability through factoring facilitates better credit management and supports faster business expansion.

Drawbacks of Factoring Invoices

Factoring invoices often results in reduced profit margins due to discount fees charged by factoring companies, which can range from 1% to 5% per invoice. Businesses may also face loss of control over their customer relationships since the factoring company handles collections, potentially damaging client trust. Furthermore, factoring can create dependency, making it difficult for companies to secure traditional financing or maintain financial stability without continuous invoice factoring.

Use Cases for Factored vs Unfactored Invoices

Factored invoices are ideal for businesses seeking immediate cash flow by selling outstanding invoices to a factoring company, which assumes collection responsibility. Unfactored invoices suit companies with strong cash reserves and effective in-house collections, allowing them to retain full control over customer relationships and payment terms. Use cases for factored invoices include startups and seasonal businesses needing quick liquidity, while unfactored invoices benefit established firms with stable receivables and minimal cash flow pressure.

Impact on Cash Flow: Factored vs Unfactored

Factored invoices improve cash flow by providing immediate access to working capital through selling receivables to a factoring company, reducing the waiting time for customer payments. Unfactored invoices can delay cash inflow due to standard payment terms, potentially causing liquidity challenges for businesses reliant on steady cash flow. Businesses leveraging invoice factoring benefit from enhanced cash flow management and operational flexibility compared to those managing unfactored invoices.

Risks and Considerations for Businesses

Factored invoices transfer the credit risk to the factoring company, reducing businesses' exposure to non-payment but potentially incurring higher fees and impacting customer relationships. Unfactored invoices keep the receivables on the business's balance sheet, maintaining full control but increasing risks related to cash flow delays and bad debts. Businesses must weigh the trade-offs between immediate liquidity and cost efficiency when choosing between factored and unfactored invoicing options.

Choosing the Right Invoice Management Strategy

Choosing the right invoice management strategy depends on cash flow needs and business size, with factored invoices providing immediate liquidity by selling receivables to a third party. Unfactored invoices retain control over collections but may result in delayed payments and increased administrative burden. Evaluating the trade-offs between cash flow acceleration and operational control ensures optimal financial management.

Important Terms

Accounts Receivable Financing

Accounts Receivable Financing improves cash flow by converting factored invoices into immediate funds, unlike unfactored invoices which delay payment until customer settlement.

Recourse Factoring

Recourse factoring involves selling invoices where the seller retains liability for unpaid invoices, contrasting with unfactored invoices that remain on the company's balance sheet and require in-house collection.

Non-Recourse Factoring

Non-recourse factoring transfers the risk of non-payment from the seller to the factor by purchasing factored invoices, unlike unfactored invoices where the seller retains the credit risk.

Invoice Discounting

Invoice discounting involves borrowing against factored invoices, which are sold to a finance company for immediate cash, unlike unfactored invoices that remain on the seller's balance sheet and are paid according to standard terms.

Debtor Ledger

A debtor ledger tracks outstanding amounts distinguishing between factored invoices sold to third parties for immediate cash and unfactored invoices retained for direct collection.

Working Capital Cycle

Factored invoices accelerate cash flow in the working capital cycle by converting receivables into immediate cash, whereas unfactored invoices extend the cash conversion period, impacting liquidity and operational efficiency.

Credit Risk Transfer

Credit Risk Transfer in factored invoices shifts default risk to the factoring company, whereas in unfactored invoices, the seller retains full credit risk until payment.

Cash Flow Acceleration

Factored invoices enable cash flow acceleration by selling receivables to a factoring company, providing immediate liquidity compared to unfactored invoices that require waiting for customer payment terms. This process improves working capital management, reduces days sales outstanding (DSO), and supports faster business growth by converting invoices into instant cash.

Advance Rate

Advance Rate for factored invoices typically ranges from 70% to 90% of the invoice value, whereas unfactored invoices require full upfront payment or rely on the buyer's creditworthiness without immediate cash advance.

Collection Responsibility

Collection responsibility for factored invoices shifts to the factoring company, while for unfactored invoices, it remains with the original seller.

factored invoice vs unfactored invoice Infographic

moneydif.com

moneydif.com