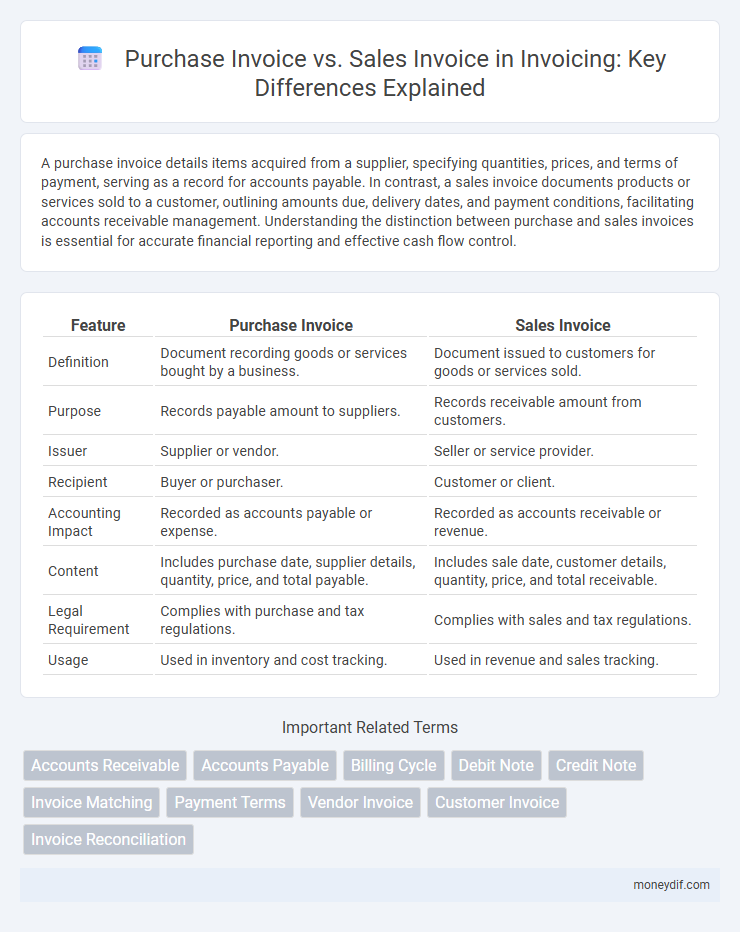

A purchase invoice details items acquired from a supplier, specifying quantities, prices, and terms of payment, serving as a record for accounts payable. In contrast, a sales invoice documents products or services sold to a customer, outlining amounts due, delivery dates, and payment conditions, facilitating accounts receivable management. Understanding the distinction between purchase and sales invoices is essential for accurate financial reporting and effective cash flow control.

Table of Comparison

| Feature | Purchase Invoice | Sales Invoice |

|---|---|---|

| Definition | Document recording goods or services bought by a business. | Document issued to customers for goods or services sold. |

| Purpose | Records payable amount to suppliers. | Records receivable amount from customers. |

| Issuer | Supplier or vendor. | Seller or service provider. |

| Recipient | Buyer or purchaser. | Customer or client. |

| Accounting Impact | Recorded as accounts payable or expense. | Recorded as accounts receivable or revenue. |

| Content | Includes purchase date, supplier details, quantity, price, and total payable. | Includes sale date, customer details, quantity, price, and total receivable. |

| Legal Requirement | Complies with purchase and tax regulations. | Complies with sales and tax regulations. |

| Usage | Used in inventory and cost tracking. | Used in revenue and sales tracking. |

Understanding Purchase Invoices

Purchase invoices document goods or services acquired by a business, detailing quantities, prices, supplier information, and payment terms essential for accurate accounting and inventory management. These invoices serve as proof of liability and are critical for expense tracking, tax deductions, and audit compliance. Understanding the distinction between purchase invoices and sales invoices helps streamline financial operations by clearly categorizing incoming costs versus revenue transactions.

What is a Sales Invoice?

A sales invoice is a financial document issued by a seller to a buyer, detailing products or services provided, quantities, prices, and total amount due. It serves as a legal proof of the transaction and payment request, facilitating accounts receivable management. Unlike a purchase invoice, which is received by the buyer, a sales invoice is generated by the seller to record and confirm the sale.

Key Differences Between Purchase and Sales Invoices

Purchase invoices document goods or services acquired by a business, detailing vendor information, quantities, costs, and payment terms to record expenses accurately. Sales invoices capture transactions where a business sells products or services, highlighting customer details, item descriptions, prices, taxes, and payment deadlines to track revenue. Key differences include the perspective of the transaction--purchase invoices represent incoming expenses, while sales invoices represent outgoing income--and the primary parties involved, with purchase invoices issued by suppliers and sales invoices generated by sellers.

Purpose of Purchase Invoices

Purchase invoices serve as official documents issued by suppliers to buyers, detailing the products or services purchased along with the exact amounts owed. They function primarily to record and verify incoming transactions, enabling accurate accounting and inventory management for businesses. The purpose of purchase invoices is to provide proof of purchase, ensure payment accuracy, and facilitate financial auditing and budgeting processes.

Purpose of Sales Invoices

Sales invoices serve as formal requests for payment issued by sellers to buyers, detailing products or services provided, quantities, prices, and payment terms. They function as legal documents that establish the buyer's obligation to pay and provide essential records for revenue tracking and tax reporting. Unlike purchase invoices, which are received by a business to record expenses, sales invoices focus on documenting transactions that generate income and support accounts receivable management.

Essential Components of Both Invoices

Purchase invoices and sales invoices share essential components such as invoice number, date, supplier or customer details, item descriptions, quantities, unit prices, and total amounts. Both types of invoices also include payment terms, tax information like VAT or GST, and authorized signatures to validate the transaction. Clear identification of buyer and seller roles distinguishes the purchase invoice, which records goods received, from the sales invoice, which documents goods sold.

How Purchase and Sales Invoices Impact Accounting

Purchase invoices record the acquisition of goods or services, directly increasing accounts payable and impacting cash flow management by documenting expense commitments. Sales invoices generate accounts receivable by recording revenue from goods or services sold, thus influencing income statements and cash inflows. Accurate processing of both purchase and sales invoices ensures balanced financial statements and effective tracking of company liabilities and revenue streams.

Common Use Cases in Business

Purchase invoices document goods or services a company buys, serving as proof for expense tracking and vendor payments in accounts payable. Sales invoices record transactions where a company sells products or services, essential for revenue recognition and accounts receivable management. Both types streamline financial processes, support accurate bookkeeping, and facilitate tax compliance in business operations.

Legal and Compliance Considerations

Purchase invoices must comply with tax regulations, including accurate vendor details, purchase descriptions, and proper VAT or GST documentation to ensure deductibility and legal validation. Sales invoices require strict adherence to invoicing standards such as including customer information, invoice numbering, and tax calculations to meet statutory reporting and audit requirements. Both invoice types must maintain proper records for prescribed durations under relevant tax laws to avoid penalties and support financial transparency.

Best Practices for Managing Both Invoice Types

Purchase invoices should be systematically recorded with accurate vendor details, purchase order references, and payment terms to ensure timely payments and avoid discrepancies. Sales invoices must include precise customer information, invoice date, itemized product or service descriptions, and clear payment instructions to facilitate efficient collections and maintain cash flow. Regular reconciliation of both purchase and sales invoices enables better financial control, reduces errors, and supports accurate accounting records.

Important Terms

Accounts Receivable

Accounts Receivable reflects outstanding balances from Sales Invoices issued to customers, whereas Purchase Invoices represent liabilities owed to suppliers and do not directly affect Accounts Receivable.

Accounts Payable

Accounts Payable tracks outstanding purchase invoices from suppliers, whereas sales invoices represent receivables generated from sales to customers.

Billing Cycle

The billing cycle synchronizes purchase invoices and sales invoices to ensure accurate transaction recording, payment scheduling, and revenue recognition within a defined accounting period.

Debit Note

A Debit Note is issued to adjust discrepancies or return goods in purchase invoices while it serves as a formal request for additional payment or correction in sales invoices.

Credit Note

A credit note is issued to correct or reduce the amount on a purchase invoice or sales invoice, reflecting returns, discounts, or billing errors in accounting records.

Invoice Matching

Invoice matching ensures accuracy by systematically comparing purchase invoices against corresponding sales invoices to verify quantities, prices, and payment terms.

Payment Terms

Payment terms define the agreed timeframe and conditions for settling amounts on purchase invoices issued by suppliers and sales invoices generated for customers to ensure timely financial transactions and cash flow management.

Vendor Invoice

Vendor invoices record purchases from suppliers and impact accounts payable, whereas sales invoices document customer sales and influence accounts receivable.

Customer Invoice

Customer Invoice represents a Sales Invoice issued to customers detailing purchased goods or services, whereas Purchase Invoice is received from suppliers documenting acquired products or services for accounting and payment processing.

Invoice Reconciliation

Invoice reconciliation involves accurately matching purchase invoices with corresponding sales invoices to ensure financial consistency and prevent discrepancies.

Purchase Invoice vs Sales Invoice Infographic

moneydif.com

moneydif.com