A proforma invoice serves as a preliminary bill of sale sent to buyers before a shipment or delivery, detailing the goods, estimated prices, and terms without demanding payment. A commercial invoice acts as the official document issued after the sale, confirming the transaction, specifying exact quantities, prices, and payment terms required by customs for clearance and payment processing. Understanding the distinction between proforma and commercial invoices is essential for accurate export documentation and seamless international trade compliance.

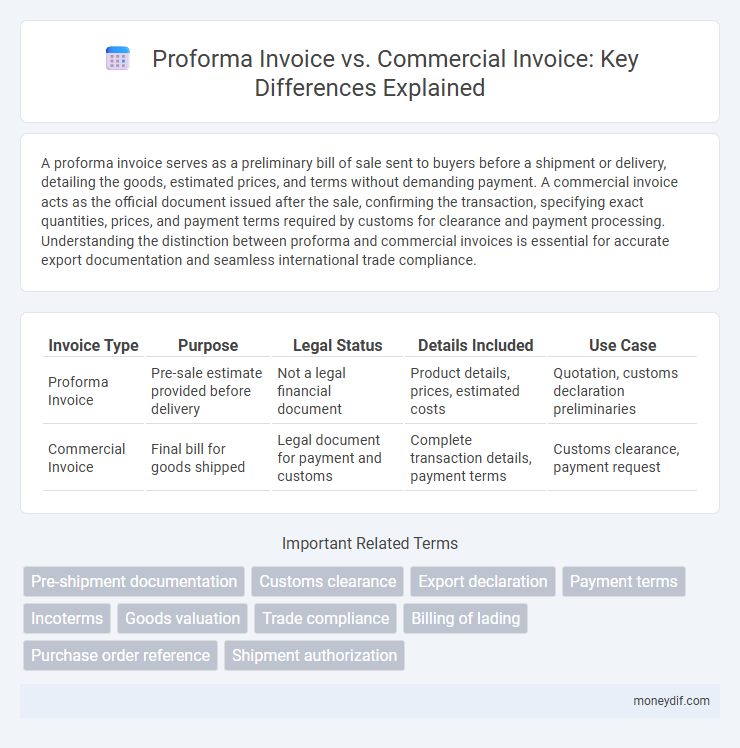

Table of Comparison

| Invoice Type | Purpose | Legal Status | Details Included | Use Case |

|---|---|---|---|---|

| Proforma Invoice | Pre-sale estimate provided before delivery | Not a legal financial document | Product details, prices, estimated costs | Quotation, customs declaration preliminaries |

| Commercial Invoice | Final bill for goods shipped | Legal document for payment and customs | Complete transaction details, payment terms | Customs clearance, payment request |

Introduction to Proforma and Commercial Invoices

A Proforma invoice is a preliminary bill of sale sent to buyers before goods are shipped, detailing the products, quantities, and prices to provide an estimated cost for customs and budgeting purposes. A Commercial invoice serves as the final bill provided after shipment, used for customs clearance and as an official document for payment, confirming the exact transaction details. Both invoices play crucial roles in international trade, with the Proforma invoice facilitating agreement and the Commercial invoice ensuring legal and financial compliance.

Defining Proforma Invoice

A proforma invoice is a preliminary document issued by a seller to a buyer outlining the estimated costs of goods or services before the final sale. It serves as a quotation or binding agreement for customs and import purposes but is not a demand for payment. Unlike a commercial invoice, it does not represent an actual sale transaction or request immediate payment.

Defining Commercial Invoice

A commercial invoice is a detailed document issued by a seller to a buyer, outlining the goods sold, their value, and terms of sale, serving as a legal record for customs and payment purposes. It includes essential information such as product description, quantity, price, payment terms, and shipping details, facilitating international trade transactions and customs clearance. Unlike a proforma invoice, which is a preliminary estimate, the commercial invoice is a finalized document used for accounting and customs declarations.

Key Differences Between Proforma and Commercial Invoices

A proforma invoice serves as a preliminary bill of sale sent to buyers before a shipment or delivery of goods, primarily used for customs purposes and to provide an estimated cost. In contrast, a commercial invoice is a definitive document issued after the sale, detailing the actual goods shipped, payment terms, and transaction specifics for accounting and import clearance. Key differences include the proforma invoice's function as a quote without payment obligations, while the commercial invoice acts as a legal document enforcing payment and facilitating customs duties.

Purpose of Proforma Invoice in International Trade

A proforma invoice serves as a preliminary bill of sale in international trade, providing a detailed estimate of goods or services before the final transaction. It helps buyers understand costs, terms, and shipment details, facilitating customs clearance and import licensing. Unlike commercial invoices, proforma invoices are not used for accounting or payment but for negotiation and approval of export or import arrangements.

Role of Commercial Invoice in Customs Clearance

The commercial invoice serves as a critical document in customs clearance, providing detailed information about the goods, their value, and origin to customs authorities. It facilitates accurate duty calculation, compliance verification, and risk assessment during international shipping. Unlike a proforma invoice, which is a preliminary quote, the commercial invoice is an official record required for legal import and export processes.

Essential Elements of a Proforma Invoice

A proforma invoice serves as a preliminary bill of sale sent to buyers before the shipment of goods or services, containing essential elements such as the description of goods, estimated prices, quantities, shipping costs, and payment terms. It provides a detailed quotation to facilitate customs clearance, import permits, and financial planning, but is not legally binding like a commercial invoice. Key details include the seller's and buyer's information, validity period, and terms of delivery, which help establish expectations before the final sales transaction.

Required Information on a Commercial Invoice

A Commercial Invoice must include detailed information such as the seller's and buyer's names and addresses, a precise description of the goods, including quantity, unit price, and total value, and the terms of sale like Incoterms. It also requires the invoice number, date of issue, currency of payment, and the country of origin of the goods for customs clearance. Accurate and complete data on this document is essential to facilitate international trade and ensure compliance with import regulations.

When to Use Proforma vs Commercial Invoice

A proforma invoice is used primarily before a sale is finalized, serving as a preliminary bill that outlines potential costs and terms for the buyer's approval or customs purposes. A commercial invoice is issued after the sale, functioning as a definitive sales document for payment and shipping, detailing the exact goods, prices, and full transaction terms. Businesses use proforma invoices during negotiations or for customs clearance, while commercial invoices are required for actual payment processing and official export documentation.

Common Mistakes to Avoid with Proforma and Commercial Invoices

Common mistakes to avoid with proforma and commercial invoices include using incomplete or inaccurate product descriptions, which can cause customs delays and disputes. Failure to specify correct currency, payment terms, and shipment details often leads to payment processing errors or shipment refusals. Ensure both invoice types are clearly labeled and include all essential buyer and seller information to maintain compliance and facilitate smooth transactions.

Important Terms

Pre-shipment documentation

A Proforma invoice serves as a preliminary estimate provided by the seller outlining goods and terms before shipment, while a Commercial invoice is the definitive document used for customs clearance and payment after the goods are shipped.

Customs clearance

Customs clearance requires a commercial invoice as the definitive document for assessing duties and taxes, while a proforma invoice serves as a preliminary estimate for shipment approval and buyer information.

Export declaration

Export declaration requires a commercial invoice as the primary document for customs clearance, while a proforma invoice serves as a preliminary quote without legal value for export transactions.

Payment terms

Payment terms in a Proforma invoice outline preliminary pricing and expected payment timelines before shipment, whereas a Commercial invoice specifies final payment amounts and legal payment obligations after goods are delivered.

Incoterms

Incoterms define the responsibilities of buyers and sellers in international trade, influencing the information required on proforma invoices and commercial invoices for clear cost and risk allocation. A proforma invoice provides estimated costs and terms before shipment, while a commercial invoice finalizes transaction details, reflecting agreed Incoterms for customs clearance and payment processing.

Goods valuation

Goods valuation for customs is primarily based on the commercial invoice, which reflects the final transaction value, while the proforma invoice serves as a preliminary estimate without definitive pricing or payment confirmation.

Trade compliance

Trade compliance requires accurate differentiation between Proforma invoices, which are preliminary quotes for customs and buyer approval, and Commercial invoices, which serve as final, legally binding documents for customs clearance and payment.

Billing of lading

The Bill of Lading serves as a crucial shipping document that confirms the receipt of goods by the carrier, while the Proforma Invoice provides a preliminary sales agreement outlining the estimated cost and terms before shipment. The Commercial Invoice, in contrast, is the final document used for customs clearance, detailing the actual transaction value, payment terms, and accurate product descriptions based on the shipment associated with the Bill of Lading.

Purchase order reference

A purchase order reference links the buyer's formal request to the proforma invoice, which serves as a preliminary bill outlining estimated costs before shipment, while the commercial invoice provides the final transaction details used for payment and customs clearance. Accurate matching of purchase order references across proforma and commercial invoices ensures streamlined order processing, financial reconciliation, and legal compliance in international trade.

Shipment authorization

Shipment authorization depends on the commercial invoice as the primary document for customs clearance and payment verification, whereas the proforma invoice serves only as a preliminary quote without legal or financial obligations. Customs officials require the commercial invoice to validate the transaction details, ensuring accurate duties and taxes are assessed before shipment approval.

Proforma invoice vs Commercial invoice Infographic

moneydif.com

moneydif.com