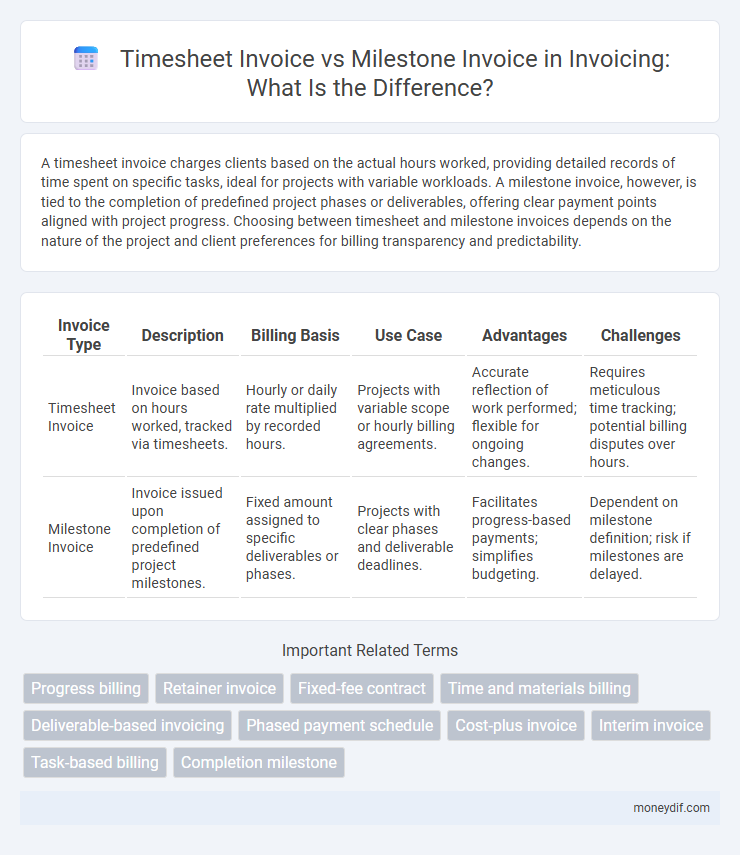

A timesheet invoice charges clients based on the actual hours worked, providing detailed records of time spent on specific tasks, ideal for projects with variable workloads. A milestone invoice, however, is tied to the completion of predefined project phases or deliverables, offering clear payment points aligned with project progress. Choosing between timesheet and milestone invoices depends on the nature of the project and client preferences for billing transparency and predictability.

Table of Comparison

| Invoice Type | Description | Billing Basis | Use Case | Advantages | Challenges |

|---|---|---|---|---|---|

| Timesheet Invoice | Invoice based on hours worked, tracked via timesheets. | Hourly or daily rate multiplied by recorded hours. | Projects with variable scope or hourly billing agreements. | Accurate reflection of work performed; flexible for ongoing changes. | Requires meticulous time tracking; potential billing disputes over hours. |

| Milestone Invoice | Invoice issued upon completion of predefined project milestones. | Fixed amount assigned to specific deliverables or phases. | Projects with clear phases and deliverable deadlines. | Facilitates progress-based payments; simplifies budgeting. | Dependent on milestone definition; risk if milestones are delayed. |

Understanding Timesheet Invoices

Timesheet invoices track billable hours based on detailed employee time records, providing transparent, granular data for each task or project phase. This invoicing method ensures accurate compensation for actual work performed, aligning payments with real-time labor inputs. Understanding timesheet invoices helps businesses maintain precise cost control and enhances client trust through clear documentation of work hours.

What Are Milestone Invoices?

Milestone invoices are billing statements issued upon the completion of specific project phases or deliverables, allowing for structured payment tied to key progress points. These invoices help manage cash flow by linking payments directly to agreed-upon achievements rather than hourly work or overall project completion. Milestone invoicing is commonly used in project management and construction contracts to ensure transparency and accountability between clients and service providers.

Key Differences Between Timesheet and Milestone Invoices

Timesheet invoices bill clients based on actual hours worked, capturing detailed employee hours and task durations, ideal for projects with variable workloads and ongoing changes. Milestone invoices, on the other hand, charge clients upon the completion of predefined project phases or deliverables, providing fixed payment amounts tied to specific project goals. The key difference lies in billing structure: timesheet invoices offer flexible, time-based charges, while milestone invoices ensure predetermined payments aligned with project progress.

When to Use a Timesheet Invoice

A timesheet invoice is ideal when billing for hourly work that requires detailed tracking of time spent on various tasks or projects, ensuring transparency and accuracy in client charges. Use a timesheet invoice in ongoing projects where work is incremental and hours fluctuate, allowing clients to verify the hours logged before payment. This method is especially effective for freelancers, consultants, and agencies that need to capture variable work durations and provide clear records of billed time.

When to Choose a Milestone Invoice

Milestone invoices are ideal for projects with clearly defined phases and deliverables, allowing clients to pay after each completed stage rather than for hourly work tracked in timesheet invoices. Choosing a milestone invoice ensures better cash flow management and aligns payments with project progress, reducing disputes over hours worked. This method is particularly effective in fixed-price contracts and long-term projects where client approval at each step is necessary.

Pros and Cons of Timesheet Invoicing

Timesheet invoicing offers flexibility by billing clients based on actual hours worked, ensuring precise payment for variable workloads. This method provides transparency and detailed tracking, which helps in resolving disputes and justifying expenses. However, timesheet invoicing can lead to unpredictable cash flow and requires meticulous time tracking, increasing administrative effort and the risk of invoicing errors.

Pros and Cons of Milestone Invoicing

Milestone invoicing offers clear payment schedules tied to project achievements, enhancing cash flow predictability and motivating timely deliverables. It can reduce disputes by linking payments to agreed-upon results, but may cause cash flow gaps if milestones are delayed or poorly defined. This method suits project-based work with distinct phases but requires precise milestone planning to avoid billing misunderstandings.

Industries That Prefer Timesheet vs Milestone Invoicing

Timesheet invoicing is commonly preferred in industries like consulting, legal services, and creative agencies where billing is based on billable hours and ongoing work efforts. Milestone invoicing suits construction, software development, and project management sectors, as payments are tied to the completion of predefined project phases or deliverables. Selecting between timesheet and milestone invoicing depends on project complexity, client preferences, and industry-specific billing practices.

How to Transition Between Timesheet and Milestone Invoices

Transitioning between timesheet invoices and milestone invoices requires clear communication of project scope changes and updated payment terms. Establishing a formal agreement that outlines billing criteria, such as hours worked versus project phases completed, helps maintain transparency and client trust. Using project management tools to track progress and automate invoice generation ensures accuracy and smooth shifts between invoicing methods.

Choosing the Right Invoice Type for Your Project

Timesheet invoices are ideal for projects with variable tasks and hours, allowing accurate billing based on actual time worked, while milestone invoices suit projects with clearly defined deliverables and fixed payment schedules. Selecting the right invoice type depends on the project's scope, client requirements, and payment structure, ensuring transparency and smooth cash flow management. Accurate invoicing enhances client trust and project profitability by aligning billing with project progress.

Important Terms

Progress billing

Progress billing allocates payments based on work completed, with timesheet invoices charging actual hours logged and milestone invoices billing upon reaching predefined project phases.

Retainer invoice

A retainer invoice secures ongoing services with a fixed upfront fee, often based on estimated hours or deliverables, unlike timesheet invoices that bill clients for actual hours worked and milestone invoices that charge upon the completion of specific project phases. Retainer invoices streamline cash flow and resource allocation by providing predictable income, contrasting with the variable nature of timesheet and milestone billing methods tied directly to work progress or project achievements.

Fixed-fee contract

Fixed-fee contracts use timesheet invoices to bill based on hours worked while milestone invoices require payment upon achieving predefined project phases.

Time and materials billing

Time and materials billing compares timesheet invoices, which track hourly labor and expenses, against milestone invoices that bill upon project phase completions to enhance accurate cost management.

Deliverable-based invoicing

Deliverable-based invoicing focuses on billing clients upon the completion of specific project deliverables, contrasting with timesheet invoicing, which charges based on recorded hours worked, and milestone invoicing, which ties payments to predefined project phases or goals. This approach enhances cash flow predictability by linking invoices directly to tangible outputs rather than time logged or broader project stages.

Phased payment schedule

Phased payment schedules align with timesheet invoices by billing based on actual hours logged, while milestone invoices trigger payments upon achieving predefined project stages.

Cost-plus invoice

Cost-plus invoices calculate total payment by adding a specific profit margin to the actual costs recorded, often tracked through detailed timesheet invoices that log hours worked and expenses incurred. In contrast, milestone invoices bill clients based on the completion of predefined project phases or deliverables, regardless of the time or cost spent, providing fixed payment points aligned with project progress.

Interim invoice

An interim invoice is typically generated based on timesheet entries reflecting hours worked, whereas a milestone invoice is issued upon completion of predefined project phases or deliverables.

Task-based billing

Task-based billing enables accurate invoicing by tracking hours in timesheet invoices or charging fixed amounts in milestone invoices based on project progress.

Completion milestone

Completion milestones align invoice payments with project progress, ensuring each timesheet invoice reflects hours worked up to the milestone date, while milestone invoices correspond to predefined deliverables or project phases. This approach enhances cash flow management by linking invoicing directly to measurable achievements rather than continuous time tracking alone.

timesheet invoice vs milestone invoice Infographic

moneydif.com

moneydif.com