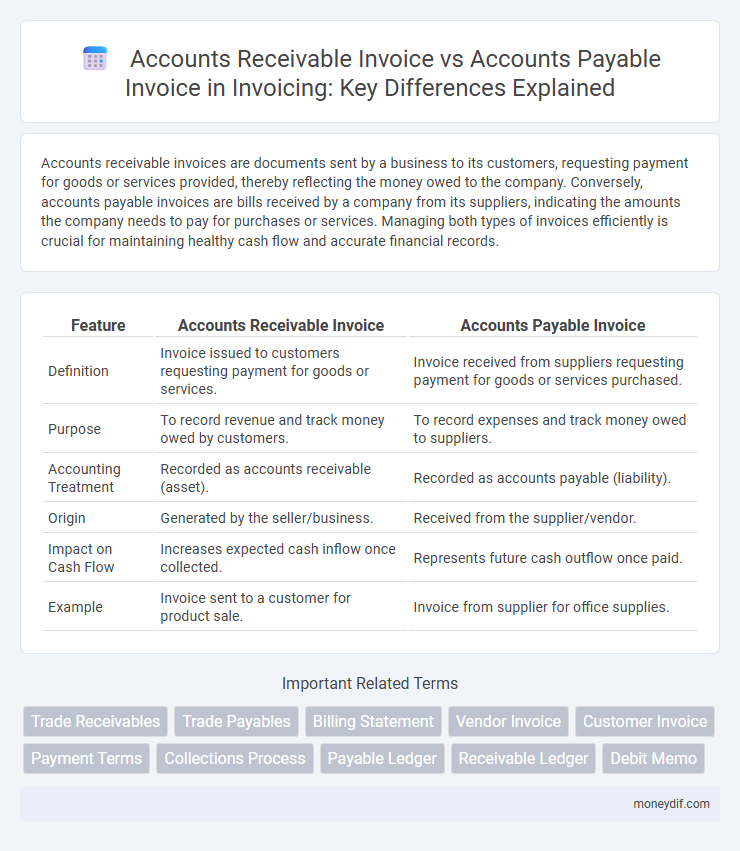

Accounts receivable invoices are documents sent by a business to its customers, requesting payment for goods or services provided, thereby reflecting the money owed to the company. Conversely, accounts payable invoices are bills received by a company from its suppliers, indicating the amounts the company needs to pay for purchases or services. Managing both types of invoices efficiently is crucial for maintaining healthy cash flow and accurate financial records.

Table of Comparison

| Feature | Accounts Receivable Invoice | Accounts Payable Invoice |

|---|---|---|

| Definition | Invoice issued to customers requesting payment for goods or services. | Invoice received from suppliers requesting payment for goods or services purchased. |

| Purpose | To record revenue and track money owed by customers. | To record expenses and track money owed to suppliers. |

| Accounting Treatment | Recorded as accounts receivable (asset). | Recorded as accounts payable (liability). |

| Origin | Generated by the seller/business. | Received from the supplier/vendor. |

| Impact on Cash Flow | Increases expected cash inflow once collected. | Represents future cash outflow once paid. |

| Example | Invoice sent to a customer for product sale. | Invoice from supplier for office supplies. |

Understanding Accounts Receivable Invoices

Accounts receivable invoices represent amounts billed to customers for goods or services delivered, reflecting expected incoming payments and crucial for managing cash flow. These invoices typically include detailed information such as invoice number, payment terms, due date, and itemized charges, which facilitate accurate tracking and timely collection. Proper understanding and management of accounts receivable invoices enhance financial forecasting and reduce the risk of bad debts.

What Are Accounts Payable Invoices?

Accounts payable invoices are bills received by a business from suppliers or vendors for goods and services purchased on credit, representing the company's short-term liabilities. These invoices detail amounts the business owes and typically include payment terms, due dates, and invoice numbers to ensure accurate tracking and timely payments. Proper management of accounts payable invoices is crucial for maintaining healthy cash flow, vendor relationships, and financial reporting accuracy.

Key Differences Between AR and AP Invoices

Accounts receivable (AR) invoices represent money owed to a company by its customers for goods or services delivered, reflecting incoming payments expected. Accounts payable (AP) invoices denote money a company owes to suppliers or vendors for purchases made on credit, indicating outgoing payments. The primary difference lies in their financial roles: AR invoices increase assets and revenue, while AP invoices increase liabilities and expenses.

Importance of AR and AP in Business Cash Flow

Accounts receivable (AR) invoices represent incoming payments owed to a business, directly impacting cash inflow and liquidity management. Accounts payable (AP) invoices denote obligations to suppliers or vendors, affecting cash outflow and operational expenses. Efficient management of both AR and AP invoices is crucial for maintaining optimal cash flow, ensuring financial stability, and supporting business growth.

Invoice Creation: Accounts Receivable vs Accounts Payable

Accounts receivable invoice creation involves generating billing documents sent to customers to request payment for goods or services delivered, ensuring accurate tracking of incoming revenue. In contrast, accounts payable invoice creation entails receiving and recording vendor bills to manage outgoing payments and maintain accurate expense records. Both processes rely on efficient invoice management systems to streamline financial operations and improve cash flow visibility.

Common Challenges with AR and AP Invoices

Accounts receivable (AR) and accounts payable (AP) invoices often face challenges such as invoice discrepancies, delayed approvals, and inefficient data entry processes. AR invoices struggle with timely customer payments and accurate revenue recognition, while AP invoices deal with matching purchase orders to invoices and preventing duplicate payments. Both AR and AP functions require robust invoice management systems to enhance accuracy, reduce errors, and improve cash flow visibility.

Best Practices for Managing Accounts Receivable Invoices

Implement clear credit policies to streamline accounts receivable invoice processing, ensuring timely customer payments and reducing outstanding balances. Utilize automated invoicing software to enhance accuracy, track payment statuses, and send prompt reminders for overdue accounts receivable invoices. Regularly reconcile accounts receivable invoices with payments received to maintain accurate financial records and improve cash flow management.

Effective Strategies for Handling Accounts Payable Invoices

Effective strategies for handling accounts payable invoices include implementing automated invoice processing systems to reduce errors and expedite approval workflows. Ensuring accurate data entry and timely reconciliation helps maintain positive vendor relationships and improve cash flow management. Regularly reviewing payment terms and leveraging early payment discounts optimize financial efficiency and strengthen accounts payable operations.

Impact on Financial Statements: AR vs AP Invoices

Accounts receivable invoices increase assets on the balance sheet by recording amounts owed by customers, directly affecting cash flow projections and revenue recognition on the income statement. Accounts payable invoices represent liabilities, increasing current obligations and reducing net income due to recorded expenses. Accurate management of AR and AP invoices is crucial for maintaining cash flow accuracy and financial statement integrity.

Choosing Accounting Software for AR and AP Invoice Management

Choosing accounting software for accounts receivable (AR) and accounts payable (AP) invoice management requires evaluating features such as automated billing, payment tracking, and integration capabilities. Software that streamlines AR invoice creation and follow-up enhances cash flow management, while robust AP invoice processing ensures timely vendor payments and accurate expense recording. Prioritizing platforms with real-time analytics, customizable reporting, and multi-currency support optimizes financial operations and improves overall invoice workflow efficiency.

Important Terms

Trade Receivables

Trade receivables represent the outstanding accounts receivable invoices issued to customers, whereas accounts payable invoices reflect the company's obligations to suppliers for purchased goods or services.

Trade Payables

Trade payables represent the outstanding amounts a company owes to suppliers based on accounts payable invoices, which directly correlate with accounts receivable invoices issued to customers for sales transactions.

Billing Statement

A billing statement summarizes accounts receivable invoices owed by customers and accounts payable invoices owed to suppliers, providing a clear overview of outstanding financial obligations.

Vendor Invoice

Vendor invoices impact accounts payable by recording amounts owed to suppliers, while accounts receivable invoices represent money owed by customers, both critical for accurate financial management and cash flow analysis.

Customer Invoice

A customer invoice primarily pertains to accounts receivable, representing amounts billed to customers for goods or services sold, whereas an accounts payable invoice records amounts a business owes to suppliers or vendors. Efficient management of customer invoices ensures timely revenue recognition and cash flow, while accounts payable invoices focus on proper vendor payment tracking and expense accuracy.

Payment Terms

Payment terms dictate the timing and conditions for settling accounts receivable invoices owed to a company and accounts payable invoices a company must pay to suppliers.

Collections Process

The collections process focuses on managing accounts receivable invoices to ensure timely payment, contrasting with accounts payable invoices which involve the company's obligations to pay suppliers.

Payable Ledger

A payable ledger tracks accounts payable invoices representing company obligations, whereas accounts receivable invoices reflect amounts owed by customers recorded in the receivable ledger.

Receivable Ledger

The Receivable Ledger tracks accounts receivable invoices issued to customers, distinguishing them from accounts payable invoices owed to suppliers.

Debit Memo

A debit memo reduces accounts payable invoices by adjusting vendor charges, while in accounts receivable, it increases customer invoices by correcting billing errors or adding additional charges.

accounts receivable invoice vs accounts payable invoice Infographic

moneydif.com

moneydif.com