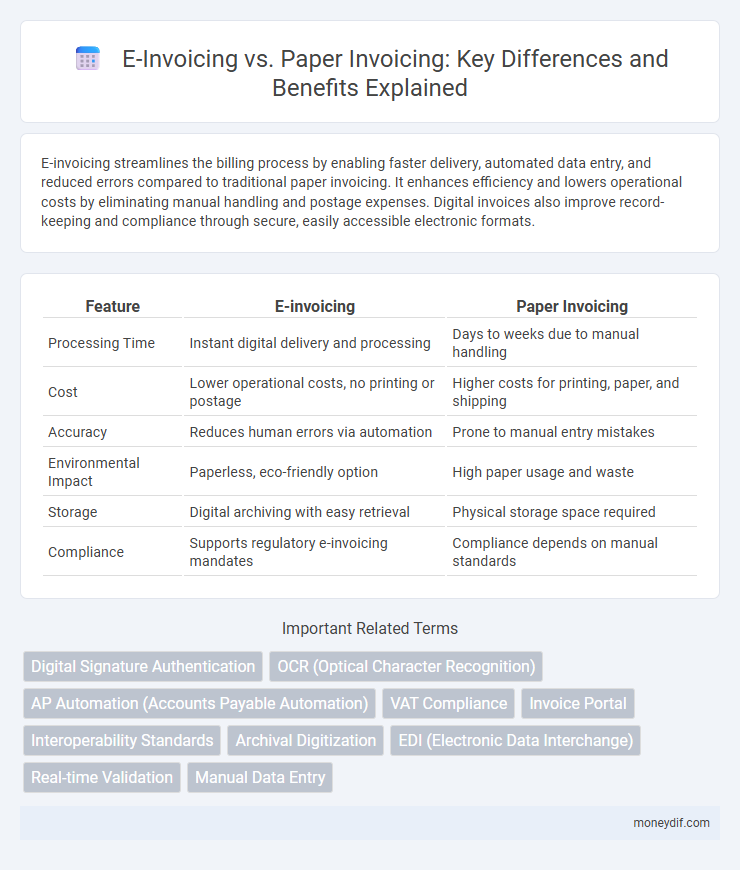

E-invoicing streamlines the billing process by enabling faster delivery, automated data entry, and reduced errors compared to traditional paper invoicing. It enhances efficiency and lowers operational costs by eliminating manual handling and postage expenses. Digital invoices also improve record-keeping and compliance through secure, easily accessible electronic formats.

Table of Comparison

| Feature | E-invoicing | Paper Invoicing |

|---|---|---|

| Processing Time | Instant digital delivery and processing | Days to weeks due to manual handling |

| Cost | Lower operational costs, no printing or postage | Higher costs for printing, paper, and shipping |

| Accuracy | Reduces human errors via automation | Prone to manual entry mistakes |

| Environmental Impact | Paperless, eco-friendly option | High paper usage and waste |

| Storage | Digital archiving with easy retrieval | Physical storage space required |

| Compliance | Supports regulatory e-invoicing mandates | Compliance depends on manual standards |

Introduction to E-Invoicing and Paper Invoicing

E-invoicing automates the invoicing process by allowing businesses to send and receive invoices electronically, enhancing accuracy and processing speed. Paper invoicing involves physical documents, which can lead to delays, higher costs, and increased risk of errors or loss. Transitioning to e-invoicing supports compliance with tax regulations, reduces environmental impact, and improves cash flow management through faster payment cycles.

Key Differences Between E-Invoicing and Paper Invoicing

E-invoicing streamlines the billing process by enabling electronic generation, transmission, and storage of invoices, reducing errors and processing time compared to traditional paper invoicing. Paper invoicing relies on physical documents, causing delays due to manual handling, mailing, and storage while increasing costs related to printing and materials. E-invoicing enhances accuracy, compliance, and real-time tracking, offering greater efficiency and environmental benefits over paper-based methods.

Efficiency and Processing Speed Comparison

E-invoicing significantly enhances efficiency by automating data entry and reducing manual errors, enabling faster processing times compared to paper invoicing. Digital invoices can be transmitted, received, and validated instantly, cutting down approval cycles from days to mere hours. Studies show organizations adopting e-invoicing experience up to 80% faster invoice processing speeds and lower operational costs.

Cost Implications: Digital vs. Paper Invoices

E-invoicing significantly reduces operational costs by eliminating paper, printing, and postage expenses, while paper invoicing incurs ongoing costs in materials and manual processing. The automation enabled by digital invoices minimizes human errors and accelerates payment cycles, resulting in improved cash flow and decreased administrative overhead. Transitioning to e-invoicing supports scalability and sustainability, offering long-term financial benefits compared to traditional paper-based invoicing systems.

Environmental Impact: Sustainability of E-Invoicing

E-invoicing drastically reduces paper consumption, saving millions of trees annually and lowering carbon emissions caused by paper production and transportation. Digital invoices minimize waste and energy use associated with printing, mailing, and storing paper documents, making them a key driver in corporate sustainability efforts. The shift to e-invoicing supports global environmental goals by promoting resource efficiency and reducing the overall ecological footprint of business processes.

Security and Fraud Prevention in Invoicing

E-invoicing enhances security by utilizing encryption protocols and secure digital signatures that prevent unauthorized access and tampering, significantly reducing fraud risks compared to paper invoicing. Digital audit trails enable precise tracking of invoice issuance, approval, and payment, ensuring transparency and accountability throughout the process. In contrast, paper invoices are more susceptible to forgery, loss, and manipulation due to physical handling and lack of automated verification mechanisms.

Compliance and Legal Considerations

E-invoicing ensures compliance with tax regulations by enabling real-time invoice validation and mandatory digital signatures, reducing the risk of fraud and errors compared to paper invoicing. Legal frameworks in many countries now require e-invoicing for certain transactions to meet audit and tax reporting standards, enhancing transparency and accountability. Paper invoices lack automated compliance checks, increasing the likelihood of legal discrepancies and delayed approvals in regulatory audits.

Integration with Business Systems

E-invoicing streamlines integration with ERP, accounting, and CRM systems through standardized data formats like XML and UBL, enabling automated data exchange and reducing manual input errors. Paper invoicing requires manual entry, leading to increased processing time and higher risk of discrepancies in business records. Seamless integration of e-invoicing enhances real-time financial reporting and improves overall operational efficiency.

Challenges in Transitioning to E-Invoicing

Transitioning to e-invoicing presents challenges such as the need for robust digital infrastructure, compliance with diverse regulatory requirements, and ensuring data security during electronic transmission. Businesses often face integration issues between legacy accounting systems and new e-invoicing platforms, which can disrupt workflow and increase operational costs. Resistance to change and lack of technical expertise among staff further complicate the adoption process, impacting efficiency and accuracy in invoicing.

Future Trends in Invoicing Technologies

E-invoicing is rapidly transforming the future of invoicing technologies by enabling real-time data exchange and reducing manual errors, leading to significant cost savings and enhanced compliance with tax regulations. Advanced technologies such as blockchain and artificial intelligence are driving innovations in secure, transparent, and automated invoice processing. Businesses adopting cloud-based e-invoicing platforms benefit from improved scalability, faster payment cycles, and seamless integration with enterprise resource planning (ERP) systems.

Important Terms

Digital Signature Authentication

Digital signature authentication enhances security and compliance in e-invoicing by ensuring data integrity and non-repudiation, unlike paper invoicing which lacks automated verification and is prone to fraud.

OCR (Optical Character Recognition)

OCR technology accelerates e-invoicing by automatically extracting data from digital invoices, reducing errors and processing time compared to manual handling of paper invoices.

AP Automation (Accounts Payable Automation)

AP Automation significantly reduces processing time and errors by electronically capturing and validating e-invoices compared to manual data entry in paper invoicing.

VAT Compliance

E-invoicing enhances VAT compliance by ensuring real-time invoice validation and reducing errors compared to traditional paper invoicing.

Invoice Portal

Invoice Portal streamlines e-invoicing by automating invoice processing, reducing errors, and cutting costs compared to traditional paper invoicing.

Interoperability Standards

Interoperability standards in e-invoicing enable seamless electronic data exchange between diverse invoicing systems, significantly reducing errors and processing times compared to traditional paper invoicing.

Archival Digitization

Archival digitization improves e-invoicing efficiency by enabling faster retrieval and secure storage compared to traditional paper invoicing methods.

EDI (Electronic Data Interchange)

Electronic Data Interchange (EDI) enables faster, more accurate e-invoicing by automating data exchange, significantly reducing errors and processing time compared to traditional paper invoicing.

Real-time Validation

Real-time validation in e-invoicing eliminates errors and accelerates processing compared to delayed manual checks in paper invoicing.

Manual Data Entry

Manual data entry in e-invoicing reduces errors and processing time compared to paper invoicing by automating data capture and validation.

e-invoicing vs paper invoicing Infographic

moneydif.com

moneydif.com