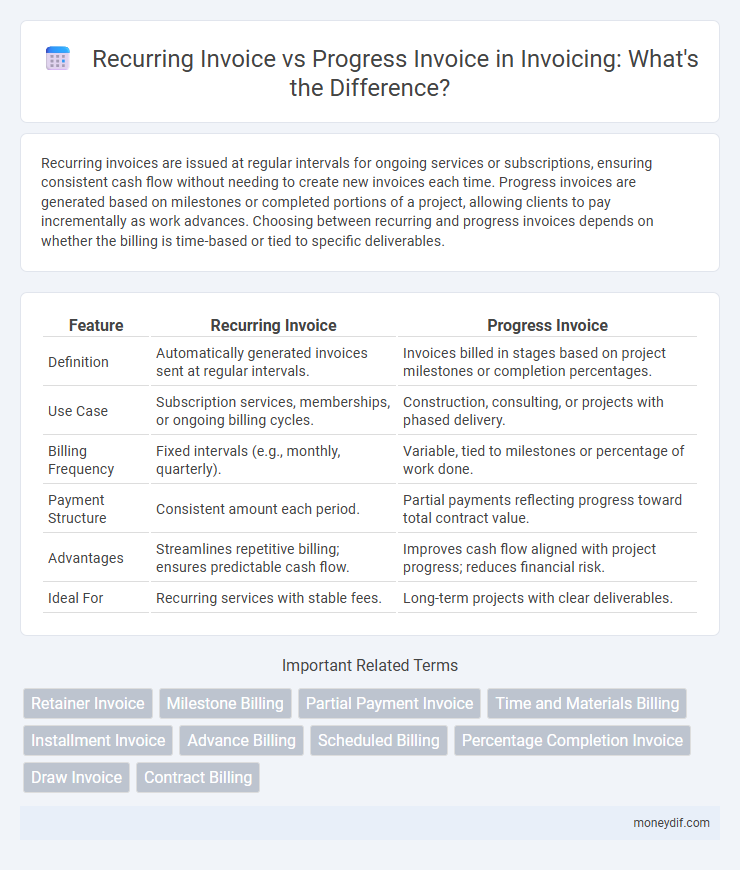

Recurring invoices are issued at regular intervals for ongoing services or subscriptions, ensuring consistent cash flow without needing to create new invoices each time. Progress invoices are generated based on milestones or completed portions of a project, allowing clients to pay incrementally as work advances. Choosing between recurring and progress invoices depends on whether the billing is time-based or tied to specific deliverables.

Table of Comparison

| Feature | Recurring Invoice | Progress Invoice |

|---|---|---|

| Definition | Automatically generated invoices sent at regular intervals. | Invoices billed in stages based on project milestones or completion percentages. |

| Use Case | Subscription services, memberships, or ongoing billing cycles. | Construction, consulting, or projects with phased delivery. |

| Billing Frequency | Fixed intervals (e.g., monthly, quarterly). | Variable, tied to milestones or percentage of work done. |

| Payment Structure | Consistent amount each period. | Partial payments reflecting progress toward total contract value. |

| Advantages | Streamlines repetitive billing; ensures predictable cash flow. | Improves cash flow aligned with project progress; reduces financial risk. |

| Ideal For | Recurring services with stable fees. | Long-term projects with clear deliverables. |

Introduction to Recurring vs Progress Invoices

Recurring invoices automate regular billing cycles by generating identical invoices at set intervals, ensuring consistent cash flow for subscription services or ongoing contracts. Progress invoices, however, bill clients incrementally based on project milestones or the percentage of work completed, providing transparency and manageable payments for both parties. Understanding the distinction helps businesses optimize billing strategies according to service type and client needs.

Definition of Recurring Invoices

Recurring invoices are automated bills sent regularly to customers for ongoing services or subscriptions, ensuring consistent cash flow and reduced administrative tasks. These invoices streamline billing cycles by generating identical charges at specified intervals, such as weekly, monthly, or annually. Recurring invoices are crucial for businesses with steady revenue streams, including SaaS companies and membership-based services.

Definition of Progress Invoices

Progress invoices are billing documents issued incrementally as specific milestones or phases of a project are completed, reflecting partial work rather than the entire contract amount. Unlike recurring invoices, which are generated regularly for ongoing services or subscriptions, progress invoices enable businesses to manage cash flow by requesting payments tied to project progress. This type of invoice is essential in industries such as construction and consulting, where work is delivered and billed in stages over time.

Key Differences: Recurring vs Progress Invoices

Recurring invoices automate billing at regular intervals for ongoing services or subscriptions, ensuring consistent cash flow and reducing manual effort. Progress invoices, however, bill customers incrementally based on project milestones or completion stages, providing transparency and aligning payments with work progress. Key differences include billing frequency, purpose, and how payment amounts are determined according to time versus project advancement.

Benefits of Using Recurring Invoices

Recurring invoices streamline cash flow by automating regular billing cycles, reducing manual errors and saving time for businesses with consistent services or subscriptions. They enhance customer satisfaction through predictable, timely payments and improve financial forecasting with steady revenue streams. Utilizing recurring invoices also lowers administrative costs and strengthens credit management by ensuring invoices are sent without delays.

Benefits of Using Progress Invoices

Progress invoices improve cash flow management by allowing businesses to bill clients in phases based on project milestones, reducing financial strain. They provide greater transparency and accountability by detailing work completed at each stage, enhancing client trust and reducing payment disputes. Using progress invoices also aids in tracking project costs, making budgeting and financial forecasting more accurate for ongoing jobs.

When to Use Recurring Invoices

Recurring invoices are ideal for billing customers who require regular, fixed payments such as subscription services, memberships, or ongoing maintenance contracts. They automate the billing process, reducing manual work and ensuring timely payments over a defined period. Businesses should use recurring invoices when the payment amount and schedule remain consistent, enhancing cash flow predictability and operational efficiency.

When to Use Progress Invoices

Progress invoices are ideal for projects with multiple milestones or ongoing work over an extended period, allowing businesses to bill clients incrementally based on completed phases. Use progress invoices when payment corresponds to stages of project completion, ensuring consistent cash flow without waiting for full project delivery. This approach is common in construction, software development, and consulting services where deliverables are spread across the timeline.

Common Industries Using Each Invoice Type

Recurring invoices are commonly used in subscription-based industries such as software-as-a-service (SaaS), telecommunications, and gym memberships, where regular, consistent billing cycles are essential. Progress invoices are prevalent in construction, custom manufacturing, and project management sectors, where payments are tied to specific milestones or phases of a project. Both invoice types improve cash flow management by aligning billing practices with industry-specific operational models.

Choosing the Right Invoice for Your Business

Selecting the right invoice type depends on your business model and cash flow needs; recurring invoices automate regular billing for subscription-based services, ensuring consistent revenue and reducing administrative tasks. Progress invoices suit projects with multiple phases or milestones, allowing you to bill clients incrementally as work is completed, improving cash flow management and client communication. Understanding the nature of your services and payment schedules helps optimize invoicing strategy for better financial control and customer satisfaction.

Important Terms

Retainer Invoice

A Retainer Invoice is an upfront payment request securing future services, differing from Recurring Invoices that bill regular intervals and Progress Invoices that charge based on project milestones.

Milestone Billing

Milestone billing allocates payment based on predefined project milestones, distinguishing recurring invoices issued at regular intervals for ongoing services from progress invoices that reflect partial completion of specific project phases.

Partial Payment Invoice

Partial payment invoices allow clients to pay a portion of the total amount due on recurring invoices issued at regular intervals or progress invoices based on project milestones and completion stages.

Time and Materials Billing

Time and Materials billing typically uses Recurring Invoices for ongoing services with consistent rates, while Progress Invoices are applied to bill partial payments based on completed work milestones.

Installment Invoice

An Installment Invoice schedules payments over time similar to a Recurring Invoice's regular billing cycle but differs from a Progress Invoice, which bills based on completed project milestones.

Advance Billing

Advance billing involves charging clients upfront, differing from recurring invoices that bill at regular intervals and progress invoices that charge based on project milestones or completion phases.

Scheduled Billing

Scheduled Billing automates payment collection by generating Recurring Invoices at fixed intervals for consistent services, while Progress Invoices bill clients incrementally based on project milestones or completion stages.

Percentage Completion Invoice

Percentage Completion Invoices calculate payment based on the work completed percentage, commonly used in Progress Invoices for project milestones, whereas Recurring Invoices bill fixed amounts at regular intervals regardless of project progress.

Draw Invoice

Draw Invoice enables efficient payment management by facilitating periodic billing in Recurring Invoices and milestone-based billing in Progress Invoices.

Contract Billing

Contract billing involves managing recurring invoices for consistent, periodic payments and progress invoices for milestone-based project payments to optimize cash flow and contract compliance.

Recurring Invoice vs Progress Invoice Infographic

moneydif.com

moneydif.com