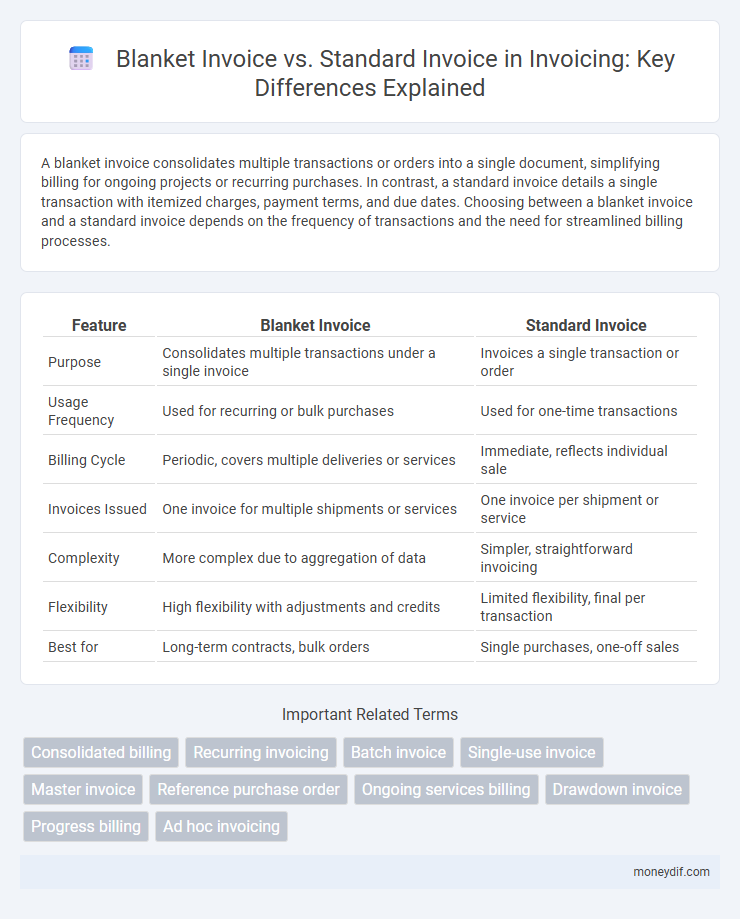

A blanket invoice consolidates multiple transactions or orders into a single document, simplifying billing for ongoing projects or recurring purchases. In contrast, a standard invoice details a single transaction with itemized charges, payment terms, and due dates. Choosing between a blanket invoice and a standard invoice depends on the frequency of transactions and the need for streamlined billing processes.

Table of Comparison

| Feature | Blanket Invoice | Standard Invoice |

|---|---|---|

| Purpose | Consolidates multiple transactions under a single invoice | Invoices a single transaction or order |

| Usage Frequency | Used for recurring or bulk purchases | Used for one-time transactions |

| Billing Cycle | Periodic, covers multiple deliveries or services | Immediate, reflects individual sale |

| Invoices Issued | One invoice for multiple shipments or services | One invoice per shipment or service |

| Complexity | More complex due to aggregation of data | Simpler, straightforward invoicing |

| Flexibility | High flexibility with adjustments and credits | Limited flexibility, final per transaction |

| Best for | Long-term contracts, bulk orders | Single purchases, one-off sales |

Understanding Blanket Invoices

Blanket invoices consolidate multiple transactions into a single document, streamlining billing processes for recurring purchases or long-term agreements, unlike standard invoices which itemize individual sales. Understanding blanket invoices helps businesses manage ongoing supplier relationships efficiently, reduce administrative workload, and improve cash flow accuracy. This approach is particularly beneficial in industries with frequent, repetitive orders, enabling clearer financial tracking and simplified payment cycles.

What is a Standard Invoice?

A standard invoice is a detailed billing document issued for individual transactions, specifying the products or services provided, quantities, prices, and payment terms. It serves as a formal request for payment from a seller to a buyer, reflecting a single sale or delivery event. Unlike blanket invoices, standard invoices are transaction-specific and require separate issuance for each purchase or service rendered.

Key Differences: Blanket vs Standard Invoices

Blanket invoices cover multiple transactions over a set period, minimizing administrative tasks by consolidating purchases, while standard invoices itemize individual transactions separately. Blanket invoices streamline billing for recurring orders, improving cash flow management and reducing paperwork, whereas standard invoices provide detailed, transaction-specific records crucial for precise accounting and audit trails. Businesses with frequent, repeat purchases benefit from blanket invoices, while those requiring detailed transaction tracking prefer standard invoices.

Use Cases for Blanket Invoices

Blanket invoices are ideal for businesses that engage in recurring transactions or long-term contracts, allowing multiple deliveries or services to be billed under a single invoice to streamline accounting processes. They simplify cash flow management and reduce administrative overhead by consolidating multiple billing events into one document, especially useful in industries like manufacturing, wholesale, or ongoing service agreements. Standard invoices suit one-time or distinct transactions, whereas blanket invoices optimize billing efficiency for continuous or repetitive orders.

When to Choose a Standard Invoice

Choose a standard invoice when billing for individual transactions or when precise payment tracking for each sale is required. Standard invoices provide detailed itemization, making them ideal for one-time purchases or variable orders with distinct due dates. This method ensures clarity for both the seller and buyer, facilitating accurate accounting and timely payment processing.

Pros and Cons of Blanket Invoices

Blanket invoices streamline billing for recurring or multiple deliveries by consolidating charges into a single document, reducing administrative workload and simplifying payment processes. However, they may complicate financial tracking and reconciliation due to the aggregation of multiple transactions, potentially leading to delayed dispute resolution and less precise accounting. Businesses must weigh the efficiency benefits against possible challenges in monitoring individual itemized charges when opting for blanket invoices.

Advantages and Limitations of Standard Invoices

Standard invoices provide detailed, transaction-specific billing that enhances accuracy and transparency for each purchase or service rendered. They facilitate precise payment tracking and financial reconciliation but may increase administrative workload due to the generation of multiple invoices for ongoing transactions. Limitations include potential inefficiency in managing repeated orders or long-term projects where consolidation of charges is preferred.

Impact on Cash Flow and Payment Terms

Blanket invoices streamline cash flow by consolidating multiple orders into a single billing cycle, reducing administrative costs and improving payment predictability for both buyers and sellers. Standard invoices require individual billing for each transaction, which can lead to fluctuating cash flow due to variable payment timings and increased processing efforts. The extended payment terms often negotiated with blanket invoices enhance liquidity management, while standard invoices typically adhere to shorter, fixed payment periods that demand more immediate cash availability.

Best Practices for Managing Invoice Types

Blanket invoices streamline recurring billing by consolidating multiple transactions into a single document, reducing administrative workload and enhancing cash flow management; best practices include regularly reviewing contract terms and ensuring clear client communication. Standard invoices offer detailed, transaction-specific billing that improves record accuracy and supports compliance audits; implement consistent numbering, timely dispatch, and thorough documentation to optimize processing efficiency. Combining both invoice types strategically can improve financial tracking and foster stronger client relationships while minimizing errors.

Choosing the Right Invoice for Your Business

Choosing the right invoice for your business depends on transaction frequency and billing complexity; blanket invoices consolidate multiple deliveries or services into a single statement, reducing administrative tasks for recurring orders. Standard invoices itemize each transaction separately, providing transparency ideal for one-time or irregular sales. Evaluating your billing cycle and customer needs ensures efficient cash flow management and accurate record-keeping.

Important Terms

Consolidated billing

Consolidated billing streamlines payment processes by grouping multiple charges into a single Blanket invoice, which simplifies tracking and reduces administrative overhead compared to Standard invoices that itemize individual transactions separately. Utilizing Blanket invoices under consolidated billing enhances cash flow management and improves financial reporting accuracy across multiple accounts or services.

Recurring invoicing

Recurring invoicing streamlines billing by automatically generating consistent charges, with blanket invoices offering a pre-approved, cumulative billing method ideal for long-term projects or ongoing services, while standard invoices provide one-time or periodic billing for individual transactions. Blanket invoices simplify payment tracking and reduce administrative overhead compared to standard invoices, which require separate issuance and reconciliation for each billing cycle.

Batch invoice

Batch invoice consolidates multiple transactions into a single billing document, optimizing accounts receivable processes compared to a standard invoice which corresponds to one specific transaction; blanket invoices facilitate recurring or ongoing billing agreements by allowing multiple invoices under a single contract, streamlining administrative overhead and improving cash flow management in large-scale or subscription-based services.

Single-use invoice

Single-use invoices are generated for one-time transactions and differ from blanket invoices, which cover multiple deliveries or services under a single agreement, and standard invoices that typically represent individual, regular billing events. Unlike blanket invoices that consolidate several charges over time, single-use invoices provide detailed, itemized billing for unique purchases, enhancing clarity in transaction records.

Master invoice

A master invoice consolidates multiple transactions under a single blanket invoice, streamlining billing compared to issuing individual standard invoices for each transaction.

Reference purchase order

Reference purchase orders link Blanket invoices, which consolidate multiple deliveries under one billing, to Standard invoices that itemize each transaction separately for precise financial tracking.

Ongoing services billing

Ongoing services billing typically utilizes blanket invoices for recurring charges over a period, while standard invoices are generated for one-time or specific service transactions.

Drawdown invoice

Drawdown invoices allocate costs from blanket invoices by gradually drawing down predefined budget amounts, unlike standard invoices which bill for individual transactions or fixed amounts.

Progress billing

Progress billing allows clients to pay for portions of a project over time, making it ideal for Blanket invoices that cover multiple items or services under a single agreement, whereas Standard invoices typically bill for completed work or delivered goods individually.

Ad hoc invoicing

Ad hoc invoicing enables businesses to generate invoices for irregular or specific transactions, differing from blanket invoices that cover multiple shipments or services under a single agreement, or standard invoices which are issued per individual transaction. This flexibility allows precise billing for unique cases, while blanket invoices streamline recurring billing and standard invoices maintain straightforward, transaction-specific records.

Blanket invoice vs Standard invoice Infographic

moneydif.com

moneydif.com