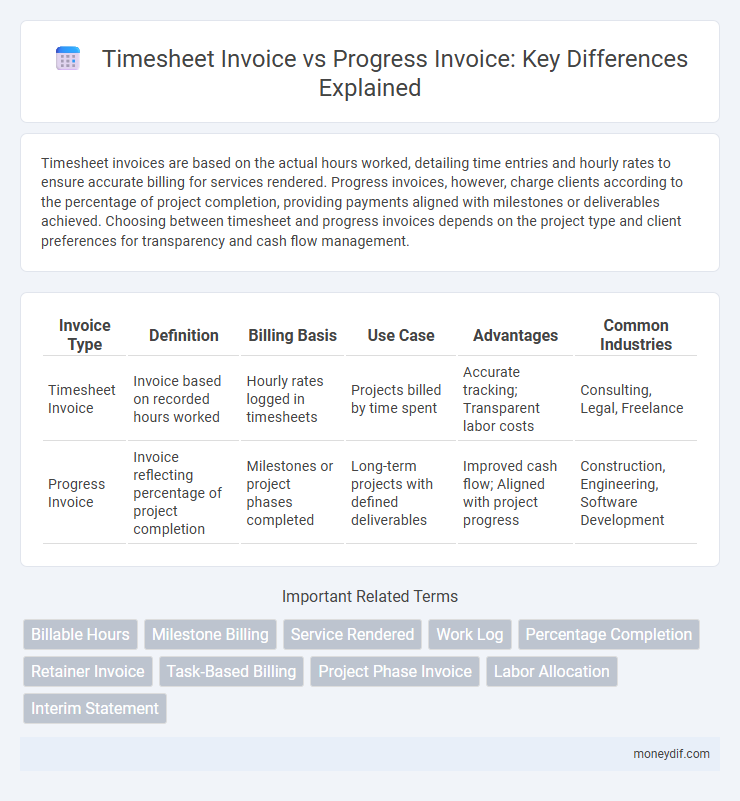

Timesheet invoices are based on the actual hours worked, detailing time entries and hourly rates to ensure accurate billing for services rendered. Progress invoices, however, charge clients according to the percentage of project completion, providing payments aligned with milestones or deliverables achieved. Choosing between timesheet and progress invoices depends on the project type and client preferences for transparency and cash flow management.

Table of Comparison

| Invoice Type | Definition | Billing Basis | Use Case | Advantages | Common Industries |

|---|---|---|---|---|---|

| Timesheet Invoice | Invoice based on recorded hours worked | Hourly rates logged in timesheets | Projects billed by time spent | Accurate tracking; Transparent labor costs | Consulting, Legal, Freelance |

| Progress Invoice | Invoice reflecting percentage of project completion | Milestones or project phases completed | Long-term projects with defined deliverables | Improved cash flow; Aligned with project progress | Construction, Engineering, Software Development |

Overview of Timesheet Invoice and Progress Invoice

Timesheet invoices bill clients based on actual hours worked, tracking labor with detailed time entries to ensure accurate compensation for services rendered. Progress invoices request partial payments tied to specific project milestones or percentage completion, helping manage cash flow during ongoing projects. Both invoice types provide transparency and support financial planning, with timesheet invoices emphasizing hourly work and progress invoices highlighting project advancement.

Key Differences Between Timesheet and Progress Invoices

Timesheet invoices bill clients based on actual hours worked, often detailed with employee names, dates, and tasks, while progress invoices charge for a percentage of the total project completed at specific milestones. Timesheet invoices suit hourly or service-based work, ensuring precise billing, whereas progress invoices benefit fixed-price projects by aligning payments with project stages. Understanding these differences helps businesses choose accurate invoicing methods, improving cash flow and client transparency.

How Timesheet Invoices Work

Timesheet invoices are generated based on the actual hours worked, recording detailed time entries for each task or project phase. They provide transparency by listing employee hours, hourly rates, and total charges, ensuring accurate billing aligned with the effort expended. This type of invoice is essential for clients who require precise tracking of labor costs on a per-hour basis.

Understanding Progress Invoices

Progress invoices invoice clients based on the percentage of project completion rather than actual hours worked, providing a clear reflection of ongoing work value. This method helps maintain cash flow by billing in stages aligned with project milestones, reducing the risk of delayed payments. Progress invoices are especially useful in long-term contracts where tracking progress against total deliverables ensures transparency and financial accuracy.

Use Cases for Timesheet Invoices

Timesheet invoices are ideal for projects where billing is based on the actual hours worked, such as consulting, legal services, and freelance work. They provide detailed records of time spent on specific tasks, ensuring accurate and transparent billing for clients. This invoicing method supports flexible project management and helps businesses track labor costs in real time.

Common Applications of Progress Invoices

Progress invoices are commonly used in construction and project-based industries to bill clients incrementally based on completed milestones or work stages, improving cash flow management throughout the project duration. These invoices enable detailed tracking of project progress and provide transparency by aligning payments with actual work performed. Common applications include long-term contracts, service engagements, and customized product deliveries where ongoing billing reflects phased completion.

Benefits of Using Timesheet Invoices

Timesheet invoices provide precise billing based on actual hours worked, enhancing transparency and accuracy for both clients and service providers. This method enables detailed tracking of labor costs, helping businesses manage budgets effectively and avoid disputes over payment. Using timesheet invoices fosters trust by clearly linking payments to documented time entries, supporting better project management and financial accountability.

Advantages of Progress Invoice Method

Progress invoices improve cash flow by allowing businesses to bill clients incrementally based on project milestones or time elapsed, reducing the risk of delayed payment. This method enhances transparency and client trust by providing detailed documentation of completed work, facilitating easier project management and dispute resolution. Progress invoicing also supports better budgeting and forecasting, enabling businesses to allocate resources efficiently and adjust plans according to ongoing project performance.

Choosing Between Timesheet and Progress Invoices

Choosing between timesheet and progress invoices depends on the nature of the project and billing preferences. Timesheet invoices are ideal for hourly work, tracking actual time spent on tasks, ensuring accurate client billing. Progress invoices suit milestone-based projects, enabling payments aligned with completed phases to improve cash flow and project management.

Best Practices for Managing Invoice Types

Timesheet invoices require detailed tracking of hours worked, making it essential to maintain accurate time logs and ensure transparency between clients and contractors. Progress invoices should reflect completed milestones with clear documentation of deliverables and percentage of project completion for effective cash flow management. Implementing standardized templates and regular communication streamlines approval processes and minimizes disputes across both invoice types.

Important Terms

Billable Hours

Billable hours tracked in timesheet invoices provide detailed labor records for specific tasks, whereas progress invoices bill clients based on project completion milestones or percentage of work finished.

Milestone Billing

Milestone Billing segments payments based on project goals, with Timesheet Invoices charging for actual hours worked while Progress Invoices bill according to the percentage of project completion.

Service Rendered

Service rendered details on timesheet invoices provide precise labor tracking, while progress invoices reflect milestone-based billing for project phases.

Work Log

Work Log data ensures accurate Timesheet Invoices by tracking labor hours precisely, whereas Progress Invoices rely on milestone completion and project deliverable values for billing.

Percentage Completion

Percentage Completion measures project progress by comparing billed amounts on timesheet invoices against progress invoices to ensure accurate financial tracking.

Retainer Invoice

A retainer invoice secures upfront payment for ongoing services, contrasting with a timesheet invoice that bills based on recorded work hours and a progress invoice that invoices for completed project milestones.

Task-Based Billing

Task-Based Billing enhances accuracy by linking timesheet invoices directly to logged work hours, whereas progress invoices focus on billing based on project milestones or percentage of completion.

Project Phase Invoice

Project Phase Invoice differentiates Timesheet Invoice, based on logged hours, from Progress Invoice, tied to completed milestones or deliverables.

Labor Allocation

Labor allocation accuracy improves project cost management by ensuring timesheet invoices align with actual hours worked while progress invoices reflect the percentage of project completion.

Interim Statement

Interim statements reconcile timesheet invoices with progress invoices by accurately reflecting labor costs and project milestones for effective financial tracking.

Timesheet Invoice vs Progress Invoice Infographic

moneydif.com

moneydif.com