A self-billing invoice is generated by the buyer on behalf of the supplier, detailing the goods or services received and the payment due, which streamlines accounting and reduces administrative burden. In contrast, a supplier invoice is issued directly by the vendor to the buyer, reflecting the transaction from the seller's perspective and serving as the primary document for payment processing. Both methods require clear communication and mutual agreement to ensure accurate record-keeping and compliance with tax regulations.

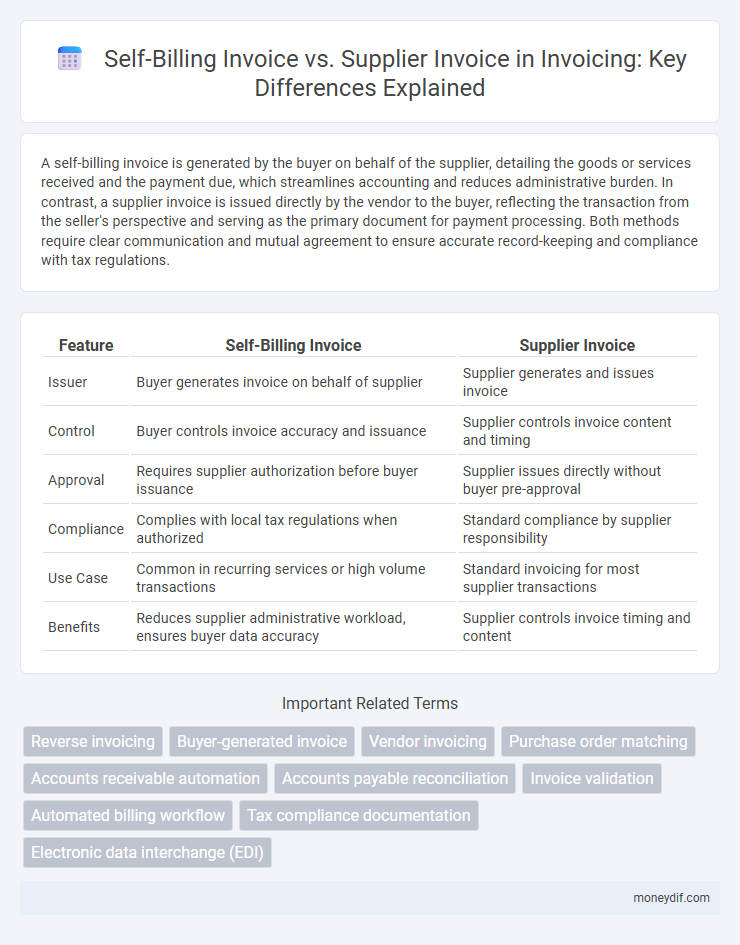

Table of Comparison

| Feature | Self-Billing Invoice | Supplier Invoice |

|---|---|---|

| Issuer | Buyer generates invoice on behalf of supplier | Supplier generates and issues invoice |

| Control | Buyer controls invoice accuracy and issuance | Supplier controls invoice content and timing |

| Approval | Requires supplier authorization before buyer issuance | Supplier issues directly without buyer pre-approval |

| Compliance | Complies with local tax regulations when authorized | Standard compliance by supplier responsibility |

| Use Case | Common in recurring services or high volume transactions | Standard invoicing for most supplier transactions |

| Benefits | Reduces supplier administrative workload, ensures buyer data accuracy | Supplier controls invoice timing and content |

Understanding Self-Billing Invoices

Self-billing invoices are created by the buyer on behalf of the supplier, streamlining the payment process by eliminating the need for the supplier to issue an invoice. This method requires a mutual agreement and clear contractual terms to ensure compliance with tax regulations and accounting standards. Self-billing improves accuracy and efficiency in transactions, reducing administrative overhead for both parties.

What Is a Supplier Invoice?

A supplier invoice is a document issued by a vendor detailing the goods or services provided, including quantities, prices, and payment terms. It serves as a formal request for payment from the buyer and is essential for accurate accounts payable records. Unlike self-billing invoices generated by the buyer, supplier invoices originate directly from the supplier and must comply with tax and legal requirements.

Key Differences Between Self-Billing and Supplier Invoices

Self-billing invoices are generated by the buyer on behalf of the supplier, whereas supplier invoices are created and sent by the supplier to the buyer. Key differences include the party responsible for invoice creation, with self-billing requiring prior agreement and compliance with tax regulations, while supplier invoices rely on the supplier's accuracy and timing. Self-billing enhances invoice processing efficiency and reduces disputes, contrasting with traditional supplier invoices, which maintain supplier control over invoicing.

Advantages of Self-Billing Invoices

Self-billing invoices streamline the payment process by allowing buyers to generate invoices on behalf of suppliers, reducing administrative errors and accelerating cash flow. This system enhances transparency and compliance by ensuring invoice accuracy tied directly to purchase orders and delivery confirmations. Self-billing also simplifies reconciliation and improves supplier relationships by minimizing disputes and payment delays.

Drawbacks of Self-Billing Systems

Self-billing systems can create complexities in maintaining accurate financial records due to limited control over invoice generation by suppliers. These systems may increase the risk of errors and disputes, as suppliers depend on buyers to generate correct invoices. Challenges in audit compliance and delayed payment approvals often arise, affecting cash flow management and vendor relationships.

Benefits of Traditional Supplier Invoices

Traditional supplier invoices provide clear documentation directly from the seller, ensuring accuracy and reducing discrepancies in payment processing. They foster trust and verify transaction authenticity by including detailed product descriptions, quantities, prices, and payment terms. Supplier invoices simplify accounting audits and compliance with tax regulations by maintaining transparent and auditable financial records.

Legal and Compliance Considerations

Self-billing invoices require a prior agreement between supplier and customer, ensuring compliance with VAT regulations and accurate tax reporting to prevent penalties. Supplier invoices must include legally mandated details such as supplier identification, invoice date, and distinct descriptions of goods or services, fulfilling statutory record-keeping requirements. Both invoice types demand adherence to country-specific legislation, electronic invoice standards, and retention periods for audit purposes to maintain legal validity.

Suitable Industries for Self-Billing

Self-billing invoices are particularly suitable for industries with high-volume transactions and recurring purchases, such as retail, manufacturing, and logistics. These sectors benefit from streamlined processes that reduce administrative costs and improve payment accuracy. The automated nature of self-billing enhances transparency and trust between buyers and suppliers in complex supply chains.

Challenges in Transitioning Between Invoice Types

Transitioning from supplier invoices to self-billing invoices presents challenges such as ensuring compliance with tax regulations and reconciling discrepancies in invoice data. Businesses must address issues related to data accuracy and alignment of accounting systems to handle the reversed billing responsibility. Effective communication between suppliers and buyers is critical to avoid disputes and maintain smooth financial workflows during the transition.

Choosing the Right Invoicing Method for Your Business

Choosing the right invoicing method depends on factors such as the volume of transactions, administrative capacity, and supplier relationships, with self-billing invoices offering automation advantages by allowing the buyer to generate invoices on behalf of the supplier. Supplier invoices require suppliers to create and send accurate billing documents, ensuring control over invoice content but often increasing processing time and potential errors. Businesses aiming to streamline accounts payable and enhance cash flow management tend to prefer self-billing in industries like manufacturing and retail where buyer verification aligns with frequent, repetitive purchases.

Important Terms

Reverse invoicing

Reverse invoicing involves the buyer generating the invoice instead of the supplier, streamlining the self-billing process by reducing errors and administrative workload. This contrasts with traditional supplier invoices where the supplier issues the invoice, often leading to delays in processing and reconciliation.

Buyer-generated invoice

Buyer-generated invoices, often used in self-billing arrangements, enable the purchaser to create and approve invoices on behalf of the supplier, streamlining accounts payable processes and ensuring accuracy in billing. Compared to traditional supplier invoices, self-billing invoices reduce administrative overhead by minimizing invoice discrepancies and accelerating payment cycles.

Vendor invoicing

Vendor invoicing involves the generation of payment requests either through self-billing invoices, where the buyer creates the invoice on behalf of the supplier, or traditional supplier invoices issued directly by the supplier. Self-billing invoice processes enhance accuracy and streamline reconciliation by reducing invoice disputes and administrative delays compared to supplier invoices.

Purchase order matching

Purchase order matching ensures accuracy by comparing self-billing invoices, generated by the buyer, against the original purchase orders and goods receipts to validate quantities and prices before payment. This process reduces discrepancies common in supplier invoices by automating invoice verification, improving financial control and supplier relationship management.

Accounts receivable automation

Accounts receivable automation streamlines the processing of self-billing invoices by directly integrating supplier-generated billing data, reducing manual entry errors and accelerating cash flow. In contrast, automation for supplier invoices emphasizes electronic data capture and matching with purchase orders to ensure timely payment and improved accuracy in accounts payable management.

Accounts payable reconciliation

Accounts payable reconciliation involves comparing self-billing invoices issued by buyers with supplier invoices to ensure accuracy and resolve discrepancies in recorded payables.

Invoice validation

Invoice validation ensures accuracy and compliance by comparing self-billing invoices, generated by the buyer on behalf of the supplier, against supplier invoices which are issued directly by the supplier. This process verifies data consistency such as amounts, tax codes, and purchase order references to prevent discrepancies and facilitate smooth financial reconciliation.

Automated billing workflow

Automated billing workflow streamlines the comparison between self-billing invoices and supplier invoices by ensuring accuracy in payment processing and reducing manual errors. Integration of electronic data interchange (EDI) and invoice reconciliation software enhances compliance with tax regulations and improves financial transparency for both buyers and suppliers.

Tax compliance documentation

Accurate tax compliance documentation requires understanding the distinctions between self-billing invoices issued by buyers and supplier invoices generated by vendors to ensure proper VAT reporting and audit readiness.

Electronic data interchange (EDI)

Electronic Data Interchange (EDI) streamlines the processing of self-billing invoices by enabling automated data exchange directly between suppliers and buyers, reducing errors and accelerating reconciliation compared to traditional supplier-issued invoices.

Self-billing invoice vs Supplier invoice Infographic

moneydif.com

moneydif.com