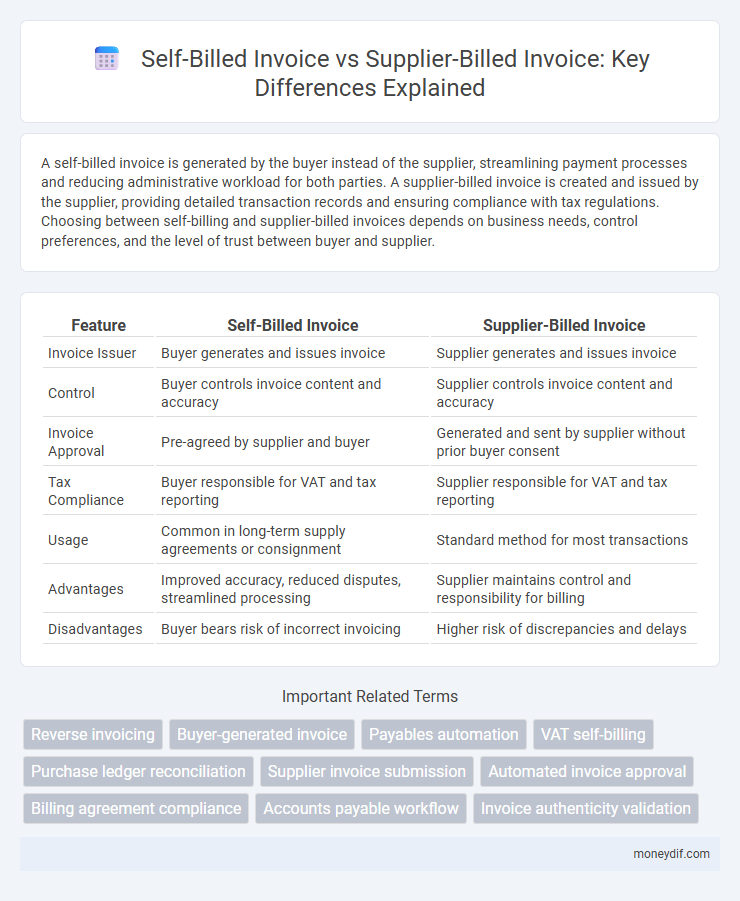

A self-billed invoice is generated by the buyer instead of the supplier, streamlining payment processes and reducing administrative workload for both parties. A supplier-billed invoice is created and issued by the supplier, providing detailed transaction records and ensuring compliance with tax regulations. Choosing between self-billing and supplier-billed invoices depends on business needs, control preferences, and the level of trust between buyer and supplier.

Table of Comparison

| Feature | Self-Billed Invoice | Supplier-Billed Invoice |

|---|---|---|

| Invoice Issuer | Buyer generates and issues invoice | Supplier generates and issues invoice |

| Control | Buyer controls invoice content and accuracy | Supplier controls invoice content and accuracy |

| Invoice Approval | Pre-agreed by supplier and buyer | Generated and sent by supplier without prior buyer consent |

| Tax Compliance | Buyer responsible for VAT and tax reporting | Supplier responsible for VAT and tax reporting |

| Usage | Common in long-term supply agreements or consignment | Standard method for most transactions |

| Advantages | Improved accuracy, reduced disputes, streamlined processing | Supplier maintains control and responsibility for billing |

| Disadvantages | Buyer bears risk of incorrect invoicing | Higher risk of discrepancies and delays |

Understanding Self-Billed Invoices: Definition and Key Features

Self-billed invoices are documents issued by the buyer instead of the supplier, streamlining the billing process by allowing buyers to calculate and record the payable amounts directly. Key features include buyer-generated invoice numbers, detailed itemized costs, and compliance with tax regulations such as VAT requirements specific to self-billing scenarios. This approach enhances transparency and reduces invoice discrepancies by aligning invoicing with actual goods or services received.

What Are Supplier-Billed Invoices? Core Concepts Explained

Supplier-billed invoices are documents issued directly by the supplier to the buyer, detailing the products or services provided, quantities, prices, and payment terms. These invoices serve as official proof of the transaction and enable the buyer to validate the charges for accounting and payment processing. Supplier-billed invoices play a crucial role in accounts payable workflows, ensuring transparency and accuracy in financial records.

Key Differences Between Self-Billed and Supplier-Billed Invoices

Self-billed invoices are generated by the buyer, allowing them to control the invoice details and streamline payment processes, while supplier-billed invoices are issued directly by the supplier to the buyer. In self-billing, the buyer records the transaction and handles VAT reporting, which improves accuracy and reduces disputes, whereas supplier-billed invoices rely on supplier data accuracy and timely submission. Key differences include responsibility for invoice creation, VAT compliance management, and control over invoice content, impacting accounting workflows and audit trails.

Pros and Cons of Self-Billed Invoices

Self-billed invoices enable buyers to generate invoices on behalf of suppliers, improving accuracy and reducing administrative workload by consolidating billing processes. This approach enhances cash flow management and compliance tracking but can create dependency on buyer systems, exposing suppliers to risks if processes are not tightly controlled. However, self-billed invoices may complicate dispute resolution and require robust agreements to ensure mutual accountability and audit trail integrity.

Advantages and Disadvantages of Supplier-Billed Invoices

Supplier-billed invoices streamline the payment process by providing buyers with detailed and consistent documentation directly from suppliers, reducing administrative burden and enhancing accuracy. However, dependence on supplier-generated invoices increases the risk of errors or fraudulent charges, requiring robust verification procedures. This invoicing method can delay payment cycles if discrepancies occur, impacting cash flow management for the buyer.

Legal and Regulatory Requirements for Self-Billing

Self-billed invoices require formal agreement between supplier and customer, complying with tax authorities' regulations to ensure accurate VAT reporting and audit trail integrity. Legal frameworks often mandate clear documentation, advance authorization, and consistent issuance procedures to validate the self-billing process. Failure to meet these regulatory requirements can result in penalties, disallowed VAT credits, or invoice invalidation under tax law.

When to Use Self-Billed vs Supplier-Billed Invoices

Self-billed invoices are used when the buyer generates the invoice on behalf of the supplier, often in scenarios where consistent transaction volumes and streamlined processing are essential, such as retail or manufacturing supply chains. Supplier-billed invoices are appropriate when suppliers retain control over invoicing, providing detailed transaction records and maintaining billing accuracy, typically used in service industries or one-off purchases. Choosing between self-billed and supplier-billed invoices depends on factors like transaction frequency, trust levels, compliance requirements, and the need for efficient accounts payable workflows.

Compliance Risks to Avoid in Self-Billing Processes

Self-billed invoices pose unique compliance risks, such as improper VAT documentation and incorrect invoice data, which can trigger audits and penalties from tax authorities. Ensuring strict adherence to VAT regulations, maintaining clear agreements between suppliers and buyers, and accurate record-keeping are essential to mitigate these risks. Failure to comply with self-billing requirements often results in financial penalties and disrupted supplier relationships.

Best Practices for Managing Supplier Relationships in Both Invoice Types

Managing supplier relationships efficiently requires clear communication and mutual agreement on invoice processes, whether using self-billed or supplier-billed invoices. Implementing automated invoicing systems and maintaining accurate records reduce discrepancies and improve payment cycles for both formats. Establishing standardized procedures and regular audits ensures compliance and fosters trust between buyers and suppliers across all invoice types.

Choosing the Right Invoice Method for Your Business

Choosing the right invoice method is crucial for optimizing cash flow and maintaining accurate financial records. Self-billed invoices allow businesses to generate invoices on behalf of their suppliers, improving invoice processing efficiency and reducing errors in accounts payable. Supplier-billed invoices, issued directly by the supplier, offer greater control over invoice details and payment schedules, making them suitable for businesses prioritizing supplier relationship management and audit compliance.

Important Terms

Reverse invoicing

Reverse invoicing occurs when the buyer issues a Self-Billed Invoice on behalf of the supplier, shifting the responsibility of invoice generation from the supplier-billed invoice process to the buyer.

Buyer-generated invoice

Buyer-generated invoices, known as self-billed invoices, are issued by the buyer instead of the supplier, contrasting with supplier-billed invoices where the supplier creates and sends the invoice directly to the buyer.

Payables automation

Payables automation enhances accuracy and efficiency by streamlining the processing of Self-Billed Invoices, where buyers generate invoices, compared to Supplier-Billed Invoices, which rely on suppliers to issue invoices.

VAT self-billing

VAT self-billing requires the customer to issue the invoice on behalf of the supplier, differing from supplier-billed invoices where the supplier generates the VAT invoice directly.

Purchase ledger reconciliation

Purchase ledger reconciliation ensures accuracy by matching self-billed invoices generated by buyers with supplier-billed invoices to validate payment records and prevent discrepancies.

Supplier invoice submission

Supplier invoice submission processes differ significantly between self-billed invoices, where the buyer generates the invoice on behalf of the supplier, and supplier-billed invoices, which are created and submitted directly by the supplier.

Automated invoice approval

Automated invoice approval streamlines the validation process by automatically verifying self-billed invoices issued by buyers against purchase orders, contrasting with supplier-billed invoices generated and submitted by suppliers for payment.

Billing agreement compliance

Billing agreement compliance ensures accurate matching and validation of Self-Billed Invoices and Supplier-Billed Invoices according to contractual terms and tax regulations.

Accounts payable workflow

Accounts payable workflows streamline processing by automating validation and payment of self-billed invoices issued by buyers while ensuring compliance and accuracy in handling supplier-billed invoices generated by vendors.

Invoice authenticity validation

Invoice authenticity validation ensures accurate verification of self-billed invoices generated by buyers versus supplier-billed invoices issued directly by suppliers to prevent fraud and accounting discrepancies.

Self-Billed Invoice vs Supplier-Billed Invoice Infographic

moneydif.com

moneydif.com