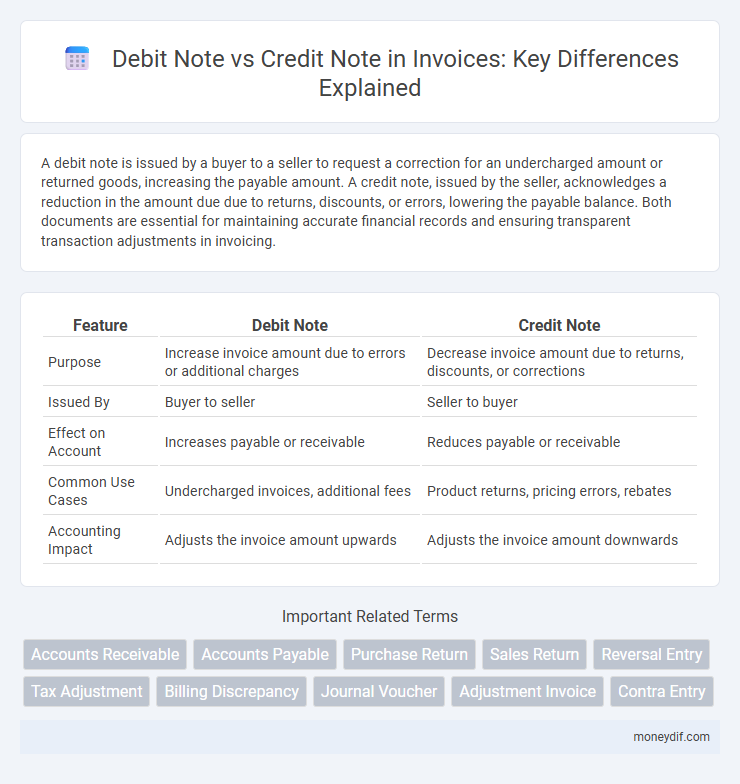

A debit note is issued by a buyer to a seller to request a correction for an undercharged amount or returned goods, increasing the payable amount. A credit note, issued by the seller, acknowledges a reduction in the amount due due to returns, discounts, or errors, lowering the payable balance. Both documents are essential for maintaining accurate financial records and ensuring transparent transaction adjustments in invoicing.

Table of Comparison

| Feature | Debit Note | Credit Note |

|---|---|---|

| Purpose | Increase invoice amount due to errors or additional charges | Decrease invoice amount due to returns, discounts, or corrections |

| Issued By | Buyer to seller | Seller to buyer |

| Effect on Account | Increases payable or receivable | Reduces payable or receivable |

| Common Use Cases | Undercharged invoices, additional fees | Product returns, pricing errors, rebates |

| Accounting Impact | Adjusts the invoice amount upwards | Adjusts the invoice amount downwards |

Definition of Debit Note

A debit note is a commercial document issued by a buyer to a seller, indicating a request for a credit adjustment due to returned goods, undercharged invoices, or accounting errors. It serves as a formal notification that increases the amount payable, reflecting discrepancies in the original invoice. This document is essential for maintaining accurate financial records and facilitating transparent transactions in business operations.

Definition of Credit Note

A credit note is a financial document issued by a seller to a buyer, indicating a reduction in the amount owed due to returned goods, pricing errors, or other adjustments. It serves as an official record that decreases the buyer's outstanding invoice balance, reflecting refunds or allowances granted. Credit notes are essential for maintaining accurate accounting records and ensuring transparency in transaction adjustments.

Key Differences Between Debit Note and Credit Note

Debit notes and credit notes serve distinct functions in accounting and invoicing processes; a debit note is issued by a buyer to request a price increase or correct underbilling, signaling an increase in amounts payable, while a credit note is issued by a seller to acknowledge returns, overbilling, or discounts, reducing the amount receivable. Debit notes effectively act as a request for additional payment, impacting accounts payable, whereas credit notes serve as proof of adjustments that reduce the invoice value and accounts receivable. These documents ensure accurate transaction records and help maintain transparent financial communication between buyers and sellers.

Purpose and Uses of Debit Notes

Debit notes serve as formal requests issued by a buyer to a seller, indicating a need to increase the amount payable due to reasons such as under-billing, damaged goods, or additional services provided. They function as an adjustment mechanism in accounting to rectify discrepancies by increasing the seller's receivables and the buyer's payables. Debit notes help maintain accurate financial records and ensure transparent communication between trading partners.

Purpose and Uses of Credit Notes

Credit notes serve as official documents issued by a seller to a buyer, reducing the amount owed due to returns, errors, or discounts on previously invoiced goods or services. They adjust the buyer's account balance by providing a monetary credit against future purchases or outstanding payments. Credit notes facilitate accurate financial records and ensure transparent transaction adjustments without requiring immediate cash refunds.

Format and Essential Components

Debit notes and credit notes share a similar format but differ in purpose and essential components. Both documents include the invoice number, date, customer details, description of goods or services, and monetary value. A debit note reflects an increase in the amount owed by the buyer due to returned goods or undercharged invoices, while a credit note indicates a reduction in the amount payable, often issued for returned items or overcharged billing.

Accounting Treatment and Journal Entries

Debit Note increases accounts payable or reduces accounts receivable by recording a liability or decreasing an asset, reflected in journal entries as a debit to the supplier account and a credit to the purchase or expense account. Credit Note decreases accounts payable or increases accounts receivable by recording a reduction in liability or an increase in asset, through journal entries that debit the purchase or sales returns account and credit the supplier or customer account. Both notes adjust the accounting records to correct invoices, refunds, or returns, ensuring accurate financial statements.

Legal and Compliance Considerations

Debit Notes and Credit Notes are essential financial documents used for adjusting invoices and must comply with legal and tax regulations to ensure validity. Debit Notes are issued to increase the amount payable due to errors or additional charges, while Credit Notes decrease the amount due or correct overbilling, each requiring proper documentation for audit and tax purposes. Compliance with local tax laws, such as GST or VAT regulations, mandates accurate record-keeping and timely issuance of these notes to avoid legal penalties and ensure transparent financial reporting.

Impact on Buyer and Seller’s Financial Records

A Debit Note increases the buyer's accounts payable and the seller's accounts receivable, reflecting an amount owed by the buyer for goods or services returned or undercharged. Conversely, a Credit Note decreases the buyer's accounts payable and the seller's accounts receivable, indicating a reduction in the amount the buyer must pay due to returns, discounts, or billing errors. Both debit and credit notes adjust financial records to ensure accurate accounting of transactions between buyer and seller.

Common Scenarios for Issuing Debit and Credit Notes

Debit notes are commonly issued when a buyer returns goods due to defects or overcharges, adjusting the invoice amount payable to the supplier. Credit notes are issued to acknowledge refunds or price reductions when goods are returned or billing errors occur, reducing the amount the customer owes. Both documents ensure accurate accounting by correcting discrepancies in sales or purchase invoices.

Important Terms

Accounts Receivable

Accounts Receivable management involves accurately recording Debit Notes to increase outstanding customer balances and Credit Notes to decrease them, ensuring precise financial reconciliation and cash flow tracking.

Accounts Payable

Accounts Payable management involves recording Debit Notes to acknowledge supplier underbilling and Credit Notes to document supplier overbilling, ensuring accurate liability reconciliation.

Purchase Return

A Purchase Return is documented using a Debit Note issued by the buyer to the supplier for returned goods, whereas a Credit Note is issued by the supplier to acknowledge the return and adjust the invoice accordingly.

Sales Return

Sales returns are processed using debit notes to document customer returns when the original sale was invoiced, while credit notes are issued by sellers to adjust or reduce the amount receivable due to such returns.

Reversal Entry

A reversal entry corrects errors by negating a prior debit or credit note transaction, ensuring accurate financial records.

Tax Adjustment

A tax adjustment related to a debit note increases the taxable amount by recording additional charges, whereas a credit note decreases the taxable amount by documenting returns or discounts.

Billing Discrepancy

Billing discrepancies arise when a debit note issued to increase charges conflicts with a credit note issued to reduce the same invoice amount, causing inconsistencies in the accounts payable and receivable.

Journal Voucher

A journal voucher records financial transactions such as debit notes, which increase expenses or assets, and credit notes, which reduce liabilities or revenue.

Adjustment Invoice

An adjustment invoice corrects prior billing errors by either issuing a debit note to increase the amount due or a credit note to decrease it.

Contra Entry

Contra entries record transfers between cash and bank accounts without affecting profit or loss, whereas debit notes serve as requests for credit adjustment, and credit notes indicate the actual credit granted to a buyer.

Debit Note vs Credit Note Infographic

moneydif.com

moneydif.com