Adjusted Present Value (APV) and Net Present Value (NPV) both measure investment profitability, but APV separates the value of the project from the value of financing effects, while NPV combines them into a single metric. APV is especially useful in leveraged buyouts and projects with complex financing structures because it allows explicit valuation of tax shields and other financing benefits. NPV provides a straightforward evaluation by discounting all cash flows at a weighted average cost of capital, making it simpler for projects with stable capital structures.

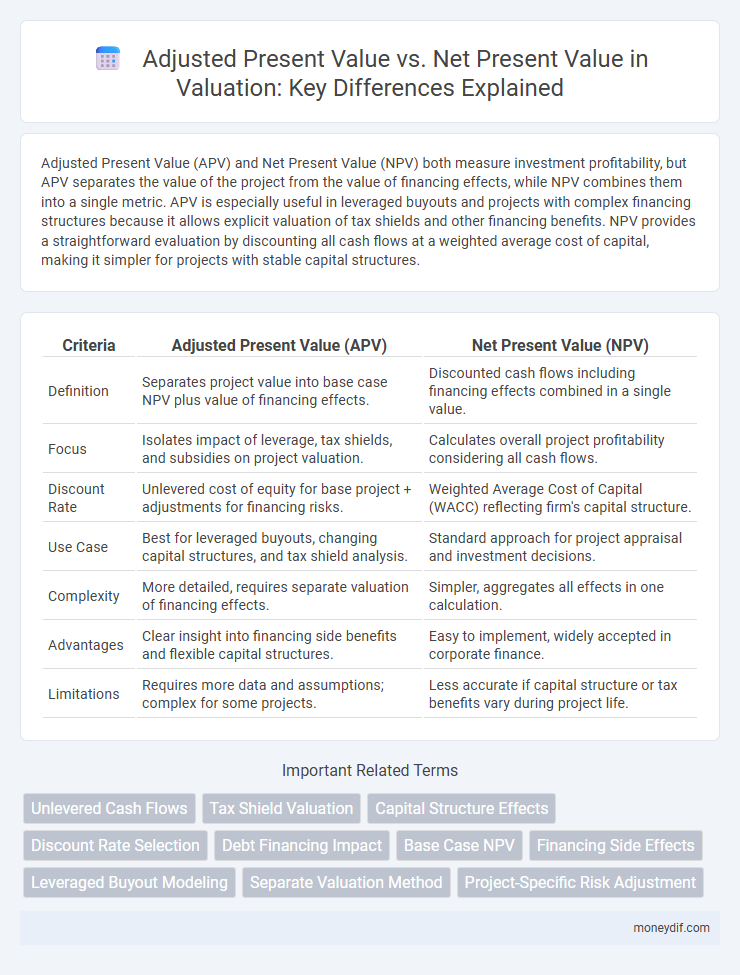

Table of Comparison

| Criteria | Adjusted Present Value (APV) | Net Present Value (NPV) |

|---|---|---|

| Definition | Separates project value into base case NPV plus value of financing effects. | Discounted cash flows including financing effects combined in a single value. |

| Focus | Isolates impact of leverage, tax shields, and subsidies on project valuation. | Calculates overall project profitability considering all cash flows. |

| Discount Rate | Unlevered cost of equity for base project + adjustments for financing risks. | Weighted Average Cost of Capital (WACC) reflecting firm's capital structure. |

| Use Case | Best for leveraged buyouts, changing capital structures, and tax shield analysis. | Standard approach for project appraisal and investment decisions. |

| Complexity | More detailed, requires separate valuation of financing effects. | Simpler, aggregates all effects in one calculation. |

| Advantages | Clear insight into financing side benefits and flexible capital structures. | Easy to implement, widely accepted in corporate finance. |

| Limitations | Requires more data and assumptions; complex for some projects. | Less accurate if capital structure or tax benefits vary during project life. |

Understanding Adjusted Present Value (APV)

Adjusted Present Value (APV) isolates the value of a project by calculating its net present value (NPV) as if it were all-equity financed and then adding the present value of tax shields and other financing effects. This approach allows clearer assessment of the impact of financing decisions separately from operational cash flows, enhancing valuation accuracy in leveraged transactions. APV provides a flexible framework for valuing projects with complex capital structures, making it particularly useful in leveraged buyouts and highly leveraged firms.

Defining Net Present Value (NPV)

Net Present Value (NPV) calculates the difference between the present value of cash inflows and outflows over a project's lifetime, using a discount rate reflecting the project's risk. This metric captures the intrinsic value of an investment by incorporating the time value of money and opportunity costs. NPV serves as a foundational valuation tool that contrasts with Adjusted Present Value (APV), which separately accounts for financing effects and operating cash flows.

Key Differences Between APV and NPV

Adjusted Present Value (APV) separates the value of an unlevered project from the tax shields and costs of financing, providing a clearer view of financial leverage effects, while Net Present Value (NPV) aggregates all cash flows into a single discount rate. APV is particularly useful in leveraged buyouts and scenarios with changing capital structures, as it explicitly values the benefits of debt tax shields and financing side effects. NPV assumes a constant weighted average cost of capital (WACC), making it less flexible for projects with fluctuating leverage or complex financing arrangements.

When to Use Adjusted Present Value

Adjusted Present Value (APV) is ideal for valuing projects with complex financing structures, such as those involving significant debt or tax shields, where separate treatment of financing effects is necessary. APV offers clearer insights by isolating the value of a project as if it were all-equity financed and then adding the present value of financing side effects. This approach is particularly useful for leveraged buyouts, restructurings, or firms facing changing capital structures during the investment horizon.

Situations Suited for Net Present Value

Net Present Value (NPV) is ideal for valuation scenarios with a stable capital structure and predictable cash flows, where financing effects are minimal or can be incorporated into the discount rate. It suits projects funded entirely by equity or when debt levels remain constant over time, allowing straightforward assessment of project profitability. NPV simplifies decision-making by focusing exclusively on the net cash inflows discounted at the firm's weighted average cost of capital (WACC).

APV vs NPV: Pros and Cons

Adjusted Present Value (APV) separates the impact of financing from project value by adding the net present value (NPV) of financing effects to the base NPV, offering clarity on leverage effects and tax shields. NPV simplifies valuation by discounting all cash flows at a weighted average cost of capital (WACC), making it straightforward but less flexible in complex capital structures or changing debt levels. APV excels in leveraged buyouts and projects with varying debt, while NPV remains efficient for firms with stable capital structure and constant discount rates.

Calculating Adjusted Present Value

Calculating Adjusted Present Value (APV) involves separately valuing a project's base-case Net Present Value (NPV) assuming all-equity financing and then adding the present value of financing side effects, such as tax shields from debt. APV is particularly useful when the project's capital structure is complex or changing, allowing clearer analysis of financing impacts. The formula for APV is: APV = NPV (all-equity financed) + Present Value of Financing Effects.

Calculating Net Present Value

Calculating Net Present Value (NPV) involves discounting all expected cash flows from a project or investment at the firm's weighted average cost of capital (WACC) to determine the net benefit. Unlike Adjusted Present Value (APV), which separates financing effects from project value, NPV integrates both operating cash flows and financing costs in a single discount rate. Accurate NPV calculation requires precise estimation of incremental cash flows, appropriate WACC selection, and consideration of the project's risk profile to assess true investment viability.

APV and NPV in Capital Budgeting Decisions

Net Present Value (NPV) measures the profitability of a project by discounting cash flows at the weighted average cost of capital (WACC), reflecting the firm's overall risk and capital structure. Adjusted Present Value (APV) separates the project value into the base case NPV assuming all-equity financing plus the present value of financing side effects, such as tax shields and bankruptcy costs. APV provides clearer insights in capital budgeting decisions when capital structure changes or leverage effects significantly impact project valuation.

Choosing Between APV and NPV for Valuation

Choosing between Adjusted Present Value (APV) and Net Present Value (NPV) for valuation hinges on the complexity of the capital structure and the need to separately value financing effects. APV is preferable when evaluating projects with changing debt levels or significant tax shields because it explicitly values the base project and financing side effects apart. NPV suits simpler cases with stable capital structures, directly calculating the project's overall value including financing costs.

Important Terms

Unlevered Cash Flows

Unlevered cash flows represent the company's operating cash flows before debt financing effects, providing a neutral basis for valuation models like Adjusted Present Value (APV) and Net Present Value (NPV). APV separates the value of the firm's operations from the tax shield benefits of debt, while NPV incorporates all cash flows, including financing effects, into a single discount rate approach.

Tax Shield Valuation

Tax Shield Valuation enhances firm value by incorporating the tax savings from debt interest, which Adjusted Present Value (APV) explicitly separates from the project's base Net Present Value (NPV). APV calculates the value of tax shields independently, providing a clearer analysis of financing effects compared to NPV, which integrates tax shields into a single discount rate.

Capital Structure Effects

Adjusted Present Value (APV) separates the impact of capital structure by valuing a project without debt and then adding tax shields, while Net Present Value (NPV) incorporates capital structure effects within a single discount rate reflecting the weighted average cost of capital (WACC).

Discount Rate Selection

Selecting the appropriate discount rate is crucial for accurately comparing Adjusted Present Value (APV) and Net Present Value (NPV) calculations, as APV separates the project's base-case value from financing effects while NPV combines them into a single discount rate reflecting project risk and capital structure.

Debt Financing Impact

Debt financing impacts the Adjusted Present Value (APV) by separating the project's base Net Present Value (NPV) from the tax shield benefits of debt, allowing a clearer analysis of financing effects. Unlike NPV, which blends operating cash flows and financing effects, APV explicitly values the increase in firm value from debt's tax advantages and financing side effects.

Base Case NPV

Base Case NPV estimates a project's value using traditional discounted cash flow methods without factoring in financing effects, while Adjusted Present Value (APV) separately accounts for the project's net present value and the net value of financing side effects, such as tax shields or bankruptcy costs. APV provides a clearer valuation in leveraged buyouts or highly leveraged structures by isolating operational cash flows from financing impacts, unlike the combined approach of Net Present Value (NPV).

Financing Side Effects

Adjusted Present Value (APV) explicitly accounts for financing side effects such as tax shields and bankruptcy costs by separately valuing them, whereas Net Present Value (NPV) typically integrates these effects indirectly within a single discount rate, potentially obscuring the precise impact of financing decisions on project value.

Leveraged Buyout Modeling

Leveraged Buyout (LBO) modeling evaluates the impact of debt financing on investment returns by separating the base project value from the tax shield benefits, which is effectively captured using Adjusted Present Value (APV) rather than Net Present Value (NPV). APV provides a clearer valuation in LBO scenarios by isolating the project's unlevered value and the present value of financing effects, enabling more accurate assessment of leverage impact on equity returns.

Separate Valuation Method

Separate Valuation Method distinguishes the value of a project by isolating the base-case net present value (NPV) of operations from the net effect of financing decisions, thereby enhancing accuracy in investment appraisal. Adjusted Present Value (APV) extends this by adding the present value of financing side effects, such as tax shields and bankruptcy costs, to the base NPV, allowing clearer analysis of value drivers in leveraged projects.

Project-Specific Risk Adjustment

Project-specific risk adjustment directly impacts the calculation of Adjusted Present Value (APV) by separating the project's base-case net present value (NPV) from the financing effects and risk premiums. APV incorporates risk adjustments through separate valuation of project risks and financing side effects, whereas NPV aggregates all cash flows discounted at a risk-adjusted rate, potentially obscuring individual risk components.

Adjusted Present Value vs Net Present Value Infographic

moneydif.com

moneydif.com