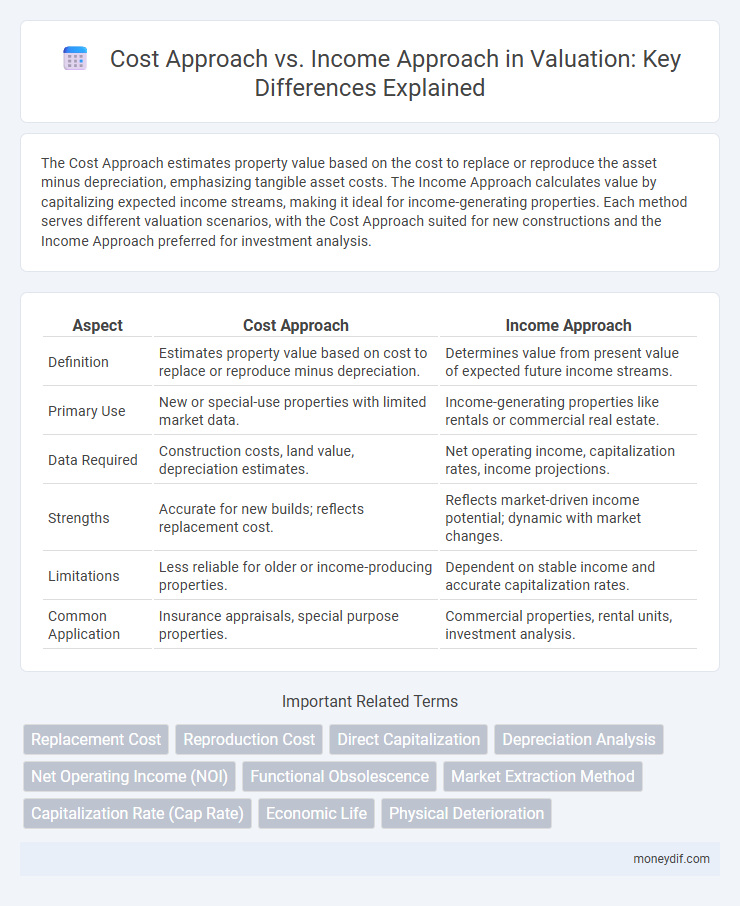

The Cost Approach estimates property value based on the cost to replace or reproduce the asset minus depreciation, emphasizing tangible asset costs. The Income Approach calculates value by capitalizing expected income streams, making it ideal for income-generating properties. Each method serves different valuation scenarios, with the Cost Approach suited for new constructions and the Income Approach preferred for investment analysis.

Table of Comparison

| Aspect | Cost Approach | Income Approach |

|---|---|---|

| Definition | Estimates property value based on cost to replace or reproduce minus depreciation. | Determines value from present value of expected future income streams. |

| Primary Use | New or special-use properties with limited market data. | Income-generating properties like rentals or commercial real estate. |

| Data Required | Construction costs, land value, depreciation estimates. | Net operating income, capitalization rates, income projections. |

| Strengths | Accurate for new builds; reflects replacement cost. | Reflects market-driven income potential; dynamic with market changes. |

| Limitations | Less reliable for older or income-producing properties. | Dependent on stable income and accurate capitalization rates. |

| Common Application | Insurance appraisals, special purpose properties. | Commercial properties, rental units, investment analysis. |

Understanding the Cost Approach in Valuation

The Cost Approach in valuation estimates a property's value by calculating the current replacement or reproduction cost of the structure minus depreciation, combined with the land value. This method is most effective for unique or new properties where market comparables are scarce or unreliable. It emphasizes tangible factors like construction costs, land appraisals, and physical depreciation to provide an objective baseline value.

Fundamentals of the Income Approach

The Income Approach in valuation prioritizes estimating the present value of future cash flows generated by an asset, reflecting its ability to produce income over time. This method involves forecasting net operating income and applying a capitalization rate or discount rate to determine the asset's market value. Unlike the Cost Approach, which relies on replacement cost, the Income Approach captures the economic benefits and risk factors essential for income-producing properties.

Key Differences: Cost Approach vs Income Approach

The Cost Approach estimates property value based on the replacement cost of the building minus depreciation plus land value, providing a tangible asset perspective. The Income Approach calculates value by capitalizing expected future income, reflecting the property's ability to generate cash flow. These methods differ in focus: the Cost Approach emphasizes construction and physical asset costs, while the Income Approach hinges on market income data and capitalization rates.

When to Use the Cost Approach

The Cost Approach is most effective for valuing new or unique properties where comparable market data is scarce, such as specialized industrial facilities or custom-built assets. It estimates value by calculating the current cost to replace or reproduce the structure minus depreciation, providing a reliable basis when income data is unavailable or unreliable. This method is preferable in appraisals involving insurance, new construction, or properties with limited income-generating history.

Ideal Scenarios for the Income Approach

The Income Approach is ideal for valuing income-producing properties such as rental apartments, office buildings, and commercial real estate where reliable cash flow projections are available. This method leverages capitalization of net operating income (NOI) or discounted cash flow (DCF) analysis to estimate market value based on anticipated income streams. Properties with stable, predictable revenues and market-driven rental rates benefit most from the Income Approach for accurate valuation.

Pros and Cons of the Cost Approach

The Cost Approach provides a clear estimate of value based on current construction costs, making it highly reliable for new or special-use properties where comparable market data is limited. It often overlooks depreciation and market demand factors, which can lead to an overestimation of value for older or income-producing properties. This approach is less effective in capturing the property's potential income generation, making it less suitable for commercial real estate valuation.

Advantages and Limitations of the Income Approach

The Income Approach offers the advantage of directly reflecting the property's potential to generate future cash flows, making it highly relevant for investment properties and income-producing assets. It accurately captures market conditions through capitalization rates and discount rates, enabling precise valuation of income streams. However, its limitations include reliance on accurate and stable income data, sensitivity to market fluctuations, and challenges in estimating future income for properties with variable or uncertain revenue.

Major Assumptions in Each Approach

The Cost Approach assumes that the property's value is equivalent to the cost of replacing or reproducing the improvements minus depreciation, emphasizing physical deterioration and functional obsolescence. The Income Approach relies on projected net operating income, applying capitalization rates or discounted cash flows to estimate value based on expected income streams, assuming stable market conditions and accurate income forecasts. Both approaches require assumptions about market conditions, depreciation, income stability, and capitalization rates, which critically influence the valuation outcome.

Impact on Property Valuation Results

The Cost Approach calculates property value based on replacement or reproduction costs minus depreciation, directly impacting valuations of new or unique properties. The Income Approach derives value from projected income streams, heavily influencing valuations of income-generating properties such as commercial real estate. Understanding these approaches reveals how market conditions and property characteristics drive variability in valuation outcomes.

Choosing the Right Approach for Accurate Valuation

Selecting the appropriate valuation method between the Cost Approach and Income Approach hinges on the asset type and market conditions. The Cost Approach is ideal for new or unique properties where replacement cost data is reliable, while the Income Approach excels for income-generating assets by capitalizing future earnings to estimate value. Accurate valuation relies on aligning the approach with property characteristics and available data, ensuring precise market value estimation.

Important Terms

Replacement Cost

Replacement Cost in the Cost Approach estimates property value based on current construction expenses, contrasting with the Income Approach which values property through potential income generation analysis.

Reproduction Cost

Reproduction cost in the Cost Approach quantifies the current expense to duplicate a property's exact structure, contrasting with the Income Approach that values property based on its potential income generation.

Direct Capitalization

Direct capitalization converts Net Operating Income (NOI) into property value using a capitalization rate, contrasting the Cost Approach's focus on replacement cost and the Income Approach's detailed discounted cash flow analysis.

Depreciation Analysis

Depreciation analysis in the Cost Approach estimates asset value by deducting physical, functional, and economic obsolescence from replacement cost, while the Income Approach calculates depreciation through the property's loss in income-producing ability over time.

Net Operating Income (NOI)

Net Operating Income (NOI) directly influences the Income Approach valuation by estimating property's income potential, while the Cost Approach focuses on calculating replacement costs minus depreciation independent of NOI.

Functional Obsolescence

Functional obsolescence reduces asset value more significantly in the Cost Approach by increasing depreciation estimates compared to the Income Approach, which reflects decreased cash flow potential.

Market Extraction Method

Market Extraction Method estimates property value by deriving depreciation and land value from comparable sales, serving as a bridge between the Cost Approach's focus on replacement costs and the Income Approach's emphasis on future income potential.

Capitalization Rate (Cap Rate)

Capitalization Rate (Cap Rate) serves as a key metric in the Income Approach, reflecting the ratio of net operating income to property value, whereas the Cost Approach calculates property value based on the replacement or reproduction cost minus depreciation without directly using Cap Rate. Investors rely on the Cap Rate in the Income Approach to assess investment returns, while the Cost Approach is often utilized for new or special-purpose properties where income data is limited.

Economic Life

The Cost Approach estimates economic life by calculating asset value based on replacement costs minus depreciation, while the Income Approach determines economic life through projected income streams and capitalization rates.

Physical Deterioration

Physical deterioration directly reduces a property's market value by lowering its remaining useful life and increasing maintenance costs, which is critically factored into the Cost Approach through depreciation adjustments. In contrast, the Income Approach indirectly accounts for physical deterioration by reflecting decreased net operating income and reduced effective rental potential due to impaired property condition.

Cost Approach vs Income Approach Infographic

moneydif.com

moneydif.com