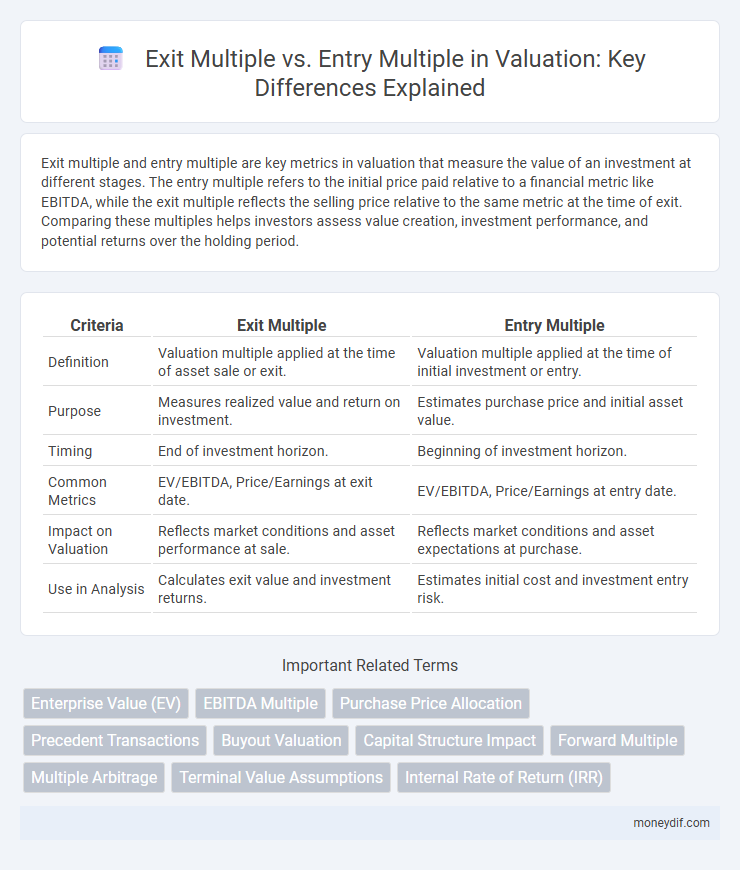

Exit multiple and entry multiple are key metrics in valuation that measure the value of an investment at different stages. The entry multiple refers to the initial price paid relative to a financial metric like EBITDA, while the exit multiple reflects the selling price relative to the same metric at the time of exit. Comparing these multiples helps investors assess value creation, investment performance, and potential returns over the holding period.

Table of Comparison

| Criteria | Exit Multiple | Entry Multiple |

|---|---|---|

| Definition | Valuation multiple applied at the time of asset sale or exit. | Valuation multiple applied at the time of initial investment or entry. |

| Purpose | Measures realized value and return on investment. | Estimates purchase price and initial asset value. |

| Timing | End of investment horizon. | Beginning of investment horizon. |

| Common Metrics | EV/EBITDA, Price/Earnings at exit date. | EV/EBITDA, Price/Earnings at entry date. |

| Impact on Valuation | Reflects market conditions and asset performance at sale. | Reflects market conditions and asset expectations at purchase. |

| Use in Analysis | Calculates exit value and investment returns. | Estimates initial cost and investment entry risk. |

Definition of Entry Multiple

Entry multiple refers to the valuation metric used at the time an investor initially acquires a stake in a company, typically expressed as a multiple of EBITDA or revenue. This multiple reflects the price paid relative to the company's financial performance at entry, serving as a baseline for assessing investment value. Understanding the entry multiple is crucial for evaluating the potential return and identifying value creation opportunities over the investment horizon.

Definition of Exit Multiple

Exit multiple refers to the valuation metric used at the time of an investment's sale or exit, typically expressed as a multiple of financial metrics like EBITDA or revenue. It reflects the price a buyer is willing to pay based on the company's performance and market conditions at exit. Understanding exit multiples is crucial for projecting potential returns and comparing investment opportunities.

Key Differences Between Entry and Exit Multiples

Exit multiple typically reflects the valuation metric used at the time of a company's sale or IPO, capturing realized market conditions, while entry multiple represents the valuation at initial investment, influenced by projected growth and risk. Exit multiples often incorporate actual financial performance and market sentiment, making them more grounded, whereas entry multiples rely on forecasts and assumptions about future cash flows. Differences between these multiples highlight changes in company value, investor expectations, and shifts in industry or economic dynamics over the holding period.

Factors Influencing Entry Multiple

Entry multiples in valuation are primarily influenced by company-specific factors such as growth prospects, profitability margins, and market position, which signal the potential for value creation. Macroeconomic conditions, including interest rates and industry trends, also play a critical role in determining entry multiples as they affect investor risk appetite and future cash flow expectations. Competitive dynamics and recent comparable transactions further shape entry multiples by providing benchmarks and highlighting relative valuation attractiveness.

Factors Impacting Exit Multiple

Exit multiples are influenced by factors such as market conditions, industry growth rates, and company performance metrics including revenue and EBITDA margins. Investor sentiment and macroeconomic trends also play a critical role in shaping exit multiples by affecting demand for similar assets and risk appetite. Competitive dynamics and the availability of financing further impact the valuation realized at exit.

Role of Multiples in Business Valuation

Exit multiple and entry multiple are critical metrics in business valuation, serving as benchmarks to estimate the value of a company at different investment stages. Entry multiples reflect the purchase price relative to financial metrics like EBITDA or revenue at acquisition, guiding initial investment decisions, while exit multiples indicate the expected selling price multiple, influencing anticipated returns. Understanding the relationship between these multiples helps investors assess value creation, risks, and potential profitability during holding periods.

Common Methods for Determining Multiples

Exit multiple and entry multiple are crucial in valuation for measuring investment returns and future value. Common methods for determining multiples include analyzing comparable company trading multiples, precedent transaction multiples, and discounted cash flow (DCF) benchmarks to ensure accurate market-based valuations. Selecting appropriate industry-specific multiples such as EV/EBITDA, P/E, or revenue multiples depends on the target company's growth stage and financial metrics.

Strategies for Optimizing Entry and Exit Multiples

Optimizing entry and exit multiples involves strategic timing and thorough market analysis to maximize investment returns. Employing value creation initiatives such as operational improvements and revenue growth can enhance exit multiples beyond initial entry multiples. Careful due diligence and competitive benchmarking at entry position investments favorably for higher multiple realization upon exit.

Impact of Market Conditions on Multiples

Market conditions significantly affect exit and entry multiples, with bullish markets often inflating exit multiples due to increased investor optimism and demand for assets. During downturns, entry multiples tend to compress as risk aversion rises and capital availability tightens, leading to more conservative valuation benchmarks. Understanding these fluctuations helps investors and businesses time their transactions to maximize value and mitigate risks associated with volatile economic environments.

Exit vs Entry Multiple: Implications for Investment Returns

Exit multiple significantly influences realized investment returns by determining the valuation at which an asset is sold, while entry multiple reflects the initial acquisition cost. A higher exit multiple compared to the entry multiple amplifies the internal rate of return (IRR) and overall profitability of the investment. Disparities between these multiples highlight market conditions and operational improvements, directly impacting investor gains.

Important Terms

Enterprise Value (EV)

Enterprise Value (EV) fluctuations are driven by the differential between Exit Multiple and Entry Multiple, directly impacting investment returns and valuation metrics.

EBITDA Multiple

The EBITDA multiple at exit reflects the company's valuation relative to its entry multiple, indicating investment return potential based on growth and market conditions.

Purchase Price Allocation

Purchase Price Allocation accurately assigns asset values based on the Exit Multiple compared to the Entry Multiple to reflect changes in investment returns and market conditions.

Precedent Transactions

Precedent transactions analysis reveals that exit multiples often exceed entry multiples due to value creation and market conditions impacting investment returns.

Buyout Valuation

Buyout valuation compares exit multiple to entry multiple to assess investment growth potential and determine the expected return on equity.

Capital Structure Impact

The impact of capital structure on valuation is significant as it influences the exit multiple relative to the entry multiple, affecting investor returns and acquisition premiums.

Forward Multiple

The Forward Multiple projects a company's future valuation by combining the Exit Multiple, which reflects the anticipated selling price, with the Entry Multiple, representing the initial purchase price, to assess investment returns.

Multiple Arbitrage

Multiple arbitrage occurs when a company is sold at a higher exit multiple than the entry multiple, enhancing investment returns by capitalizing on market valuation differences.

Terminal Value Assumptions

Terminal value assumptions often depend on applying an exit multiple that reflects anticipated market conditions compared to the entry multiple used at the initial investment valuation.

Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) measures investment profitability by comparing the Exit Multiple to the Entry Multiple, where a higher Exit Multiple relative to the Entry Multiple indicates greater returns over the investment period.

Exit Multiple vs Entry Multiple Infographic

moneydif.com

moneydif.com