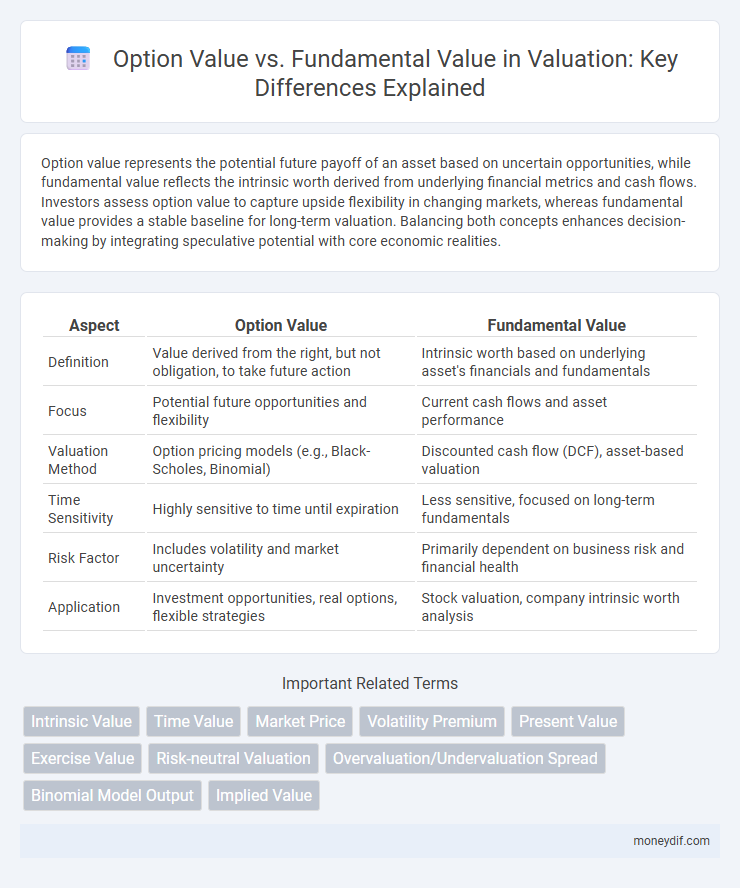

Option value represents the potential future payoff of an asset based on uncertain opportunities, while fundamental value reflects the intrinsic worth derived from underlying financial metrics and cash flows. Investors assess option value to capture upside flexibility in changing markets, whereas fundamental value provides a stable baseline for long-term valuation. Balancing both concepts enhances decision-making by integrating speculative potential with core economic realities.

Table of Comparison

| Aspect | Option Value | Fundamental Value |

|---|---|---|

| Definition | Value derived from the right, but not obligation, to take future action | Intrinsic worth based on underlying asset's financials and fundamentals |

| Focus | Potential future opportunities and flexibility | Current cash flows and asset performance |

| Valuation Method | Option pricing models (e.g., Black-Scholes, Binomial) | Discounted cash flow (DCF), asset-based valuation |

| Time Sensitivity | Highly sensitive to time until expiration | Less sensitive, focused on long-term fundamentals |

| Risk Factor | Includes volatility and market uncertainty | Primarily dependent on business risk and financial health |

| Application | Investment opportunities, real options, flexible strategies | Stock valuation, company intrinsic worth analysis |

Defining Option Value and Fundamental Value

Option value represents the potential worth of an asset based on future opportunities or choices, often reflecting the flexibility to capitalize on uncertain market conditions. Fundamental value is determined by intrinsic factors such as cash flows, earnings, and growth prospects, serving as the asset's true economic worth. Distinguishing between option value and fundamental value is crucial for accurate asset valuation and investment decision-making.

Key Differences Between Option Value and Fundamental Value

Option value represents the potential upside embedded in an asset's future choices or opportunities, while fundamental value reflects the intrinsic worth based on underlying cash flows and financial performance. Option value captures volatility and flexibility, often assessed through models like Black-Scholes, whereas fundamental value relies on discounted cash flow (DCF) analysis and tangible metrics. The key difference lies in option value emphasizing uncertainty and managerial decisions, contrasting with fundamental value's focus on stable, quantifiable economic factors.

Components of Fundamental Value

Fundamental value consists of intrinsic components such as discounted expected cash flows, growth prospects, and risk-adjusted discount rates that reflect a company's true economic worth. This value excludes market sentiment and focuses purely on quantifiable financial metrics like earnings, dividends, and asset values. Understanding these components helps differentiate fundamental value from option value, which derives from potential future opportunities and managerial flexibilities.

Factors Influencing Option Value

Option value is influenced by factors such as volatility of the underlying asset, time to expiration, and interest rates, which collectively enhance potential upside beyond the fundamental value. Higher volatility increases the likelihood of favorable price movements, thereby raising the option's premium. Extended time horizons provide more opportunities for asset appreciation, while fluctuating interest rates affect the cost of carrying the option, all shaping the overall option valuation.

Methods for Calculating Option Value

Option value is quantified using models like the Black-Scholes formula, which calculates the premium based on volatility, time to expiration, and underlying asset price. Real options analysis applies financial option pricing techniques to investment decisions, accounting for flexibility and uncertainty in future cash flows. Binomial tree models offer a discrete-time framework to evaluate option value by simulating possible price paths and exercise decisions at each node.

Approaches to Fundamental Valuation

Fundamental valuation approaches analyze an asset's intrinsic worth based on its expected cash flows, discount rates, and growth assumptions, contrasting with option value which captures strategic flexibility and uncertainty. Discounted Cash Flow (DCF) models are predominant, projecting future earnings and discounting them to present value using weighted average cost of capital (WACC). Residual income and dividend discount models also provide fundamental valuation metrics by emphasizing earnings quality and shareholder distributions.

Practical Examples: Option Value vs Fundamental Value

Option value represents the potential upside of an investment under uncertain future conditions, such as holding stock options in a volatile tech startup, where flexibility to buy shares later can yield significant profits. Fundamental value reflects the intrinsic worth derived from an asset's cash flows, earnings, and balance sheet, as seen in valuing a mature company like Coca-Cola based on dividend discount models. Comparing these, option value captures strategic opportunities and timing benefits, while fundamental value anchors assessment in current financial performance and asset strength.

Importance in Investment Decision-Making

Option value captures the potential upside from strategic flexibility and future opportunities, often overlooked in fundamental value based on current cash flows or assets. Incorporating option value into investment decisions enhances risk-adjusted returns by recognizing growth opportunities in uncertain environments. Investors integrating both values achieve more accurate asset pricing and improved portfolio optimization.

Limitations and Risks of Each Valuation Method

Option value valuation often overestimates worth due to reliance on volatility estimates and assumptions about market conditions, introducing significant model risk and sensitivity to input errors. Fundamental value analysis can underestimate or misestimate intrinsic value because it depends heavily on accurate financial forecasts and stable economic assumptions, which are prone to uncertainty and bias. Both methods face limitations in capturing real-world complexities, making hybrid approaches or scenario analyses essential for comprehensive risk assessment.

Integrating Option and Fundamental Values in Valuation Strategies

Integrating option value with fundamental value enhances valuation accuracy by capturing both the intrinsic worth and the strategic potential embedded in assets. Option value reflects the flexibility and future opportunities such as expansion, abandonment, or delay options, complementing fundamental value derived from cash flow forecasts and asset performance. Employing hybrid valuation models that combine discounted cash flow analysis with real options theory optimizes investment decisions and risk assessment in dynamic market conditions.

Important Terms

Intrinsic Value

Intrinsic value in options represents the difference between the underlying asset's current price and the option's strike price, while fundamental value reflects the inherent worth of the asset based on economic and financial analysis.

Time Value

Time value reflects the premium of an option's market price above its fundamental value, representing potential future gains from volatility and time until expiration.

Market Price

Market price reflects the option value by incorporating investors' expectations of future volatility and growth, often diverging from fundamental value which is based on intrinsic cash flow analysis. The divergence between market price and fundamental value highlights the premium investors assign to flexibility and potential upside embedded in the option component of assets.

Volatility Premium

The volatility premium represents the additional return investors demand for bearing the uncertainty inherent in option prices compared to the fundamental value of the underlying asset. This premium arises because option valuations often exceed intrinsic values due to implied volatility, reflecting market expectations of future price fluctuations beyond fundamental assessments.

Present Value

Present Value quantifies the current worth of expected future cash flows, serving as a foundational metric in financial valuation. Option Value reflects the premium included in asset prices for potential future opportunities, often exceeding the Fundamental Value derived solely from present discounted cash flows.

Exercise Value

Exercise value represents the immediate profitability of exercising an option, calculated as the difference between the underlying asset's current price and the option's strike price. It contrasts with the fundamental value, which reflects the option's intrinsic worth based on expected future payoffs, and the option value, encompassing both exercise value and time value components.

Risk-neutral Valuation

Risk-neutral valuation calculates an option's value by discounting expected payoffs under a probability measure where all assets grow at the risk-free rate, distinguishing the option value from the fundamental value driven by actual market probabilities. This approach isolates the option's theoretical price regardless of investors' risk preferences, enabling consistent pricing frameworks in financial derivatives markets.

Overvaluation/Undervaluation Spread

The Overvaluation/Undervaluation Spread measures the discrepancy between an option's market price and its fundamental value, reflecting potential mispricing driven by market sentiment or volatility.

Binomial Model Output

The Binomial Model output calculates option value by simulating possible price paths and comparing them to the fundamental value derived from intrinsic stock characteristics.

Implied Value

Implied value reflects the market price of an option derived from models such as Black-Scholes, often diverging from the fundamental value based on underlying asset valuation due to factors like volatility and time decay. The option value represents the premium investors pay for potential future gains, encapsulating both intrinsic value from the fundamental asset price and extrinsic value influenced by market expectations.

Option Value vs Fundamental Value Infographic

moneydif.com

moneydif.com