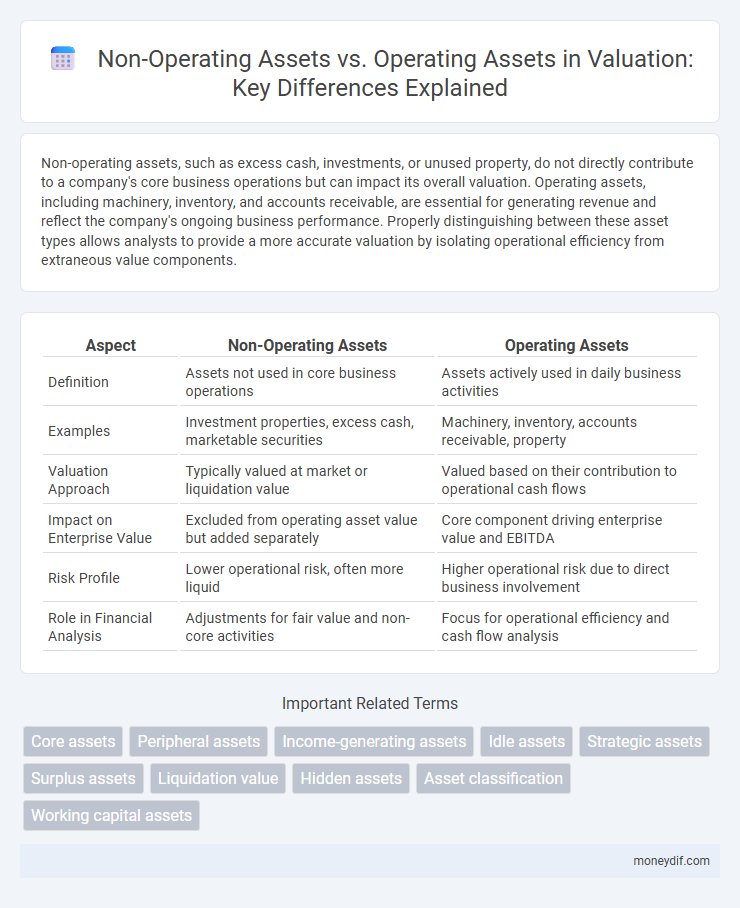

Non-operating assets, such as excess cash, investments, or unused property, do not directly contribute to a company's core business operations but can impact its overall valuation. Operating assets, including machinery, inventory, and accounts receivable, are essential for generating revenue and reflect the company's ongoing business performance. Properly distinguishing between these asset types allows analysts to provide a more accurate valuation by isolating operational efficiency from extraneous value components.

Table of Comparison

| Aspect | Non-Operating Assets | Operating Assets |

|---|---|---|

| Definition | Assets not used in core business operations | Assets actively used in daily business activities |

| Examples | Investment properties, excess cash, marketable securities | Machinery, inventory, accounts receivable, property |

| Valuation Approach | Typically valued at market or liquidation value | Valued based on their contribution to operational cash flows |

| Impact on Enterprise Value | Excluded from operating asset value but added separately | Core component driving enterprise value and EBITDA |

| Risk Profile | Lower operational risk, often more liquid | Higher operational risk due to direct business involvement |

| Role in Financial Analysis | Adjustments for fair value and non-core activities | Focus for operational efficiency and cash flow analysis |

Introduction to Asset Classification in Valuation

Non-operating assets refer to holdings not essential to a company's core business operations, such as excess cash, investments, or idle real estate, which are valued separately from operating assets. Operating assets include property, plant, equipment, and inventory that contribute directly to revenue generation and ongoing business activities. Accurate asset classification during valuation ensures appropriate allocation of cash flows and risk, thereby enhancing the precision of enterprise value assessments.

Defining Operating Assets

Operating assets are tangible and intangible resources essential for a company's core business activities and revenue generation, including property, plant, equipment, and inventory. These assets directly contribute to production, sales, and service delivery, distinguishing them from non-operating assets, which are not actively used in daily operations. Identifying operating assets is critical in valuation to accurately assess enterprise value by isolating assets that drive business performance.

Understanding Non-Operating Assets

Non-operating assets encompass investments, excess cash, and non-core properties that do not support primary business operations but can add value to a firm's overall worth. These assets are excluded from operational cash flow analysis to provide a clearer picture of the company's core earning capability. Proper valuation separates operating assets, which drive revenues and profits, from non-operating assets to enhance accuracy in business appraisal and investment decisions.

Key Differences Between Operating and Non-Operating Assets

Operating assets directly support a company's core business activities and revenue generation, including equipment, inventory, and accounts receivable. Non-operating assets consist of investments, excess cash, or real estate not tied to the primary operations and do not contribute to daily business performance. Valuation methods distinguish these assets to accurately assess enterprise value, as operating assets impact earnings while non-operating assets often require separate valuation adjustments.

Importance of Operating Assets in Business Valuation

Operating assets are critical in business valuation as they directly generate revenue and reflect the company's core operational efficiency. These assets, including machinery, inventory, and accounts receivable, influence cash flow projections and profitability assessments vital for accurate valuation. Non-operating assets, such as excess real estate or marketable securities, are valued separately since they do not contribute to ongoing business operations.

Role of Non-Operating Assets in Company Worth

Non-operating assets, such as excess cash, investments, and unused real estate, contribute significantly to a company's total valuation by adding standalone value separate from core business operations. Their presence can enhance shareholder value by providing liquidity or potential for future strategic initiatives, often leading to premium acquisition offers. Accurate differentiation between operating and non-operating assets is essential for investors and analysts to assess true enterprise value and make informed investment decisions.

Impact on Financial Statements and Ratios

Non-operating assets, such as excess cash or investments, are excluded from core business operations and can inflate total asset values, impacting financial ratios like return on assets (ROA) and asset turnover by lowering their efficiency metrics. Operating assets, including inventory, property, and equipment, reflect the resources actively used in generating revenue, directly influencing profitability and operational efficiency ratios. Distinguishing between these asset types is crucial for accurate valuation analysis, as non-operating assets may distort performance assessments and mislead investors regarding a company's true operational health.

Methods to Identify Non-Operating vs Operating Assets

Methods to identify non-operating versus operating assets primarily involve a thorough analysis of financial statements, where operating assets are directly tied to core business activities, such as inventory, accounts receivable, and property, plant, and equipment. Non-operating assets include investments, surplus cash, or real estate unrelated to primary operations, and can be isolated through segment reporting, notes to financial statements, and reviewing the firm's asset utilization ratios. Techniques like discounted cash flow analysis applied only to operating assets and adjusted book value methods help distinguish the contribution of operating versus non-operating assets to overall enterprise value.

Common Examples of Operating and Non-Operating Assets

Operating assets primarily include machinery, inventory, and accounts receivable essential for daily business functions, whereas non-operating assets typically encompass investments, idle land, and excess cash not directly involved in core operations. Common examples of operating assets are production equipment and raw materials that contribute to revenue generation. Non-operating assets often consist of marketable securities and real estate holdings maintained for investment purposes or future sale.

Best Practices for Accurate Asset Valuation

Distinguishing non-operating assets from operating assets is critical in valuation to ensure accuracy and clarity in financial analysis. Best practices involve isolating non-operating assets such as excess cash, marketable securities, and idle equipment to prevent inflating enterprise value and to provide a true picture of core business performance. Accurate asset valuation relies on thorough documentation, consistent classification, and adjustment of cash flows to reflect only operating assets contributing to ongoing revenue generation.

Important Terms

Core assets

Core assets primarily consist of operating assets directly involved in a company's main business activities, while non-operating assets include investments or properties not essential to daily operations but contributing to overall value.

Peripheral assets

Peripheral assets typically refer to non-operating assets that do not directly contribute to a company's core business operations, unlike operating assets which are actively used in producing goods or services.

Income-generating assets

Income-generating assets include both operating assets, which directly contribute to core business revenues, and non-operating assets, such as investments or real estate, which generate income independently of primary operations.

Idle assets

Idle assets are a subset of non-operating assets, as they are not actively used in the core operations, unlike operating assets that directly contribute to revenue generation.

Strategic assets

Strategic assets, typically categorized as non-operating assets, include investments and intellectual properties that provide long-term competitive advantage without daily operational involvement, while operating assets consist of equipment and inventory directly used in production.

Surplus assets

Surplus assets, classified as non-operating assets, are resources not essential to core business operations, contrasting with operating assets that directly support revenue generation.

Liquidation value

Liquidation value primarily considers non-operating assets separately from operating assets to accurately estimate the net proceeds if a company's assets are sold off quickly.

Hidden assets

Hidden assets often arise within non-operating assets as undervalued or unrecognized resources distinct from core operating assets essential for business functions.

Asset classification

Asset classification distinguishes non-operating assets, such as excess cash and investments, from operating assets directly used in core business activities like inventory and equipment.

Working capital assets

Working capital assets primarily consist of operating assets such as inventory, accounts receivable, and cash required for daily operations, while non-operating assets like investments and excess cash are excluded from working capital calculations.

Non-operating assets vs operating assets Infographic

moneydif.com

moneydif.com