The Price-to-Earnings (P/E) ratio measures a company's current share price relative to its earnings per share, offering insight into investor expectations and profitability. The Price-to-Book (P/B) ratio compares a firm's market value to its book value, highlighting its asset valuation and financial stability. Evaluating both ratios together provides a comprehensive view of a stock's valuation by balancing earnings performance with underlying asset strength.

Table of Comparison

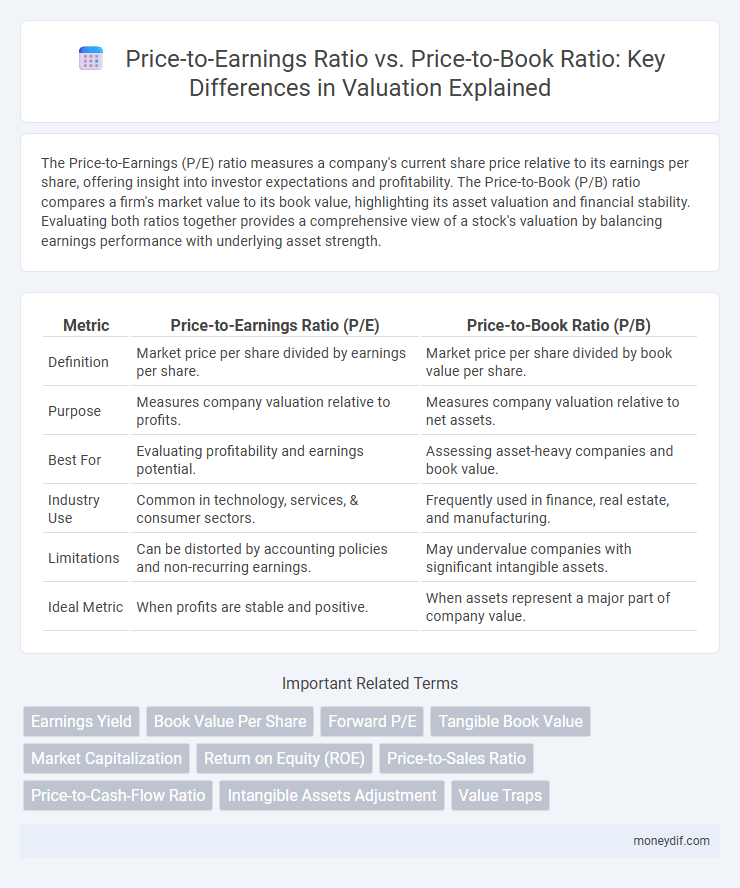

| Metric | Price-to-Earnings Ratio (P/E) | Price-to-Book Ratio (P/B) |

|---|---|---|

| Definition | Market price per share divided by earnings per share. | Market price per share divided by book value per share. |

| Purpose | Measures company valuation relative to profits. | Measures company valuation relative to net assets. |

| Best For | Evaluating profitability and earnings potential. | Assessing asset-heavy companies and book value. |

| Industry Use | Common in technology, services, & consumer sectors. | Frequently used in finance, real estate, and manufacturing. |

| Limitations | Can be distorted by accounting policies and non-recurring earnings. | May undervalue companies with significant intangible assets. |

| Ideal Metric | When profits are stable and positive. | When assets represent a major part of company value. |

Introduction to Valuation Ratios

Price-to-Earnings (P/E) Ratio measures a company's current share price relative to its per-share earnings, serving as a key indicator of market expectations and profitability. Price-to-Book (P/B) Ratio compares a stock's market value to its book value, highlighting how investors value the company's net assets. Both ratios are essential valuation tools that provide unique insights into a firm's financial health and investment potential.

Understanding the Price-to-Earnings (P/E) Ratio

The Price-to-Earnings (P/E) ratio measures a company's current share price relative to its per-share earnings, providing insight into market expectations of future growth and profitability. It is widely used to compare valuation levels across companies within the same industry, as higher P/E ratios often indicate higher anticipated earnings growth. Investors rely on the P/E ratio to assess whether a stock is overvalued or undervalued compared to its historical average or peers, making it a crucial metric in equity valuation.

Exploring the Price-to-Book (P/B) Ratio

The Price-to-Book (P/B) ratio is a key valuation metric that compares a company's market price to its book value, highlighting how much investors pay for each dollar of net assets. It is particularly useful for assessing companies with significant tangible assets, such as financial institutions or manufacturing firms, where book value provides a clearer estimate of intrinsic worth. Unlike the Price-to-Earnings (P/E) ratio, which depends on earnings that can be volatile or manipulated, the P/B ratio reflects a more stable asset-based valuation, aiding investors in identifying undervalued stocks with solid balance sheets.

Key Differences Between P/E and P/B Ratios

The Price-to-Earnings (P/E) ratio measures a company's current share price relative to its per-share earnings, emphasizing profitability and market expectations, while the Price-to-Book (P/B) ratio compares a stock's market value to its book value, highlighting asset valuation. P/E is key for assessing earnings growth and investor sentiment, whereas P/B is crucial for evaluating companies with significant tangible assets, like financial institutions or manufacturers. Understanding the distinction between earnings performance (P/E) and net asset value (P/B) aids investors in selecting valuation metrics aligned with industry characteristics and investment goals.

When to Use P/E Ratio for Valuation

The Price-to-Earnings (P/E) Ratio is most effective for valuing companies with consistent earnings and stable profit margins, particularly in sectors like technology and consumer goods. It reflects market expectations of future earnings growth, making it ideal for assessing growth stocks or companies with reliable income streams. Using the P/E Ratio helps investors compare profitability relative to share price, guiding investment decisions where earnings performance is a key valuation driver.

When to Use P/B Ratio for Valuation

The Price-to-Book (P/B) ratio is most effective for valuing companies in asset-intensive industries, such as banking, real estate, and manufacturing, where book value closely reflects the company's intrinsic worth. Investors rely on the P/B ratio when assessing firms with significant tangible assets or during periods of earnings volatility, as it offers a more stable measure compared to the Price-to-Earnings (P/E) ratio. This metric helps identify undervalued companies trading below their net asset value, signaling potential investment opportunities.

Industry Impact on P/E and P/B Ratios

Price-to-Earnings (P/E) and Price-to-Book (P/B) ratios vary significantly across industries due to differences in capital intensity, growth prospects, and risk profiles. High-growth technology firms typically exhibit elevated P/E ratios reflecting expected future earnings, while asset-heavy industries like utilities show higher P/B ratios driven by substantial tangible assets on the balance sheet. Understanding industry-specific benchmarks is crucial for accurate valuation, as comparing these ratios across unrelated sectors may lead to misleading conclusions about a company's financial health and investment potential.

Limitations of P/E and P/B Ratios

Price-to-Earnings (P/E) ratios can be misleading for companies with volatile or negative earnings, as they do not capture future growth potential or asset values. Price-to-Book (P/B) ratios may underestimate companies with significant intangible assets or intellectual property not reflected on balance sheets. Both metrics fail to account for differences in industry capital structures and accounting practices, limiting their effectiveness as standalone valuation tools.

Practical Examples: P/E vs P/B in Action

The Price-to-Earnings (P/E) ratio measures a company's current share price relative to its earnings per share, making it ideal for evaluating profitability and growth potential in sectors like technology. The Price-to-Book (P/B) ratio compares share price to the company's book value, providing insight into asset-heavy industries such as banking or manufacturing where tangible assets matter more. Investors typically use P/E to gauge how much they pay for earnings, while P/B is preferred for assessing whether a stock is undervalued based on its net asset value.

Choosing the Right Valuation Metric

Choosing the right valuation metric depends on the company's industry and financial structure, as Price-to-Earnings (P/E) ratio is more suitable for firms with consistent earnings, while Price-to-Book (P/B) ratio better evaluates asset-heavy companies or those with volatile earnings. The P/E ratio emphasizes profitability by comparing stock price to earnings per share, making it ideal for mature businesses with stable income streams. In contrast, the P/B ratio assesses market value relative to book value, providing insights into companies' net asset value, especially useful in sectors like finance and real estate.

Important Terms

Earnings Yield

Earnings Yield, calculated as the inverse of the Price-to-Earnings Ratio, provides a direct profitability metric that can be contrasted with the Price-to-Book Ratio to assess a company's valuation relative to its earnings and book value.

Book Value Per Share

Book Value Per Share (BVPS) is a key metric used to calculate the Price-to-Book Ratio (P/B), which compares a company's market price per share to its book value, while the Price-to-Earnings Ratio (P/E) evaluates stock value based on earnings, reflecting different aspects of financial health and investment valuation.

Forward P/E

Forward P/E (Price-to-Earnings) ratio estimates a company's future earnings relative to its current stock price, providing insights into growth expectations compared to the historical Price-to-Earnings ratio, which uses past earnings. Unlike the Price-to-Book ratio that assesses company value based on net asset value, Forward P/E focuses on profitability forecasts and is more sensitive to earnings growth projections in stock valuation analysis.

Tangible Book Value

Tangible Book Value provides a conservative asset measure that, when compared with the Price-to-Book Ratio and Price-to-Earnings Ratio, helps investors assess stock valuation by emphasizing physical asset backing versus earnings performance.

Market Capitalization

Market capitalization helps investors compare the Price-to-Earnings Ratio and Price-to-Book Ratio by indicating the company's size and market value relative to its earnings and book value.

Return on Equity (ROE)

Return on Equity (ROE) measures a company's profitability relative to shareholder equity and helps investors assess whether a high Price-to-Earnings (P/E) ratio is justified over a Price-to-Book (P/B) ratio by indicating efficient equity utilization.

Price-to-Sales Ratio

The Price-to-Sales Ratio measures company valuation based on revenue, offering a useful alternative to the Price-to-Earnings Ratio which focuses on net income, while the Price-to-Book Ratio evaluates market value relative to book equity, highlighting different financial perspectives.

Price-to-Cash-Flow Ratio

The Price-to-Cash-Flow ratio offers a more accurate measure of a company's valuation by comparing market price to operating cash flow, often revealing cash generation efficiency overlooked by Price-to-Earnings and Price-to-Book ratios.

Intangible Assets Adjustment

Adjusting intangible assets improves the accuracy of the Price-to-Book Ratio, thereby providing a more reliable comparison with the Price-to-Earnings Ratio for company valuation.

Value Traps

A high Price-to-Earnings ratio combined with a low Price-to-Book ratio often signals a value trap where stocks appear undervalued by book value but are overvalued relative to earnings potential.

Price-to-Earnings Ratio vs Price-to-Book Ratio Infographic

moneydif.com

moneydif.com