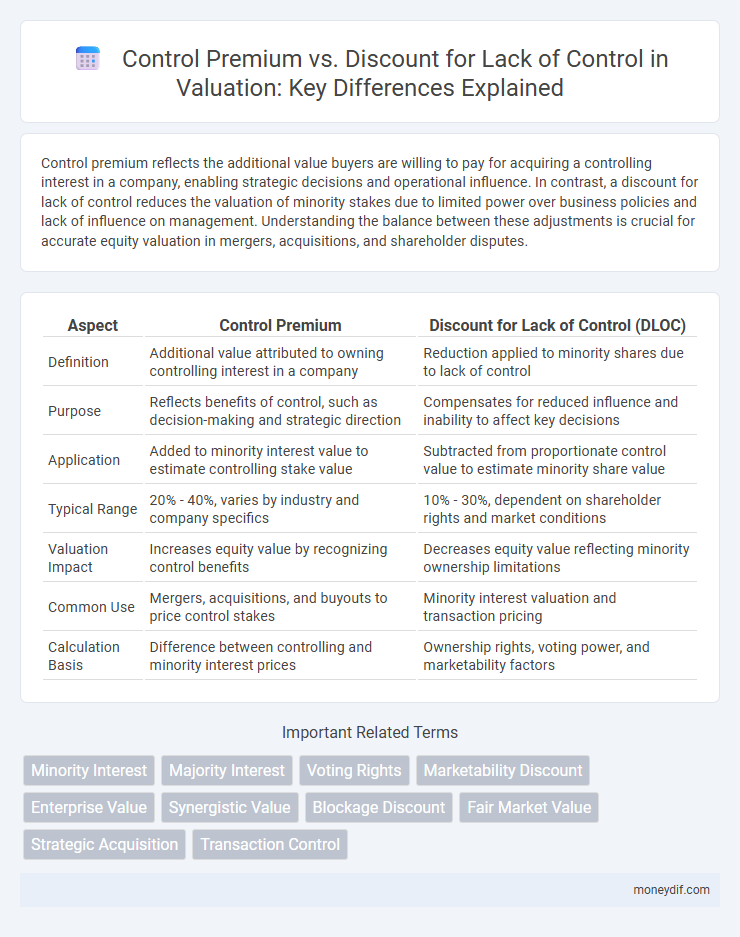

Control premium reflects the additional value buyers are willing to pay for acquiring a controlling interest in a company, enabling strategic decisions and operational influence. In contrast, a discount for lack of control reduces the valuation of minority stakes due to limited power over business policies and lack of influence on management. Understanding the balance between these adjustments is crucial for accurate equity valuation in mergers, acquisitions, and shareholder disputes.

Table of Comparison

| Aspect | Control Premium | Discount for Lack of Control (DLOC) |

|---|---|---|

| Definition | Additional value attributed to owning controlling interest in a company | Reduction applied to minority shares due to lack of control |

| Purpose | Reflects benefits of control, such as decision-making and strategic direction | Compensates for reduced influence and inability to affect key decisions |

| Application | Added to minority interest value to estimate controlling stake value | Subtracted from proportionate control value to estimate minority share value |

| Typical Range | 20% - 40%, varies by industry and company specifics | 10% - 30%, dependent on shareholder rights and market conditions |

| Valuation Impact | Increases equity value by recognizing control benefits | Decreases equity value reflecting minority ownership limitations |

| Common Use | Mergers, acquisitions, and buyouts to price control stakes | Minority interest valuation and transaction pricing |

| Calculation Basis | Difference between controlling and minority interest prices | Ownership rights, voting power, and marketability factors |

Understanding Control Premium in Valuation

Control premium in valuation reflects the additional value an acquirer is willing to pay for obtaining a controlling interest in a company, often ranging from 20% to 40% above the market price. This premium accounts for benefits such as strategic decision-making power, improved operational synergies, and the ability to influence dividend policies. Understanding the control premium is crucial for accurately assessing the fair value in mergers and acquisitions, especially when contrasting with discounts applied for lack of control.

Defining Discount for Lack of Control

The Discount for Lack of Control (DLOC) represents the reduction applied to the value of a minority ownership interest due to the absence of control over business decisions and operations. It quantifies the marketability and influence limitations, reflecting decreased negotiating power, dividend rights, and strategic decision-making ability compared to controlling interests. Typically, DLOC percentages range from 10% to 40%, depending on factors like industry, company size, and shareholder agreements.

Key Differences Between Control Premium and Lack of Control Discount

Control premium reflects the additional value buyers are willing to pay for acquiring controlling interest in a company, often ranging from 20% to 40% above market price. Discount for lack of control represents the reduction in value applied when owning minority shares without decision-making power, typically between 10% to 30%. The key difference lies in control premium enhancing value due to influence over operations and strategic decisions, whereas the discount decreases value due to limited control and marketability restrictions.

Factors Influencing Control Premium

Factors influencing control premium include the target company's profitability, growth prospects, and market position, which enhance the value of control rights. The size of the block of shares acquired significantly affects the premium, as larger blocks confer greater influence over decisions and operational strategies. Legal and regulatory environment, as well as potential synergies from the acquisition, also play critical roles in determining the control premium.

Situations Triggering Discount for Lack of Control

Situations triggering a discount for lack of control typically arise in minority interest valuations where shareholders lack decision-making power, limiting influence over strategic business decisions, dividend policies, and operational control. Market conditions, such as illiquidity of shares and restricted voting rights, further necessitate applying these discounts to reflect reduced value compared to controlling interests. Additionally, contractual limitations and regulatory constraints on minority shareholders amplify the discount to account for diminished control and marketability risks.

Methodologies for Calculating Control Premium

Control premium calculation methodologies primarily include the market approach, which compares transaction prices of controlling interests to minority interests, and the income approach, which incorporates expected future cash flows adjusted for control benefits. Empirical studies often utilize merger and acquisition data to estimate average control premiums, while discounted cash flow models assess incremental value derived from control rights. Quantitative methods also factor in synergies, governance enhancements, and strategic benefits that justify the premium paid for control.

Application of Discounts for Lack of Control in Practice

Discounts for Lack of Control (DLOC) are applied in practice to adjust the valuation of minority ownership interests by reflecting their limited ability to influence corporate decisions. These discounts typically range between 15% and 35%, depending on factors such as the size of the ownership stake, voting rights, and restrictions on transferability. Proper application of DLOC ensures that the valuation accurately represents the reduced marketability and lack of control inherent in non-controlling equity positions.

Impact of Corporate Governance on Control Value

Corporate governance significantly influences the control premium by affecting the perceived quality of management decisions, transparency, and shareholder rights, thereby increasing the value attributed to control. Poor governance structures often lead to a higher discount for lack of control due to increased risks of mismanagement and reduced influence over strategic decisions. Firms with strong corporate governance frameworks typically command lower discounts and higher control premiums in valuation.

Real-World Examples: Control Premium vs Lack of Control Discount

Control premiums often range from 20% to 40% in mergers and acquisitions, reflecting the value buyers place on decision-making authority and strategic influence. Discounts for lack of control typically fall between 15% and 35%, accounting for the limited ability of minority shareholders to affect corporate policies or dividends. Real-world cases, such as the acquisition of Dell by Silver Lake Partners, demonstrate a significant control premium driven by the buyer's ability to implement restructuring and operational changes.

Best Practices for Incorporating Control Adjustments in Valuation

Best practices for incorporating control adjustments in valuation emphasize the importance of systematically analyzing market data to determine an appropriate control premium or discount for lack of control (DLOC). Valuators should consider factors such as cash flow control, decision-making authority, and marketability to ensure adjustments accurately reflect the specific circumstances of the investment. Consistent documentation and application of empirical studies or precedent transactions enhance the reliability and credibility of the control adjustment in the valuation process.

Important Terms

Minority Interest

Minority interest reflects ownership stakes without control, often leading to a discount for lack of control due to limited influence on business decisions. Control premiums represent the additional value attributed to majority stakes that grant decision-making authority, highlighting the valuation gap between controlling and non-controlling interests.

Majority Interest

Majority interest typically commands a control premium reflecting the enhanced decision-making authority and strategic influence compared to the discount applied for lack of control on minority shares.

Voting Rights

Voting rights significantly affect control premiums by increasing the value of shares with controlling interests, whereas lack of voting rights often results in a discount reflecting diminished influence over corporate decisions.

Marketability Discount

Marketability discount reflects the reduced value of shares due to limited liquidity compared to easily tradable stocks, often applied alongside control premium which represents the extra value a buyer is willing to pay for controlling interest; discounts for lack of control, contrastingly, reduce the value of minority stakes lacking decision-making power. These valuation adjustments are critical in mergers and acquisitions, affecting the final equity pricing by balancing control benefits and marketability constraints.

Enterprise Value

Enterprise Value reflects the total company worth, which factors in Control Premiums for majority stakes and Discounts for Lack of Control in minority holdings.

Synergistic Value

Synergistic value often justifies paying a control premium, reflecting the additional benefits gained from acquiring control compared to the discount applied for lack of control in minority stakes.

Blockage Discount

The Blockage Discount reduces the value of a large stock position due to market impact and liquidity constraints, contrasting with the Control Premium which increases value for controlling interest, while the Discount for Lack of Control reflects a reduction in value for minority, non-controlling shares.

Fair Market Value

Fair Market Value considers both Control Premium, reflecting added value for controlling interest, and Discount for Lack of Control, representing reduced value for minority stakes without decision-making power.

Strategic Acquisition

Strategic acquisitions often incorporate a control premium reflecting the value of decision-making authority, contrasted by a discount for lack of control applied when minority interests limit influence.

Transaction Control

Transaction control influences the valuation of a business by applying a control premium for majority ownership with decision-making power or a discount for lack of control in minority stakes.

Control Premium vs Discount for Lack of Control Infographic

moneydif.com

moneydif.com