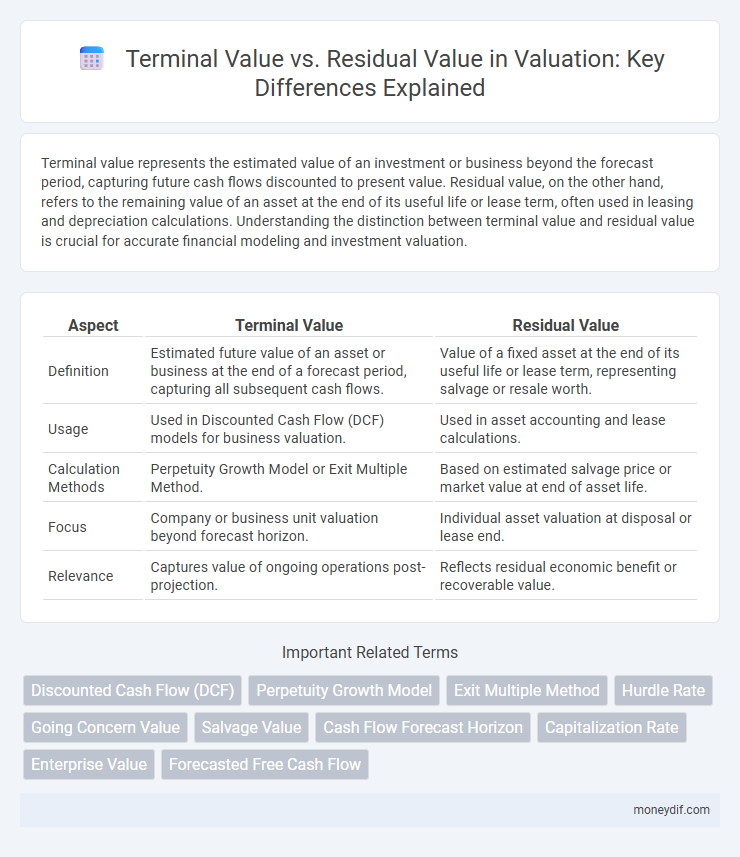

Terminal value represents the estimated value of an investment or business beyond the forecast period, capturing future cash flows discounted to present value. Residual value, on the other hand, refers to the remaining value of an asset at the end of its useful life or lease term, often used in leasing and depreciation calculations. Understanding the distinction between terminal value and residual value is crucial for accurate financial modeling and investment valuation.

Table of Comparison

| Aspect | Terminal Value | Residual Value |

|---|---|---|

| Definition | Estimated future value of an asset or business at the end of a forecast period, capturing all subsequent cash flows. | Value of a fixed asset at the end of its useful life or lease term, representing salvage or resale worth. |

| Usage | Used in Discounted Cash Flow (DCF) models for business valuation. | Used in asset accounting and lease calculations. |

| Calculation Methods | Perpetuity Growth Model or Exit Multiple Method. | Based on estimated salvage price or market value at end of asset life. |

| Focus | Company or business unit valuation beyond forecast horizon. | Individual asset valuation at disposal or lease end. |

| Relevance | Captures value of ongoing operations post-projection. | Reflects residual economic benefit or recoverable value. |

Understanding Terminal Value in Valuation

Terminal value represents the present value of all future cash flows beyond a specific forecast period, capturing the ongoing worth of an asset or business in valuation models. It significantly impacts the total valuation by accounting for the majority of a company's value in discounted cash flow (DCF) analysis, especially when cash flows stabilize. Understanding terminal value ensures accurate long-term investment decisions by reflecting sustainable growth rates and discount rates post-projection.

What is Residual Value?

Residual value represents the estimated worth of an asset at the end of its useful life or the conclusion of a projected period. It reflects the remaining value that can be recovered through sale, disposal, or continued use, distinct from terminal value, which is a projection of an asset's value into perpetuity. Accurately calculating residual value is essential for precise asset valuation and effective financial forecasting.

Terminal Value vs Residual Value: Key Differences

Terminal value estimates a business's worth beyond the forecast period using perpetuity growth or exit multiple methods, capturing long-term cash flow potential. Residual value, often used in asset-based valuation, represents the expected salvage value or remaining worth of an asset after its useful life. Terminal value focuses on overall enterprise continuation, while residual value targets specific asset disposal value.

Methods for Calculating Terminal Value

Terminal value is commonly calculated using the Perpetuity Growth Model or the Exit Multiple Method, both essential in discounted cash flow (DCF) analysis. The Perpetuity Growth Model estimates terminal value by projecting a constant perpetual growth rate of free cash flows beyond the forecast period, while the Exit Multiple Method derives terminal value by applying a market-based multiple to a financial metric such as EBITDA. Selecting the method depends on factors such as industry stability, growth prospects, and available market comparables.

Residual Value Calculation Techniques

Residual value calculation techniques primarily involve estimating the future worth of an asset at the end of its useful life using methods such as the perpetuity growth model, which assumes a constant growth rate in cash flows, or the exit multiple approach, applying industry-specific valuation multiples. Discounted cash flow (DCF) analysis is frequently combined with these methods to determine the present value of expected terminal cash flows accurately. Accurate residual value estimation is critical for precise asset valuation, influencing investment decisions and financial forecasting.

Role of Terminal Value in Discounted Cash Flow Analysis

Terminal value represents the estimated value of an asset or business beyond the explicit forecast period in discounted cash flow (DCF) analysis, capturing future cash flows that are expected to continue indefinitely. It plays a critical role in valuation by often accounting for a significant portion of the total enterprise value, providing a realistic estimate of long-term growth potential. Residual value differs as it typically pertains to the salvage value of physical assets at the end of a projection period, whereas terminal value focuses on cash flow perpetuity.

Impact of Residual Value in Asset Valuation

Residual value significantly influences asset valuation by representing the estimated worth of an asset at the end of its useful life, impacting depreciation calculations and cash flow forecasts. Accurately assessing residual value enhances the precision of terminal value estimates, which are critical for determining the present value of future cash flows in discounted cash flow (DCF) models. Underestimating residual value can lead to undervaluation of the asset, while overestimating it inflates terminal value and skews investment decisions.

Common Mistakes in Estimating Terminal and Residual Values

Common mistakes in estimating terminal and residual values include overreliance on unrealistic growth rates that exceed the economy's long-term growth potential, leading to inflated valuations. Another frequent error is failing to properly adjust discount rates for risk changes over time, which results in inaccurate present value calculations. Additionally, inconsistent application of valuation methods between terminal and residual value estimates can cause significant distortions in overall asset or company valuation.

Terminal Value and Residual Value: Industry Applications

Terminal value represents the present value of all future cash flows beyond a forecast period, commonly used in discounted cash flow (DCF) valuation to capture long-term growth potential in industries like technology and manufacturing. Residual value, often applied in asset-intensive sectors such as automotive and aviation, reflects the estimated salvage or resale value of an asset at the end of its useful life, influencing lease pricing and depreciation calculations. Both terminal and residual values are critical for accurate financial modeling, impacting investment decisions and asset management strategies across various industries.

Choosing Between Terminal and Residual Value in Financial Modeling

Choosing between terminal value and residual value in financial modeling depends on the projection horizon and the nature of the asset. Terminal value often captures the value beyond explicit forecast periods using perpetuity growth or exit multiples, suitable for ongoing businesses with stable growth. Residual value is preferred for tangible assets with limited useful life, reflecting the asset's expected salvage value at the end of the forecast period.

Important Terms

Discounted Cash Flow (DCF)

Discounted Cash Flow (DCF) analysis involves estimating Terminal Value to capture the value of all future cash flows beyond the projection period, while Residual Value specifically refers to the net value of assets remaining after depreciation or amortization. Terminal Value often represents a broader economic perspective, incorporating growth assumptions, whereas Residual Value is an accounting measure used primarily for asset valuation.

Perpetuity Growth Model

The Perpetuity Growth Model estimates Terminal Value by applying a constant growth rate to future cash flows, while Residual Value represents the net asset value remaining after accounting for liabilities.

Exit Multiple Method

The Exit Multiple Method estimates Terminal Value by applying a market-based multiple to projected financial metrics, whereas Residual Value represents the unamortized value of an asset after accounting for depreciation.

Hurdle Rate

The hurdle rate influences the discount rate applied to calculate terminal value, which often differs from residual value by reflecting expected future cash flows beyond the projection period rather than simply the net asset value.

Going Concern Value

Going Concern Value represents the total value of a business as an ongoing entity, closely related to Terminal Value which estimates the future cash flows beyond a forecast period, while Residual Value refers to the net value of assets after depreciation or disposal.

Salvage Value

Salvage value represents the estimated worth of an asset at the end of its useful life, often used interchangeably with residual value, whereas terminal value refers to the projected value of an investment beyond a forecast period in financial modeling.

Cash Flow Forecast Horizon

Cash Flow Forecast Horizon determines the period over which cash flows are projected before calculating Terminal Value, which estimates the business value beyond this horizon, while Residual Value often reflects net asset value at the end of the forecast period.

Capitalization Rate

The capitalization rate directly influences the calculation of terminal value, while residual value typically reflects the asset's estimated value at the end of its useful life, requiring different valuation approaches.

Enterprise Value

Enterprise Value calculation integrates Terminal Value to estimate a firm's future cash flow beyond the forecast period, while Residual Value represents the book value of assets remaining after debt settlement.

Forecasted Free Cash Flow

Forecasted Free Cash Flow (FCF) is a critical input in calculating Terminal Value, which estimates a company's value beyond the explicit forecast period using a perpetuity growth model or exit multiple approach. Residual Value, often used interchangeably with Terminal Value, specifically represents the present value of all future free cash flows beyond the forecast horizon, reflecting the ongoing business worth in discounted cash flow (DCF) analysis.

Terminal Value vs Residual Value Infographic

moneydif.com

moneydif.com