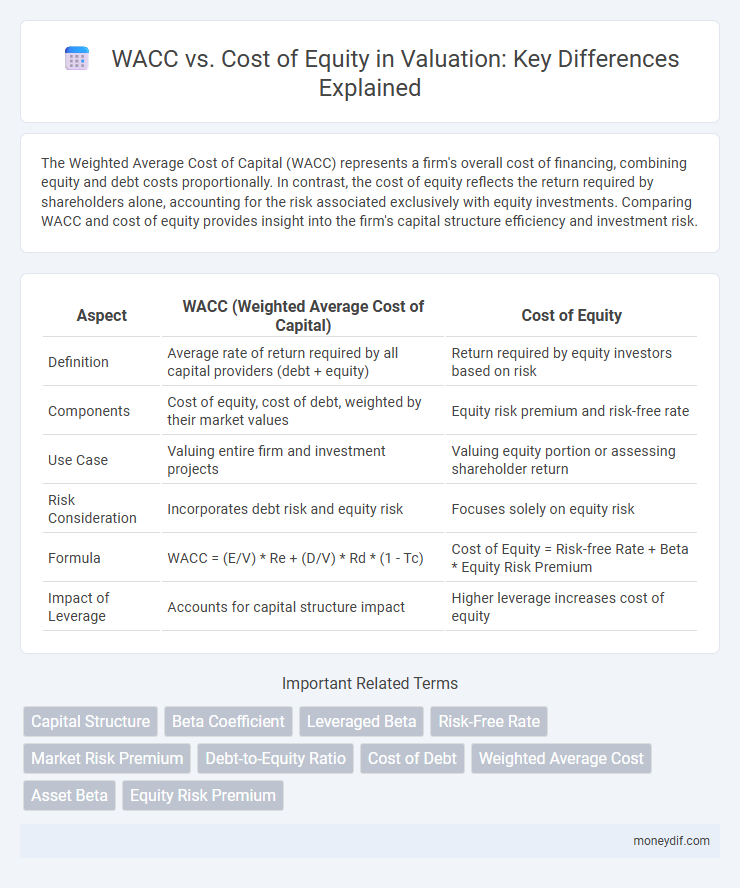

The Weighted Average Cost of Capital (WACC) represents a firm's overall cost of financing, combining equity and debt costs proportionally. In contrast, the cost of equity reflects the return required by shareholders alone, accounting for the risk associated exclusively with equity investments. Comparing WACC and cost of equity provides insight into the firm's capital structure efficiency and investment risk.

Table of Comparison

| Aspect | WACC (Weighted Average Cost of Capital) | Cost of Equity |

|---|---|---|

| Definition | Average rate of return required by all capital providers (debt + equity) | Return required by equity investors based on risk |

| Components | Cost of equity, cost of debt, weighted by their market values | Equity risk premium and risk-free rate |

| Use Case | Valuing entire firm and investment projects | Valuing equity portion or assessing shareholder return |

| Risk Consideration | Incorporates debt risk and equity risk | Focuses solely on equity risk |

| Formula | WACC = (E/V) * Re + (D/V) * Rd * (1 - Tc) | Cost of Equity = Risk-free Rate + Beta * Equity Risk Premium |

| Impact of Leverage | Accounts for capital structure impact | Higher leverage increases cost of equity |

Understanding WACC and Cost of Equity

Weighted Average Cost of Capital (WACC) represents the average rate a company is expected to pay to finance its assets, combining costs of equity, debt, and preferred stock weighted by their market values. Cost of equity specifically reflects the return investors require for investing in the company's equity, typically estimated using models like the Capital Asset Pricing Model (CAPM). Understanding the distinction between WACC and cost of equity is crucial for accurate valuation, as WACC accounts for the overall capital structure while cost of equity focuses solely on shareholder returns.

Key Differences Between WACC and Cost of Equity

WACC (Weighted Average Cost of Capital) represents the average rate a company expects to pay to finance its assets, incorporating the cost of both debt and equity weighted by their respective proportions. Cost of equity specifically measures the return required by equity investors, reflecting the risk of investing in the company's shares alone. Key differences include that WACC accounts for the overall capital structure, balancing debt and equity costs, while cost of equity isolates shareholder return expectations without considering debt financing impact.

Components of WACC

The Weighted Average Cost of Capital (WACC) incorporates the cost of equity, cost of debt, and the respective proportions of equity and debt in the capital structure. While the cost of equity reflects the return required by shareholders, WACC provides a comprehensive measure by weighting this alongside the after-tax cost of debt. This balance captures the overall required return investors expect from the firm's combined financing sources.

Calculating the Cost of Equity

Calculating the cost of equity involves estimating the expected return required by equity investors, often using the Capital Asset Pricing Model (CAPM) which incorporates the risk-free rate, equity beta, and equity market premium. Unlike WACC, which blends the cost of debt and cost of equity weighted by their proportions in the capital structure, the cost of equity specifically measures the return demanded by shareholders for bearing equity risk. Accurate calculation of the cost of equity is essential for valuation models to determine the appropriate discount rate for equity cash flows.

Factors Affecting WACC and Cost of Equity

WACC is influenced by the proportion of debt and equity in a company's capital structure, interest rates on debt, and the firm's tax rate, which together determine the overall cost of financing. The cost of equity depends primarily on the company's risk profile measured by beta, expected market returns, and investor perception of growth and stability. Variations in market conditions, company leverage, and investor risk appetite directly impact both WACC and the cost of equity, affecting valuation accuracy.

Role of WACC in Business Valuation

Weighted Average Cost of Capital (WACC) represents the firm's overall required return, combining the cost of equity and debt proportional to their capital structure, crucial for calculating enterprise value in business valuation. Unlike the cost of equity, which measures returns required by shareholders alone, WACC accounts for all sources of capital, making it essential for discounting free cash flows to the firm. Accurate WACC estimation ensures realistic valuation outcomes by reflecting the blended risk and capital costs affecting investment decisions and company worth.

When to Use Cost of Equity vs. WACC

Use Cost of Equity when evaluating projects or investments financed solely by equity, as it reflects the return required by shareholders. WACC is appropriate for valuing firms or projects with a mixed capital structure, incorporating both debt and equity costs to provide a comprehensive discount rate. Selecting the correct metric is crucial for accurate valuation and optimal capital budgeting decisions.

Impact on Investment Decisions

WACC combines the cost of debt and cost of equity to determine a firm's overall capital cost, directly influencing project valuation and investment decisions by setting a discount rate that reflects the total risk. Cost of equity specifically measures the return required by shareholders, impacting decisions when evaluating equity-financed projects or comparing returns against shareholder expectations. Understanding the interplay between WACC and cost of equity enables more accurate assessments of investment viability and optimal capital structure choices.

Common Misconceptions about WACC and Cost of Equity

WACC (Weighted Average Cost of Capital) represents the firm's overall cost of financing, blending the costs of debt and equity weighted by their market values, whereas the cost of equity reflects the return required by equity investors alone. A common misconception is equating WACC directly with the cost of equity, ignoring the impact of cheaper debt financing and tax shields that lower WACC below the cost of equity. Misunderstanding this distinction can lead to incorrect valuation inputs, resulting in flawed investment decisions and inaccurate enterprise value estimations.

Practical Examples: WACC vs. Cost of Equity in Valuation

WACC represents the average rate a company is expected to pay to finance its assets, incorporating both equity and debt costs, while the cost of equity specifically reflects the return required by shareholders. In valuation, WACC is used as the discount rate for free cash flows to the firm, encompassing the entire capital structure, whereas the cost of equity is applied when discounting free cash flows to equity, focusing solely on shareholders' returns. For example, a company with 40% debt and 60% equity might have a WACC of 8%, reflecting blended costs, while its cost of equity alone could be 12%, highlighting higher risk borne by equity investors.

Important Terms

Capital Structure

The optimal capital structure balances debt and equity to minimize the weighted average cost of capital (WACC) while ensuring the cost of equity reflects associated financial risks.

Beta Coefficient

Beta coefficient measures systematic risk and directly influences the cost of equity, which is a key component of the Weighted Average Cost of Capital (WACC).

Leveraged Beta

Leveraged beta reflects the impact of a company's capital structure on its risk, causing the weighted average cost of capital (WACC) to typically be lower than the cost of equity due to the inclusion of cheaper debt financing.

Risk-Free Rate

The risk-free rate directly influences both the Weighted Average Cost of Capital (WACC) and the cost of equity by serving as the baseline return in the Capital Asset Pricing Model (CAPM) used to calculate equity risk premium.

Market Risk Premium

Market Risk Premium directly influences the cost of equity, which is a key component in calculating the Weighted Average Cost of Capital (WACC).

Debt-to-Equity Ratio

The Debt-to-Equity Ratio directly influences the Weighted Average Cost of Capital (WACC) by balancing the relative costs of debt and equity financing, often reducing WACC below the cost of equity alone due to the tax advantages of debt.

Cost of Debt

Cost of debt typically remains lower than cost of equity due to tax deductibility of interest expenses and lower risk perceived by lenders, significantly influencing the weighted average cost of capital (WACC). A company's WACC balances the cost of debt and cost of equity, optimizing capital structure to minimize overall financing costs while maximizing firm value.

Weighted Average Cost

Weighted Average Cost of Capital (WACC) represents a firm's overall cost of financing, balancing the cost of equity and cost of debt, while the cost of equity specifically reflects the return required by shareholders, typically higher than WACC due to equity's greater risk.

Asset Beta

Asset Beta measures a firm's systematic risk excluding leverage, serving as a key input for calculating the Weighted Average Cost of Capital (WACC) and differentiating it from the leveraged Cost of Equity.

Equity Risk Premium

Equity Risk Premium significantly influences the Cost of Equity, which is a core component in calculating the Weighted Average Cost of Capital (WACC) for accurate investment valuation.

WACC vs cost of equity Infographic

moneydif.com

moneydif.com