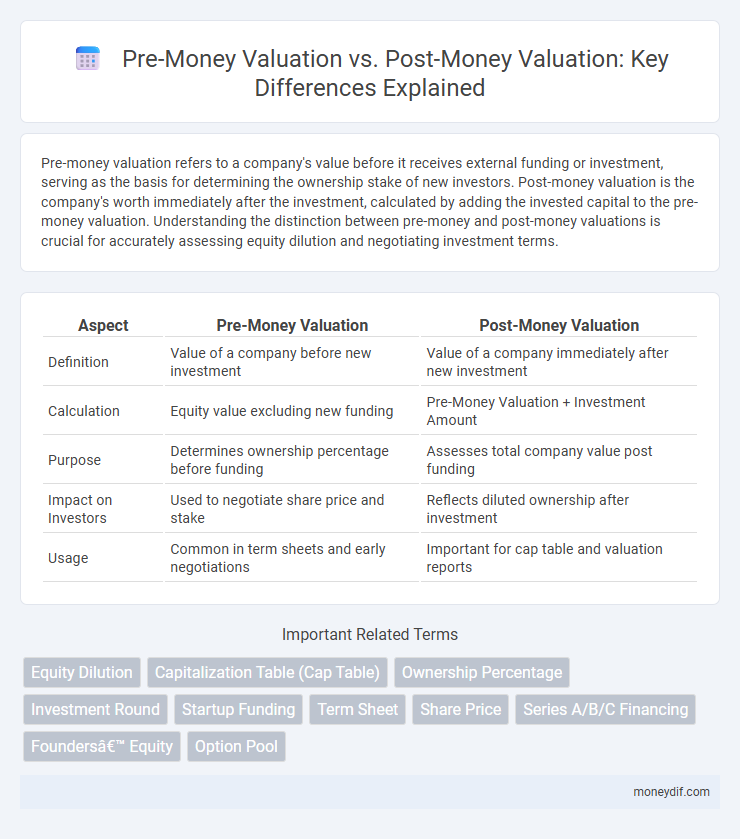

Pre-money valuation refers to a company's value before it receives external funding or investment, serving as the basis for determining the ownership stake of new investors. Post-money valuation is the company's worth immediately after the investment, calculated by adding the invested capital to the pre-money valuation. Understanding the distinction between pre-money and post-money valuations is crucial for accurately assessing equity dilution and negotiating investment terms.

Table of Comparison

| Aspect | Pre-Money Valuation | Post-Money Valuation |

|---|---|---|

| Definition | Value of a company before new investment | Value of a company immediately after new investment |

| Calculation | Equity value excluding new funding | Pre-Money Valuation + Investment Amount |

| Purpose | Determines ownership percentage before funding | Assesses total company value post funding |

| Impact on Investors | Used to negotiate share price and stake | Reflects diluted ownership after investment |

| Usage | Common in term sheets and early negotiations | Important for cap table and valuation reports |

Understanding Pre-Money and Post-Money Valuation

Pre-money valuation represents a company's estimated worth before receiving new external funding or investment, serving as a baseline for equity negotiations. Post-money valuation is calculated by adding the total amount of new equity capital raised to the pre-money valuation, reflecting the company's value immediately after the funding round. Understanding the distinction ensures accurate equity dilution comprehension and informs investment decisions during startup fundraising.

Key Differences Between Pre-Money and Post-Money Valuation

Pre-money valuation represents a company's value before new capital is invested, while post-money valuation reflects the company's value immediately after the investment. The key difference lies in the inclusion of new funding; post-money valuation equals pre-money valuation plus the amount of new equity investment. Understanding these distinctions is crucial for accurately assessing ownership percentages and the financial impact of funding rounds.

Why Pre-Money and Post-Money Valuation Matter in Fundraising

Pre-money valuation establishes a company's worth before new investments, directly impacting the ownership percentage investors receive during fundraising. Post-money valuation reflects the company's value immediately after funding, incorporating the injected capital and providing clarity on equity dilution. Understanding both valuations is critical for founders and investors to negotiate fair terms and assess future investment potential.

Calculating Pre-Money Valuation: Methods and Formulas

Calculating pre-money valuation involves methods such as the Berkus method, which assesses qualitative factors to estimate startup value, and the discounted cash flow (DCF) model, which projects future cash flows discounted to present value. Another common formula is pre-money valuation equals post-money valuation minus new investment, allowing investors to determine a company's worth before external funding. These approaches provide critical insights for negotiating ownership percentages and understanding a company's financial standing prior to capital infusion.

How to Calculate Post-Money Valuation

Post-money valuation is calculated by adding the amount of new equity investment to the pre-money valuation. This figure reflects the company's value immediately after the investment round and determines the ownership percentage of new investors. Accurately calculating post-money valuation is essential for equity dilution analysis and for setting clear terms in funding agreements.

Impact of Investment Rounds on Valuation

Pre-money valuation represents a company's worth before receiving new investment, while post-money valuation includes the capital injected during the funding round, directly impacting ownership percentages and equity dilution. Investment rounds increase the post-money valuation, reflecting the company's updated worth after accounting for the new funds raised. This valuation shift influences investor equity stakes and future fundraising capabilities, emphasizing the critical role of accurate pre- and post-money assessments in strategic financial planning.

Common Mistakes in Valuation Calculations

Common mistakes in valuation calculations often arise from confusing pre-money valuation with post-money valuation, leading to inaccurate equity percentage computations. Misinterpreting the pre-money valuation as the company's worth after new investment dilutes shareholder ownership projections. Failing to properly account for the investment amount results in an inflated or deflated valuation that impacts fundraising decisions and investor negotiations.

Pre-Money vs Post-Money: Implications for Founders and Investors

Pre-money valuation represents a company's value before new investment, determining the ownership percentage founders retain, while post-money valuation includes the new capital, impacting investor equity stakes directly. Founders benefit from higher pre-money valuations to minimize dilution, whereas investors focus on post-money valuation to gauge the worth of their investment and potential returns. Understanding the balance between pre-money and post-money valuations is crucial for negotiating fair terms that satisfy both founders seeking control and investors aiming for substantial equity.

Negotiating Valuation Terms with Investors

Negotiating valuation terms with investors requires a clear understanding of pre-money and post-money valuations to align expectations on company worth before and after investment. Pre-money valuation reflects the company's value prior to new capital infusion, influencing equity percentage offered, while post-money valuation accounts for the injected capital, defining ownership distribution. Accurate negotiation balances investor interests and founder equity, ensuring fair valuation that supports future fundraising and company growth.

Real-World Examples: Applying Pre-Money and Post-Money Valuation

Pre-money valuation represents a company's worth before new capital injection, while post-money valuation includes this investment, reflecting the company's value immediately after funding. For example, if a startup has a pre-money valuation of $5 million and raises $2 million, the post-money valuation becomes $7 million. This distinction is critical in venture capital deals, determining ownership percentages and investor equity based on the timing of valuation relative to funding rounds.

Important Terms

Equity Dilution

Equity dilution occurs when new shares are issued, decreasing existing shareholders' ownership percentage, influenced by the difference between pre-money valuation and post-money valuation; pre-money valuation represents a company's value before investment, while post-money valuation includes the new capital injection. Understanding these valuations is essential for accurately calculating dilution impact and negotiating ownership stakes during fundraising rounds.

Capitalization Table (Cap Table)

A Capitalization Table (Cap Table) illustrates ownership percentages and equity dilution by detailing Pre-Money Valuation before new investments and Post-Money Valuation after incorporating those investments.

Ownership Percentage

Ownership percentage is calculated by dividing an investor's contribution by the post-money valuation, which equals the pre-money valuation plus the new investment amount. A higher pre-money valuation results in a lower ownership percentage for new investors, while post-money valuation determines the actual equity stake after the investment.

Investment Round

Pre-money valuation represents a company's value before new investment, while post-money valuation equals the pre-money valuation plus the amount of new equity raised in the investment round.

Startup Funding

Pre-money valuation represents a startup's estimated worth before receiving external investment, while post-money valuation includes the new capital from the latest funding round, reflecting the company's value immediately afterward. Understanding the distinction is critical for founders and investors to accurately determine equity stakes and negotiate ownership percentages during funding negotiations.

Term Sheet

The term sheet clearly defines the pre-money valuation as the company's value before new investment and the post-money valuation as the total value after adding the investment amount.

Share Price

Share price is calculated by dividing the pre-money valuation by the total number of outstanding shares before new investment, reflecting the company's value prior to funding. Post-money valuation includes the new capital infusion, increasing the share base and adjusting the share price to represent the company's value immediately after the investment round.

Series A/B/C Financing

Series A/B/C financing rounds commonly involve negotiations around pre-money valuation, which determines the company's value before new capital is injected, directly impacting the ownership percentage of new investors. Post-money valuation reflects the company's worth immediately after investment, calculated by adding the new funding amount to the pre-money valuation, and is crucial for understanding dilution effects on existing shareholders.

Founders’ Equity

Founders' equity reflects their ownership percentage determined by subtracting the investment amount from the post-money valuation, which equals the pre-money valuation plus new capital invested.

Option Pool

An option pool, typically representing 10-20% of company equity, impacts pre-money and post-money valuations by diluting existing shareholders' stakes before or after investment, depending on whether it is carved out pre-money or post-money. Investors often require the option pool to be included in pre-money valuation calculations to ensure sufficient shares are reserved for future employees without diluting their post-investment ownership percentage.

Pre-Money Valuation vs Post-Money Valuation Infographic

moneydif.com

moneydif.com