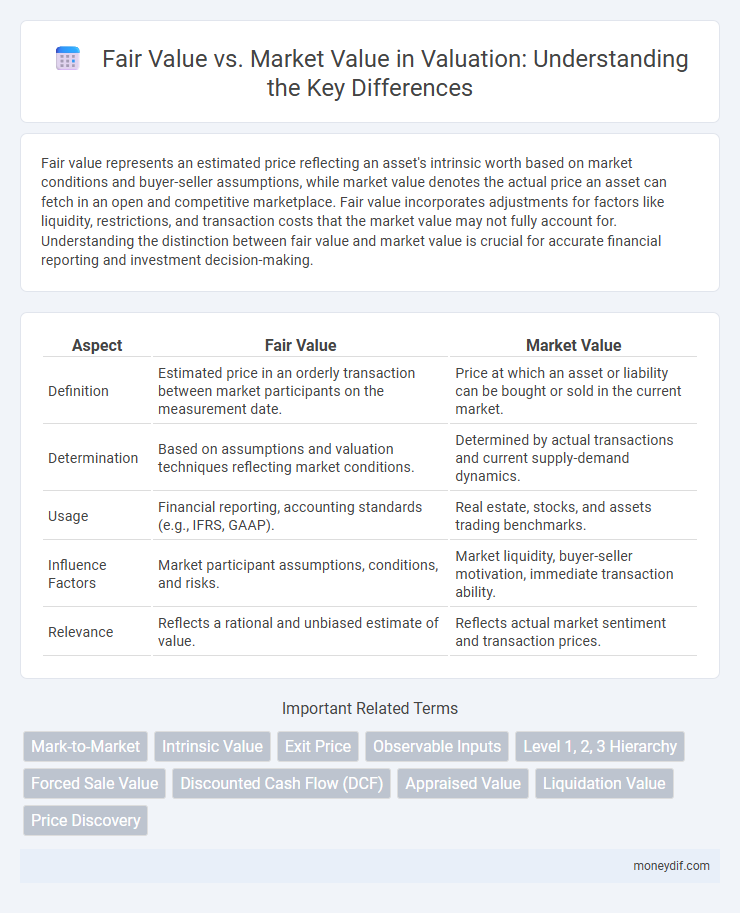

Fair value represents an estimated price reflecting an asset's intrinsic worth based on market conditions and buyer-seller assumptions, while market value denotes the actual price an asset can fetch in an open and competitive marketplace. Fair value incorporates adjustments for factors like liquidity, restrictions, and transaction costs that the market value may not fully account for. Understanding the distinction between fair value and market value is crucial for accurate financial reporting and investment decision-making.

Table of Comparison

| Aspect | Fair Value | Market Value |

|---|---|---|

| Definition | Estimated price in an orderly transaction between market participants on the measurement date. | Price at which an asset or liability can be bought or sold in the current market. |

| Determination | Based on assumptions and valuation techniques reflecting market conditions. | Determined by actual transactions and current supply-demand dynamics. |

| Usage | Financial reporting, accounting standards (e.g., IFRS, GAAP). | Real estate, stocks, and assets trading benchmarks. |

| Influence Factors | Market participant assumptions, conditions, and risks. | Market liquidity, buyer-seller motivation, immediate transaction ability. |

| Relevance | Reflects a rational and unbiased estimate of value. | Reflects actual market sentiment and transaction prices. |

Understanding the Concepts: Fair Value vs Market Value

Fair value represents the estimated price at which an asset would change hands between knowledgeable, willing parties in an arm's length transaction, reflecting its intrinsic worth based on current conditions. Market value is the actual price at which an asset is bought or sold in a competitive and open market, influenced by supply and demand dynamics. Understanding the distinction between fair value and market value is essential for accurate financial reporting, investment decisions, and asset valuation.

Key Differences Between Fair Value and Market Value

Fair value reflects an estimated price based on a rational and unbiased valuation using relevant information, often employed in accounting and financial reporting to ensure accuracy in asset measurement. Market value represents the actual price an asset would fetch in an open and competitive market, influenced by current supply and demand dynamics. Key differences include that fair value accounts for hypothetical transaction conditions and comprehensive data analysis, while market value relies on observable market transactions and prevailing conditions.

Regulatory Frameworks: Standards for Fair Value and Market Value

Regulatory frameworks such as IFRS 13 and USPAP establish rigorous standards for fair value measurement, emphasizing exit price and market participant assumptions. Market value, governed by guidelines like the International Valuation Standards (IVS), prioritizes an arm's-length transaction between knowledgeable parties. These standards ensure consistency and reliability in valuation practices across financial reporting and regulatory compliance.

Applications in Financial Reporting and Valuation

Fair value reflects the estimated price at which an asset or liability could be exchanged in an orderly transaction between market participants at the measurement date, emphasizing exit price concepts aligned with accounting standards such as IFRS 13 and ASC 820. Market value denotes the most probable price in an arm's length transaction under normal market conditions, often used for transactions and taxation purposes but may differ from fair value due to market inefficiencies or restrictions. In financial reporting, fair value measurement enhances transparency and comparability by incorporating current market conditions, whereas market value supports practical valuation in less regulated or non-financial contexts.

Factors Influencing Fair Value Assessment

Factors influencing fair value assessment include market conditions, asset-specific characteristics, and the valuation purpose. Fair value reflects an exit price in an orderly transaction between market participants at the measurement date. Inputs such as observable market data, recent transaction prices, and assumptions about risk and liquidity significantly impact the fair value determination.

Determinants of Market Value in Real-World Scenarios

Market value is primarily determined by supply and demand dynamics, recent sales of comparable properties, and current economic conditions influencing buyer behavior. Location desirability, property condition, and market trends such as interest rates also significantly impact the market value. Real-world factors like local zoning laws, neighborhood developments, and buyer motivations play crucial roles in shaping the market value distinct from the theoretical notion of fair value.

Common Methods Used to Calculate Fair Value

Common methods used to calculate fair value include the income approach, market approach, and cost approach. The income approach estimates present value based on expected future cash flows, often utilizing discounted cash flow (DCF) analysis. The market approach derives value from comparable transactions or market prices, while the cost approach assesses replacement or reproduction costs adjusted for depreciation.

Market Value Trends and Influencing Forces

Market value trends reflect the fluctuating prices that buyers are willing to pay in real estate and financial markets, driven primarily by supply-demand dynamics, economic conditions, and investor sentiment. Key influencing forces include interest rate changes, regulatory policies, local economic growth, and market liquidity, all of which can cause rapid shifts in asset pricing. Understanding these forces helps analysts predict potential market value fluctuations and better align investment strategies with prevailing market conditions.

Challenges and Limitations in Measuring Fair and Market Values

Challenges in measuring fair value stem from the reliance on market participant assumptions and the difficulty in establishing exit prices for unique or illiquid assets. Market value measurement confronts limitations due to transient market conditions, informational asymmetry, and liquidity constraints that distort price signals. Both valuation approaches struggle with subjectivity and inconsistency when market data is scarce or asset comparability is low.

Practical Implications: Choosing Between Fair Value and Market Value

Choosing between fair value and market value has practical implications for financial reporting, asset management, and investment decisions. Fair value reflects an estimate based on objective inputs such as recent transactions and market participant assumptions, providing a more accurate reflection of an asset's worth under current conditions. Market value represents the price achievable in an open market transaction, often influenced by liquidity and supply-demand dynamics, making it crucial for real estate and securities trading.

Important Terms

Mark-to-Market

Mark-to-Market accounting requires assets and liabilities to be recorded at their Fair Value, which represents an estimate of the price at which an orderly transaction would occur between market participants. This differs from Market Value, which reflects the actual current price in an active and liquid market, often causing discrepancies in asset valuation during periods of market volatility.

Intrinsic Value

Intrinsic value represents the true, fundamental worth of an asset based on its expected cash flows and risk, often differing from fair value, which reflects market participant assumptions, and market value, determined by actual trading prices.

Exit Price

Exit Price represents the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction at measurement date, reflecting Fair Value which may differ from Market Value due to market conditions and transaction specifics.

Observable Inputs

Observable inputs are market-based data points such as quoted prices for identical or similar assets, commonly used in Level 1 and Level 2 fair value measurements to enhance valuation accuracy. These inputs provide a transparent and objective basis for determining fair value compared to market value, which may reflect transaction prices influenced by market conditions or liquidity constraints.

Level 1, 2, 3 Hierarchy

Level 1 hierarchy includes quoted prices in active markets representing fair value, Level 2 involves observable inputs other than quoted prices for identical assets, and Level 3 uses unobservable inputs reflecting market participant assumptions, differentiating fair value assessments from market value estimations.

Forced Sale Value

Forced Sale Value represents the estimated price of an asset when sold under duress, typically lower than Fair Value, which reflects the price in an orderly transaction between willing parties; Market Value assumes a normal sale condition, often exceeding Forced Sale Value due to the absence of external pressures. Understanding the distinctions between these valuation metrics is crucial for accurate asset appraisal, risk assessment, and decision-making in distressed sale scenarios.

Discounted Cash Flow (DCF)

Discounted Cash Flow (DCF) analysis estimates an asset's fair value by calculating the present value of expected future cash flows, which can differ from the market value influenced by supply, demand, and investor sentiment.

Appraised Value

The appraised value reflects an expert's estimation based on property condition and comparable sales, whereas fair value represents an equitable price in an orderly transaction, and market value indicates the most probable price a property would fetch in an open market.

Liquidation Value

Liquidation value represents the estimated amount a company's assets would fetch under forced sale conditions, often lower than both fair value, which reflects an asset's rational market price based on standard transactions, and market value, which denotes the price an asset would sell for in an active, open market.

Price Discovery

Price discovery efficiently determines an asset's market value by reflecting real-time supply and demand dynamics, while fair value represents an estimated intrinsic worth based on fundamental analysis.

Fair Value vs Market Value Infographic

moneydif.com

moneydif.com