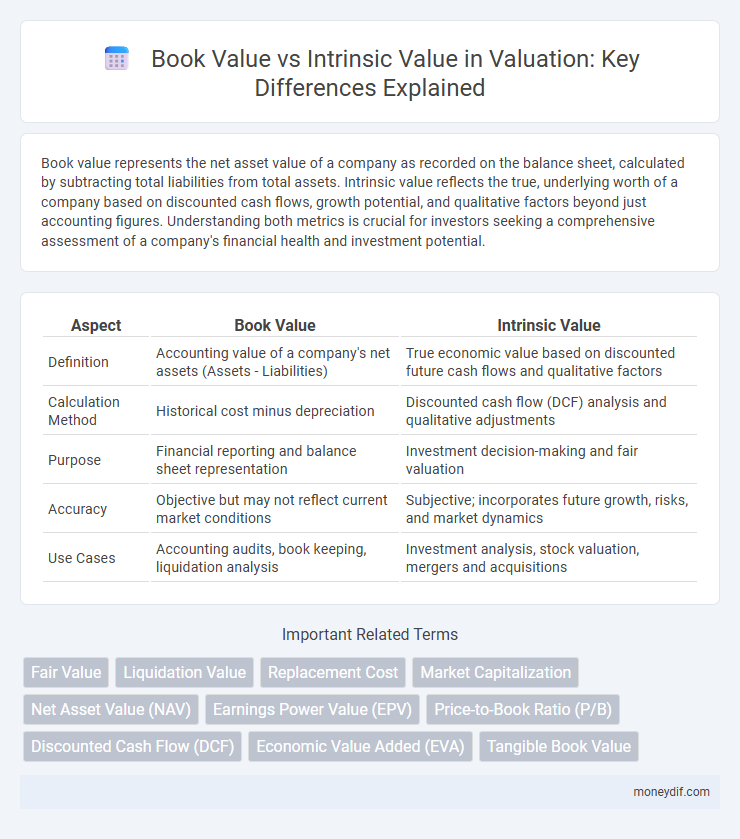

Book value represents the net asset value of a company as recorded on the balance sheet, calculated by subtracting total liabilities from total assets. Intrinsic value reflects the true, underlying worth of a company based on discounted cash flows, growth potential, and qualitative factors beyond just accounting figures. Understanding both metrics is crucial for investors seeking a comprehensive assessment of a company's financial health and investment potential.

Table of Comparison

| Aspect | Book Value | Intrinsic Value |

|---|---|---|

| Definition | Accounting value of a company's net assets (Assets - Liabilities) | True economic value based on discounted future cash flows and qualitative factors |

| Calculation Method | Historical cost minus depreciation | Discounted cash flow (DCF) analysis and qualitative adjustments |

| Purpose | Financial reporting and balance sheet representation | Investment decision-making and fair valuation |

| Accuracy | Objective but may not reflect current market conditions | Subjective; incorporates future growth, risks, and market dynamics |

| Use Cases | Accounting audits, book keeping, liquidation analysis | Investment analysis, stock valuation, mergers and acquisitions |

Understanding Book Value: Definition and Components

Book value represents a company's net asset value calculated as total assets minus total liabilities recorded on the balance sheet. It includes tangible assets like property, equipment, and inventory, as well as intangible assets such as patents and trademarks, minus depreciation and amortization. Understanding book value helps investors assess the baseline financial health and liquidation value of a firm compared to its market price or intrinsic value.

What is Intrinsic Value? A Comprehensive Overview

Intrinsic value represents the true, inherent worth of an asset based on fundamental analysis of its tangible and intangible factors, rather than its current market price. It incorporates discounted cash flow projections, risk assessments, and growth potential to provide a realistic estimate of long-term value. Understanding intrinsic value is crucial for investors seeking to identify undervalued or overvalued securities compared to their book value or market price.

Key Differences Between Book Value and Intrinsic Value

Book value represents a company's net asset value recorded on the balance sheet, reflecting historical costs minus liabilities, while intrinsic value estimates the true economic worth based on future cash flow projections and qualitative factors. Book value is static and accounting-based, providing a snapshot of equity, whereas intrinsic value adapts to market conditions, growth potential, and risk, offering a more comprehensive valuation. Investors use book value for baseline assessments, but intrinsic value is critical for understanding long-term profitability and investment potential.

Calculating Book Value: Methods and Examples

Book value represents a company's net asset value calculated by subtracting total liabilities from total assets on the balance sheet, serving as a conservative measure of value. Common methods to calculate book value include the basic formula: Book Value = Total Assets - Total Liabilities, and adjusted book value, which incorporates intangible assets and potential write-downs for more accuracy. For example, if a company reports $5 million in total assets and $3 million in total liabilities, the book value is $2 million, providing a baseline for comparing to intrinsic value estimates derived from discounted cash flow analysis.

Approaches to Estimating Intrinsic Value

Approaches to estimating intrinsic value include the discounted cash flow (DCF) method, which projects future cash flows and discounts them to present value using an appropriate discount rate, reflecting the asset's risk profile. Another common approach is the earnings power value (EPV), which capitalizes normalized earnings to capture sustainable profitability. Adjusted book value also plays a role by revising the book value to reflect fair market values of assets and liabilities, bridging tangible asset assessment and intrinsic worth.

Why Book Value Matters in Financial Analysis

Book value represents the accounting value of a company's assets minus its liabilities, providing a tangible baseline for evaluating financial health. Intrinsic value estimates the true worth based on future cash flows and growth potential, often involving subjective assumptions. Book value matters in financial analysis because it offers a conservative measure to assess whether a stock is undervalued or overvalued compared to its market price.

The Role of Intrinsic Value in Investment Decisions

Intrinsic value represents the true worth of an asset based on fundamental analysis, including cash flow projections, growth potential, and risk factors, whereas book value reflects the accounting value recorded on financial statements. Investors rely on intrinsic value to make informed decisions, as it offers a deeper insight into the asset's long-term profitability and market potential beyond mere historical costs. Understanding intrinsic value helps identify undervalued securities, enabling strategic investment choices that maximize returns and minimize risks.

Limitations of Relying on Book Value Alone

Book value often fails to capture the true economic worth of a company due to its reliance on historical costs and ignores intangible assets such as brand value, intellectual property, and goodwill. It does not reflect future growth prospects or market conditions, leading to potential undervaluation or overvaluation in comparison to intrinsic value. Investors should incorporate cash flow analysis, earnings potential, and market sentiment to obtain a more accurate assessment beyond book value alone.

Real-World Scenarios: Book Value vs Intrinsic Value

Book value represents a company's net asset value recorded on the balance sheet, often reflecting historical costs and depreciation, while intrinsic value estimates the true worth based on future cash flow projections and market conditions. In real-world scenarios, book value may undervalue companies with significant intangible assets or growth potential, making intrinsic value a more comprehensive measure for investment decisions. Investors frequently rely on intrinsic value analysis to capture economic realities missed by book value metrics, particularly in industries like technology or services where assets are not fully tangible.

Choosing the Right Metric: When to Use Book Value or Intrinsic Value

Book value serves as a practical metric for assessing a company's net asset value based on its balance sheet, making it suitable for industries with tangible assets like manufacturing and real estate. Intrinsic value incorporates discounted future cash flows and qualitative factors, providing a comprehensive valuation ideal for growth companies or firms with significant intangible assets. Selecting the appropriate metric depends on the company's industry, asset structure, and the purpose of the valuation, with book value offering a snapshot of current worth and intrinsic value reflecting long-term economic potential.

Important Terms

Fair Value

Fair value represents the estimated market price of an asset, contrasting with book value, which is based on accounting records, and intrinsic value, which reflects the true economic worth calculated through fundamental analysis.

Liquidation Value

Liquidation value represents the net amount obtainable from selling assets quickly, often lower than book value, while intrinsic value reflects a comprehensive, long-term assessment based on underlying fundamentals.

Replacement Cost

Replacement Cost represents the current expense to replace an asset and often exceeds Book Value, which reflects historical cost minus depreciation; Intrinsic Value, however, accounts for an asset's true worth based on future cash flows and market conditions, making Replacement Cost a practical benchmark to assess under- or overvaluation when comparing to these values.

Market Capitalization

Market capitalization represents a company's total equity value based on its stock price, but it often diverges from book value and intrinsic value, which reflect accounting assets and fundamental worth, respectively.

Net Asset Value (NAV)

Net Asset Value (NAV) represents the total value of a fund's assets minus liabilities, closely aligning with book value as it reflects the accounting value per share based on reported financials. Intrinsic value differs by incorporating qualitative factors and future cash flow projections, offering a more comprehensive estimate of an asset's true worth beyond the NAV or book value.

Earnings Power Value (EPV)

Earnings Power Value (EPV) estimates a company's intrinsic value by capitalizing normalized earnings, offering a more accurate valuation than book value by focusing on sustainable profit-generating capacity.

Price-to-Book Ratio (P/B)

The Price-to-Book Ratio (P/B) compares a company's market price to its book value, serving as a key indicator to assess whether the stock is undervalued or overvalued relative to its intrinsic value.

Discounted Cash Flow (DCF)

Discounted Cash Flow (DCF) analysis calculates a company's intrinsic value by estimating the present value of its expected future cash flows, providing a forward-looking assessment that often contrasts with the historical-based book value recorded on the balance sheet. While book value reflects the net asset value at a given point, the intrinsic value derived from DCF captures the company's true economic worth considering growth potential and risk-adjusted returns.

Economic Value Added (EVA)

Economic Value Added (EVA) measures a company's financial performance by calculating the value created beyond its cost of capital, highlighting the difference between the book value of equity and the intrinsic value perceived by investors. EVA focuses on true economic profit, suggesting that when intrinsic value exceeds book value, the firm generates positive economic returns beyond accounting measures.

Tangible Book Value

Tangible book value excludes intangible assets, providing a more conservative measure than book value, while intrinsic value estimates a company's true worth based on fundamental analysis beyond just accounting figures.

Book Value vs Intrinsic Value Infographic

moneydif.com

moneydif.com