Option Pricing Method (OPM) values complex securities by modeling potential outcomes using financial mathematics, incorporating volatility and time to maturity to estimate fair value. Probability-Weighted Expected Return Method (PWERM) calculates valuation by assigning weighted probabilities to various future scenarios and discounting expected cash flows accordingly. OPM is favored for its precision in pricing path-dependent options, while PWERM offers flexibility in incorporating multiple discrete business outcomes.

Table of Comparison

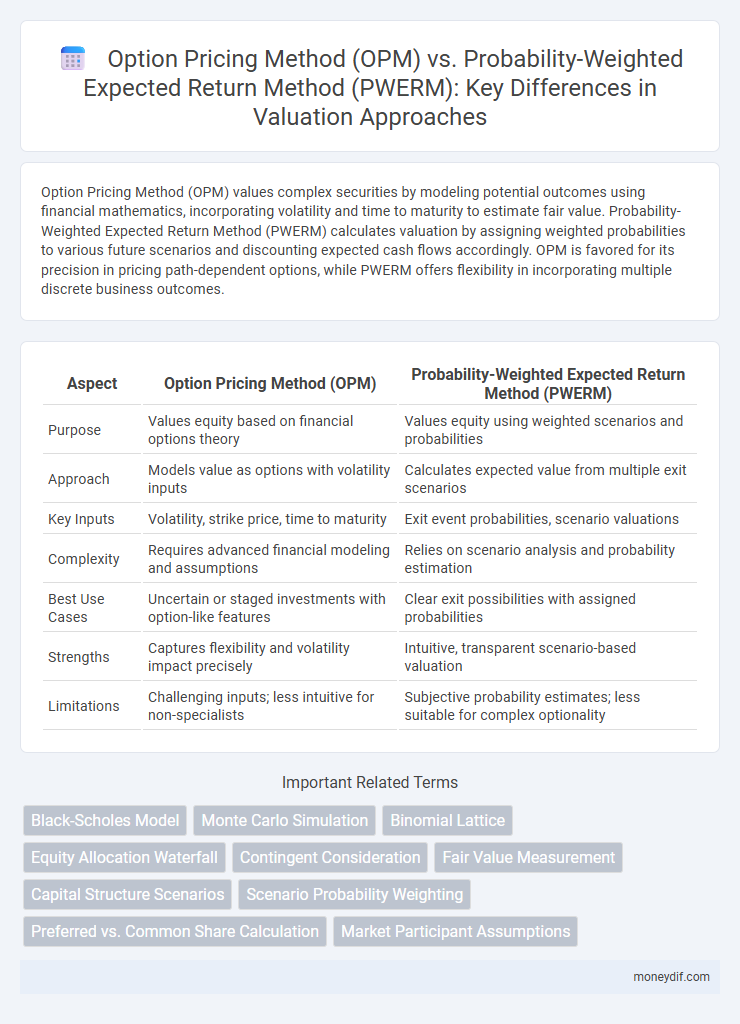

| Aspect | Option Pricing Method (OPM) | Probability-Weighted Expected Return Method (PWERM) |

|---|---|---|

| Purpose | Values equity based on financial options theory | Values equity using weighted scenarios and probabilities |

| Approach | Models value as options with volatility inputs | Calculates expected value from multiple exit scenarios |

| Key Inputs | Volatility, strike price, time to maturity | Exit event probabilities, scenario valuations |

| Complexity | Requires advanced financial modeling and assumptions | Relies on scenario analysis and probability estimation |

| Best Use Cases | Uncertain or staged investments with option-like features | Clear exit possibilities with assigned probabilities |

| Strengths | Captures flexibility and volatility impact precisely | Intuitive, transparent scenario-based valuation |

| Limitations | Challenging inputs; less intuitive for non-specialists | Subjective probability estimates; less suitable for complex optionality |

Introduction to Option Pricing Method (OPM) and PWERM

Option Pricing Method (OPM) leverages financial models such as the Black-Scholes or binomial models to estimate the value of equity options in complex capital structures by incorporating volatility, time to maturity, and risk-free rates. Probability-Weighted Expected Return Method (PWERM) calculates value by assigning probabilities to discrete future scenarios and discounting their respective cash flows, reflecting potential exit values and timelines. Both methods address different valuation complexities: OPM is suited for capturing the impacts of multiple rounds and liquidation preferences, whereas PWERM provides a scenario-based valuation reflecting diverse possible outcomes.

Conceptual Framework: OPM vs PWERM

Option Pricing Method (OPM) estimates the value of options by modeling the underlying asset's price dynamics using stochastic processes, capturing volatility and time-decay effects. Probability-Weighted Expected Return Method (PWERM) calculates value by assigning probabilities to discrete future outcomes and discounting their expected cash flows. OPM inherently incorporates market-based inputs and continuous risk adjustment, whereas PWERM relies on scenario analysis emphasizing specific business milestones and subjective probability assessments.

Key Assumptions Underlying OPM and PWERM

The Option Pricing Method (OPM) assumes market efficiency, volatility estimation, and precise exercise price timing to value options accurately, relying heavily on financial market data and stochastic modeling. The Probability-Weighted Expected Return Method (PWERM) depends on assigning probabilities to discrete future scenarios and estimating expected returns, requiring subjective judgment on scenario likelihoods and potential outcomes. Both methods differ fundamentally in their treatment of uncertainty, with OPM emphasizing continuous price fluctuations and PWERM focusing on discrete, scenario-based probabilities.

Mathematical Models: Black-Scholes, Binomial, and PWERM Calculations

The Option Pricing Method (OPM) utilizes mathematical models like Black-Scholes and Binomial trees to estimate the fair value of financial options by calculating theoretical prices based on volatility, time to expiration, and underlying asset price. The Probability-Weighted Expected Return Method (PWERM) involves calculating expected values by assigning probabilities to different future scenarios and discounting them to present value, commonly applied in valuation of complex equity instruments. Black-Scholes provides a closed-form solution optimized for European options, whereas the Binomial model offers flexibility with American options, while PWERM relies on scenario analysis and probability distributions for a comprehensive valuation approach.

Applicability in Startup and Private Company Valuations

Option Pricing Method (OPM) excels in valuing startups and private companies with multiple financing rounds and convertible securities by modeling complex capital structures. Probability-Weighted Expected Return Method (PWERM) suits businesses with distinct exit scenarios, allowing valuation based on weighted outcomes of potential liquidity events. OPM offers granular control for early-stage firms, while PWERM provides clarity when discrete exit outcomes are identifiable.

Inputs and Data Requirements for Each Method

Option Pricing Method (OPM) requires detailed inputs such as volatility estimates, risk-free rates, option strike prices, and time to expiration, relying heavily on market data and statistical models to capture uncertainty in valuation. Probability-Weighted Expected Return Method (PWERM) depends on identifying discrete future outcomes with assigned probabilities and corresponding cash flow estimates, demanding comprehensive scenario analysis and expert judgment. While OPM leverages quantitative market-driven variables, PWERM emphasizes qualitative input of potential states and their likelihoods, reflecting differing data intensity and modeling approaches.

Advantages and Limitations of OPM

The Option Pricing Method (OPM) offers a rigorous framework for valuing complex financial instruments with embedded options by capturing volatility and time value more accurately than the Probability-Weighted Expected Return Method (PWERM). Its key advantage lies in modeling the dynamic exercise strategy and market conditions, providing a market-consistent valuation especially useful for startup equity and convertible securities. However, OPM requires sophisticated inputs such as volatility estimates and risk-neutral probabilities, which can introduce model risk and complexity, limiting its applicability when reliable market data is scarce.

Advantages and Limitations of PWERM

The Probability-Weighted Expected Return Method (PWERM) offers advantages such as capturing multiple future scenarios with assigned probabilities, providing a more nuanced valuation in uncertain markets compared to deterministic approaches. PWERM's reliance on subjective probability estimates can introduce bias and complexity, which may affect the accuracy and consistency of the valuation outcomes. Limitations also include challenges in modeling numerous discrete outcomes and the potential for oversimplification when probabilities do not fully reflect market realities.

Case Studies: OPM vs PWERM in Practice

Case studies comparing Option Pricing Method (OPM) and Probability-Weighted Expected Return Method (PWERM) reveal OPM's strength in valuing companies with volatile or uncertain future cash flows due to its ability to model managerial flexibility and multiple outcomes. PWERM is favored in scenarios with clearer probability estimates and more stable projections, offering straightforward calculations based on discrete state probabilities and outcomes. Practical applications demonstrate OPM's superiority in technology and biotech sectors, while PWERM remains prevalent in mature industries with well-defined exit scenarios.

Choosing the Right Method for Valuation Scenarios

Option Pricing Method (OPM) excels in valuing equity with multiple contingencies and complex capital structures by modeling the underlying asset's volatility and time to maturity. Probability-Weighted Expected Return Method (PWERM) fits scenarios with discrete outcomes and clear probability estimates, offering straightforward calculations for projecting expected returns. Selecting between OPM and PWERM hinges on the nature of the valuation, where OPM suits dynamic, continuous-state environments, and PWERM applies to defined, scenario-based projections.

Important Terms

Black-Scholes Model

The Black-Scholes Model, a foundational Option Pricing Method (OPM), uses risk-neutral valuation to price options, contrasting with the Probability-Weighted Expected Return Method (PWERM) which incorporates actual probability distributions of returns.

Monte Carlo Simulation

Monte Carlo Simulation enhances Option Pricing Method (OPM) accuracy by modeling stochastic price paths, while Probability-Weighted Expected Return Method (PWERM) estimates option value by averaging discounted payoffs weighted by scenario probabilities.

Binomial Lattice

The Binomial Lattice approach in option pricing method (OPM) models multiple possible asset price paths over discrete time intervals for precise derivative valuation, contrasting with the Probability-Weighted Expected Return Method (PWERM), which calculates option value based on the weighted average of expected payoffs under different scenarios without path-dependent modeling.

Equity Allocation Waterfall

Equity Allocation Waterfall analysis compares the Option Pricing Method (OPM) and Probability-Weighted Expected Return Method (PWERM) by evaluating the distribution of equity based on complex option-like features versus probability-weighted outcomes to optimize startup valuation accuracy.

Contingent Consideration

Contingent consideration valuation in business combinations often utilizes the Option Pricing Method (OPM) or the Probability-Weighted Expected Return Method (PWERM), where OPM applies financial option theory for scenarios with defined payoff structures, while PWERM evaluates multiple probable outcomes with assigned probabilities. OPM is preferable for contingent payments resembling call or put options, and PWERM suits complex scenarios with several discrete potential results, ensuring accurate fair value measurement under IFRS 3 and ASC 805.

Fair Value Measurement

Fair Value Measurement often utilizes the Option Pricing Method (OPM) for valuing complex financial instruments with embedded options, while the Probability-Weighted Expected Return Method (PWERM) is preferred for estimating value based on multiple expected outcomes and their associated probabilities.

Capital Structure Scenarios

Capital Structure Scenarios leverage the Option Pricing Method (OPM) to value equity by modeling the firm's assets as options, capturing potential upside and downside volatility, while the Probability-Weighted Expected Return Method (PWERM) assesses value through explicit scenario probabilities and corresponding cash flow outcomes. OPM provides dynamic valuation sensitive to market volatility and capital structure complexity, whereas PWERM relies on discrete, pre-defined scenarios with assigned likelihoods, making it suitable for straightforward, event-driven forecasting.

Scenario Probability Weighting

Scenario Probability Weighting enhances accuracy in Option Pricing Method (OPM) by adjusting scenario probabilities, contrasting with the Probability-Weighted Expected Return Method (PWERM) that averages outcomes without probability adjustment.

Preferred vs. Common Share Calculation

Preferred share valuation in Option Pricing Method (OPM) typically models conversion features and liquidation preferences as call options, reflecting complex payoff structures under various exit scenarios, whereas Common share calculation under Probability-Weighted Expected Return Method (PWERM) assigns weighted present values based on forecasted exit outcomes, offering a probabilistic assessment of equity value. OPM captures volatility and rights embedded in preferred securities, while PWERM emphasizes scenario analysis for common holders, making each method suitable for distinct preference and liquidity characteristics in security valuation.

Market Participant Assumptions

Market participant assumptions significantly influence Option Pricing Method (OPM) by incorporating market-based volatility and risk preferences, while Probability-Weighted Expected Return Method (PWERM) relies on subjective probability estimates and expected cash flows.

Option Pricing Method (OPM) vs Probability-Weighted Expected Return Method (PWERM) Infographic

moneydif.com

moneydif.com