Contingent consideration refers to the portion of a purchase price that depends on future events or performance targets, often structured to bridge valuation gaps between buyer and seller. Earn-outs are a specific form of contingent consideration where payments are made based on the acquired company's financial performance post-transaction, aligning interests and mitigating risks. Both instruments require careful valuation to accurately reflect future uncertainties and contractual terms in the deal price.

Table of Comparison

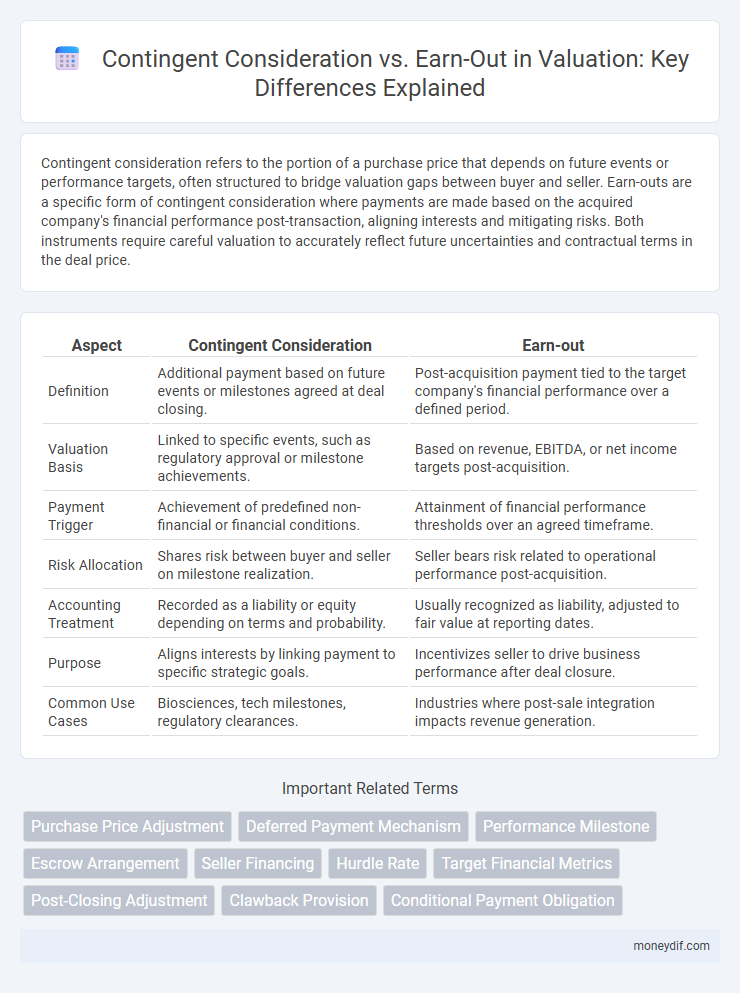

| Aspect | Contingent Consideration | Earn-out |

|---|---|---|

| Definition | Additional payment based on future events or milestones agreed at deal closing. | Post-acquisition payment tied to the target company's financial performance over a defined period. |

| Valuation Basis | Linked to specific events, such as regulatory approval or milestone achievements. | Based on revenue, EBITDA, or net income targets post-acquisition. |

| Payment Trigger | Achievement of predefined non-financial or financial conditions. | Attainment of financial performance thresholds over an agreed timeframe. |

| Risk Allocation | Shares risk between buyer and seller on milestone realization. | Seller bears risk related to operational performance post-acquisition. |

| Accounting Treatment | Recorded as a liability or equity depending on terms and probability. | Usually recognized as liability, adjusted to fair value at reporting dates. |

| Purpose | Aligns interests by linking payment to specific strategic goals. | Incentivizes seller to drive business performance after deal closure. |

| Common Use Cases | Biosciences, tech milestones, regulatory clearances. | Industries where post-sale integration impacts revenue generation. |

Introduction to Contingent Consideration and Earn-Outs

Contingent consideration refers to future payments made by the buyer to the seller based on the achievement of specific financial or operational targets post-transaction. Earn-outs are a common form of contingent consideration, structured to bridge valuation gaps by aligning the interests of both parties through performance-based compensation. These mechanisms play a critical role in mergers and acquisitions by addressing uncertainties in the target company's future performance and managing risk allocation.

Key Differences Between Contingent Consideration and Earn-Outs

Contingent consideration involves a predetermined payment based on future events or performance metrics agreed upon during a transaction, while earn-outs specifically tie additional compensation to the target company's future financial performance. Contingent consideration is often structured as a fixed amount contingent on certain conditions, whereas earn-outs typically encompass a series of payments dependent on achieving specific revenue or EBITDA targets. Understanding these distinctions is crucial for accurate valuation, risk allocation, and alignment of buyer-seller incentives in mergers and acquisitions.

Purpose and Strategic Use in M&A Transactions

Contingent consideration in M&A transactions serves to align buyer and seller interests by tying part of the purchase price to future performance metrics, mitigating valuation risk. Earn-outs function similarly but emphasize post-closing operational milestones, incentivizing management continuity and performance improvement. Both instruments strategically balance valuation certainty with performance-based incentives to enhance deal value and integration success.

Structuring Contingent Consideration Agreements

Structuring contingent consideration agreements requires clearly defining performance metrics and payment triggers linked to specific financial or operational milestones, ensuring alignment with valuation assumptions. Careful drafting of terms such as earn-out periods, caps, floors, and dispute resolution mechanisms mitigates risks related to future uncertainties and potential disagreements. Precise documentation and valuation models enhance transparency and facilitate fair assessment of contingent liabilities in merger and acquisition transactions.

Common Earn-Out Structures in Deal Valuation

Common earn-out structures in deal valuation typically involve milestone-based payments tied to financial performance targets such as revenue, EBITDA, or net income achieved post-transaction. These structures align seller incentives with future company growth while mitigating buyer risk by deferring a portion of payment contingent on tangible business outcomes. Valuation models often incorporate probability-weighted scenarios to estimate the fair value of contingent consideration under earn-out agreements.

Valuation Methods for Contingent Consideration

Valuation methods for contingent consideration primarily utilize option pricing models, discounted cash flow (DCF) analysis, and Monte Carlo simulations to estimate future payment liabilities based on probable outcomes. These approaches assess the present value of contingent payments tied to performance targets or specific events, factoring in volatility, time horizon, and risk-adjusted discount rates. Accurate valuation of contingent consideration is critical for financial reporting under IFRS 3 and ASC 805, ensuring that the recorded liabilities or assets reflect fair value at acquisition date.

Risks and Challenges in Earn-Out Valuations

Earn-out valuations present significant risks such as misaligned incentives between buyers and sellers, leading to disputes over performance targets and financial reporting. The challenge of accurately forecasting future earnings under market uncertainties complicates the fair valuation of contingent payments. Earn-outs also increase complexity in financial due diligence, requiring robust mechanisms to monitor and enforce agreement terms effectively.

Accounting and Financial Reporting Implications

Contingent consideration and earn-outs affect valuation and financial reporting by introducing variable future payments based on performance targets, requiring initial recognition at fair value under IFRS 3 and ASC 805. Subsequent measurement differs: contingent consideration classified as a liability is adjusted through profit or loss, while earn-outs classified as equity typically have no remeasurement. Accurate classification impacts financial statements transparency, influencing metrics like goodwill impairment testing and deferred tax calculations.

Legal and Tax Considerations

Contingent consideration and earn-outs differ significantly in legal and tax implications, with contingent consideration often structured as a liability affecting the balance sheet and triggering taxable events upon payment, while earn-outs are typically treated as additional purchase price that can influence the allocation of purchase price among assets. Legal agreements for contingent consideration require precise conditions to define payout triggers, minimizing dispute risk, whereas earn-outs demand detailed performance metrics and timelines to ensure enforceability and clear tax treatment. Understanding jurisdiction-specific regulations is critical since tax authorities may categorize earn-out payments as ordinary income or capital gains, impacting both buyer and seller tax liabilities.

Best Practices for Negotiating and Documenting Terms

Contingent consideration and earn-outs require clear, measurable performance milestones to align buyer and seller interests during valuation. Best practices include defining specific financial metrics, timeframes, and conditions to reduce ambiguity and potential disputes. Detailed documentation should incorporate dispute resolution clauses and periodic review mechanisms to ensure transparent and enforceable agreements.

Important Terms

Purchase Price Adjustment

Purchase price adjustment mechanisms such as contingent consideration and earn-outs differ in that contingent consideration is a predetermined payment based on future events or performance, while earn-outs specifically tie additional payments to achieving agreed-upon financial targets post-transaction.

Deferred Payment Mechanism

Deferred payment mechanisms such as contingent consideration and earn-outs structure post-acquisition payments based on future performance metrics, with contingent consideration often tied to specific financial targets and earn-outs typically linked to broader operational milestones.

Performance Milestone

Performance milestones in contingent consideration often define specific financial or operational targets that trigger additional payments, ensuring alignment of earn-outs with company performance. Structured earn-outs tied to these milestones mitigate acquisition risks by linking payments directly to realized outcomes such as revenue growth or EBITDA thresholds.

Escrow Arrangement

Escrow arrangements secure funds for contingent consideration to ensure earn-out payments are made only when predefined financial or performance milestones are achieved.

Seller Financing

Seller financing often differs from contingent consideration and earn-out agreements by providing upfront loan terms directly from the seller, whereas earn-outs and contingent considerations tie payments to future performance milestones or specific financial targets.

Hurdle Rate

The hurdle rate in contingent consideration agreements determines the minimum performance threshold that triggers earn-out payments, aligning seller incentives with future company performance.

Target Financial Metrics

Target financial metrics for contingent consideration typically focus on achieving specific performance thresholds or milestones, whereas earn-out agreements are structured to tie payment directly to future financial results or operational targets.

Post-Closing Adjustment

Post-closing adjustments in M&A transactions often involve contingent consideration and earn-outs, where contingent consideration refers to payments based on future events or financial metrics, while earn-outs tie payments directly to the acquired company's performance targets.

Clawback Provision

A clawback provision in contingent consideration agreements safeguards buyers by enabling repayment if earn-out targets tied to post-acquisition performance metrics are not achieved.

Conditional Payment Obligation

Conditional Payment Obligation refers to a financial liability linked to Contingent Consideration or Earn-out agreements, where payment is triggered by specific future events or performance metrics post-acquisition.

Contingent Consideration vs Earn-out Infographic

moneydif.com

moneydif.com