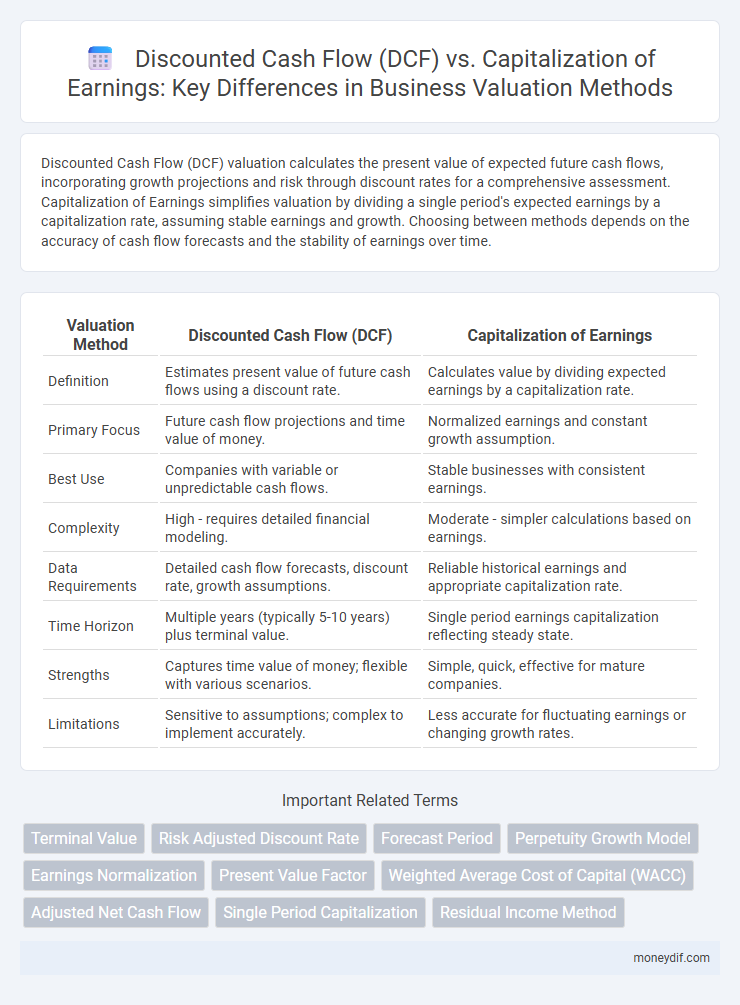

Discounted Cash Flow (DCF) valuation calculates the present value of expected future cash flows, incorporating growth projections and risk through discount rates for a comprehensive assessment. Capitalization of Earnings simplifies valuation by dividing a single period's expected earnings by a capitalization rate, assuming stable earnings and growth. Choosing between methods depends on the accuracy of cash flow forecasts and the stability of earnings over time.

Table of Comparison

| Valuation Method | Discounted Cash Flow (DCF) | Capitalization of Earnings |

|---|---|---|

| Definition | Estimates present value of future cash flows using a discount rate. | Calculates value by dividing expected earnings by a capitalization rate. |

| Primary Focus | Future cash flow projections and time value of money. | Normalized earnings and constant growth assumption. |

| Best Use | Companies with variable or unpredictable cash flows. | Stable businesses with consistent earnings. |

| Complexity | High - requires detailed financial modeling. | Moderate - simpler calculations based on earnings. |

| Data Requirements | Detailed cash flow forecasts, discount rate, growth assumptions. | Reliable historical earnings and appropriate capitalization rate. |

| Time Horizon | Multiple years (typically 5-10 years) plus terminal value. | Single period earnings capitalization reflecting steady state. |

| Strengths | Captures time value of money; flexible with various scenarios. | Simple, quick, effective for mature companies. |

| Limitations | Sensitive to assumptions; complex to implement accurately. | Less accurate for fluctuating earnings or changing growth rates. |

Introduction to Business Valuation Methods

Discounted Cash Flow (DCF) valuation estimates a business's intrinsic value by projecting future cash flows and discounting them to present value using the weighted average cost of capital (WACC). Capitalization of Earnings simplifies valuation by dividing a single-period normalized earnings figure by an appropriate capitalization rate, reflecting the expected return on investment. Both methods are fundamental in business valuation, with DCF providing a detailed, forward-looking analysis and Capitalization of Earnings offering a quicker, yield-based approach.

What is Discounted Cash Flow (DCF)?

Discounted Cash Flow (DCF) is a valuation method that estimates the present value of an asset based on its expected future cash flows, discounted at a rate reflecting the risk and time value of money. This approach captures the intrinsic value by projecting free cash flows and applying a discount rate, often the weighted average cost of capital (WACC). DCF provides a detailed assessment of asset worth, especially for long-term investments with predictable cash flow patterns.

What is Capitalization of Earnings?

Capitalization of Earnings is a valuation method that estimates the value of a business based on its expected future earnings, divided by a capitalization rate reflecting risk and growth. Unlike Discounted Cash Flow (DCF), which forecasts detailed cash flows over multiple years, Capitalization of Earnings uses a single representative earnings figure, often normalized, to simplify valuation. This approach is particularly useful for businesses with stable, predictable earnings and less detailed financial projections.

Key Differences Between DCF and Capitalization of Earnings

Discounted Cash Flow (DCF) values a business based on the present value of projected future cash flows, incorporating time value of money and risk through a discount rate. Capitalization of Earnings estimates value by dividing a single economic benefit, typically normalized earnings, by a capitalization rate, reflecting a constant growth assumption. DCF is more flexible for variable cash flows and growth rates, while Capitalization of Earnings suits stable, mature companies with predictable earnings.

When to Use DCF Valuation

Discounted Cash Flow (DCF) valuation is most suitable for businesses with fluctuating or non-stable cash flows, as it captures future cash flow variability by applying an appropriate discount rate. It provides a comprehensive valuation by accounting for projected growth, risk, and the time value of money, making it ideal for startups or companies in dynamic industries. DCF is preferred when detailed financial forecasts are available, contrasting with Capitalization of Earnings, which suits stable, mature businesses with predictable earnings.

When to Use Capitalization of Earnings

Capitalization of Earnings is ideal for valuing stable businesses with consistent earnings and predictable growth rates, where future cash flows are expected to remain uniform over time. This method simplifies valuation by applying a capitalization rate to current earnings, avoiding the complexities of forecasting detailed cash flows required in Discounted Cash Flow (DCF) analysis. It works best in industries with low volatility and mature markets, providing a straightforward approach when accurate, long-term cash flow projections are difficult to obtain.

Assumptions and Inputs for DCF Analysis

Discounted Cash Flow (DCF) analysis relies heavily on accurate projections of future cash flows, discount rates, and terminal values, with assumptions about revenue growth, operating margins, and capital expenditures directly impacting valuation outcomes. Key inputs include the weighted average cost of capital (WACC) as the discount rate and detailed financial forecasts spanning typically 5 to 10 years, which must reflect realistic economic conditions and company-specific risks. Unlike Capitalization of Earnings, which uses a single-period earnings estimate and capitalization rate, DCF requires multi-period forecasts, making the quality and precision of assumptions critical to deriving reliable intrinsic value estimates.

Assumptions and Inputs for Capitalization of Earnings

Capitalization of Earnings relies on steady earnings and a stable capitalization rate, assuming consistent future income and risk profile of the business. Key inputs include normalized earnings, often adjusted for non-recurring items, and the appropriate capitalization rate, which reflects the required rate of return and growth expectations. Unlike Discounted Cash Flow (DCF), this approach assumes a perpetuity model, simplifying valuation by focusing on ongoing earnings rather than detailed cash flow projections.

Pros and Cons of Each Valuation Approach

Discounted Cash Flow (DCF) valuation offers a detailed projection of future cash flows, capturing time value of money and providing flexibility for varying growth rates, but it requires accurate forecasts and is sensitive to assumptions like discount rate, making it complex and potentially subjective. Capitalization of Earnings simplifies valuation by using a single representative earnings figure and a capitalization rate, facilitating quicker analysis, yet it assumes stable earnings and growth, which can lead to inaccuracies in fluctuating or cyclical businesses. Choosing between DCF and Capitalization of Earnings depends on the stability of cash flows, availability of reliable data, and the valuation purpose, balancing complexity against precision.

Choosing the Right Method for Your Business Valuation

Selecting the appropriate valuation method depends on your business's cash flow stability and growth prospects. Discounted Cash Flow (DCF) is ideal for companies with fluctuating earnings and long-term growth potential, as it incorporates future cash flow forecasts discounted to present value. Capitalization of Earnings suits businesses with steady, predictable earnings, converting a single normalized income figure into value using a capitalization rate reflecting risk and growth.

Important Terms

Terminal Value

Terminal Value in Discounted Cash Flow (DCF) captures the present value of all future cash flows beyond the forecast period, while Capitalization of Earnings estimates Terminal Value by dividing a single representative earnings figure by a capitalization rate, emphasizing long-term profitability stability.

Risk Adjusted Discount Rate

The Risk Adjusted Discount Rate in Discounted Cash Flow (DCF) analysis accounts for project-specific risk by adjusting the discount rate, unlike Capitalization of Earnings which typically uses a lower, less variable rate reflecting steady-state earnings.

Forecast Period

The forecast period in Discounted Cash Flow (DCF) analysis projects cash flows over a finite time horizon, while Capitalization of Earnings assumes a steady-state earnings level beyond the initial forecast period.

Perpetuity Growth Model

The Perpetuity Growth Model, integral to Discounted Cash Flow (DCF) analysis, calculates terminal value by projecting infinite cash flow growth, whereas Capitalization of Earnings converts current earnings into value based on a capitalization rate without assuming growth.

Earnings Normalization

Earnings normalization adjusts atypical financial results to provide a consistent basis for valuation when comparing Discounted Cash Flow (DCF) and Capitalization of Earnings methodologies.

Present Value Factor

The Present Value Factor quantifies the current worth of future cash flows in Discounted Cash Flow (DCF) analysis, whereas Capitalization of Earnings converts a single period's expected earnings into value by dividing by a capitalization rate.

Weighted Average Cost of Capital (WACC)

Weighted Average Cost of Capital (WACC) serves as the discount rate in Discounted Cash Flow (DCF) analysis to evaluate future cash flows, whereas Capitalization of Earnings uses a capitalization rate derived from WACC adjusted for growth to estimate business value based on current earnings.

Adjusted Net Cash Flow

Adjusted Net Cash Flow provides a more accurate basis for Discounted Cash Flow (DCF) valuation by reflecting true operating cash generation, whereas Capitalization of Earnings relies on steady earnings projections without explicitly accounting for cash flow timing.

Single Period Capitalization

Single Period Capitalization calculates value by dividing a single year's earnings by the capitalization rate, contrasting with Discounted Cash Flow (DCF) which projects and discounts multiple future cash flows to present value.

Residual Income Method

The Residual Income Method calculates firm value by subtracting the equity charge from net income, enhancing Discounted Cash Flow (DCF) analysis which focuses on future cash flow projections. Unlike the Capitalization of Earnings approach that uses a single period's earnings divided by a capitalization rate, the Residual Income Method accounts for the cost of equity and incorporates accounting profits adjusted for book value growth.

Discounted Cash Flow (DCF) vs Capitalization of Earnings Infographic

moneydif.com

moneydif.com