Enterprise Value represents the total value of a company, including debt, equity, and cash, reflecting the entire business worth. Equity Value specifically measures the value attributable to shareholders, calculated by multiplying the share price by the number of outstanding shares. Understanding the distinction between Enterprise Value and Equity Value is crucial for accurate company valuation and investment decisions.

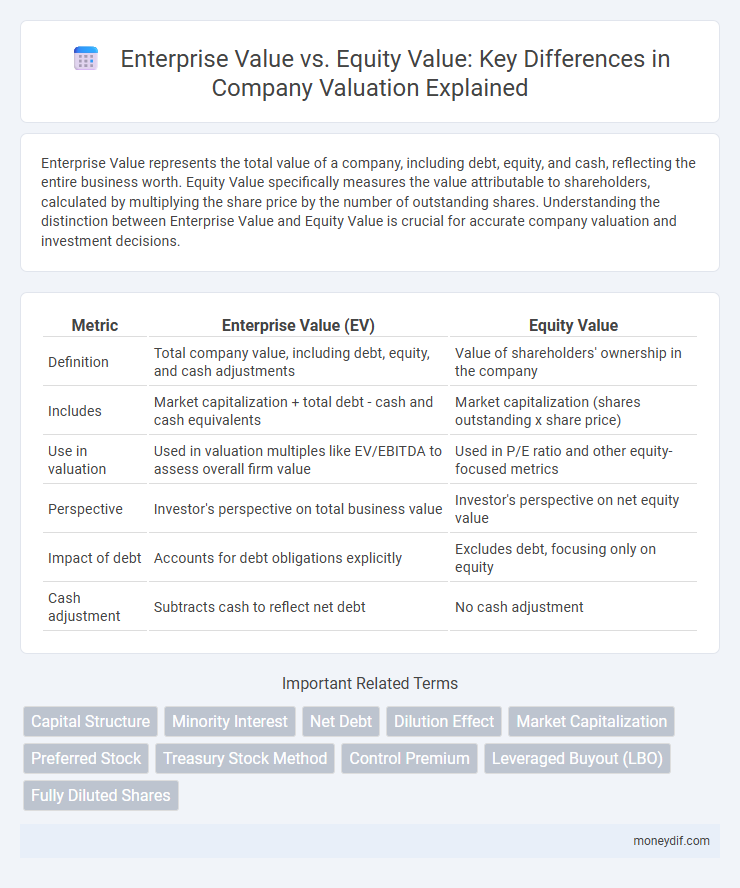

Table of Comparison

| Metric | Enterprise Value (EV) | Equity Value |

|---|---|---|

| Definition | Total company value, including debt, equity, and cash adjustments | Value of shareholders' ownership in the company |

| Includes | Market capitalization + total debt - cash and cash equivalents | Market capitalization (shares outstanding x share price) |

| Use in valuation | Used in valuation multiples like EV/EBITDA to assess overall firm value | Used in P/E ratio and other equity-focused metrics |

| Perspective | Investor's perspective on total business value | Investor's perspective on net equity value |

| Impact of debt | Accounts for debt obligations explicitly | Excludes debt, focusing only on equity |

| Cash adjustment | Subtracts cash to reflect net debt | No cash adjustment |

Introduction to Enterprise Value and Equity Value

Enterprise Value represents the total value of a company, including market capitalization, debt, and cash adjustments, providing a comprehensive measure of firm worth. Equity Value reflects the value attributable solely to shareholders, calculated as market capitalization or share price multiplied by outstanding shares. Understanding these metrics is crucial for accurate business valuation and investment decision-making.

Defining Enterprise Value: What It Represents

Enterprise Value (EV) represents the total value of a company, encompassing its market capitalization, debt, minority interest, preferred equity, and subtracting cash and cash equivalents. It reflects the entire economic value available to all stakeholders, not just shareholders, making it critical for assessing a company's takeover or acquisition price. Unlike Equity Value, which only accounts for shareholders' equity, EV provides a comprehensive measure of a firm's financial worth and operational risk.

Understanding Equity Value in Valuation

Equity Value represents the shareholders' ownership in a company and is calculated by multiplying the current share price by the total number of outstanding shares. It reflects the market value of equity available to common shareholders after subtracting net debt and preferred equity from Enterprise Value. Accurate understanding of Equity Value is crucial for investors and analysts to assess a company's market capitalization and guide investment decisions.

Key Components of Enterprise Value

Enterprise Value (EV) represents a company's total value, including market capitalization, total debt, and minority interest, minus cash and cash equivalents. Key components of EV are market value of equity, net debt (total debt minus cash), preferred stock, and non-controlling interests, which provide a comprehensive measure of the firm's economic worth. This metric enables comparison across companies by reflecting both equity and debt holders' claims, distinct from Equity Value which solely accounts for shareholders' ownership.

Key Components of Equity Value

Key components of Equity Value include the company's market capitalization, calculated by multiplying the current share price by the total number of outstanding shares, along with the value of stock options, warrants, and convertible securities that may dilute ownership. Equity Value reflects the residual claim on the company's assets after all liabilities are deducted, distinguishing it from Enterprise Value which incorporates debt and cash levels. Accurate assessment of Equity Value is essential for shareholders to understand their ownership stake and potential return on investment.

Major Differences Between Enterprise Value and Equity Value

Enterprise Value (EV) represents the total value of a company, including market capitalization, debt, preferred stock, and minority interest, minus cash and cash equivalents, reflecting the theoretical takeover price. Equity Value, also known as market capitalization, only accounts for the value attributable to shareholders, excluding debt and other obligations. The major difference lies in EV capturing the complete capital structure, making it essential for assessing company valuation in mergers and acquisitions, while Equity Value focuses solely on shareholder ownership.

Why Enterprise Value Matters in M&A Transactions

Enterprise Value (EV) represents the total value of a company, including debt, equity, and cash, providing a comprehensive measure crucial for M&A transactions. Unlike Equity Value, which only accounts for shareholders' interest, EV captures the true acquisition cost by factoring in debt obligations that the buyer assumes. This makes EV essential for accurate valuation, deal structuring, and comparing target companies regardless of capital structure differences.

When to Use Equity Value in Financial Analysis

Equity value is used in financial analysis when focusing on the value available to shareholders after debt holders have been paid, making it essential for assessing shareholder returns and stock market performance. It is particularly relevant in scenarios such as calculating earnings per share (EPS), price-to-earnings (P/E) ratios, and equity-based valuation multiples like price-to-book (P/B) ratio. Analysts use equity value to evaluate the company's market capitalization and to determine the price investors are willing to pay for a share of the company.

Common Valuation Multiples: EV/EBITDA vs P/E Ratio

Enterprise Value (EV) captures the entire firm value including debt and cash, making EV/EBITDA a preferred multiple for comparing operational performance while neutralizing capital structure differences. The P/E ratio focuses solely on equity value and net earnings, reflecting profitability from a shareholder perspective but can be skewed by leverage and capital structure variations. EV/EBITDA is widely used in capital-intensive industries to assess valuation irrespective of financing, whereas the P/E ratio is favored for analyzing profitability in sectors with stable capital structures.

Enterprise Value vs Equity Value: Practical Calculation Examples

Enterprise Value (EV) represents the total value of a company, including equity, debt, and cash adjustments, while Equity Value reflects the value attributable solely to shareholders. Practical calculation involves starting with market capitalization for Equity Value and adjusting for net debt (total debt minus cash) to derive Enterprise Value. For example, a firm with a market cap of $500 million, debt of $200 million, and cash of $50 million has an EV of $650 million (500 + 200 - 50).

Important Terms

Capital Structure

Enterprise Value represents the total firm value including debt and equity, while Equity Value reflects the shareholders' ownership interest after subtracting net debt.

Minority Interest

Minority interest represents the portion of a subsidiary's equity not owned by the parent company and is added to Enterprise Value but excluded from Equity Value to accurately reflect total firm value.

Net Debt

Net debt, calculated as total debt minus cash and cash equivalents, is a critical component in transitioning from equity value to enterprise value, reflecting a company's true valuation by including financial obligations. Enterprise value represents the total market value of a firm's operating assets, encompassing equity value plus net debt, preferred stock, and minority interest, providing a comprehensive assessment beyond just shareholder equity.

Dilution Effect

The dilution effect occurs when issuing additional shares reduces existing shareholders' ownership percentage, impacting the equity value without immediately changing the enterprise value, which reflects the total firm value including debt. This effect causes equity value per share to decline, while enterprise value remains stable, highlighting the difference between market capitalization and total company valuation.

Market Capitalization

Enterprise Value represents a company's total market capitalization plus debt, minus cash, providing a more comprehensive valuation than Equity Value, which only reflects shareholders' ownership.

Preferred Stock

Preferred stock is a component of a company's capital structure that is often excluded from equity value but included in enterprise value since it has priority over common equity in liquidation and dividend payments. Enterprise value reflects the total value of a firm's operating assets by adding debt, preferred stock, and minority interest to equity value and subtracting cash, providing a comprehensive measure for valuation and acquisition analysis.

Treasury Stock Method

The Treasury Stock Method calculates the dilutive impact of in-the-money options and warrants on Equity Value by assuming proceeds from exercise repurchase outstanding shares, affecting the diluted share count but not Enterprise Value, which remains unaffected since it reflects total firm value including debt. This method helps refine the Earnings Per Share (EPS) calculation by adjusting the denominator without altering Enterprise Value metrics used in valuation multiples.

Control Premium

Control Premium represents the additional value paid over Equity Value to acquire a controlling interest, often reflected as a percentage increase in Enterprise Value during mergers and acquisitions.

Leveraged Buyout (LBO)

A Leveraged Buyout (LBO) primarily focuses on acquiring a company's Enterprise Value (EV), which represents the total value including debt and equity, rather than just its Equity Value, which accounts only for shareholder ownership. Understanding the distinction between Enterprise Value and Equity Value is crucial in LBOs since the transaction involves financing the acquisition through significant debt, impacting the overall capital structure and returns.

Fully Diluted Shares

Fully diluted shares represent the total number of shares outstanding assuming all convertible securities, options, and warrants are exercised, impacting the calculation of Equity Value by increasing the share count. Enterprise Value accounts for the entire firm value including debt and cash, remaining unaffected by changes in share count, making fully diluted shares primarily relevant for assessing per-share metrics within Equity Value.

Enterprise Value vs Equity Value Infographic

moneydif.com

moneydif.com