Minority interest represents the ownership stake held by shareholders who do not have control over company decisions, typically owning less than 50% of shares. Majority interest refers to shareholders with controlling stakes, usually over 50%, allowing them to influence management and strategic direction. In valuation, understanding the distinction is crucial for accurately assessing control premiums and discounting minority holdings.

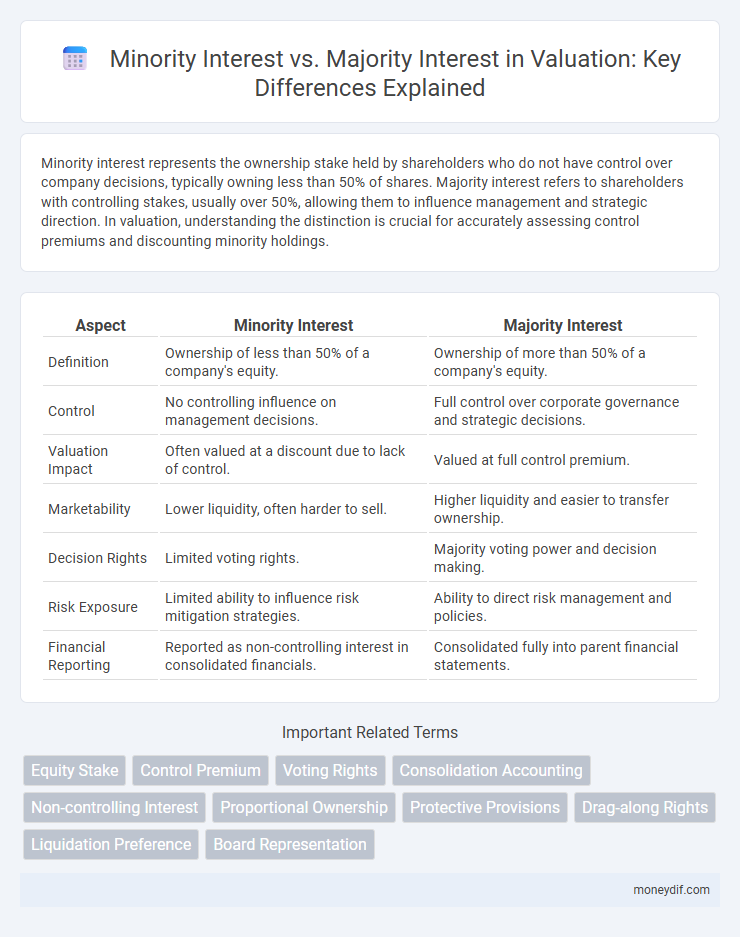

Table of Comparison

| Aspect | Minority Interest | Majority Interest |

|---|---|---|

| Definition | Ownership of less than 50% of a company's equity. | Ownership of more than 50% of a company's equity. |

| Control | No controlling influence on management decisions. | Full control over corporate governance and strategic decisions. |

| Valuation Impact | Often valued at a discount due to lack of control. | Valued at full control premium. |

| Marketability | Lower liquidity, often harder to sell. | Higher liquidity and easier to transfer ownership. |

| Decision Rights | Limited voting rights. | Majority voting power and decision making. |

| Risk Exposure | Limited ability to influence risk mitigation strategies. | Ability to direct risk management and policies. |

| Financial Reporting | Reported as non-controlling interest in consolidated financials. | Consolidated fully into parent financial statements. |

Understanding Minority and Majority Interests

Minority interest represents a shareholder's ownership stake of less than 50% in a company, lacking control over corporate decisions, whereas majority interest exceeds 50% ownership, granting control and influence over management and strategic direction. Valuation of minority interest often incorporates discounts for lack of control and marketability, reflecting its limited influence compared to majority interest, which is valued at or near full pro-rata equity value. Understanding the distinctions between minority and majority interests is critical for accurate equity valuation, merger and acquisition analysis, and financial reporting.

Key Differences Between Minority and Majority Ownership

Minority interest represents ownership of less than 50% in a company, limiting control and influence over corporate decisions, while majority interest exceeds 50%, granting significant control and decision-making power. Minority owners often face constraints in voting rights and dividend claims compared to majority owners who can shape strategic direction and operational policies. The valuation impact varies as majority interests usually command a control premium, whereas minority interests may include a discount reflecting lack of control.

Valuation Approaches for Minority vs Majority Interests

Valuation approaches for minority interests typically involve discounts for lack of control and marketability, reflecting limited influence on corporate decisions and restricted liquidity. Majority interest valuations often apply control premiums, acknowledging the ability to direct operations, strategic decisions, and access to cash flows. Approaches such as the income, market, and asset-based methods are adjusted to incorporate these ownership effects, ensuring accurate representation of economic value for both minority and majority stakes.

Impact of Control on Business Valuation

Majority interest typically commands control over business decisions, directly influencing the company's strategy, financial policies, and operational efficiency, which can result in a premium valuation. Minority interest lacks control rights, often leading to a discount due to limited influence on corporate actions and higher risk exposure. The impact of control manifests in valuation adjustments, reflecting the purchaser's ability to steer the company's direction and unlock value.

Discount for Lack of Control (DLOC) Explained

Discount for Lack of Control (DLOC) reflects the reduced value of minority interest shares compared to majority interest shares due to limited decision-making power and control over company operations. Minority interest lacks the ability to influence strategic decisions, leading to a valuation discount often ranging between 10% and 30%, depending on the company's governance structure and shareholder rights. This discount is critical in valuation methods to accurately represent the economic benefit and risk profile associated with minority stakes versus controlling interests.

Premiums Associated with Majority Interest

Majority interest commands a control premium reflecting the power to influence management decisions, operational strategies, and dividend policies, which is typically absent in minority interest valuations. Minority interest is often discounted due to lack of control and limited ability to affect company outcomes, resulting in distinct valuation differentials. Understanding these premiums is crucial for accurate equity valuation and investment decision-making.

Legal Rights of Minority and Majority Shareholders

Minority shareholders typically possess limited legal rights, often restricted to voting on major corporate changes and accessing basic financial information, without authority to dictate operational decisions. Majority shareholders hold substantial control rights, including the power to appoint directors, influence corporate policies, and approve mergers or acquisitions. Legal frameworks generally protect minority shareholders against oppression and unfair treatment, ensuring certain procedural safeguards and avenues for redress in corporate governance.

Marketability Concerns: Minority vs Majority

Minority interest often faces significant marketability discounts due to limited control and influence over company decisions, resulting in reduced liquidity and fewer exit opportunities for investors. Majority interest, holding controlling stakes, typically enjoys higher marketability and premium valuations driven by decision-making authority and strategic direction capabilities. Marketability concerns in valuation highlight how minority stakes must be adjusted for lack of control and reduced transferability in comparison to majority holdings.

Implications for Mergers and Acquisitions

Minority interest represents a non-controlling stake in a subsidiary, influencing valuation adjustments in mergers and acquisitions by reflected minority rights and potential lack of control premium. Majority interest entails controlling ownership, often commanding a control premium due to decision-making authority, strategic influence, and consolidated financial reporting benefits. Accurate differentiation between minority and majority interests ensures fair valuation, affects negotiation leverage, and impacts post-acquisition integration and financial reporting.

Practical Examples in Minority and Majority Interest Valuation

Minority interest valuation often involves applying discounts for lack of control and marketability, such as a 20-30% discount when valuing a 15% stake in a private company. In contrast, majority interest valuation typically reflects control premiums, as seen in acquisitions where buyers pay 15-25% above market value for a 60-75% ownership to gain decision-making authority. Real-world examples include minority shareholders in family businesses receiving discounts due to limited influence, while majority shareholders leverage their control to enhance the company's value through strategic decisions.

Important Terms

Equity Stake

Equity stake refers to the ownership percentage an investor holds in a company, influencing control rights and profit distribution; minority interest represents an equity stake less than 50%, limiting control and voting power. Majority interest indicates ownership exceeding 50%, granting decision-making authority and consolidated financial statement influence.

Control Premium

Control premium reflects the additional value investors are willing to pay to obtain majority interest, granting decision-making power and strategic control over a company, whereas minority interest lacks such influence and is typically valued lower due to limited voting rights and reduced control over operations. This premium varies based on factors like industry, company performance, and the level of control conferred by majority ownership.

Voting Rights

Voting rights balance minority interest protection with majority interest decision-making power to ensure equitable representation in governance.

Consolidation Accounting

Consolidation accounting requires combining majority interest assets and liabilities fully while recognizing minority interest as the non-controlling shareholder's equity portion in the consolidated financial statements.

Non-controlling Interest

Non-controlling interest represents the equity stake held by minority shareholders in a subsidiary, distinguishing it from majority interest which confers controlling ownership and decision-making power.

Proportional Ownership

Proportional ownership determines the extent of control and financial interest a shareholder holds in a company, where a majority interest typically exceeds 50% ownership, granting significant control and consolidation rights, while a minority interest represents less than 50%, often resulting in limited influence and the recognition of minority interest as a separate line item in consolidated financial statements. Understanding proportional ownership is crucial for accurately reflecting equity interests, voting power, and the allocation of profits or losses between majority and minority shareholders.

Protective Provisions

Protective provisions safeguard minority interest by requiring majority interest approval for critical decisions, ensuring minority shareholders maintain influence in corporate governance.

Drag-along Rights

Drag-along rights enable majority shareholders to compel minority shareholders to join in the sale of a company, ensuring unified exit terms and maximizing transaction value for all parties involved.

Liquidation Preference

Liquidation preference determines the payout hierarchy in a company's exit event, often prioritizing majority interest shareholders over minority interest holders to secure their investment returns.

Board Representation

Board representation typically reflects the proportional ownership of minority and majority interest holders, ensuring decision-making power aligns with equity stakes.

Minority Interest vs Majority Interest Infographic

moneydif.com

moneydif.com