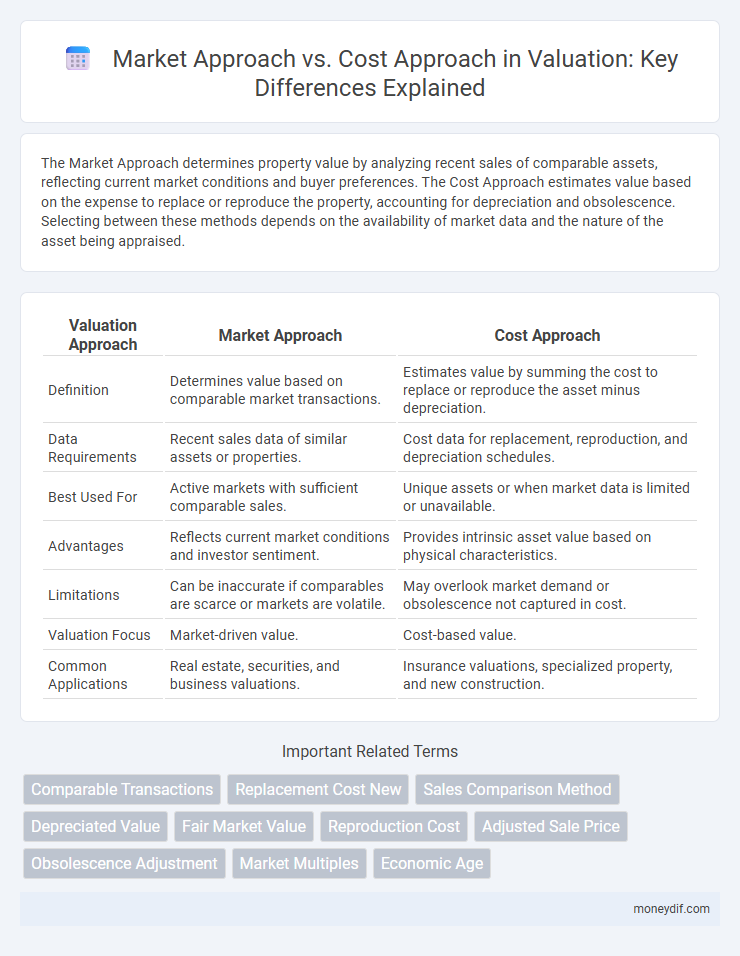

The Market Approach determines property value by analyzing recent sales of comparable assets, reflecting current market conditions and buyer preferences. The Cost Approach estimates value based on the expense to replace or reproduce the property, accounting for depreciation and obsolescence. Selecting between these methods depends on the availability of market data and the nature of the asset being appraised.

Table of Comparison

| Valuation Approach | Market Approach | Cost Approach |

|---|---|---|

| Definition | Determines value based on comparable market transactions. | Estimates value by summing the cost to replace or reproduce the asset minus depreciation. |

| Data Requirements | Recent sales data of similar assets or properties. | Cost data for replacement, reproduction, and depreciation schedules. |

| Best Used For | Active markets with sufficient comparable sales. | Unique assets or when market data is limited or unavailable. |

| Advantages | Reflects current market conditions and investor sentiment. | Provides intrinsic asset value based on physical characteristics. |

| Limitations | Can be inaccurate if comparables are scarce or markets are volatile. | May overlook market demand or obsolescence not captured in cost. |

| Valuation Focus | Market-driven value. | Cost-based value. |

| Common Applications | Real estate, securities, and business valuations. | Insurance valuations, specialized property, and new construction. |

Introduction to Valuation Methods

Market approach relies on analyzing comparable asset sales to estimate value based on current market conditions, reflecting buyer and seller behavior. Cost approach determines value by calculating the expense to replace or reproduce the asset, adjusted for depreciation and obsolescence. Understanding these fundamental valuation methods enables accurate asset assessment, aiding investment decisions and financial reporting.

Understanding the Market Approach

The Market Approach estimates value by comparing the subject asset to similar assets recently sold in the market, emphasizing actual transaction prices and market trends. It relies on robust data sets such as comparable sales, price per unit, and market demand indicators to reflect current economic conditions. This approach offers more reliable valuation by incorporating real market behavior rather than theoretical cost estimations.

How the Cost Approach Works

The Cost Approach determines property value by calculating the current cost to replace or reproduce the asset, minus depreciation. This method is particularly effective for unique or new properties with limited market comparables. It integrates direct construction costs, indirect fees, and physical depreciation to estimate a realistic value grounded in tangible expenditures.

Key Differences Between Market and Cost Approaches

The key differences between the Market Approach and Cost Approach in valuation lie in their fundamental methodologies: the Market Approach estimates value based on comparable sales data and current market conditions, reflecting what buyers are willing to pay. In contrast, the Cost Approach calculates value by summing the land value and the depreciated cost of improvements, focusing on the replacement or reproduction cost. Market Approach is preferred for assets with active market transactions, while Cost Approach is useful for unique or specialized properties lacking direct comparables.

Advantages of the Market Approach

The Market Approach offers valuation advantages by reflecting current market conditions and investor sentiment through comparable sales data, ensuring relevance and accuracy. It provides a straightforward and transparent method that is easily understood by stakeholders, enhancing credibility in negotiations. This approach also adapts quickly to market fluctuations, making it ideal for valuing assets with active, observable markets.

Benefits of the Cost Approach

The Cost Approach provides a highly reliable valuation by calculating the replacement or reproduction cost of an asset minus depreciation, offering a clear benchmark for unique or specialized properties. It benefits stakeholders by minimizing market volatility influence, making it ideal for properties with limited market data or recent improvements. This approach ensures precise asset valuation by emphasizing physical asset conditions and construction costs.

Limitations of the Market Approach

The Market Approach in valuation is limited by the availability and relevance of comparable sales data, which can be scarce or outdated in unique or specialized markets. Price fluctuations and market volatility may distort comparability, leading to less reliable estimates. This approach often struggles to account for property-specific factors and intangible assets that significantly affect value.

Drawbacks of the Cost Approach

The Cost Approach often undervalues properties due to its inability to account for market demand and income potential, leading to less accurate valuations. It struggles to reflect depreciation accurately, especially in older or specialized properties with unique features. This approach may also overlook external factors like location and economic conditions, limiting its reliability in dynamic real estate markets.

Choosing the Right Approach for Accurate Valuation

Selecting the right valuation approach depends on the asset type and market conditions; the Market Approach leverages comparable sales data for assets with active markets, ensuring relevance and accuracy. For unique or specialized assets lacking sufficient market comparables, the Cost Approach estimates value based on replacement or reproduction costs, accounting for depreciation. An accurate valuation integrates the approach that best reflects the asset's economic characteristics and available data, enhancing reliability for investment or financial reporting.

Market Approach vs Cost Approach: Which to Use?

The Market Approach leverages comparable sales data to determine value, making it ideal for properties with active, similar markets. The Cost Approach calculates value based on the replacement cost minus depreciation, best suited for unique or new properties lacking sufficient market data. Choosing between these methods depends on property type, availability of market data, and the purpose of the valuation.

Important Terms

Comparable Transactions

Comparable Transactions in the Market Approach analyze recent sales of similar assets or businesses to estimate value based on real market data, reflecting current supply and demand conditions. In contrast, the Cost Approach determines value by calculating the replacement or reproduction cost of an asset minus depreciation, focusing on the intrinsic economic cost rather than market trends.

Replacement Cost New

Replacement Cost New measures the expense to replace an asset with a new one at current prices, serving as a key valuation input in the Cost Approach compared to the Market Approach which relies on comparable sales data.

Sales Comparison Method

The Sales Comparison Method, a core technique within the Market Approach, estimates property value by analyzing recent sales of similar properties, emphasizing market-driven data for precise valuation. This contrasts with the Cost Approach, which calculates value based on the cost to replace or reproduce the asset, focusing on construction expenses rather than market activity.

Depreciated Value

Depreciated value calculated using the Market Approach reflects current comparable sales adjusted for asset age and condition, while the Cost Approach estimates depreciated value based on original cost minus accumulated depreciation and obsolescence.

Fair Market Value

Fair Market Value is best estimated using the Market Approach when there is sufficient comparable sales data, reflecting the price informed buyers and sellers agree upon in an open market. The Cost Approach, focusing on the cost to replace or reproduce an asset minus depreciation, is preferred for unique or specialized properties lacking active market comparables.

Reproduction Cost

Reproduction cost in the Market Approach is estimated by comparing similar assets' market prices, while in the Cost Approach, it is calculated based on the current expenses to recreate the asset exactly.

Adjusted Sale Price

Adjusted Sale Price reflects modifications in comparable property transactions to align with the subject property's characteristics, playing a crucial role in the Market Approach by enhancing price accuracy based on actual sales data. In contrast, the Cost Approach relies on replacement or reproduction costs minus depreciation, where Adjusted Sale Price is less relevant, emphasizing construction expenses and asset wear instead of market-derived pricing.

Obsolescence Adjustment

Obsolescence adjustment in valuation is critical, with the Market Approach reflecting current demand-based depreciation while the Cost Approach accounts for inherent asset deterioration and functional or economic obsolescence.

Market Multiples

Market multiples in the Market Approach use comparable company data to estimate value, whereas the Cost Approach relies on the asset's replacement or reproduction costs to determine value.

Economic Age

The Economic Age significantly influences property valuation by emphasizing current market trends in the Market Approach while relying on historical depreciation and replacement costs in the Cost Approach.

Market Approach vs Cost Approach Infographic

moneydif.com

moneydif.com