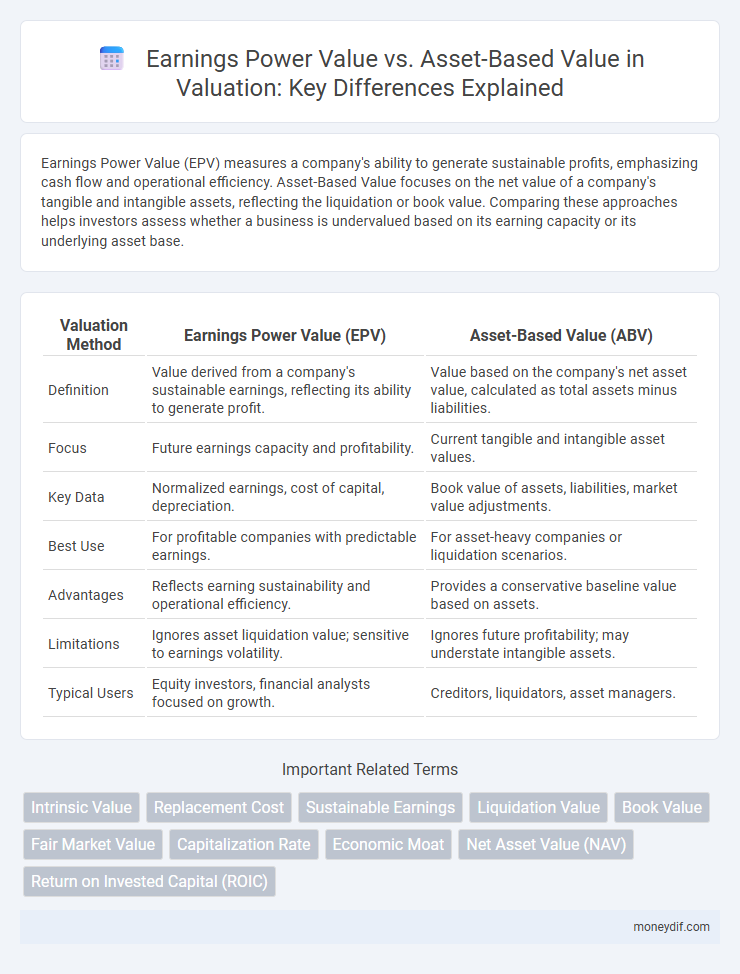

Earnings Power Value (EPV) measures a company's ability to generate sustainable profits, emphasizing cash flow and operational efficiency. Asset-Based Value focuses on the net value of a company's tangible and intangible assets, reflecting the liquidation or book value. Comparing these approaches helps investors assess whether a business is undervalued based on its earning capacity or its underlying asset base.

Table of Comparison

| Valuation Method | Earnings Power Value (EPV) | Asset-Based Value (ABV) |

|---|---|---|

| Definition | Value derived from a company's sustainable earnings, reflecting its ability to generate profit. | Value based on the company's net asset value, calculated as total assets minus liabilities. |

| Focus | Future earnings capacity and profitability. | Current tangible and intangible asset values. |

| Key Data | Normalized earnings, cost of capital, depreciation. | Book value of assets, liabilities, market value adjustments. |

| Best Use | For profitable companies with predictable earnings. | For asset-heavy companies or liquidation scenarios. |

| Advantages | Reflects earning sustainability and operational efficiency. | Provides a conservative baseline value based on assets. |

| Limitations | Ignores asset liquidation value; sensitive to earnings volatility. | Ignores future profitability; may understate intangible assets. |

| Typical Users | Equity investors, financial analysts focused on growth. | Creditors, liquidators, asset managers. |

Introduction to Valuation Approaches

Earnings Power Value (EPV) emphasizes a company's ability to generate sustainable profits by normalizing earnings and adjusting for economic risks, making it ideal for businesses with stable cash flows. Asset-Based Value (ABV) calculates value based on net asset holdings, focusing on tangible and intangible assets, which suits firms with significant physical or financial assets but limited earnings history. Selecting between EPV and ABV depends on the business model, industry stability, and the quality of earnings versus asset reliability.

Defining Earnings Power Value (EPV)

Earnings Power Value (EPV) represents a company's sustainable profit potential by capitalizing normalized earnings without factoring in future growth. It reflects the ongoing cash flow a business can generate under stable operating conditions, emphasizing operational performance over asset liquidation. EPV provides a clearer picture of intrinsic value by focusing on profit-generating ability rather than just the book value of assets.

Understanding Asset-Based Value

Asset-Based Value calculates a company's worth by summing the market value of its tangible and intangible assets minus liabilities, providing a snapshot grounded in the balance sheet. This approach is especially useful for asset-intensive firms or businesses facing liquidation, as it reflects the intrinsic value of physical and financial holdings independent of future earning potential. Understanding Asset-Based Value helps investors assess downside risk and the baseline value supporting a company's market price.

Key Differences Between EPV and Asset-Based Value

Earnings Power Value (EPV) focuses on a company's ability to generate sustainable profits derived from its core operations, emphasizing normalized earnings and operational efficiency. In contrast, Asset-Based Value centers on the net book value or liquidation value of a company's tangible and intangible assets, highlighting the firm's balance sheet strength. Key differences include EPV's forward-looking income approach versus the static, historical-cost perspective of Asset-Based Value, making EPV more suitable for ongoing businesses and Asset-Based Value more relevant for companies facing liquidation or asset restructuring.

When to Use Earnings Power Value

Earnings Power Value (EPV) is preferred for companies with stable and predictable earnings, as it reflects the sustainable income potential excluding growth and one-time events. EPV is ideal when the focus is on cash flow generation rather than asset liquidation, making it suitable for service-oriented or intangible asset-heavy businesses. Use EPV in industries with consistent profitability and minimal asset write-down risks, ensuring valuation aligns with ongoing operational performance.

Situations Favoring Asset-Based Valuation

Asset-based valuation is favored in situations where a company has significant tangible assets and limited earnings potential, such as holding companies or businesses facing financial distress. This method provides a clear picture of the liquidation value by emphasizing net asset value rather than future earnings. It is particularly useful for firms with inconsistent cash flows or in industries with rapidly depreciating intangible assets.

Calculating Earnings Power Value: Step-by-Step

Calculating Earnings Power Value (EPV) involves normalizing earnings by adjusting for non-recurring items and sustainable earnings levels, then capitalizing these earnings using the weighted average cost of capital (WACC) or the cost of equity. Begin by determining adjusted operating income or EBITDA to reflect ongoing profitability, subtract normalized taxes to achieve net operating profit after tax (NOPAT), and divide by the appropriate capitalization rate. This method emphasizes future earning capacity over book value, contrasting asset-based valuation that focuses on net tangible asset value.

Calculating Asset-Based Value: Step-by-Step

Calculating Asset-Based Value involves summing the fair market value of a company's tangible and intangible assets and subtracting its liabilities to determine net asset value. Begin by identifying all assets on the balance sheet, including fixed assets like property and equipment, current assets such as inventory and receivables, and intangible assets like patents or trademarks. Adjust asset values to their current market price rather than book value, then deduct total liabilities to obtain the precise asset-based valuation.

Pros and Cons of Each Valuation Method

Earnings Power Value (EPV) provides a forward-looking measure based on the company's sustainable earnings, making it ideal for businesses with strong profit generation and growth potential, but it can be less reliable in volatile industries or during economic downturns. Asset-Based Value (ABV) calculates the company's net asset value by subtracting liabilities from total assets, offering a tangible floor valuation useful for asset-heavy or distressed companies, but it may undervalue firms with significant intangible assets or strong earning power. Both methods serve different purposes; EPV emphasizes operational profitability while ABV focuses on balance sheet strength, requiring investors to choose based on business nature and valuation goals.

Choosing the Right Approach for Your Business

Choosing the right valuation approach depends on the nature of your business and its financial characteristics. Earnings Power Value (EPV) suits companies with stable, sustainable earnings, emphasizing cash flow generation and profitability. Asset-Based Value is more appropriate for asset-intensive businesses, focusing on the net asset value recorded on the balance sheet and providing a liquidation perspective.

Important Terms

Intrinsic Value

Intrinsic value reflects a company's true worth based on fundamental analysis, often assessed through Earnings Power Value (EPV) which measures sustainable operating earnings adjusted for maintenance capital expenditures. Asset-Based Value evaluates intrinsic value by summing the fair market value of a company's net assets, emphasizing tangible holdings rather than ongoing earning capacity.

Replacement Cost

Replacement cost underestimates a company's true worth when Earnings Power Value exceeds Asset-Based Value by capturing ongoing operational profitability rather than mere asset reproduction expenses.

Sustainable Earnings

Sustainable earnings reflect a company's true Earnings Power Value by emphasizing consistent profit generation, which often provides a more accurate valuation than asset-based value that relies solely on the company's book assets.

Liquidation Value

Liquidation value represents the net cash a company can realize if its assets are sold immediately, often lower than earnings power value, which reflects ongoing profitability, and asset-based value, which accounts for the fair market value of all assets minus liabilities.

Book Value

Earnings Power Value reflects a company's sustainable profit potential while Asset-Based Value measures its net asset worth, both providing different perspectives compared to traditional Book Value.

Fair Market Value

Fair Market Value often balances the insights from Earnings Power Value, which assesses a company's sustainable profit-generating ability, and Asset-Based Value, which calculates worth based on net asset holdings. Understanding these valuations aids investors in determining accurate pricing by reflecting both operational efficiency and tangible asset strength.

Capitalization Rate

Capitalization Rate reflects the relationship between a property's Net Operating Income (NOI) and its Market Value, serving as a critical metric when comparing Earnings Power Value (EPV) and Asset-Based Value (ABV). While EPV emphasizes the income-generating potential measured by NOI divided by Cap Rate, ABV focuses on the underlying asset's book or replacement cost, making Cap Rate central to valuing income-producing assets versus their tangible asset values.

Economic Moat

Economic Moat refers to a company's sustainable competitive advantages that protect its Earnings Power Value (EPV) from competitors and market fluctuations, allowing persistent above-average profitability. While EPV focuses on the firm's normalized earnings capacity, Asset-Based Value emphasizes the company's tangible and intangible asset worth, with a strong moat typically enhancing EPV beyond the book value of its assets.

Net Asset Value (NAV)

Net Asset Value (NAV) measures a company's total assets minus liabilities, serving as a foundation for comparing Earnings Power Value, which focuses on sustainable operating income, against Asset-Based Value, emphasizing the liquidation worth of assets.

Return on Invested Capital (ROIC)

Return on Invested Capital (ROIC) measures a company's efficiency in generating earnings from invested capital, directly influencing Earnings Power Value by reflecting operational profitability, whereas Asset-Based Value emphasizes the company's net asset worth regardless of operational performance.

Earnings Power Value vs Asset-Based Value Infographic

moneydif.com

moneydif.com