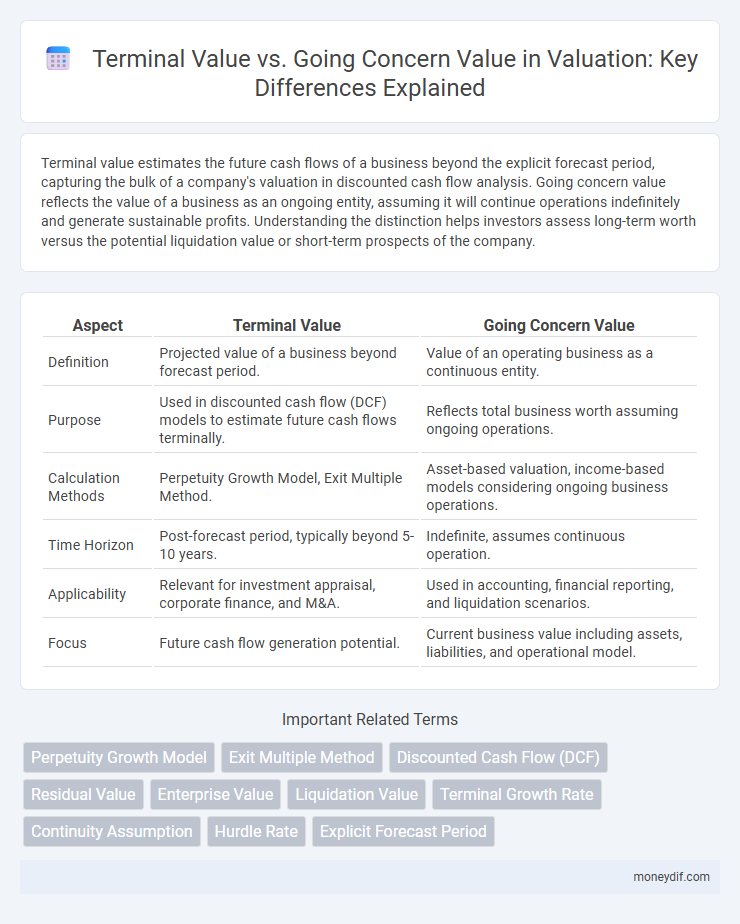

Terminal value estimates the future cash flows of a business beyond the explicit forecast period, capturing the bulk of a company's valuation in discounted cash flow analysis. Going concern value reflects the value of a business as an ongoing entity, assuming it will continue operations indefinitely and generate sustainable profits. Understanding the distinction helps investors assess long-term worth versus the potential liquidation value or short-term prospects of the company.

Table of Comparison

| Aspect | Terminal Value | Going Concern Value |

|---|---|---|

| Definition | Projected value of a business beyond forecast period. | Value of an operating business as a continuous entity. |

| Purpose | Used in discounted cash flow (DCF) models to estimate future cash flows terminally. | Reflects total business worth assuming ongoing operations. |

| Calculation Methods | Perpetuity Growth Model, Exit Multiple Method. | Asset-based valuation, income-based models considering ongoing business operations. |

| Time Horizon | Post-forecast period, typically beyond 5-10 years. | Indefinite, assumes continuous operation. |

| Applicability | Relevant for investment appraisal, corporate finance, and M&A. | Used in accounting, financial reporting, and liquidation scenarios. |

| Focus | Future cash flow generation potential. | Current business value including assets, liabilities, and operational model. |

Introduction to Terminal Value and Going Concern Value

Terminal value represents the estimated value of a business beyond the forecast period, capturing the bulk of its future cash flows in valuation models. Going concern value reflects the total worth of a company assuming it will continue operating indefinitely, incorporating both tangible and intangible assets. Understanding the distinction between terminal value and going concern value is crucial for accurate enterprise valuation and investment decision-making.

Defining Terminal Value

Terminal Value represents the estimated value of a business beyond the explicit forecast period, capturing the present value of all future cash flows in perpetuity. It is a critical component in discounted cash flow (DCF) valuation models, often calculated using the Gordon Growth Model or Exit Multiple Method. Unlike Going Concern Value, which reflects the overall ongoing worth, Terminal Value specifically isolates the business's long-term sustainability post-forecast horizon.

Understanding Going Concern Value

Going Concern Value represents the total worth of a business assuming it continues operations indefinitely, reflecting assets, liabilities, and expected future cash flows beyond a specific forecast period. It contrasts with Terminal Value, which estimates the business's value at the end of a projection horizon, often based on assumptions of steady growth or liquidation. Understanding Going Concern Value is crucial for investors and analysts to assess the ongoing operational profitability and long-term sustainability of a company.

Key Differences Between Terminal Value and Going Concern Value

Terminal Value represents the estimated value of a business's cash flows beyond a specific forecast period, often calculated using the perpetuity growth or exit multiple methods. Going Concern Value reflects the total value of a business as an ongoing entity, integrating both tangible and intangible assets as well as anticipated operational profitability. Key differences include Terminal Value's focus on future cash flows post-projection horizon, while Going Concern Value encompasses the entire firm's worth based on its current operational status.

Methods for Calculating Terminal Value

Terminal value in valuation often relies on two primary methods: the perpetual growth model and the exit multiple method. The perpetual growth model estimates terminal value by projecting free cash flows to grow at a constant rate indefinitely, while the exit multiple method applies an industry-standard multiple to a financial metric like EBITDA at the end of the forecast period. Both methods capture the continuing value of a business beyond the explicit forecast horizon, essential in discounted cash flow (DCF) analysis.

Approaches to Assessing Going Concern Value

Approaches to assessing Going Concern Value primarily include the income approach, market approach, and asset-based approach, each reflecting different perspectives on a business's ongoing operational worth. The income approach projects future cash flows discounted to present value, emphasizing sustainable profitability and growth potential. The market approach compares similar ongoing businesses or transactions, while the asset-based approach adjusts total assets and liabilities to reflect true operating value beyond liquidation or terminal values.

Strategic Importance in Business Valuation

Terminal Value represents the projected value of a business at the end of the forecast period, capturing future cash flows beyond explicit projections, while Going Concern Value reflects the ongoing operations and intrinsic worth of the business as a functioning entity. Strategic importance lies in aligning Terminal Value assumptions with realistic growth prospects and market conditions to accurately reflect long-term viability. Proper differentiation enhances valuation accuracy, supporting critical investment, merger, and acquisition decisions.

Common Mistakes with Terminal and Going Concern Value

Common mistakes in terminal value and going concern value calculations often stem from using overly optimistic or arbitrary growth rates, leading to inflated valuations. Ignoring market dynamics, such as competitive pressures and economic cycles, results in unrealistic projections for perpetuity values. Failing to align discount rates and growth assumptions with the company's risk profile and industry context undermines the credibility of both terminal and going concern value estimates.

Real-World Examples: Terminal Value vs Going Concern Value

Terminal value often captures the projected cash flows beyond a forecast period, as seen in valuing tech startups with high growth but uncertain long-term profits. Going concern value reflects the business's overall worth based on its ability to continue operations, exemplified by manufacturing companies with stable, ongoing cash flows. Real-world examples highlight terminal value's role in venture capital, while going concern value is crucial in traditional industries with steady income streams.

Choosing the Right Approach for Business Valuation

Terminal Value captures the business's value at the end of a forecast period, emphasizing future cash flows beyond projected years, while Going Concern Value assesses the ongoing, operational worth based on current assets and profitability. Selecting the appropriate approach depends on factors such as the business lifecycle stage, industry stability, and cash flow predictability. Accurate valuation requires aligning the method with the company's growth prospects and financial health to reflect true economic value.

Important Terms

Perpetuity Growth Model

The Perpetuity Growth Model calculates Terminal Value by estimating the present value of infinite future cash flows growing at a constant rate, which differs from Going Concern Value that reflects the overall valuation of an ongoing business including all operational assets and liabilities.

Exit Multiple Method

The Exit Multiple Method calculates Terminal Value by applying a chosen industry multiple to the projected financial metric, providing a market-based estimate of Going Concern Value for a company's ongoing operations.

Discounted Cash Flow (DCF)

The Discounted Cash Flow (DCF) method calculates Terminal Value by estimating the perpetual cash flows beyond the forecast period, reflecting the enterprise's ongoing viability, while the Going Concern Value represents the total present value of all expected future cash flows including both the forecast period and terminal phase. Terminal Value often constitutes the largest portion of the DCF valuation, emphasizing the importance of accurate growth rate assumptions and discount rates to distinguish sustainable business operations from liquidation or cessation scenarios.

Residual Value

Residual value represents the estimated worth of an asset at the end of its useful life, serving as a key component in terminal value calculations that project future cash flows beyond a forecast period. Terminal value contrasts with going concern value by focusing on asset-specific or project-specific valuation, while going concern value reflects the business's overall ability to generate sustainable earnings indefinitely.

Enterprise Value

Enterprise Value incorporates Terminal Value as a critical component in discounted cash flow analysis, representing the present value of a company's future cash flows beyond the forecast period, whereas Going Concern Value reflects the total worth of a business based on its ongoing operations and ability to generate profits indefinitely.

Liquidation Value

Liquidation value represents the estimated amount obtainable if assets are sold individually, typically lower than terminal value, which assumes a going concern's continuation and reflects the business's sustainable future cash flows.

Terminal Growth Rate

Terminal Growth Rate significantly influences Terminal Value by projecting perpetual cash flow increases beyond the forecast period, distinguishing it from the Going Concern Value which encompasses total operational value including short-term earnings and asset utility. Accurate estimation of Terminal Growth Rate ensures Terminal Value reflects sustainable growth expectations, critical for long-term valuation in discounted cash flow models.

Continuity Assumption

The Continuity Assumption ensures that terminal value projections accurately reflect a company's going concern value by presuming ongoing operational viability beyond the forecast period.

Hurdle Rate

Hurdle rate determines the minimum acceptable return used to discount Terminal Value and Going Concern Value in valuation models, influencing investment decisions by reflecting risk and expected profitability.

Explicit Forecast Period

The explicit forecast period defines the timeframe during which cash flows are projected in detail, directly impacting the accuracy of terminal value calculations by reducing uncertainty. Terminal value estimates the going concern value beyond this period, capturing all subsequent cash flows and often constituting the majority of a company's total valuation in discounted cash flow (DCF) analysis.

Terminal Value vs Going Concern Value Infographic

moneydif.com

moneydif.com