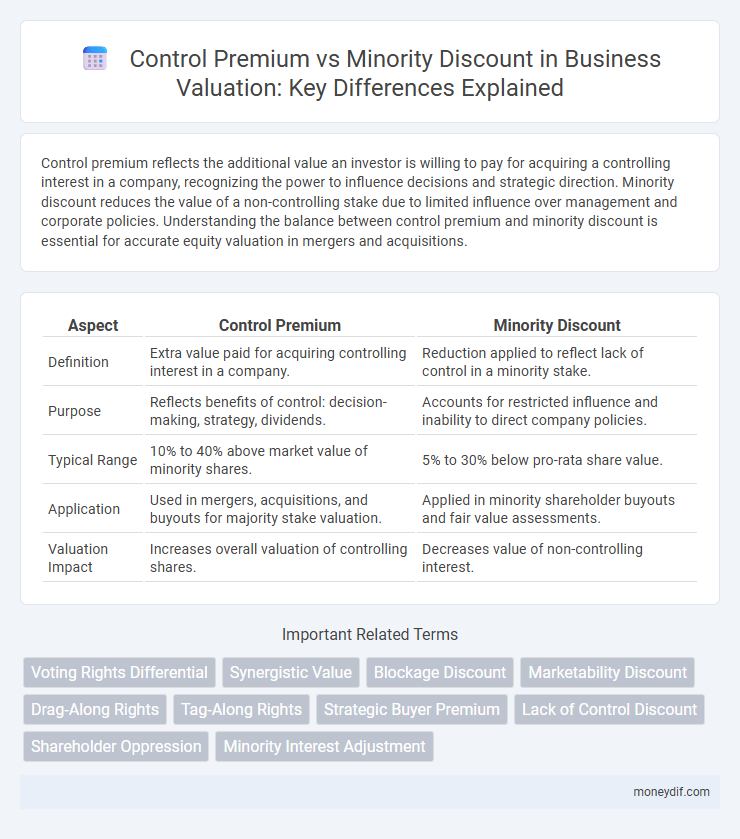

Control premium reflects the additional value an investor is willing to pay for acquiring a controlling interest in a company, recognizing the power to influence decisions and strategic direction. Minority discount reduces the value of a non-controlling stake due to limited influence over management and corporate policies. Understanding the balance between control premium and minority discount is essential for accurate equity valuation in mergers and acquisitions.

Table of Comparison

| Aspect | Control Premium | Minority Discount |

|---|---|---|

| Definition | Extra value paid for acquiring controlling interest in a company. | Reduction applied to reflect lack of control in a minority stake. |

| Purpose | Reflects benefits of control: decision-making, strategy, dividends. | Accounts for restricted influence and inability to direct company policies. |

| Typical Range | 10% to 40% above market value of minority shares. | 5% to 30% below pro-rata share value. |

| Application | Used in mergers, acquisitions, and buyouts for majority stake valuation. | Applied in minority shareholder buyouts and fair value assessments. |

| Valuation Impact | Increases overall valuation of controlling shares. | Decreases value of non-controlling interest. |

Understanding Control Premium in Valuation

Control premium in valuation represents the additional value investors are willing to pay to acquire a controlling interest in a company, reflecting the power to influence strategic decisions, operations, and distributions. This premium often ranges from 20% to 40%, depending on factors such as industry conditions, company performance, and acquisition motivations. Understanding control premium is essential for accurate valuation as it differentiates the price of controlling shares from that of minority interests, which often trade at a discount due to limited influence.

What Is a Minority Discount?

A minority discount reflects the reduction in value applied to a minority ownership interest in a company due to the lack of control over business decisions and limited influence on management. This discount quantifies the decreased marketability and voting power compared to majority shares, often ranging from 10% to 30%. Minority discounts are critical in valuation assessments for mergers, acquisitions, and shareholder disputes where ownership stakes do not confer controlling rights.

Key Differences: Control Premium vs Minority Discount

Control premium reflects the additional value an acquirer is willing to pay for a controlling interest in a company, capturing benefits like decision-making power and strategic influence. Minority discount, conversely, reduces the value of a non-controlling interest due to lack of control and limited ability to influence corporate decisions. Key differences include ownership rights, control benefits, and transferability restrictions, which significantly impact valuation adjustments.

Factors Influencing Control Premium

Control premium is influenced by factors such as the strategic value of control, the ability to implement decisions, and synergy potential in mergers and acquisitions. Market conditions, regulatory environment, and the financial health of the target company also impact control premium valuation. The size of the block of shares and the degree of existing shareholder influence play critical roles in determining the magnitude of the control premium.

Determinants of Minority Discount

The determinants of minority discount primarily include the lack of control rights, limited influence over company decisions, and reduced access to critical information compared to controlling shareholders. Marketability constraints and potential conflicts of interest between majority and minority stakeholders further deepen this discount. These factors collectively diminish the perceived value of minority stakes during valuation.

Application in Mergers and Acquisitions

Control premiums reflect the added value acquirers are willing to pay for obtaining majority control, enabling strategic decision-making and operational changes in mergers and acquisitions. Minority discounts represent the reduced value assigned to non-controlling stakes due to limited influence over company policies and dividend distributions. Applying these valuation adjustments ensures accurate pricing and fair negotiation outcomes during transactional processes in M&A deals.

Methods to Calculate Control Premium

Methods to calculate control premium include the guideline public company method, which compares the control company's stock price to minority interest companies, and the merger and acquisition method, analyzing premiums paid in recent transactions. The discounted cash flow (DCF) method also estimates control premium by reflecting enhanced cash flow potentials under control. Market data adjustments and statistical regression models are frequently used to refine control premium estimations.

Minority Discount Calculation Techniques

Minority discount calculation techniques often involve quantitative methods such as the discounted cash flow (DCF) analysis adjusted for lack of control and marketability, or the comparable company analysis applying observed discounts in similar minority interest transactions. Empirical studies indicate that minority discounts typically range from 20% to 40%, reflecting the diminished influence over business decisions and dividend distributions. Precise minority discount determination incorporates factors like voting rights, market liquidity, and strategic significance, ensuring accurate reflection of minority shareholders' valuation impact.

Real-World Case Studies and Examples

Control premium represents the additional value paid by acquirers to obtain controlling interest in a company, often justified by enhanced decision-making power and strategic benefits. Minority discounts reflect the reduced value of non-controlling stakes due to limited influence over corporate policies, as seen in real-world cases like the acquisition of Heinz by Berkshire Hathaway, where control premiums ranged from 20% to 30%. Empirical studies highlight how industry-specific factors and transaction contexts influence the magnitude of these premiums and discounts, with technology sector deals exhibiting higher control premiums compared to traditional manufacturing.

Impact on Business Valuation Decisions

Control Premium reflects the added value investors assign for acquiring a controlling interest, often resulting in a higher business valuation. Minority Discount captures the reduced worth attributed to non-controlling stakes due to limited influence over decisions and strategic direction. These contrasting adjustments significantly impact valuation models, shaping acquisition strategies, negotiation leverage, and final transaction pricing.

Important Terms

Voting Rights Differential

Voting rights differential significantly influences the control premium and minority discount by determining the economic value gap between controlling and non-controlling equity interests.

Synergistic Value

Synergistic value emerges when the combined entity's worth exceeds the sum of its individual parts, often justifying a control premium paid during acquisitions to obtain decision-making authority. Conversely, minority discounts reflect the reduced value of non-controlling interests due to limited influence, highlighting the inverse relationship between control premiums and minority discounts in valuation scenarios.

Blockage Discount

Blockage discounts reflect price reductions applied to large block sales of securities due to limited market liquidity, contrasting with control premiums that increase value for majority stakes and minority discounts that decrease value for non-controlling interests.

Marketability Discount

Marketability discount reduces the value of minority shares due to lack of control and limited liquidity, contrasting with control premiums that increase value for controlling interests.

Drag-Along Rights

Drag-along rights protect majority shareholders by enabling them to compel minority shareholders to join in the sale of a company, ensuring a smoother transaction often linked to capturing a control premium. This mechanism effectively mitigates the minority discount by aligning minority shareholder interests with those of the controlling party during exit events.

Tag-Along Rights

Tag-along rights protect minority shareholders by allowing them to join a sale of shares at the same control premium price enjoyed by majority shareholders, mitigating the risks typically associated with minority discounts.

Strategic Buyer Premium

Strategic Buyer Premium typically reflects a higher valuation paid by acquirers seeking control, exceeding the Control Premium that compensates for management influence, and contrasts with the Minority Discount applied to non-controlling interest valuations. This premium captures synergies, operational efficiencies, and the ability to influence key decisions, distinguishing it from minority stakes that lack these control benefits.

Lack of Control Discount

The Lack of Control Discount reflects a reduction in value applied to minority ownership interests due to their inability to influence company decisions, contrasting with the Control Premium which represents the added value attributed to ownership stakes that confer operational control. This discount is often factored in valuation models when assessing minority shares, balancing against the Control Premium that compensates for the benefits and decision-making power held by majority shareholders.

Shareholder Oppression

Shareholder oppression often arises when majority shareholders exercise control that diminishes the value of minority holdings, highlighting the conflict between control premium and minority discount in valuation. Control premium reflects the added value of controlling interest, while minority discount accounts for lack of control and marketability, both crucial in legal disputes over fair equity valuation.

Minority Interest Adjustment

Minority Interest Adjustment accounts for the value discount applied to non-controlling stakes in valuation, reflecting the Minority Discount which contrasts with the Control Premium assigned to majority interests; this adjustment ensures accurate representation of ownership value in financial statements by recognizing the diminished influence of minority shareholders. The balance between Control Premium and Minority Discount is critical in mergers and acquisitions, impacting the purchase price allocation and stakeholder equity assessments.

Control Premium vs Minority Discount Infographic

moneydif.com

moneydif.com