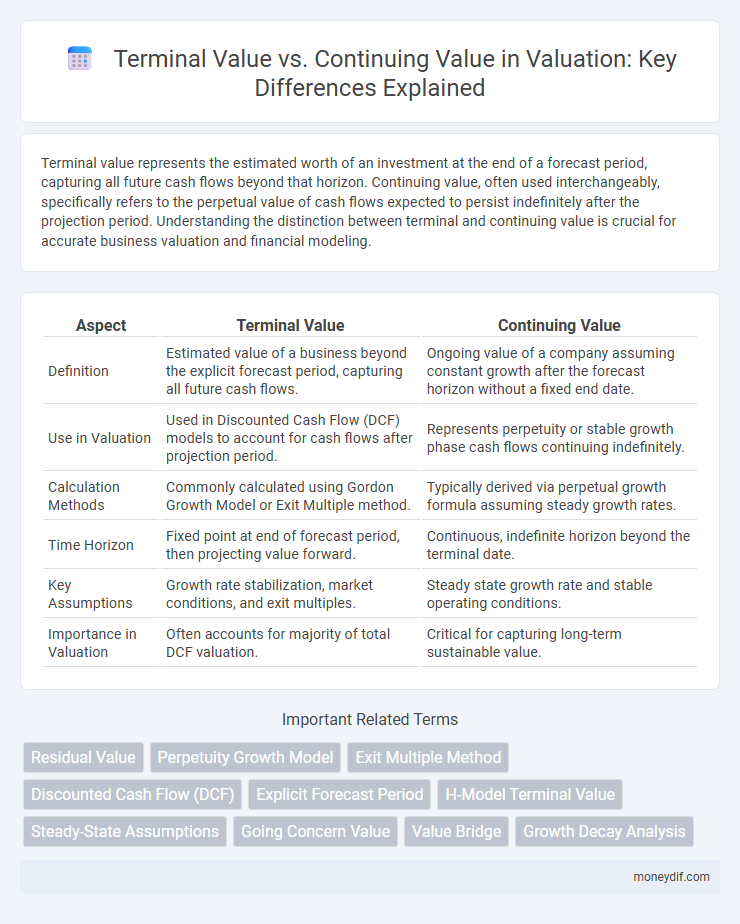

Terminal value represents the estimated worth of an investment at the end of a forecast period, capturing all future cash flows beyond that horizon. Continuing value, often used interchangeably, specifically refers to the perpetual value of cash flows expected to persist indefinitely after the projection period. Understanding the distinction between terminal and continuing value is crucial for accurate business valuation and financial modeling.

Table of Comparison

| Aspect | Terminal Value | Continuing Value |

|---|---|---|

| Definition | Estimated value of a business beyond the explicit forecast period, capturing all future cash flows. | Ongoing value of a company assuming constant growth after the forecast horizon without a fixed end date. |

| Use in Valuation | Used in Discounted Cash Flow (DCF) models to account for cash flows after projection period. | Represents perpetuity or stable growth phase cash flows continuing indefinitely. |

| Calculation Methods | Commonly calculated using Gordon Growth Model or Exit Multiple method. | Typically derived via perpetual growth formula assuming steady growth rates. |

| Time Horizon | Fixed point at end of forecast period, then projecting value forward. | Continuous, indefinite horizon beyond the terminal date. |

| Key Assumptions | Growth rate stabilization, market conditions, and exit multiples. | Steady state growth rate and stable operating conditions. |

| Importance in Valuation | Often accounts for majority of total DCF valuation. | Critical for capturing long-term sustainable value. |

Introduction to Terminal Value and Continuing Value

Terminal Value represents the estimated value of a business or project beyond the explicit forecast period, capturing future cash flows in perpetuity. Continuing Value is a component of Terminal Value, often calculated using the Gordon Growth Model, reflecting the ongoing value assuming a stable growth rate. Both metrics play a crucial role in discounted cash flow (DCF) analysis to assess long-term investment worth.

Key Concepts: Terminal Value and Continuing Value Defined

Terminal value represents the estimated value of a business or asset beyond the explicit forecast period, capturing the bulk of future cash flows in a discounted cash flow (DCF) analysis. Continuing value, often used interchangeably with terminal value, specifically refers to the value assuming the business continues its operations indefinitely at a stable growth rate. Both concepts are crucial in valuation as they account for the substantial portion of total value that occurs after the detailed projection horizon.

Why Terminal Value Matters in Valuation

Terminal value captures the bulk of a company's valuation by estimating future cash flows beyond the forecast period, reflecting long-term growth potential. It simplifies complex financial models by aggregating infinite projections into a single, present value figure, providing investors a comprehensive understanding of a company's worth. Accurate terminal value calculation is crucial as it significantly impacts investment decisions, mergers and acquisitions, and overall valuation reliability.

The Role of Continuing Value in Business Valuation

Continuing value represents the present worth of all future cash flows beyond a specific projection period in business valuation, capturing long-term sustainability and growth. It plays a critical role by providing a comprehensive estimate of a business's worth after explicit forecast horizons, often constituting the largest portion of total valuation. Accurate calculation of continuing value ensures realistic assessment of ongoing operational performance and strategic potential.

Calculation Methods for Terminal Value

Terminal Value calculation methods primarily include the Perpetuity Growth Model and the Exit Multiple Method, both integral in estimating a business's value beyond explicit forecast periods. The Perpetuity Growth Model derives terminal value by projecting a constant growth rate in free cash flows, typically linked to the long-term economic growth rate or inflation. The Exit Multiple Method calculates terminal value by applying an industry-relevant valuation multiple, such as EV/EBITDA, to the company's financial metric in the final forecast year.

Approaches to Estimating Continuing Value

Approaches to estimating continuing value in valuation primarily include the Perpetuity Growth Model and the Exit Multiple Method. The Perpetuity Growth Model calculates continuing value by assuming free cash flows grow at a constant rate indefinitely, incorporating the discount rate and growth rate into the formula. The Exit Multiple Method estimates continuing value by applying an industry-related multiple, such as EBITDA or revenue multiples, to projected financial metrics at the end of the forecast period.

Terminal Value vs Continuing Value: Key Differences

Terminal value represents the present value of all future cash flows beyond the explicit forecast period, commonly used in discounted cash flow (DCF) valuation to capture a company's perpetuity growth potential. Continuing value often refers to the value of ongoing operations assuming a stable growth rate after the forecast horizon but can sometimes be used interchangeably with terminal value, depending on context. Key differences lie in scope and application: terminal value specifically concludes the valuation horizon, while continuing value emphasizes perpetual stability in earnings or cash flows.

Common Mistakes in Estimating Terminal and Continuing Values

Common mistakes in estimating Terminal Value include assuming perpetual growth rates that exceed economic or industry norms, leading to inflated valuation outcomes. Continuing Value errors often involve neglecting cash flow variability and discount rate adjustments over long-term horizons, which reduces accuracy. Failure to differentiate between stable growth phases and terminal periods may result in misrepresentation of a company's sustainable value.

Practical Examples: Terminal Value and Continuing Value in Action

Terminal Value represents the present value of all future cash flows beyond a projection period, commonly estimated using the Gordon Growth Model or Exit Multiple approach. In practical valuation, Terminal Value often accounts for more than 50% of the total enterprise value, highlighting its critical impact on investment decisions. Continuing Value, a subset of Terminal Value, specifically captures the perpetuity cash flows assuming stable growth, frequently applied in asset-intensive industries with predictable, long-term revenue streams.

Best Practices for Accurate Value Assessment

Terminal Value and Continuing Value are crucial components in valuation models, requiring careful differentiation to ensure precise projections. Best practices involve using a conservative growth rate aligned with industry trends for Terminal Value while applying a stable, perpetuity-based growth assumption for Continuing Value. Accurate discount rate selection and regular model updates are essential to reflect changing market conditions and improve valuation reliability.

Important Terms

Residual Value

Residual Value represents the estimated worth of an asset or investment at the end of a forecast period, closely related to Terminal Value, which estimates the present value of all future cash flows beyond this period, while Continuing Value often refers to the ongoing valuation of a business assuming perpetual operations.

Perpetuity Growth Model

The Perpetuity Growth Model calculates Terminal Value by estimating Continuing Value as the present value of infinite future cash flows growing at a constant rate beyond the forecast period.

Exit Multiple Method

The Exit Multiple Method calculates Terminal Value by applying a relevant industry multiple to projected financial metrics, while Continuing Value assumes perpetual growth beyond the forecast period.

Discounted Cash Flow (DCF)

Terminal Value in Discounted Cash Flow (DCF) analysis estimates the present value of all future cash flows beyond the forecast period, while Continuing Value specifically represents the sustainable perpetuity value used to capture long-term business profitability.

Explicit Forecast Period

Explicit forecast period defines the timeframe for detailed financial projections before calculating Terminal Value, which estimates future cash flows beyond that period, while Continuing Value serves as an alternative approach to capture the perpetuity of cash flows after the explicit forecast ends.

H-Model Terminal Value

The H-Model Terminal Value estimates future cash flows by combining an initial high growth phase that linearly declines into a stable perpetual growth rate, providing a more nuanced alternative to traditional Terminal Value or Continuing Value methods in discounted cash flow analysis.

Steady-State Assumptions

Steady-state assumptions simplify Terminal Value calculations by presuming constant cash flows and growth rates beyond the forecast period, distinguishing them from the often more variable Continuing Value estimations.

Going Concern Value

Going Concern Value represents the total worth of a business as an ongoing entity, typically calculated using Terminal Value projections that estimate future cash flows beyond a forecast period, while Continuing Value focuses specifically on the value attributed to the company's operations after the explicit forecast horizon.

Value Bridge

Value Bridge illustrates how Terminal Value captures the business's future cash flows beyond the forecast period, while Continuing Value reflects the ongoing worth of those cash flows into perpetuity.

Growth Decay Analysis

Growth Decay Analysis evaluates the impact of declining growth rates on Terminal Value calculations, refining Continuing Value estimates to enhance long-term financial projections.

Terminal Value vs Continuing Value Infographic

moneydif.com

moneydif.com