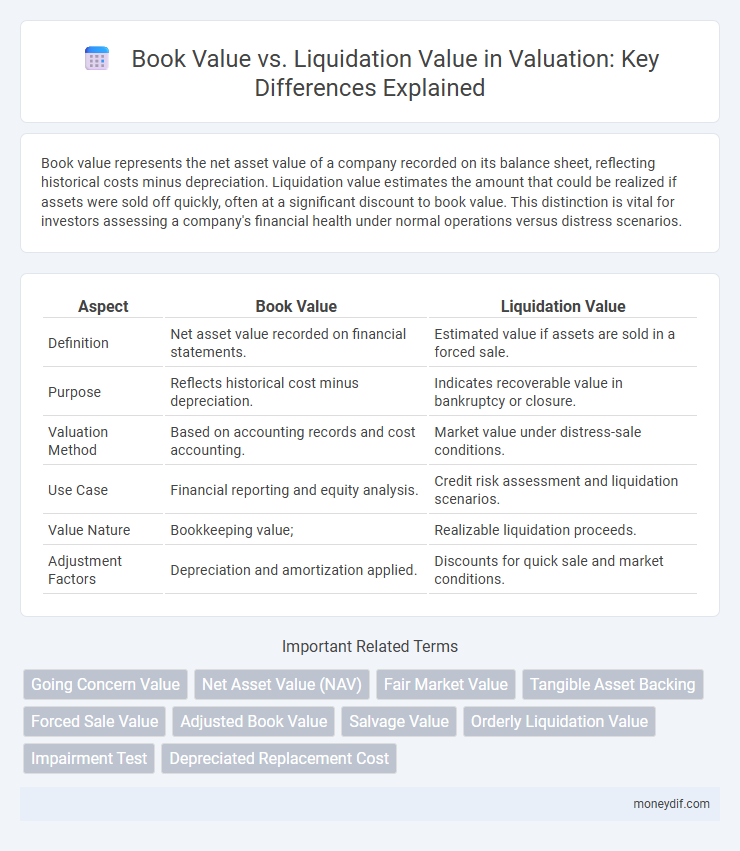

Book value represents the net asset value of a company recorded on its balance sheet, reflecting historical costs minus depreciation. Liquidation value estimates the amount that could be realized if assets were sold off quickly, often at a significant discount to book value. This distinction is vital for investors assessing a company's financial health under normal operations versus distress scenarios.

Table of Comparison

| Aspect | Book Value | Liquidation Value |

|---|---|---|

| Definition | Net asset value recorded on financial statements. | Estimated value if assets are sold in a forced sale. |

| Purpose | Reflects historical cost minus depreciation. | Indicates recoverable value in bankruptcy or closure. |

| Valuation Method | Based on accounting records and cost accounting. | Market value under distress-sale conditions. |

| Use Case | Financial reporting and equity analysis. | Credit risk assessment and liquidation scenarios. |

| Value Nature | Bookkeeping value; | Realizable liquidation proceeds. |

| Adjustment Factors | Depreciation and amortization applied. | Discounts for quick sale and market conditions. |

Introduction to Book Value and Liquidation Value

Book value represents a company's net asset value calculated as total assets minus liabilities, reflecting the accounting value on the balance sheet. Liquidation value estimates the net cash a business can generate if its assets are sold quickly, often at a discount compared to book value. Understanding the distinction helps investors evaluate the realistic worth of a company under normal operations versus distress scenarios.

Defining Book Value: Meaning and Calculation

Book value represents a company's net asset value calculated as total assets minus total liabilities on the balance sheet. It reflects the historical cost of assets, adjusted for depreciation, rather than current market value. Investors use book value to assess a firm's intrinsic worth and compare it with market capitalization for valuation analysis.

Understanding Liquidation Value: Key Components

Liquidation value reflects the estimated amount realizable from selling an asset or a company's entire inventory under forced sale conditions, often lower than book value due to urgency and market constraints. Key components include asset sellability, market demand, liquidation costs such as legal and administrative fees, and timing affecting the sale process. Understanding these factors ensures accurate valuation in distressed scenarios, critical for creditors and investors assessing recovery potential.

Major Differences Between Book Value and Liquidation Value

Book value represents the net asset value of a company based on historical cost accounting, reflecting the original purchase price minus depreciation. Liquidation value estimates the net amount realizable if assets are sold quickly under distressed conditions, often resulting in significantly lower values than book value. Major differences include purpose, with book value used for ongoing operations and financial reporting, while liquidation value is crucial for bankruptcy or asset disposal scenarios.

Importance of Book Value in Financial Analysis

Book value represents the net asset value of a company as recorded on the balance sheet, providing a reliable benchmark for assessing financial stability and shareholder equity. It is crucial in financial analysis because it reflects the historical cost of assets minus liabilities, offering insights into a company's intrinsic worth beyond market fluctuations. Unlike liquidation value, which estimates the net proceeds from selling assets under distress, book value helps investors and analysts evaluate long-term performance and solvency.

Significance of Liquidation Value in Business Valuation

Liquidation value represents the estimated amount that can be realized if a company's assets are sold off quickly, often lower than book value due to forced sale conditions. This metric is significant in business valuation for assessing downside risk, especially in distress scenarios or bankruptcy proceedings. It provides a conservative benchmark for creditors and investors when evaluating a company's financial health and potential recovery in liquidation events.

Factors Influencing Book Value and Liquidation Value

Book value is influenced by factors such as original acquisition cost, accumulated depreciation, and asset impairment, reflecting the net recorded value on the balance sheet. Liquidation value depends on market conditions, asset salability, and liquidation costs, representing the probable amount obtainable if assets are sold quickly. Understanding these factors is crucial for accurate asset appraisal within financial reporting and distress scenarios.

Practical Scenarios: When to Use Each Valuation Method

Book value represents the net asset value recorded on the balance sheet, ideal for assessing ongoing business worth in stable markets or for long-term investment analysis. Liquidation value estimates the cash obtainable if assets are sold quickly, crucial in distressed situations, bankruptcy proceedings, or when a company faces imminent closure. Choosing between these methods depends on the financial condition and intended use, with book value guiding operational decisions and liquidation value supporting crisis management or asset recovery.

Book Value vs Liquidation Value: Implications for Investors

Book value represents a company's net asset value based on its balance sheet, reflecting historical costs minus depreciation, serving as a baseline for investor valuation. Liquidation value estimates the net cash obtainable if assets were sold off quickly, often lower than book value due to fire-sale conditions and asset impairments. Investors use the disparity between book value and liquidation value to assess risks, with a significant gap signaling potential asset illiquidity or overvaluation in normal market conditions.

Conclusion: Choosing the Right Valuation Metric

Selecting the appropriate valuation metric depends on the business context and purpose; book value reflects the historical cost of assets minus liabilities, providing a stable measure for ongoing operations. Liquidation value estimates the net cash achievable if assets were sold under distress, offering critical insight during bankruptcy or asset sale scenarios. For investment analysis, book value supports long-term assessment, while liquidation value is crucial for understanding worst-case recovery, guiding more informed financial decisions.

Important Terms

Going Concern Value

Going Concern Value represents the intangible worth of a company as an operating entity, often exceeding its Book Value, which records historical asset costs, and is typically higher than Liquidation Value that reflects the immediate sale price of assets under distress conditions. This value captures ongoing profitability, brand reputation, and customer relationships, distinguishing it from the more static measurements of Book Value and the forced-sale perspective of Liquidation Value.

Net Asset Value (NAV)

Net Asset Value (NAV) represents the market value of a fund's total assets minus liabilities, reflecting the current worth per share for investors. Unlike Book Value, which records assets at historical cost, and Liquidation Value, which estimates net proceeds if assets were sold quickly, NAV provides a real-time, market-based assessment of an investment vehicle's value.

Fair Market Value

Fair Market Value represents the estimated price at which an asset would change hands between a willing buyer and seller, reflecting current market conditions. Unlike Book Value, which is based on historical costs minus depreciation, and Liquidation Value, which estimates the asset's worth if sold quickly under distressed conditions, Fair Market Value provides a more accurate and realistic assessment for investment decisions and financial reporting.

Tangible Asset Backing

Tangible asset backing measures a company's book value based on physical assets, which often exceeds its liquidation value reflecting the estimated sale price in distress.

Forced Sale Value

Forced Sale Value typically falls below Book Value, reflecting a distressed transaction price often closer to or even below Liquidation Value, which estimates the net proceeds from asset disposal under urgent conditions. Understanding the disparity between these metrics is crucial for accurately assessing asset impairment and financial risk during insolvency or rapid disposition scenarios.

Adjusted Book Value

Adjusted Book Value refines Book Value by incorporating asset revaluations and liabilities adjustments to provide a more accurate estimation than Liquidation Value, which reflects the net proceeds if assets were sold off quickly.

Salvage Value

Salvage value represents the estimated residual worth of an asset at the end of its useful life, differing from book value, which reflects the asset's net carrying amount after depreciation, and liquidation value, which is the actual amount recoverable through the immediate sale of the asset during distress. Understanding the distinctions among salvage value, book value, and liquidation value is critical for accurate financial reporting and asset management decisions.

Orderly Liquidation Value

Orderly Liquidation Value represents the estimated proceeds from selling assets systematically over time, typically higher than Forced Liquidation Value but often lower than Book Value due to depreciation and market conditions.

Impairment Test

Impairment tests assess whether an asset's book value exceeds its recoverable amount, which is often compared to its liquidation value--the net amount expected if the asset is sold or disposed of. A company must recognize an impairment loss when the book value is higher than the liquidation or fair value, ensuring accurate financial reporting and compliance with accounting standards like IFRS or GAAP.

Depreciated Replacement Cost

Depreciated Replacement Cost represents the asset's current value accounting for wear and age, typically positioned between the lower Liquidation Value and the higher Book Value in financial assessments.

Book Value vs Liquidation Value Infographic

moneydif.com

moneydif.com