Economic Value Added (EVA) measures a company's financial performance by calculating the value created above the required return on its capital, emphasizing operational efficiency and profitability. Market Value Added (MVA) reflects the difference between a firm's market value and the capital invested by shareholders, indicating overall market perception and long-term value creation. Both metrics are crucial for valuation, with EVA focusing on internal value generation and MVA on external market assessment.

Table of Comparison

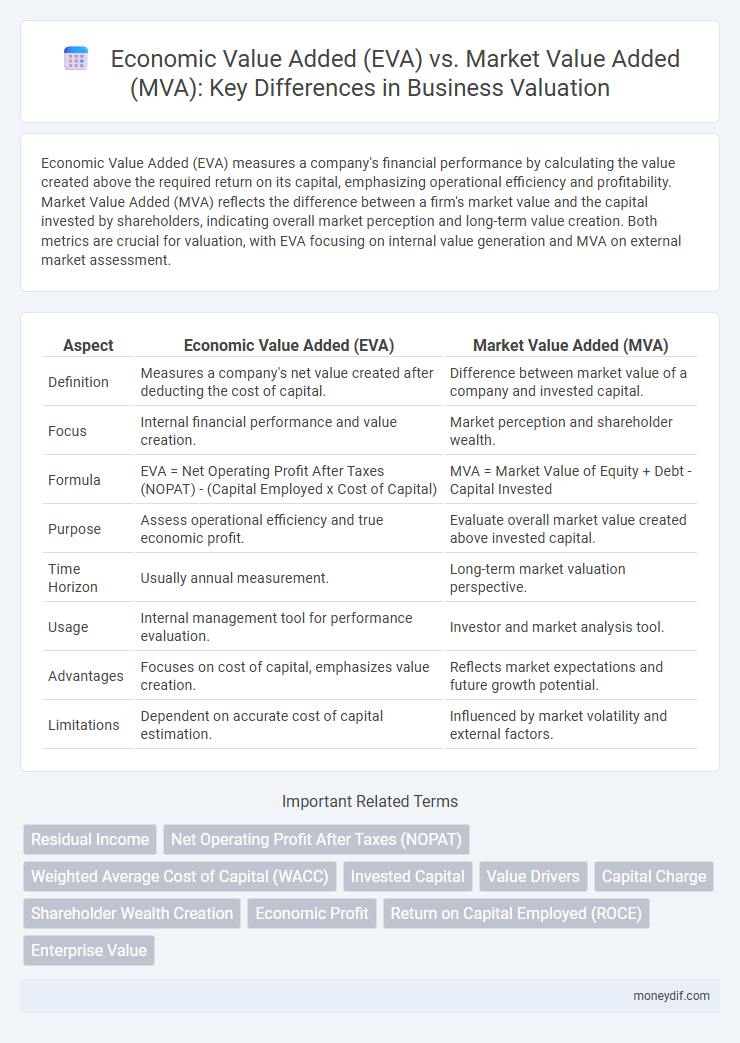

| Aspect | Economic Value Added (EVA) | Market Value Added (MVA) |

|---|---|---|

| Definition | Measures a company's net value created after deducting the cost of capital. | Difference between market value of a company and invested capital. |

| Focus | Internal financial performance and value creation. | Market perception and shareholder wealth. |

| Formula | EVA = Net Operating Profit After Taxes (NOPAT) - (Capital Employed x Cost of Capital) | MVA = Market Value of Equity + Debt - Capital Invested |

| Purpose | Assess operational efficiency and true economic profit. | Evaluate overall market value created above invested capital. |

| Time Horizon | Usually annual measurement. | Long-term market valuation perspective. |

| Usage | Internal management tool for performance evaluation. | Investor and market analysis tool. |

| Advantages | Focuses on cost of capital, emphasizes value creation. | Reflects market expectations and future growth potential. |

| Limitations | Dependent on accurate cost of capital estimation. | Influenced by market volatility and external factors. |

Introduction to EVA and MVA

Economic Value Added (EVA) measures a company's financial performance by calculating the value created beyond the required return on invested capital, reflecting true economic profit. Market Value Added (MVA) represents the difference between a firm's market value and the capital invested by shareholders, indicating the wealth generated for investors. Both metrics provide complementary insights into value creation, with EVA focusing on internal operational efficiency and MVA capturing investor perceptions and market expectations.

Defining Economic Value Added (EVA)

Economic Value Added (EVA) measures a company's financial performance by calculating the residual wealth created after deducting the cost of capital from net operating profit after taxes (NOPAT). It quantifies value generation by determining if the firm's returns exceed the required minimum return of its investors. EVA serves as a critical metric for assessing true economic profit and guiding strategic financial decisions.

Understanding Market Value Added (MVA)

Market Value Added (MVA) represents the difference between a company's total market value and the capital invested by shareholders and debt holders, reflecting the wealth created over invested capital. MVA is a crucial indicator for investors as it quantifies the value generated beyond the book value of invested funds, integrating market perceptions and future growth expectations. Understanding MVA helps assess company performance and management effectiveness in enhancing shareholder wealth through strategic decisions.

Key Formulae for EVA and MVA Calculation

Economic Value Added (EVA) is calculated as Net Operating Profit After Taxes (NOPAT) minus the capital charge, where the capital charge equals the invested capital multiplied by the weighted average cost of capital (WACC). Market Value Added (MVA) is determined by subtracting the book value of invested capital from the market value of the firm's equity and debt combined. Both EVA and MVA focus on value creation, with EVA measuring intra-period value and MVA capturing cumulative value added to shareholders.

EVA vs MVA: Core Differences

Economic Value Added (EVA) measures a company's financial performance by calculating net operating profit after taxes minus the capital charge, highlighting value creation from operational efficiency. Market Value Added (MVA) represents the difference between the market value of a firm's equity and debt and the capital invested by shareholders, reflecting investor perception of the firm's overall value. EVA focuses on internal value generation through operational success, whereas MVA captures external market valuation and investor expectations.

Importance of EVA in Company Valuation

Economic Value Added (EVA) measures a company's true economic profit by deducting the cost of capital from net operating profit after taxes, providing a clear indicator of value creation. EVA focuses on operational efficiency and capital cost, making it crucial for assessing management performance and long-term value generation. This metric is important in company valuation as it reveals whether a business is generating returns above its cost of capital, directly impacting shareholder wealth and investment decisions.

Role of MVA in Measuring Shareholder Value

Market Value Added (MVA) serves as a critical metric in valuation by quantifying the difference between a company's market capitalization and the capital invested by shareholders, effectively reflecting the wealth created for shareholders. Unlike Economic Value Added (EVA), which measures internal profitability after cost of capital, MVA captures the market's assessment of a firm's future growth potential and value creation prospects. Investors and analysts rely on MVA to gauge the effectiveness of management strategies in enhancing shareholder value over time.

Real-World Examples: EVA and MVA Application

Economic Value Added (EVA) measures a company's financial performance by calculating net operating profit after taxes minus the capital cost, with companies like Coca-Cola using EVA to optimize capital allocation and drive shareholder value. Market Value Added (MVA) represents the difference between a firm's market value and the capital invested by shareholders, seen in firms like Apple where sustained high MVA reflects strong investor confidence and successful growth strategies. Real-world examples highlight how firms integrate EVA for internal performance evaluation and use MVA as a market-based indicator of long-term value creation.

EVA and MVA: Advantages and Limitations

Economic Value Added (EVA) measures a company's financial performance by calculating the value created above the required return on its capital, providing a clear indication of profitability and efficient capital use. Market Value Added (MVA) reflects the difference between the market value of a firm and the capital invested by shareholders, offering insight into market perceptions of value creation. EVA is limited by its reliance on accounting adjustments and may not capture market expectations, while MVA can be influenced by market volatility and investor sentiment, potentially obscuring intrinsic company performance.

Choosing Between EVA and MVA for Business Analysis

Choosing between Economic Value Added (EVA) and Market Value Added (MVA) for business analysis depends on the specific financial insights required. EVA measures a company's true economic profit by accounting for the cost of capital, offering a clear indication of value creation from operational efficiency. MVA reflects the difference between market value and invested capital, emphasizing investor perception and market-driven growth potential.

Important Terms

Residual Income

Residual Income measures net operating profit after deducting the cost of capital, serving as the basis for Economic Value Added (EVA), which evaluates company performance by adding residual income to invested capital, whereas Market Value Added (MVA) reflects the difference between a firm's market value and the capital invested by shareholders.

Net Operating Profit After Taxes (NOPAT)

Net Operating Profit After Taxes (NOPAT) measures a firm's operating efficiency by calculating profits from core operations after tax adjustments, serving as a key input in Economic Value Added (EVA) to determine value creation above the cost of capital. In contrast, Market Value Added (MVA) reflects the total market value created for shareholders, representing the difference between a company's market capitalization and the capital invested, linking financial performance indicated by NOPAT and EVA to market perceptions and investor returns.

Weighted Average Cost of Capital (WACC)

Weighted Average Cost of Capital (WACC) serves as the critical discount rate in Economic Value Added (EVA) calculations to assess true economic profit, while Market Value Added (MVA) reflects the difference between a firm's market value and invested capital, indicating shareholder wealth creation relative to the cost of capital.

Invested Capital

Invested capital represents the total funds deployed in a company's operations, serving as the basis for calculating Economic Value Added (EVA) by measuring net operating profit after taxes minus the capital charge, and it contrasts with Market Value Added (MVA), which reflects the difference between the company's market value and the invested capital, indicating shareholder wealth creation.

Value Drivers

Economic Value Added (EVA) measures a company's true economic profit by subtracting the cost of capital from net operating profit after taxes, while Market Value Added (MVA) represents the difference between a firm's market value and the invested capital, highlighting value creation for shareholders.

Capital Charge

Capital charge represents the cost of capital applied to invested capital, serving as a crucial component in Economic Value Added (EVA) calculation, which measures value creation internally, whereas Market Value Added (MVA) reflects the difference between a company's market value and invested capital, indicating external market perception of value.

Shareholder Wealth Creation

Economic Value Added (EVA) measures a company's true economic profit by subtracting the cost of capital from net operating profit, while Market Value Added (MVA) reflects the difference between a firm's market value and the capital invested by shareholders, both serving as critical indicators for shareholder wealth creation.

Economic Profit

Economic Profit measures a company's true profitability by subtracting total costs of capital from net operating profit, closely relating to Economic Value Added (EVA) which quantifies value created beyond required returns, while Market Value Added (MVA) reflects the difference between a firm's market value and invested capital, indicating overall market perception of value creation.

Return on Capital Employed (ROCE)

Return on Capital Employed (ROCE) measures profitability relative to capital invested, directly influencing Economic Value Added (EVA) by indicating value creation above capital costs, while Market Value Added (MVA) reflects investor perceptions of a company's future EVA performance and growth potential.

Enterprise Value

Enterprise Value reflects a company's total market value by integrating Economic Value Added (EVA), which measures operational profitability beyond capital costs, and Market Value Added (MVA), representing the wealth created for shareholders above invested capital.

Economic Value Added (EVA) vs Market Value Added (MVA) Infographic

moneydif.com

moneydif.com