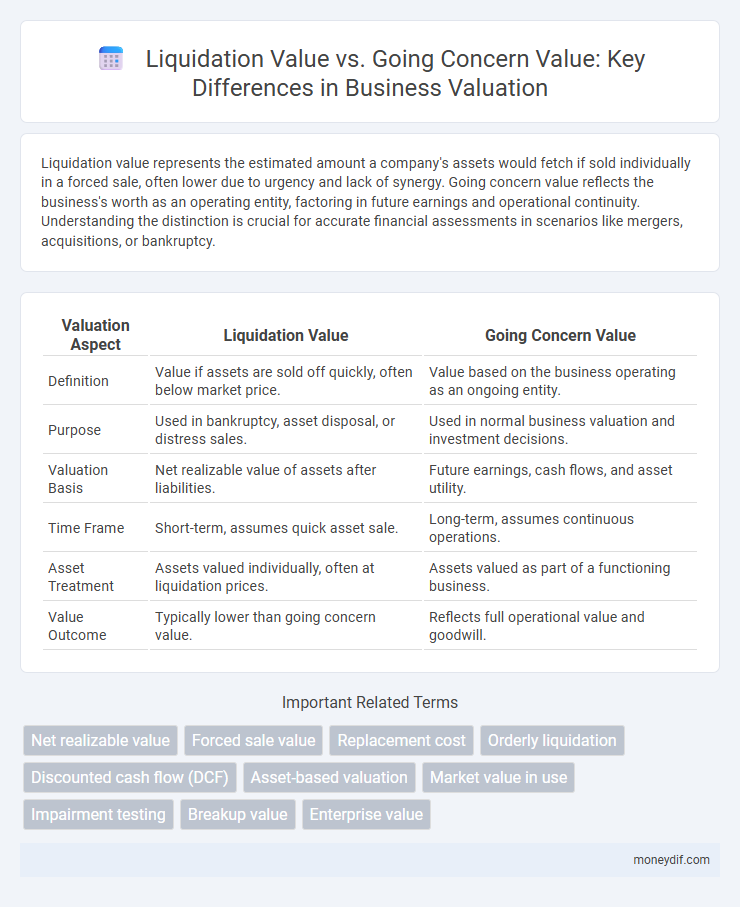

Liquidation value represents the estimated amount a company's assets would fetch if sold individually in a forced sale, often lower due to urgency and lack of synergy. Going concern value reflects the business's worth as an operating entity, factoring in future earnings and operational continuity. Understanding the distinction is crucial for accurate financial assessments in scenarios like mergers, acquisitions, or bankruptcy.

Table of Comparison

| Valuation Aspect | Liquidation Value | Going Concern Value |

|---|---|---|

| Definition | Value if assets are sold off quickly, often below market price. | Value based on the business operating as an ongoing entity. |

| Purpose | Used in bankruptcy, asset disposal, or distress sales. | Used in normal business valuation and investment decisions. |

| Valuation Basis | Net realizable value of assets after liabilities. | Future earnings, cash flows, and asset utility. |

| Time Frame | Short-term, assumes quick asset sale. | Long-term, assumes continuous operations. |

| Asset Treatment | Assets valued individually, often at liquidation prices. | Assets valued as part of a functioning business. |

| Value Outcome | Typically lower than going concern value. | Reflects full operational value and goodwill. |

Introduction to Valuation Approaches

Liquidation value represents the estimated amount an asset or business would fetch if sold quickly under distressed conditions, often reflecting lower market prices due to urgency. Going concern value assumes the business will continue operating, incorporating future earning potential and intangible assets, thus generally yielding higher valuations. Understanding these distinct approaches aids valuators in selecting the appropriate method based on the purpose of valuation and business continuity.

Defining Liquidation Value

Liquidation value refers to the estimated amount that an asset or business can realistically be sold for in a forced sale or quick disposition, typically under distressed conditions. It differs from going concern value, which assumes the business will continue operating and generating profits. Liquidation value prioritizes rapid sale and immediate cash realization, often resulting in a significantly lower valuation compared to ongoing operational worth.

Understanding Going Concern Value

Going concern value reflects the estimated worth of a business as an ongoing entity, incorporating its ability to generate future cash flows and maintain operational continuity. This valuation approach considers intangible assets like brand reputation, customer relationships, and workforce expertise, which are often excluded in liquidation value assessments. Understanding going concern value is essential for accurately capturing a company's sustainable profitability beyond mere asset liquidation.

Key Differences Between Liquidation and Going Concern Value

Liquidation value represents the estimated amount a business's assets would fetch if sold individually in a forced sale scenario, often significantly lower than market value due to distress conditions. Going concern value reflects the company's worth as an ongoing enterprise, incorporating future earnings potential, operational continuity, and intangible assets like goodwill. Key differences include asset valuation approach, consideration of business profitability, and the perspective of sale--immediate liquidation versus sustained operation.

Factors Influencing Liquidation Value

Liquidation value is primarily influenced by factors such as the condition and marketability of assets, the urgency of the sale, and the presence of existing liabilities. Distressed or forced sales often reduce asset prices compared to orderly transactions, leading to lower valuation. Economic conditions and industry-specific demand also play critical roles in determining the final liquidation value.

Factors Affecting Going Concern Value

Going concern value is influenced by factors such as the company's ongoing operational profitability, anticipated future cash flows, market position, and customer loyalty. The presence of intangible assets like brand reputation, intellectual property, and skilled workforce enhances the going concern value beyond liquidation value. Economic conditions, industry trends, and management efficiency also play critical roles in determining the sustainability and growth potential reflected in the going concern valuation.

When to Use Liquidation Value in Valuation

Liquidation value is used in valuation when a business faces insolvency, bankruptcy, or forced sale scenarios, where asset disposition must occur quickly and without regard to ongoing operations. It provides a conservative estimate reflecting the net amount realizable from selling assets in a distressed state, often below market value. This metric is crucial for creditors and stakeholders assessing worst-case recovery in financially troubled companies.

When to Apply Going Concern Value

Going concern value is applied when a business is expected to continue its operations without the intention to liquidate, reflecting the assumption that assets will be used to generate profits over time. This valuation method is essential for companies with stable cash flows, ongoing contracts, and operational efficiencies that contribute to long-term profitability. It is typically used in mergers and acquisitions, financial reporting, and investment analysis where the entity's future earning potential is a critical factor.

Implications for Investors and Creditors

Liquidation value represents the estimated amount realizable if an asset or business is sold quickly, often below market value, signaling higher risk and lower recovery for investors and creditors in distress scenarios. Going concern value reflects the expected worth if the business operates continuously, providing a more favorable outlook on profitability and debt repayment capacity, which can influence lending terms and investment confidence. Understanding these distinctions helps investors and creditors assess potential loss severity and make informed decisions regarding risk management and resource allocation.

Practical Examples of Liquidation vs Going Concern Valuations

Liquidation value is exemplified when a company sells assets quickly, often at a discount, such as in bankruptcy scenarios where equipment and inventory are sold separately to pay creditors. In contrast, going concern value reflects the business's ability to generate ongoing profits, demonstrated by a profitable retailer assessed for acquisition based on future cash flows and market position. Practical valuation highlights the stark difference: liquidation yields lower asset-based value, while going concern considers earnings, brand strength, and future growth potential.

Important Terms

Net realizable value

Net realizable value represents the estimated amount collectible from asset liquidation, typically lower than going concern value which reflects ongoing operational worth.

Forced sale value

Forced sale value typically falls below both liquidation value and going concern value due to the urgency and distressed conditions associated with a rapid asset disposition.

Replacement cost

Replacement cost represents the expense to acquire a similar asset, often exceeding liquidation value but aligning closely with going concern value due to its basis in ongoing operational utility.

Orderly liquidation

Orderly liquidation value estimates asset sale proceeds during a controlled wind-down, typically higher than liquidation value but lower than going concern value, which reflects business operating potential.

Discounted cash flow (DCF)

Discounted cash flow (DCF) valuation differentiates liquidation value, reflecting asset sell-off worth, from going concern value, representing ongoing operational profitability discounted over time.

Asset-based valuation

Asset-based valuation assesses a company's worth by calculating its net asset value, distinguishing between liquidation value, which estimates the sale proceeds if assets are sold off immediately, and going concern value, which reflects the ongoing operational value of the business.

Market value in use

Market value in use represents the estimated value of an asset based on its ability to generate cash flows under continuing operations, typically exceeding liquidation value but potentially differing from going concern value reflecting overall business viability.

Impairment testing

Impairment testing compares an asset's carrying amount to its recoverable amount, using liquidation value to determine the net proceeds upon asset disposal and going concern value to assess value based on continued operation.

Breakup value

Breakup value represents the estimated proceeds from liquidating a company's assets individually, typically lower than liquidation value, which assumes orderly asset disposal, and significantly less than going concern value, reflecting the business's ongoing operational worth.

Enterprise value

Enterprise value reflects the total valuation of a company assuming it operates as a going concern, incorporating equity, debt, and cash components to represent ongoing profitability potential. In contrast, liquidation value estimates the net proceeds from asset sales if the company ceases operations immediately, typically resulting in a lower valuation due to forced asset disposals and absence of future earnings.

Liquidation value vs going concern value Infographic

moneydif.com

moneydif.com