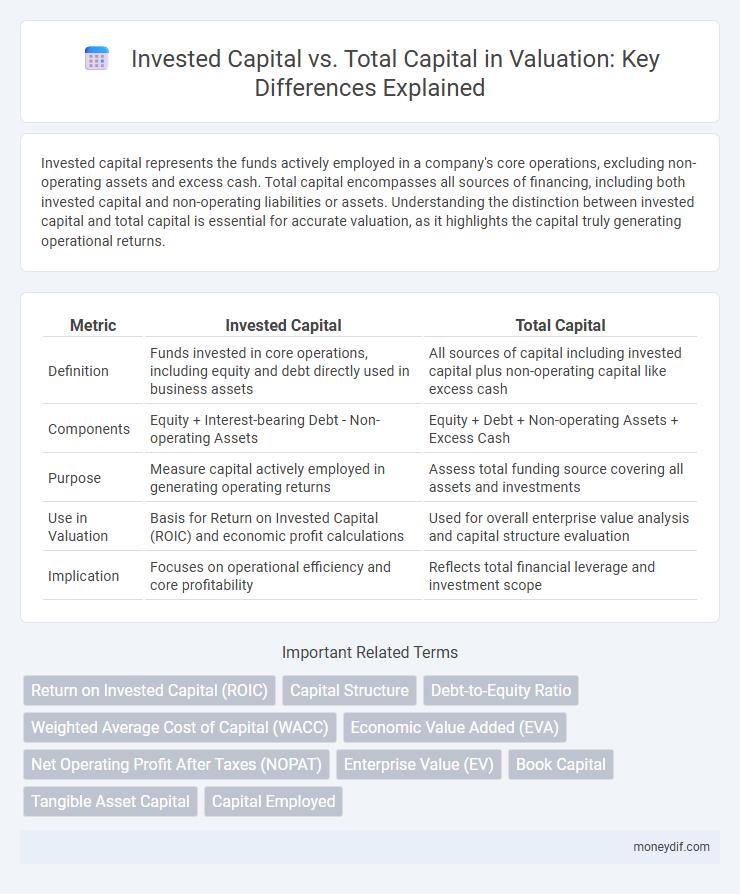

Invested capital represents the funds actively employed in a company's core operations, excluding non-operating assets and excess cash. Total capital encompasses all sources of financing, including both invested capital and non-operating liabilities or assets. Understanding the distinction between invested capital and total capital is essential for accurate valuation, as it highlights the capital truly generating operational returns.

Table of Comparison

| Metric | Invested Capital | Total Capital |

|---|---|---|

| Definition | Funds invested in core operations, including equity and debt directly used in business assets | All sources of capital including invested capital plus non-operating capital like excess cash |

| Components | Equity + Interest-bearing Debt - Non-operating Assets | Equity + Debt + Non-operating Assets + Excess Cash |

| Purpose | Measure capital actively employed in generating operating returns | Assess total funding source covering all assets and investments |

| Use in Valuation | Basis for Return on Invested Capital (ROIC) and economic profit calculations | Used for overall enterprise value analysis and capital structure evaluation |

| Implication | Focuses on operational efficiency and core profitability | Reflects total financial leverage and investment scope |

Understanding Invested Capital: Definition and Components

Invested capital refers to the total amount of money that a company has utilized to fund its operations and growth, encompassing debt and equity financing. It includes components such as equity capital, long-term debt, and sometimes short-term borrowings used for operational purposes, excluding non-operational assets like excess cash. Understanding invested capital is essential for accurate valuation, as it reflects the actual funds deployed in the business generating returns.

Total Capital Explained: Key Elements and Structure

Total capital represents the sum of all financial resources a company utilizes, encompassing both debt and equity, to fund its operations and growth. Key elements include long-term debt, common equity, preferred equity, and sometimes short-term obligations that are part of the ongoing capital structure. Understanding the composition and structure of total capital is crucial for accurate company valuation and assessing financial leverage.

Invested Capital vs Total Capital: Core Differences

Invested Capital refers to the total amount of money that shareholders and debt holders have put into a company, including equity and interest-bearing debt, while Total Capital encompasses all sources of financing, including non-interest-bearing liabilities. The core difference lies in the exclusion of non-operating liabilities from Invested Capital, which provides a clearer picture of the capital actively employed in generating returns. Understanding this distinction is crucial for accurate valuation metrics like Return on Invested Capital (ROIC) and assessing a company's operational efficiency.

How to Calculate Invested Capital

Invested Capital is calculated by summing the book value of equity and interest-bearing debt, minus non-operating cash and investments to focus on operating assets. Total Capital includes all sources of funding such as equity, debt, and any non-interest-bearing liabilities used in the company's operations. Precise calculation of Invested Capital is crucial for effective valuation metrics like Return on Invested Capital (ROIC) and economic profit analysis.

Measuring Total Capital: Common Approaches

Measuring total capital often involves summing invested capital with non-operating liabilities and equity components to reflect the full financial structure. Common approaches include adjusting invested capital by adding net working capital, total debt, and preferred equity, providing a comprehensive view of a company's financing. This method helps analysts accurately assess valuation metrics like return on capital employed (ROCE) and enterprise value (EV).

Importance in Business Valuation

Invested Capital represents the total funds invested by shareholders and debt holders directly into a business, while Total Capital includes both invested capital and non-interest-bearing liabilities. Understanding the distinction is crucial in business valuation as Invested Capital provides a clearer measure of the actual operational assets generating returns, facilitating accurate calculation of Return on Invested Capital (ROIC). Emphasizing Invested Capital ensures analysts assess value creation efficiency without distortions from short-term liabilities, enhancing investment decision quality.

Impact on Financial Ratios and Performance Metrics

Invested capital, representing equity plus interest-bearing debt used in operations, directly influences return on invested capital (ROIC) by measuring operational efficiency. Total capital includes all sources of financing, such as non-interest-bearing liabilities, impacting leverage ratios like debt-to-capital and affecting cost of capital assessments. The distinction affects profitability and solvency metrics, guiding investors in evaluating a company's financial health and investment performance.

Common Misconceptions in Capital Analysis

Invested capital often confuses analysts because it excludes non-operating assets and liabilities, whereas total capital encompasses all sources of financing, including debt and equity. A common misconception is equating invested capital directly with total capital, which can lead to overstated returns on invested capital (ROIC) calculations. Accurate capital analysis requires distinguishing operating assets used in core business from total capital structure to avoid misinterpretation of financial performance.

Practical Examples: Application in Real Valuations

Invested Capital represents the funds deployed in a company's core operations, including equity and interest-bearing debt, while Total Capital encompasses Invested Capital plus non-operating assets and liabilities. In real valuations, distinguish between these to avoid inflating enterprise value by excluding excess cash or non-operating investments, ensuring a precise valuation baseline. For instance, when valuating a manufacturing firm, removing surplus cash holdings from Total Capital provides a clearer picture of operational efficiency and return on invested capital metrics.

Choosing the Right Metric for Your Valuation Needs

Invested capital represents the funds deployed directly into a company's core operations, excluding non-operating assets and liabilities, while total capital encompasses all sources of financing, including debt, equity, and non-operating liabilities. Selecting invested capital as the valuation metric provides a more accurate measure of operating efficiency and returns, making it ideal for assessing operational performance. Total capital suits broader valuation analyses where understanding the complete financial structure and obligations is essential for investor decision-making.

Important Terms

Return on Invested Capital (ROIC)

Return on Invested Capital (ROIC) measures a company's profitability and efficiency by comparing net operating profit after tax (NOPAT) to invested capital, which specifically excludes non-operating assets and liabilities, whereas total capital includes all sources of financing such as debt and equity.

Capital Structure

Capital structure determines the proportion of invested capital, which includes equity and debt used directly in operations, relative to total capital that combines invested capital and non-operating liabilities, impacting financial leverage and risk.

Debt-to-Equity Ratio

The Debt-to-Equity Ratio measures financial leverage by comparing total debt to shareholders' equity, highlighting the balance between borrowed funds and invested capital. It differs from Total Capital metrics by focusing on the proportion of debt relative to equity rather than combining debt and equity to evaluate overall capital structure.

Weighted Average Cost of Capital (WACC)

Weighted Average Cost of Capital (WACC) represents the average rate a company must pay to finance its invested capital, which includes both debt and equity, distinguishing it from total capital that may encompass non-operating assets.

Economic Value Added (EVA)

Economic Value Added (EVA) measures a company's financial performance by calculating the value created above the required return on invested capital (IC), emphasizing the efficiency of capital utilization. EVA distinguishes between invested capital, which reflects the funds actively employed in operations, and total capital, which includes all funding sources, highlighting the importance of optimizing invested capital to generate value beyond total capital costs.

Net Operating Profit After Taxes (NOPAT)

Net Operating Profit After Taxes (NOPAT) measures a company's operational efficiency by reflecting profits generated from Invested Capital, which specifically includes debt and equity used in operations, unlike Total Capital that may also encompass non-operational liabilities.

Enterprise Value (EV)

Enterprise Value (EV) represents the total market value of a company's operating assets, combining market capitalization, debt, and preferred equity while subtracting cash, providing a comprehensive measure of invested capital. Unlike total capital, which includes all sources of financing such as debt and equity, EV focuses on the value of invested capital available to all stakeholders, offering a clearer picture for valuation and investment analysis.

Book Capital

Book capital represents the net value of a company's assets recorded on the balance sheet, serving as a key component in calculating invested capital, which differs from total capital by excluding non-operating assets and liabilities.

Tangible Asset Capital

Tangible Asset Capital represents the portion of Invested Capital allocated to physical assets, excluding intangibles, which differs from Total Capital as it encompasses both tangible and intangible investments.

Capital Employed

Capital Employed represents the total amount of Invested Capital, including equity and debt, actively used in business operations and is often compared to Total Capital, which encompasses all sources of financing including liabilities not directly involved in day-to-day activities.

Invested Capital vs Total Capital Infographic

moneydif.com

moneydif.com