Synergy value arises when the combined worth of merged entities exceeds their individual standalone values due to cost savings, increased market power, or enhanced revenue streams. Standalone value reflects the intrinsic worth of a business operating independently without considering potential integrations or collaborations. Understanding the difference between synergy value and standalone value is crucial for accurate valuation during mergers and acquisitions.

Table of Comparison

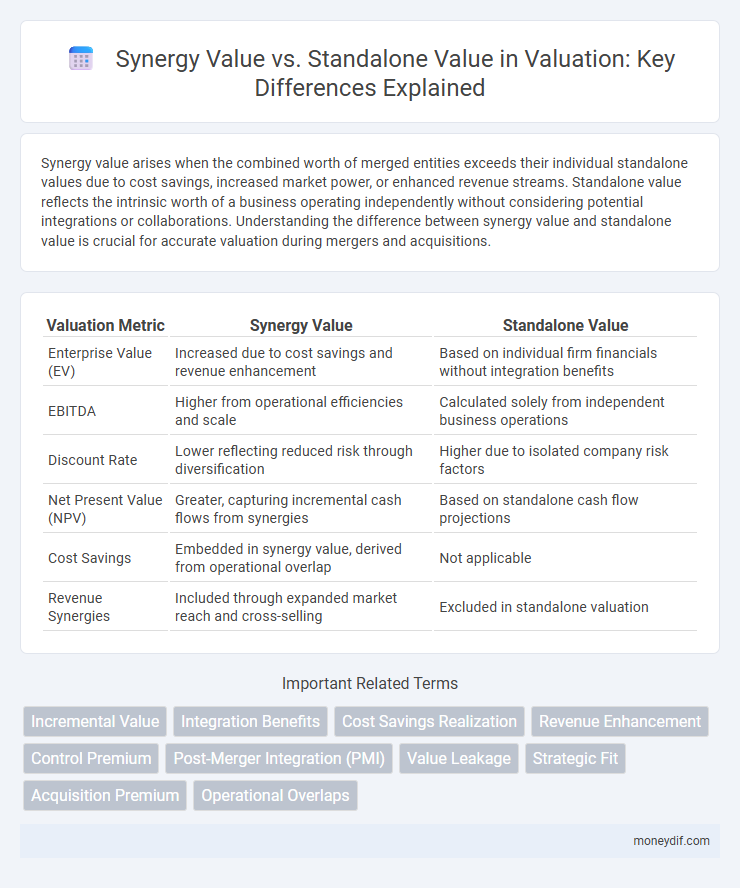

| Valuation Metric | Synergy Value | Standalone Value |

|---|---|---|

| Enterprise Value (EV) | Increased due to cost savings and revenue enhancement | Based on individual firm financials without integration benefits |

| EBITDA | Higher from operational efficiencies and scale | Calculated solely from independent business operations |

| Discount Rate | Lower reflecting reduced risk through diversification | Higher due to isolated company risk factors |

| Net Present Value (NPV) | Greater, capturing incremental cash flows from synergies | Based on standalone cash flow projections |

| Cost Savings | Embedded in synergy value, derived from operational overlap | Not applicable |

| Revenue Synergies | Included through expanded market reach and cross-selling | Excluded in standalone valuation |

Understanding Synergy Value in Valuation

Synergy value represents the incremental worth generated when two companies combine, surpassing the sum of their standalone values due to efficiencies, cost savings, or enhanced market power. It is critical to quantify synergy value accurately in valuation models to reflect realistic merger benefits and avoid overpayment. Understanding synergy value involves analyzing potential revenue enhancements, cost reductions, and strategic advantages that create value beyond individual entity performance.

Defining Standalone Value: The Baseline Approach

Standalone value represents a company's intrinsic worth based solely on its existing assets, operations, and cash flow generation without factoring in potential synergies from mergers or acquisitions. This baseline valuation serves as a critical reference point, enabling investors and analysts to isolate and quantify the additional value created through synergies. Accurately defining standalone value is essential for effective deal assessment, negotiation, and post-merger integration strategies.

Key Differences Between Synergy Value and Standalone Value

Synergy value represents the additional worth generated when two companies merge or collaborate, exceeding the sum of their individual standalone values, which reflect each company's intrinsic value operating independently. Key differences include the incorporation of cost savings, revenue enhancements, and improved efficiencies in synergy value, whereas standalone value is based solely on existing operational performance and assets. Synergy value accounts for strategic benefits and market opportunities unavailable to firms acting alone, making it critical for merger and acquisition decisions.

Types of Synergies in Mergers and Acquisitions

Types of synergies in mergers and acquisitions primarily include revenue synergies and cost synergies, which directly impact the combined entity's valuation. Revenue synergies arise from cross-selling, expanded market reach, and enhanced product offerings, increasing overall sales potential beyond standalone values. Cost synergies occur through economies of scale, streamlined operations, and reduced redundancies, improving profit margins and driving higher synergy value compared to individual company valuations.

Methods to Calculate Synergy Value

Synergy value is calculated by comparing the combined entity's projected cash flows to the sum of standalone cash flows of the merging companies, discounting the incremental cash flows using a weighted average cost of capital (WACC). Methods such as discounted cash flow (DCF) analysis and comparable transaction multiples help quantify the value created by operational efficiencies, revenue enhancements, or cost savings. Market-based approaches and scenario analysis further refine synergy estimates by incorporating risk adjustments and probability-weighted outcomes.

Approaches to Assess Standalone Value

Approaches to assess standalone value primarily involve the discounted cash flow (DCF) method, which projects unlevered free cash flows and discounts them at the weighted average cost of capital (WACC) to estimate intrinsic company worth. Market-based valuation techniques, including comparable company analysis and precedent transaction analysis, provide relative value insights by benchmarking against similar firms and past deals. Asset-based valuation, calculating the net asset value by offsetting total liabilities from total assets, offers an additional perspective, particularly for capital-intensive businesses with substantial tangible assets.

Impact of Synergy Realization on Deal Pricing

Synergy value represents the incremental worth generated by combining two entities, often surpassing the sum of their standalone values due to cost savings, revenue enhancements, and operational efficiencies. Realizing these synergies can significantly impact deal pricing by justifying higher acquisition premiums and influencing negotiation dynamics. Accurate estimation and realization of synergies are critical for aligning price with anticipated value creation and minimizing post-deal integration risks.

Common Pitfalls in Estimating Synergy Value

Estimating synergy value often suffers from common pitfalls such as overestimating revenue enhancements and underestimating integration costs, leading to inflated merger valuations. Analysts frequently rely on optimistic assumptions about cost savings and revenue growth without accounting for cultural clashes or operational disruptions post-merger. Accurate synergy assessment requires conservative modeling and rigorous due diligence to align synergy projections closer to realistic standalone value comparisons.

Case Studies: Synergy vs Standalone Outcomes

Case studies reveal that synergy value often surpasses standalone value by capturing revenue enhancements and cost reductions achievable through combined operations. Analysis of mergers in the technology and healthcare sectors demonstrates that synergies can contribute up to a 30% premium over the sum of individual firm valuations. Empirical data highlights that failure to realize projected synergies frequently results in valuation shortfalls, underscoring the importance of accurate synergy estimation in deal negotiations.

Synergy Value and Standalone Value in Strategic Decision-Making

Synergy value represents the additional worth generated when two companies combine, often exceeding the sum of their standalone values due to operational efficiencies and market advantages. Standalone value refers to the intrinsic worth of a company operating independently, providing a baseline for evaluating potential mergers or acquisitions. In strategic decision-making, comparing synergy value against standalone value is crucial to determine whether the combined entity will create sustainable competitive advantages and justify the transaction costs.

Important Terms

Incremental Value

Incremental Value measures the additional benefits generated from Synergy Value as compared to Standalone Value in combined business operations.

Integration Benefits

Integration benefits maximize synergy value by combining assets and capabilities, resulting in higher overall returns compared to the standalone value of individual entities.

Cost Savings Realization

Cost savings realization quantifies the financial benefits achieved through synergy value, where combined operations reduce expenses beyond what standalone entities could accomplish independently. Measuring the difference between synergy value and standalone value highlights efficiency improvements and resource optimization that drive increased profitability.

Revenue Enhancement

Revenue enhancement from synergy value exceeds standalone value by integrating complementary assets and optimizing cross-functional collaboration.

Control Premium

Control Premium represents the additional amount a buyer is willing to pay over the standalone value of a target company, reflecting expected synergies such as cost reductions, revenue enhancements, and improved market positioning. Synergy Value quantifies the incremental benefits generated from a merger or acquisition beyond the sum of standalone entities, serving as the primary justification for paying a Control Premium during deal negotiations.

Post-Merger Integration (PMI)

Post-Merger Integration (PMI) maximizes synergy value by combining complementary assets and operations, creating greater overall value than the sum of standalone values of the merged entities.

Value Leakage

Value leakage occurs when the combined Synergy Value of merged entities fails to exceed the sum of their Standalone Values, indicating inefficiencies in integration or overlooked operational overlaps. Measuring and optimizing synergy capture ensures that mergers or acquisitions generate true incremental benefits rather than merely rebranding existing assets.

Strategic Fit

Strategic fit enhances synergy value by aligning complementary resources and capabilities of combined entities, creating greater value than the sum of standalone operations. Evaluating synergy value versus standalone value helps determine whether integration generates cost savings, revenue growth, or competitive advantages exceeding individual business performance.

Acquisition Premium

Acquisition premium reflects the excess paid over the standalone value of a target company, justified by anticipated synergy value from merger efficiencies.

Operational Overlaps

Operational overlaps reduce costs and enhance synergy value by eliminating redundancies compared to standalone value.

Synergy Value vs Standalone Value Infographic

moneydif.com

moneydif.com