Discount for Lack of Marketability (DLOM) pertains to the reduction in value of an asset due to the inability to quickly sell it in the open market. In contrast, Discount for Lack of Liquidity (DLOL) relates to difficulties in converting an asset into cash without significant loss in value. Both discounts impact valuation but address distinct aspects of marketability and cash flow accessibility.

Table of Comparison

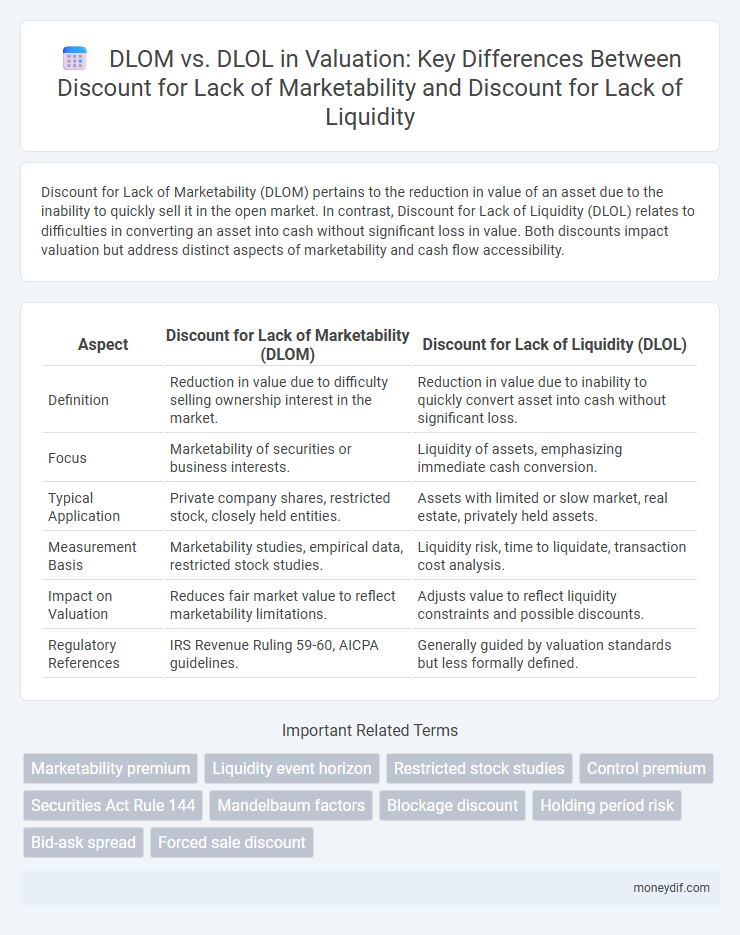

| Aspect | Discount for Lack of Marketability (DLOM) | Discount for Lack of Liquidity (DLOL) |

|---|---|---|

| Definition | Reduction in value due to difficulty selling ownership interest in the market. | Reduction in value due to inability to quickly convert asset into cash without significant loss. |

| Focus | Marketability of securities or business interests. | Liquidity of assets, emphasizing immediate cash conversion. |

| Typical Application | Private company shares, restricted stock, closely held entities. | Assets with limited or slow market, real estate, privately held assets. |

| Measurement Basis | Marketability studies, empirical data, restricted stock studies. | Liquidity risk, time to liquidate, transaction cost analysis. |

| Impact on Valuation | Reduces fair market value to reflect marketability limitations. | Adjusts value to reflect liquidity constraints and possible discounts. |

| Regulatory References | IRS Revenue Ruling 59-60, AICPA guidelines. | Generally guided by valuation standards but less formally defined. |

Introduction to DLOM and DLOL in Business Valuation

Discount for Lack of Marketability (DLOM) reflects the reduction in value of a business interest due to the inability to quickly sell or convert the asset into cash at fair market value, often applied in private company valuations. Discount for Lack of Liquidity (DLOL) specifically considers the difficulty and time required to liquidate an asset without significant price concessions, often influenced by market conditions and transaction costs. Both discounts adjust the valuation to account for restrictions affecting the transferability and cash conversion of business interests, ensuring more accurate reflection of fair value in illiquid or restricted markets.

Defining Discount for Lack of Marketability (DLOM)

Discount for Lack of Marketability (DLOM) represents the reduction applied to the value of an asset due to the absence of a ready market for its sale, reflecting the difficulty and time required to convert the asset into cash. DLOM quantifies the diminution in value stemming from restrictions on transferring ownership or selling privately held securities, which can significantly impact valuation in mergers, acquisitions, and financial reporting. This discount differs from Discount for Lack of Liquidity (DLOL), which relates more specifically to the ease of buying or selling an asset quickly without affecting its price.

Understanding Discount for Lack of Liquidity (DLOL)

Discount for Lack of Liquidity (DLOL) reflects the reduction applied to an asset's value due to its inability to be quickly sold or converted into cash without significant loss. It is distinct from Discount for Lack of Marketability (DLOM), which addresses the difficulty in finding a buyer rather than the speed of conversion. Understanding DLOL requires analyzing the asset's trading volume, bid-ask spreads, and prevailing market conditions that influence immediacy of sale.

Key Differences Between DLOM and DLOL

Discount for Lack of Marketability (DLOM) reflects the reduction in value due to the inability to sell an interest in a timely manner without a significant price concession, commonly applied to private company shares. Discount for Lack of Liquidity (DLOL) specifically addresses the difficulty of converting an asset into cash quickly without affecting its price, often relevant to assets with limited trading volume or market presence. Key differences include DLOM's broader impact on overall market access versus DLOL's focus on cash conversion speed and transactional volume constraints.

Factors Influencing the Application of DLOM

Factors influencing the application of Discount for Lack of Marketability (DLOM) include the size of the market, holding period restrictions, and transferability limitations that affect the ease of selling an asset. Unlike Discount for Lack of Liquidity (DLOL), which primarily reflects the time it takes to convert an asset into cash, DLOM encompasses broader marketability constraints such as regulatory compliance, market depth, and investor demand. Empirical studies and empirical restricted stock studies also play a critical role in determining appropriate DLOM adjustments based on observed market behaviors.

Determinants Affecting DLOL in Valuation

Discount for Lack of Liquidity (DLOL) in valuation is primarily influenced by trading restrictions, settlement periods, and market trading volumes that limit the ease of converting assets into cash. The nature of the asset's market, including the presence of active buyers and sellers, directly affects DLOL magnitude, as thin or infrequent trading increases liquidity risk. Regulatory factors and contractual limitations, such as lock-up agreements or transfer restrictions, further impact DLOL by restricting market access and prolonging the selling process.

Methods for Quantifying DLOM

Discount for Lack of Marketability (DLOM) quantifies the reduction in value due to the inability to quickly sell an asset in the public market, commonly estimated using restricted stock studies, pre-IPO studies, and option pricing models. Restricted stock studies analyze price differentials between restricted and unrestricted shares to approximate marketability discounts, while pre-IPO studies assess discounts based on transactions of private company shares before going public. Option pricing models employ financial theory to simulate the cost of illiquidity by treating marketability as an embedded option, offering a theoretical method to quantify DLOM.

Approaches to Calculating DLOL

Discount for Lack of Liquidity (DLOL) is primarily calculated using market-based approaches, including bid-ask spread analysis and traded price impact on thinly traded securities. The option pricing model and event study methods also provide quantitative frameworks for estimating DLOL by assessing the cost and timing of converting an asset to cash. These approaches contrast with Discount for Lack of Marketability (DLOM), which focuses more on non-transferability and restrictions, emphasizing qualitative factors and empirical studies of restricted stock transactions.

Practical Examples: Applying DLOM vs DLOL

Applying Discount for Lack of Marketability (DLOM) typically involves assessing private company shares where restrictions on selling over a prolonged period reduce value, such as shares in family-owned businesses or startups. Discount for Lack of Liquidity (DLOL) applies to assets with limited trading frequency or small public float, like restricted stock in publicly traded companies or thinly traded securities on OTC markets. Practical valuation frequently combines both discounts when analyzing restricted shares of private firms that also face secondary market illiquidity, requiring careful separation of marketability and liquidity impacts.

Best Practices for Addressing DLOM and DLOL in Valuation Reports

Best practices for addressing Discount for Lack of Marketability (DLOM) and Discount for Lack of Liquidity (DLOL) in valuation reports involve clearly distinguishing between the two discounts based on the asset's characteristics and market conditions. Valuators should utilize empirical data from restricted stock studies, pre-IPO studies, and marketability models to support DLOM, while relying on trading volume, bid-ask spreads, and market depth to justify DLOL adjustments. Comprehensive documentation of methodologies, assumptions, and relevant market data enhances transparency and credibility in the valuation conclusions.

Important Terms

Marketability premium

Marketability premium reflects the value added by enabling faster sale, whereas Discount for Lack of Marketability (DLOM) quantifies the reduction in value due to restricted market access and Discount for Lack of Liquidity (DLOL) addresses the price impact from the inability to quickly convert an asset into cash.

Liquidity event horizon

The liquidity event horizon significantly impacts the Discount for Lack of Marketability (DLOM) by reflecting the time investors must wait to sell, whereas the Discount for Lack of Liquidity (DLOL) quantifies the immediate inability to transact, making both critical but distinct factors in valuing illiquid assets.

Restricted stock studies

Restricted stock studies primarily analyze the Discount for Lack of Marketability (DLOM) by comparing restricted shares, which cannot be sold freely in the public market, to freely traded shares to estimate the marketability discount. The Discount for Lack of Liquidity (DLOL), often confused with DLOM, specifically addresses the reduced ability to quickly convert an asset into cash without a significant price concession, but restricted stock studies focus more on marketability constraints rather than immediate liquidity concerns.

Control premium

Control premium reflects the value added by controlling interest, typically higher than discounts like DLOM and DLOL, which adjust for reduced marketability and liquidity of minority or non-controlling shares.

Securities Act Rule 144

Securities Act Rule 144 distinguishes Discount for Lack of Marketability (DLOM), reflecting the inability to sell private securities promptly, from Discount for Lack of Liquidity (DLOL), which pertains to the difficulty of converting securities into cash quickly without significant price concessions.

Mandelbaum factors

Mandelbaum factors specifically address the Discount for Lack of Marketability (DLOM) by evaluating characteristics that affect an asset's marketability, while the Discount for Lack of Liquidity (DLOL) focuses on the ease of converting the asset into cash without significant price reduction.

Blockage discount

Blockage discount reflects price reductions due to large block sales impacting market price, distinct from Discount for Lack of Marketability (DLOM) which addresses limited transferability, and Discount for Lack of Liquidity (DLOL) which relates to difficulty converting assets into cash.

Holding period risk

Holding period risk significantly impacts the Discount for Lack of Marketability (DLOM) as it reflects the uncertainty and potential value loss due to the extended time required to sell an asset in an illiquid market, whereas Discount for Lack of Liquidity (DLOL) primarily addresses the immediate difficulty in converting an asset into cash without a substantial price discount. DLOM quantifies the value reduction caused by limited market access over the holding period, contrasting with DLOL which focuses on the instantaneous market depth and transaction cost effects on asset liquidity.

Bid-ask spread

The bid-ask spread primarily reflects the Discount for Lack of Liquidity (DLOL), while the Discount for Lack of Marketability (DLOM) encompasses broader factors including but not limited to liquidity constraints.

Forced sale discount

Forced sale discount reflects the reduced price due to a seller's urgency, often overlapping with Discount for Lack of Marketability (DLOM), which adjusts valuation for restricted ability to sell an asset in normal conditions. Discount for Lack of Liquidity (DLOL) specifically applies to assets difficult to convert quickly to cash without significant loss, making DLOM broader by encompassing marketability restrictions beyond mere liquidity constraints.

Discount for Lack of Marketability (DLOM) vs Discount for Lack of Liquidity (DLOL) Infographic

moneydif.com

moneydif.com