Implied value reflects the estimated worth of an asset derived from market conditions, financial metrics, and future cash flow projections, often used in investment analysis. Stated value, however, is the nominal amount assigned to stock shares in a company's charter, primarily serving legal and accounting purposes without necessarily representing market value. Understanding the distinction between implied and stated value is crucial for accurate asset valuation and informed decision-making in finance.

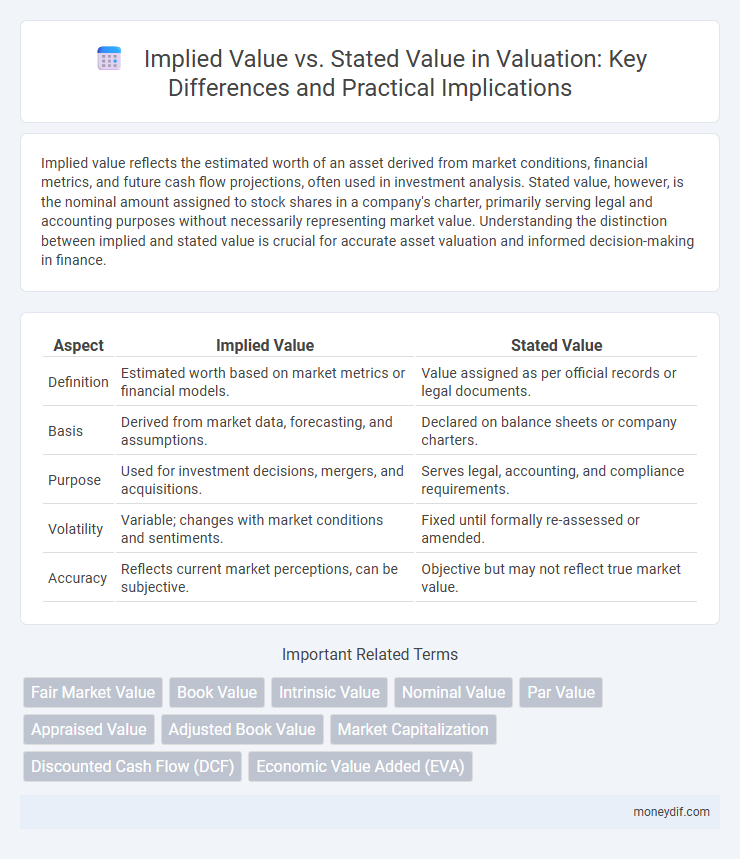

Table of Comparison

| Aspect | Implied Value | Stated Value |

|---|---|---|

| Definition | Estimated worth based on market metrics or financial models. | Value assigned as per official records or legal documents. |

| Basis | Derived from market data, forecasting, and assumptions. | Declared on balance sheets or company charters. |

| Purpose | Used for investment decisions, mergers, and acquisitions. | Serves legal, accounting, and compliance requirements. |

| Volatility | Variable; changes with market conditions and sentiments. | Fixed until formally re-assessed or amended. |

| Accuracy | Reflects current market perceptions, can be subjective. | Objective but may not reflect true market value. |

Introduction to Implied Value and Stated Value

Implied value represents the estimated worth of an asset derived from market data or financial models, reflecting its true potential in real-world conditions. Stated value, often assigned by a company during issuance, signifies the nominal or face value recorded on the balance sheet, primarily for accounting purposes. Understanding the distinction between implied and stated values is crucial for accurate business valuation and investment decision-making.

Defining Implied Value in Valuation

Implied value in valuation refers to the estimated worth of an asset or company derived from financial models, market conditions, and comparable transactions rather than the stated or book value. It often reflects the present value of expected future cash flows, providing a market-based perspective on intrinsic worth. This metric is essential for investors seeking to assess the potential return relative to the publicly reported or stated value.

Understanding Stated Value in Financial Reporting

Stated value refers to the arbitrary amount assigned to a company's stock by the board of directors and recorded in the equity section of the balance sheet, often used when no par value is assigned. It serves as a baseline for accounting purposes but does not reflect the actual market or implied value of the shares, which is influenced by factors such as earnings, assets, and market conditions. Understanding stated value helps in distinguishing between the legal capital of stock and its economic worth during financial reporting and valuation analysis.

Key Differences Between Implied Value and Stated Value

Implied value represents the estimated worth of an asset derived from market data or financial models, reflecting its potential economic benefit. Stated value is the nominal value assigned to a share by a company, often used for legal or accounting purposes without direct market correlation. Key differences include that implied value fluctuates with market conditions while stated value remains fixed, and implied value influences investment decisions whereas stated value impacts the company's balance sheet.

Methods Used to Calculate Implied Value

Implied value is typically calculated using valuation methods such as the discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions to estimate the intrinsic worth of an asset or equity stake. These approaches incorporate projected financial metrics, market multiples, and transaction premiums to derive a value not explicitly stated on financial statements. Unlike stated value, which is a nominal value assigned to shares on a company's balance sheet, implied value reflects market-driven or intrinsic valuation based on comprehensive financial modeling and comparable benchmarks.

Situations Where Stated Value is Applied

Stated value is typically applied in situations involving no-par value stock issuance or when companies need to assign a nominal value to shares for legal or accounting purposes. It establishes a minimum baseline for the stock's value on the balance sheet, ensuring compliance with corporate law and facilitating the calculation of capital stock. Unlike implied value, stated value does not reflect market perceptions or fair market value but serves as an internal accounting reference.

Practical Examples of Implied vs Stated Value

Implied value represents the worth derived from market-based calculations or financial metrics, such as price-to-earnings ratios or discounted cash flow models, while stated value is explicitly assigned on a company's balance sheet, often for legal or accounting purposes. For example, in a stock issuance, a company may state a par value of $1 per share, but its implied value based on recent trading prices might be $25 per share, reflecting true market perception. Understanding the difference helps investors evaluate whether the recorded book value of equity aligns with the actual economic value reflected by market conditions.

Implications for Investors and Stakeholders

Implied value reflects the estimated worth of an asset based on market perceptions and future earnings potential, offering investors a dynamic insight into real-time valuation fluctuations. Stated value, often a fixed accounting figure, may not capture the asset's true economic potential, limiting stakeholders' ability to make fully informed decisions. Understanding the divergence between implied and stated value helps investors assess risk, identify market opportunities, and better evaluate company performance.

Common Misconceptions and Pitfalls

Implied value often reflects the estimated worth derived from market-based methods, while stated value is a fixed book value assigned by the company, leading to common misconceptions that they are interchangeable. Misinterpreting stated value as market value can result in overvaluations or undervaluations during financial analysis and investment decisions. Analysts must carefully differentiate these terms to avoid pitfalls such as inaccurate equity assessments and flawed valuation models.

Conclusion: Choosing the Right Valuation Approach

Implied value reflects the market perception based on factors like earnings multiples and comparable company analysis, while stated value is the nominal or book value recorded on financial statements. Selecting the right valuation approach depends on the purpose of the valuation, with implied value offering a market-driven perspective and stated value providing legal or accounting clarity. For investment decisions or transaction negotiations, implied value typically presents a more accurate economic worth, whereas stated value is essential for statutory reporting and compliance.

Important Terms

Fair Market Value

Fair Market Value represents the price a willing buyer pays a willing seller in an arm's-length transaction, distinguishing it from Implied Value, which is derived from estimated future benefits, and Stated Value, which is recorded on financial statements without necessarily reflecting market conditions.

Book Value

Book value represents the net asset value of a company as recorded on its balance sheet, calculated by subtracting liabilities from total assets. Implied value estimates a company's worth based on market perceptions or financial models, often differing from the stated value, which is the nominal value assigned to shares in the company's charter.

Intrinsic Value

Intrinsic value represents the true worth of an asset based on fundamentals, while implied value is derived from market expectations and stated value is the nominal value assigned by a company.

Nominal Value

Nominal value refers to the face value of a security or asset, often set during issuance, while implied value is derived from market factors and underlying fundamentals, reflecting the asset's true economic worth. Stated value, similar to nominal value, is a fixed amount assigned by a company, primarily for accounting purposes, and does not fluctuate with market conditions.

Par Value

Par value represents the nominal value of a stock, serving as a baseline for legal capital, while implied value estimates the market or intrinsic worth, and stated value is an assigned amount used when no par value exists.

Appraised Value

Appraised value represents the expert's estimate of a property's worth based on current market conditions, contrasting with implied value, which is derived from financial metrics or comparable asset data, while stated value is the nominal or declared amount often used in accounting or legal contexts. Understanding these distinctions is crucial for accurate property investment decisions and valuation analyses.

Adjusted Book Value

Adjusted Book Value calculates a company's net asset value by modifying the stated book value with implied value adjustments from market-based valuations and intangible asset reappraisals.

Market Capitalization

Market capitalization reflects a company's implied value based on current stock price multiplied by outstanding shares, offering a market-driven estimate often differing from the stated book value derived from accounting records. This discrepancy between implied value and stated value highlights investor perceptions, growth potential, and intangible assets not captured on the balance sheet.

Discounted Cash Flow (DCF)

Discounted Cash Flow (DCF) analysis determines a company's implied value by projecting future cash flows and discounting them to present value, often revealing discrepancies with the stated value on financial statements. This difference highlights market perceptions or hidden risks that may not be reflected in the book value, providing a more intrinsic valuation for investment decisions.

Economic Value Added (EVA)

Economic Value Added (EVA) measures a company's true economic profit by subtracting the cost of capital from its net operating profit after taxes, highlighting value creation beyond stated accounting profits. Implied Value reflects market expectations and future cash flows embedded in EVA, often diverging from Stated Value, which is based on historical book values, emphasizing the significance of EVA in assessing intrinsic corporate worth.

Implied Value vs Stated Value Infographic

moneydif.com

moneydif.com