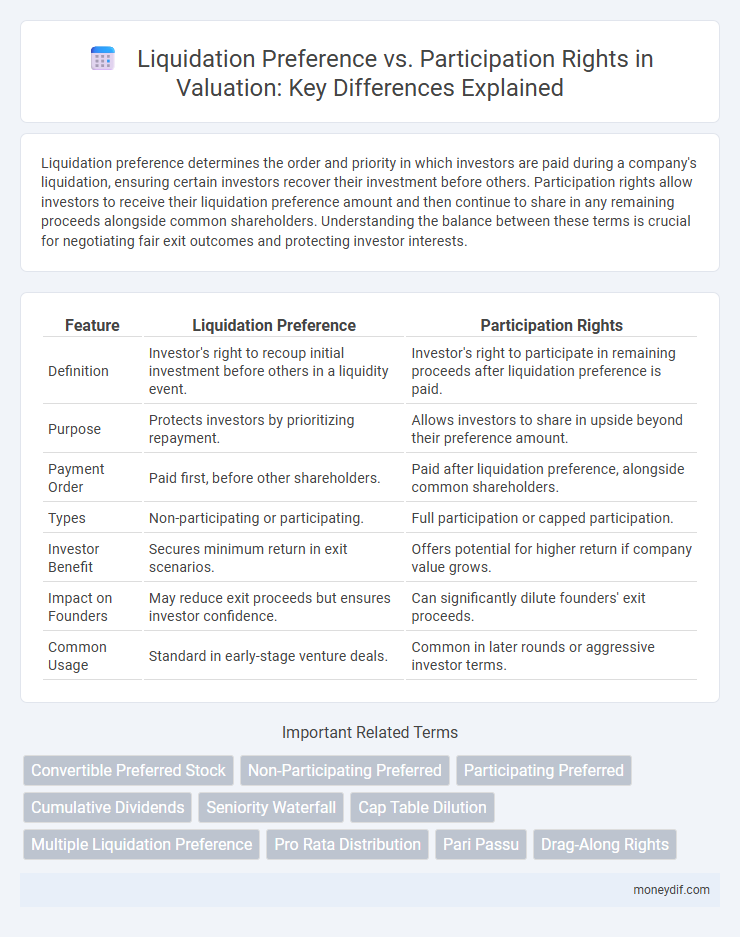

Liquidation preference determines the order and priority in which investors are paid during a company's liquidation, ensuring certain investors recover their investment before others. Participation rights allow investors to receive their liquidation preference amount and then continue to share in any remaining proceeds alongside common shareholders. Understanding the balance between these terms is crucial for negotiating fair exit outcomes and protecting investor interests.

Table of Comparison

| Feature | Liquidation Preference | Participation Rights |

|---|---|---|

| Definition | Investor's right to recoup initial investment before others in a liquidity event. | Investor's right to participate in remaining proceeds after liquidation preference is paid. |

| Purpose | Protects investors by prioritizing repayment. | Allows investors to share in upside beyond their preference amount. |

| Payment Order | Paid first, before other shareholders. | Paid after liquidation preference, alongside common shareholders. |

| Types | Non-participating or participating. | Full participation or capped participation. |

| Investor Benefit | Secures minimum return in exit scenarios. | Offers potential for higher return if company value grows. |

| Impact on Founders | May reduce exit proceeds but ensures investor confidence. | Can significantly dilute founders' exit proceeds. |

| Common Usage | Standard in early-stage venture deals. | Common in later rounds or aggressive investor terms. |

Introduction to Liquidation Preference and Participation Rights

Liquidation preference determines the payout order and amount investors receive during a company's liquidation, ensuring preferred shareholders recover their initial investment before common shareholders. Participation rights allow preferred shareholders to receive their liquidation preference and then participate pro-rata in the remaining proceeds alongside common shareholders. Understanding these terms is crucial for accurately assessing investor returns and company valuation in venture financing.

Defining Liquidation Preference in Venture Financing

Liquidation preference in venture financing defines the order and amount investors receive upon a liquidity event, ensuring they recover their initial investment before common shareholders. It is a contractual right that protects investors by specifying multiple scenarios, such as participating or non-participating preferences, which determine whether they share in remaining proceeds after their payout. Understanding liquidation preference is crucial for accurately valuing startup equity and negotiating investment terms.

Understanding Participation Rights Explained

Participation rights allow investors to receive their liquidation preference amount first and then share in any remaining proceeds alongside common shareholders, enhancing their overall return in exit events. Unlike pure liquidation preference, participation rights can be either capped or uncapped, influencing the total payout an investor may secure during company liquidation or acquisition. Understanding these rights is crucial for founders and investors as they directly impact the distribution hierarchy and valuation outcomes during fundraising or exit scenarios.

Types of Liquidation Preferences

Types of liquidation preferences vary primarily between standard liquidation preference and participating liquidation preference, each influencing investor payouts differently during a company exit. Standard liquidation preference ensures investors receive their initial investment before common shareholders, while participating rights allow investors to first reclaim their investment and then share in the remaining proceeds with common shareholders. Understanding these distinctions is critical for accurate valuation and negotiating equity terms in venture capital deals.

Participation Rights: Full vs. Capped Participation

Participation rights dictate how investors share proceeds during a liquidity event, with full participation allowing investors to receive their liquidation preference plus a proportional share of remaining proceeds. Capped participation limits the total return investors can earn, ensuring founders and shareholders retain more upside potential beyond a preset threshold. Understanding the distinction impacts valuation negotiations by balancing investor protection with growth incentives for the company.

Key Differences Between Liquidation Preference and Participation Rights

Liquidation preference determines the order and amount investors receive during a company liquidation, ensuring preferred shareholders get their original investment or a multiple before common shareholders. Participation rights allow preferred shareholders to first receive their liquidation preference amount and then share pro-rata in the remaining proceeds with common shareholders. The key difference lies in payout structure: liquidation preference guarantees a fixed return priority, while participation rights offer additional upside by enabling investors to benefit beyond their initial preference amount.

Impact on Founders and Early Investors

Liquidation preference guarantees founders and early investors a return on investment before common shareholders in a liquidation event, often protecting their initial equity stake from being diluted. Participation rights enable these investors to receive their liquidation preference first and then share in the remaining proceeds alongside common shareholders, potentially increasing their overall payout but reducing the founders' residual value. Understanding these terms is crucial for founders to negotiate terms that balance investor protection with long-term equity retention.

Negotiating Liquidation Terms in Term Sheets

Negotiating liquidation preference and participation rights in term sheets requires a clear understanding of how these terms impact investor returns during exit events. Liquidation preference determines the payout order and amount investors receive before common shareholders, often expressed as a multiple of the original investment. Participation rights allow investors to share in remaining proceeds after their liquidation preference is paid, which can significantly affect the founder's and employee's upside in a company exit.

Real-World Examples and Case Studies

Liquidation preference determines the payout order during a company exit, ensuring investors recover their initial investment before others, as seen in Airbnb's early funding rounds where preferred shareholders secured returns despite a complex exit structure. Participation rights allow investors to receive both their liquidation preference and a proportional share of remaining proceeds, exemplified by the WeWork funding scenario where investors maximized returns through full participation clauses amid valuation challenges. Real-world case studies highlight how these terms impact investor returns and influence negotiation dynamics in venture capital deals.

Strategic Considerations for Startups and Investors

Liquidation preference determines the payout order in exit scenarios, ensuring investors recoup their initial investment before common shareholders receive proceeds, which is crucial in protecting early-stage investors. Participation rights enable investors to receive their liquidation preference and then share in remaining proceeds with common shareholders, potentially diluting returns for founders but increasing investor upside. Startups must balance these terms strategically to attract investment while maintaining founder equity and control, whereas investors prioritize protections and upside participation aligned with valuation risk.

Important Terms

Convertible Preferred Stock

Convertible preferred stock offers liquidation preference to prioritize repayment during liquidation while allowing conversion into common stock to benefit from participation rights in future equity appreciation.

Non-Participating Preferred

Non-participating preferred stockholders receive liquidation preference, entitling them to a fixed payout before common shareholders, but do not participate in remaining proceeds after their preference is met, unlike participating preferred stockholders who share in additional distributions. This structure limits returns for non-participating preferred investors to their liquidation preference amount, prioritizing capital recovery without equity upside in exit events.

Participating Preferred

Participating Preferred shares combine liquidation preference priority with rights to share in remaining proceeds, maximizing investor returns compared to simple liquidation preference or participation rights alone.

Cumulative Dividends

Cumulative dividends ensure preferred shareholders receive accumulated unpaid dividends before liquidation preference and participation rights determine their priority in asset distribution during company liquidation.

Seniority Waterfall

Seniority waterfall determines the payment priority in liquidation, where liquidation preference ensures preferred shareholders recoup their investment before others, while participation rights allow them to share remaining proceeds with common shareholders.

Cap Table Dilution

Cap table dilution impacts investor ownership percentages differently based on liquidation preference structures and participation rights, where non-participating preferred shares limit dilution by converting at liquidation price, while participating preferred shares exacerbate dilution by allowing both preferential payout and pro-rata participation.

Multiple Liquidation Preference

Multiple Liquidation Preference magnifies investor returns by granting multiples of the original investment upon exit, differing from standard Liquidation Preference which ensures only the initial amount plus accrued dividends, and contrasts with Participation Rights that allow investors to both reclaim their preference and share in remaining proceeds.

Pro Rata Distribution

Pro rata distribution ensures investors receive a proportionate share of proceeds after satisfying liquidation preferences, balancing the advantage of participation rights in equity liquidation events.

Pari Passu

Pari Passu ensures that shareholders or creditors share liquidation proceeds equally without priority, contrasting with liquidation preference that grants senior stakeholders first claim over assets. Participation rights allow investors to receive both their liquidation preference and a pro-rata share of remaining proceeds, effectively combining priority with residual participation.

Drag-Along Rights

Drag-along rights ensure majority shareholders can compel minority shareholders to sell during a liquidation event, impacting the execution of liquidation preference and participation rights by determining payout hierarchy and pro-rata distributions.

Liquidation Preference vs Participation Rights Infographic

moneydif.com

moneydif.com